Billionaire Jim Ratcliffe has accomplished the acquisition of a stake in Manchester United, defeating rival bids from petro-states and hedge funds and ending a bidding struggle marked by hype and rancor.

Via his chemical conglomerate Ineos Group, Ratcliffe can pay $33 a share for a 25% stake within the membership, valuing the membership at about $5.4 billion, falling beneath initial hopes of $6 billion.

The choice to usher in Ratcliffe, considered one of Britain’s richest individuals, marks the tip of a drawn-out sale course of formally begun by the Glazer household simply over a 12 months in the past. At instances, the deal drew hype and hypothesis nearer to the Premier League’s deadline day or the NFL draft than a billion-dollar deal in a public firm.

Bloomberg first reported that the Glazers would contemplate promoting a minority stake within the crew, and that Ratcliffe had emerged because the front-runner.

In keeping with a press release on Sunday:

- Ratcliffe will purchase 25% of the Class B shares owned by the Glazer household and start a young supply for 25% of the listed Class A shares

- Ratcliffe will make investments $300 million into membership

- New buyers will get two board seats.

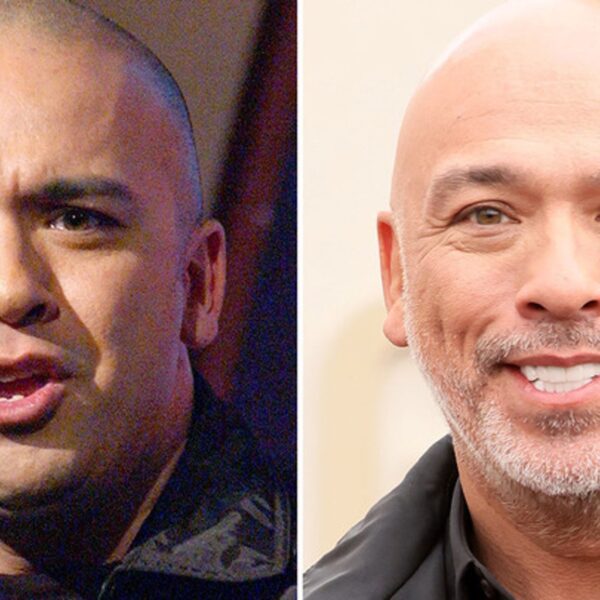

For a lot of the previous 12 months, Ratcliffe battled a rival supply from Sheikh Jassim bin Hamad Al Thani, the third son of Qatar’s former prime minister, for outright management of the membership. However neither bidder might match co-chairs Joel and Avram Glazer need to cement Manchester United because the world’s costliest sporting asset.

The Qatari group had made it clear they’d not overpay for the membership. Earlier than the bidding struggle started, Sheikh Hamad bin Jassim bin Jaber Al Thani, Qatar’s former prime minister and Sheikh Jassim’s father, informed Bloomberg that he wasn’t a fan of soccer investments within the Premier League.

In October, the Qatari camp withdrew its supply, claimed to be across the £5 billion mark, however which probably included debt and host of funding extras comparable to redevelopment of the coaching floor. The Qatari’s relationship with Raine Group — the funding financial institution in command of the sale — had deteriorated, in line with individuals acquainted with the matter.

It stays to be seen how Ratcliffe, a self-made billionaire, will handle the membership alongside Joel and Avram Glazer, who inherited the crew from their father Malcolm, who made a fortune from a variety of investments together with actual property and broadcasting.

The victory additionally cements Ratcliffe’s plans to construct out a personal sporting empire after failing in a late try to purchase Chelsea FC final 12 months. Through his chemical big Ineos, Ratcliffe additionally owns France’s Ligue 1 OGC Good, the biking group previously referred to as Workforce Sky, and a stake within the Mercedes-AMG Petronas Method One crew.

The choice from the Glazers to maintain maintain of the membership will virtually actually anger followers, who’ve protested for years to oust the unpopular homeowners.

Malcolm Glazer purchased Manchester United in a 2005 leveraged buyout that saddled it with huge money owed, and the household has confronted mistrust from hardcore supporters ever since. Whereas this was mitigated within the early years of their possession because the crew continued to win trophies underneath Alex Ferguson, resentment has grown steadily after the famend coach’s retirement in 2013.

The household employed funding financial institution Raine Group, who have been additionally in-charge of the sale of Chelsea FC, to drum up curiosity for the one dominant crew that has floundered in recent times.

However whereas Chelsea noticed a fierce struggle to win the deal, Sheikh Jassim and Ratcliffe have been the one two vital events to publicly declare an curiosity in shopping for Man United, after rising rates of interest mixed with what many noticed as an extreme valuation put many bidders off.

A lot of monetary teams, together with Elliott Associates LP and Carlyle Group Inc., additionally put bids in, in line with individuals acquainted with the state of affairs, however just for minority stakes.

At factors, the bidding descended into farce. In late March, simply earlier than the second-round deadline for provides, a flurry of contradictory statements and reviews emerged concerning provides being positioned, withdrawn, or not even made, resulting in Ratcliffe and Jassim being given additional time to bid.

Consideration will now flip to how Ratcliffe will flip round a floundering membership, affected by years of under-performance and a dilapidated stadium.

“Our shared ambition is clear: we all want to see Manchester United back where we belong,” mentioned Ratcliffe in a press release, “at the very top of English, European and world football.”

![LinkedIn Highlights the Potential of Video Adverts for B2B Manufacturers [Infographic]](https://whizbuddy.com/wp-content/uploads/2024/04/bG9jYWw6Ly8vZGl2ZWltYWdlL2IyYl9tYXJrZXRlcnNfaW5mby5wbmc.webp.webp)