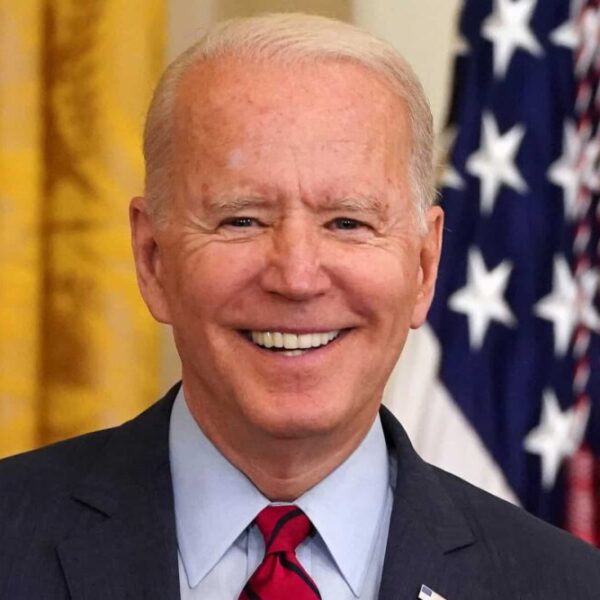

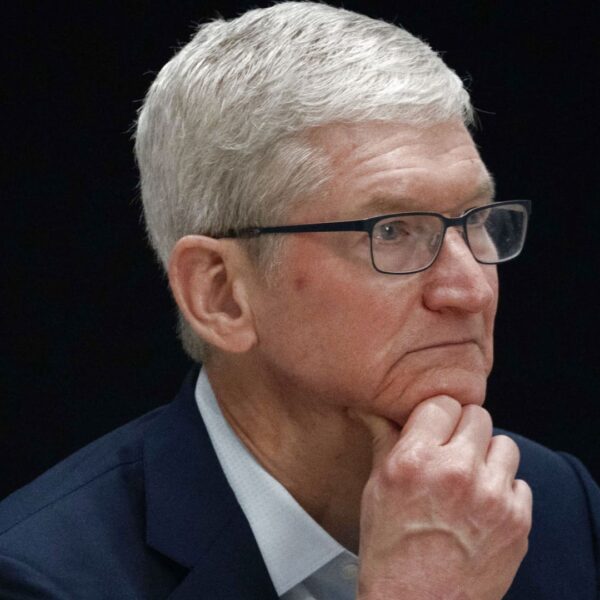

India’s smartwatch market has reworked, seemingly in a single day. For years, it has been dominated by its homegrown gamers, whereas international giants like Apple and Samsung have struggled for presence, amid the a whole bunch of thousands and thousands of annual shipments. Abruptly, nonetheless, the class has been flooded with unknown manufacturers, which haven’t any prior and vital existence. These have began gaining buyer focus and are anticipated to finally push the market towards a consolidation stage.

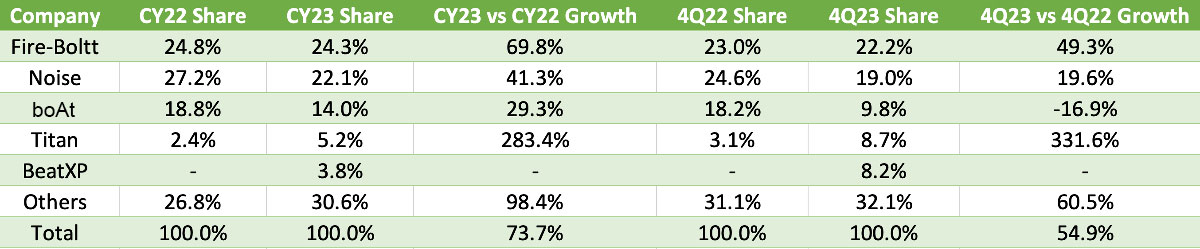

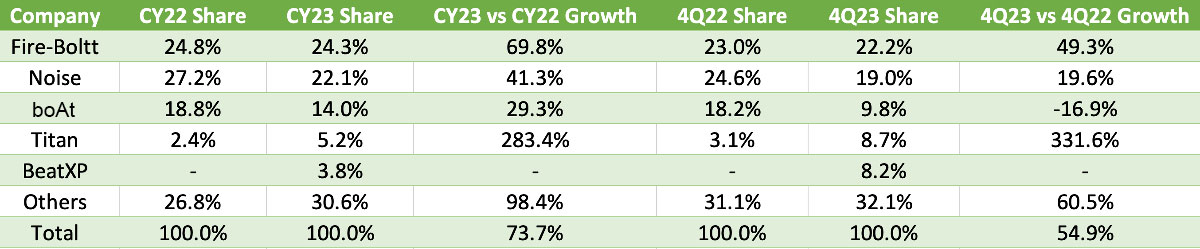

Home manufacturers like Fireplace-Boltt, Noise and boAt have dominated the class, making up greater than 60% of the whole market. Apple and Samsung, then again, fell from 4.5% to a bit of over 2% share mixed, with 1.1 million models shipped in 2023, according to market intelligence agency IDC.

In the meantime, new entrants have seen a surge of their market share from three to 3-5% in 2020 to 15-20% final yr. Vikas Sharma, senior market analyst for wearable gadgets, IDC, informed TechCrunch that the class now accounts for 134.2 million models yearly.

These manufacturers generally carry an unrecognized title or are knockoffs of established merchandise. Many are direct copies of massive international manufacturers like Apple and Samsung, priced at lower than $12 (1,000 Indian rupees). The Apple Watch worth in India begins at $360 (29,900 Indian rupees) for the Apple Watch SE, whereas the Samsung Galaxy Watch 4 retails at $290 (23,999 Indian rupees). The Indian smartwatches from manufacturers reminiscent of Fireplace-Boltt, boAt and Noise begin from $12.

Apple Watch Extremely lookalike accessible on-line in India at about $9. Picture Credit: Flipkart

Not like the costlier fashions, off-brand merchandise typically haven’t any warranties. In some instances, the retailer affords clients a substitute assure, however that’s, too, not offered by the producer and given merely on a chunk of paper and even verbally. Health monitoring metrics are sometimes inaccurate on account of inferior choice of sensors to save lots of prices, whereas the {hardware}/software program combo leaves a lot to be desired. Nonetheless, the accuracy — even on the smartwatches supplied by established Indian gamers — generally doesn’t match that of the Apple Watch or Samsung Galaxy Watch, as these distributors compromise on sensor high quality to take care of affordability.

“The accuracy of the sensors is not good enough [across most affordable smartwatches] to provide the same level of user experience, which users get in a premium model,” Counterpoint’s senior analysis analyst Anshika Jain informed TechCrunch.

Sharma identified the aesthetics, which make these unknown branded fashions resemble the Apple Watch and Apple Watch Extremely or some high-end rounded smartwatches, in addition to affordability, assist them achieve buyer consideration.

Hong Kong-based market analyst agency Counterpoint Analysis has noticed the variety of unknown manufacturers within the Indian smartwatch market has grown from 78 in 2021 to 128 in 2023.

“There has been almost 80-90% growth in the number of unknown brands,” stated Jain. “This clearly indicates how the market has become more crowded now.”

She famous the sample the analyst agency has noticed for the final couple of years: Most unknown manufacturers emerge in the course of the third quarter — across the time of the festive season within the nation — and stay lively for one or two quarters earlier than disappearing utterly. Moreover, these are possible white-label merchandise imported from China at dirt-cheap costs or assembled by an Indian electronics manufacturing providers accomplice, she stated.

Declining costs

The expansion of unknown manufacturers within the Indian smartwatch market has not but considerably impacted all of the native corporations dominating the market. Nonetheless, the prevailing gamers are cautious. Some established native manufacturers have began feeling the warmth. Moreover, the rising market share of unknown manufacturers has lowered the common promoting worth (ASP).

Sameer Mehta, co-founder and CEO of Warburg Pincus-backed boAt, informed TechCrunch the decline in ASPs is as excessive as 90%.

“Overall volumes have started going down,” he stated. “ASPs have declined by, say, 90%, which essentially does not fare well for any industry. Tell me one industry where the price erosion reaches 90% in just one year.”

Market analysts have additionally noticed a large dip within the ASP, although not as substantial a drop as Mehta talked about.

Jain of Counterpoint, in the meantime, stated the ASP dropped by round 39% to $36 in 2023 from $59 in 2022. “There’s a lot of froth at the bottom, which is just bringing in devices and putting it out in the market. Once that goes away, there will be some sanctity. Everybody will stop investing in the business if nobody is making money in the business.”

boAt, India’s third-leading smartwatch model, noticed a 17% decline in year-on-year development within the fourth quarter, per IDC. The smartwatch enterprise contributes about 20% of the startup’s revenues.

Picture Credit: TechCrunch / IDC

Mehta stated regardless of seeing some influence from the unrecognized manufacturers, boAt would proceed to generate 15-20% of revenues from smartwatches within the subsequent couple of years.

Not like boAt, Fireplace-Boltt and Noise (the highest two manufacturers), noticed year-on-year development in the identical quarter.

Gaurav Khatri, co-founder of Bose-backed Noise, informed TechCrunch the startup didn’t see any notable influence from the “constant influx of new entrants and brands.”

Strikes to retain the market

Market specialists imagine the continuing shift with unknown manufacturers increasing their presence will have an effect on all key gamers — until the dominants change their technique and add extra worth to their future smartwatches.

Presently, market incumbents primarily goal first-time patrons — just like unknown manufacturers. As an alternative, analysts imagine that established manufacturers ought to goal current clients.

“People are not opting for these [established Indian branded] smartwatches for their next purchase with the same level of enthusiasm for the first purchase… the main reason is obviously the customer experience and user interface of these devices, which is not that smooth,” stated Counterpoint’s Jain.

Most established Indian gamers don’t give attention to bringing distinctive precious options to smartwatches, in contrast to their big-tech counterparts together with Apple and Samsung. Smartwatch makers within the nation additionally generally use the identical Chinese language unique design producers [ODMs], limiting product differentiation. Many of those fashions even bear an uncanny resemblance to Apple and Samsung. Nonetheless, Indian manufacturers declare to develop printed circuit boards domestically, and design software program experiences in-house, distinguishing themselves from international gamers. Native assembling basically helps producers keep away from import duties which are 20%.

Final yr, smartwatch manufacturers boAt and Noise entered the smart ring market in India to diversify their product catalog. Nonetheless, the sensible ring market in India, which noticed greater than 100,000 shipments in 2023, is led by Ultrahuman, with a share of 43.1% in This fall, per IDC.

Mehta of boAt informed TechCrunch the startup is seeking to give attention to creating totally different classes within the smartwatch market, reminiscent of new fashions geared toward youngsters and the aged, sports activities and wellness, to retain its presence. Equally, it’s seeking to design its new smartwatches for second- or third-time patrons, who’re extra conscious of their well being and wellness and search for better-quality gadgets. Nonetheless, these modifications will improve the pricing of boAt smartwatches.

That stated, market analysts like IDC’s Sharma predicts the Indian smartwatch market will see solely single-digit development this yr on account of stiff competitors from unknown manufacturers and dropping ASPs. The market used to see over 150% year-on-year growth within the earlier years.

Sharma additionally believes that the smartwatch market might consolidate within the coming couple of years, and fewer gamers can be left.

“There will be a flatline coming in the next two years… it all picked up after COVID, and now it’s gone to a sky level… we’ll soon see a saturation point,” he stated.