On-chain knowledge exhibits the Bitcoin inflows going in direction of “accumulation wallets” have hit a brand new all-time excessive, an indication that could possibly be bullish for the asset.

Bitcoin HODLer Inflows Just lately Hit 25,300 BTC

As defined in a post on X by Ki Younger Ju, the founder and CEO of the on-chain analytics agency CryptoQuant, Bitcoin inflows towards accumulation wallets have hit a brand new ATH.

Now, what precisely are accumulation addresses? In line with Ju, the wallets that fulfill the next 5 circumstances are counted amongst these accumulation addresses.

The primary situation is that the deal with should have no outgoing transaction. This naturally implies that an accumulation deal with would have solely witnessed incoming transfers.

Second, the steadiness of the deal with ought to be not less than 10 BTC. On the present cryptocurrency change price, this decrease restrict is equal to round $512,000.

The third rule is that the deal with shouldn’t be a part of centralized exchanges or miners. These two are particular entities on the community for apparent causes, so they’re excluded and restricted to “normal” buyers.

The fourth situation is that the deal with ought to have obtained greater than two incoming transfers in its life, and the fifth and closing situation is that the newest of those transfers ought to have occurred throughout the previous seven years.

Wallets which have been dormant for greater than seven years are often completely misplaced to time resulting from lacking keys, in order that they don’t precisely depend as “HODLers” like the opposite accumulation addresses would.

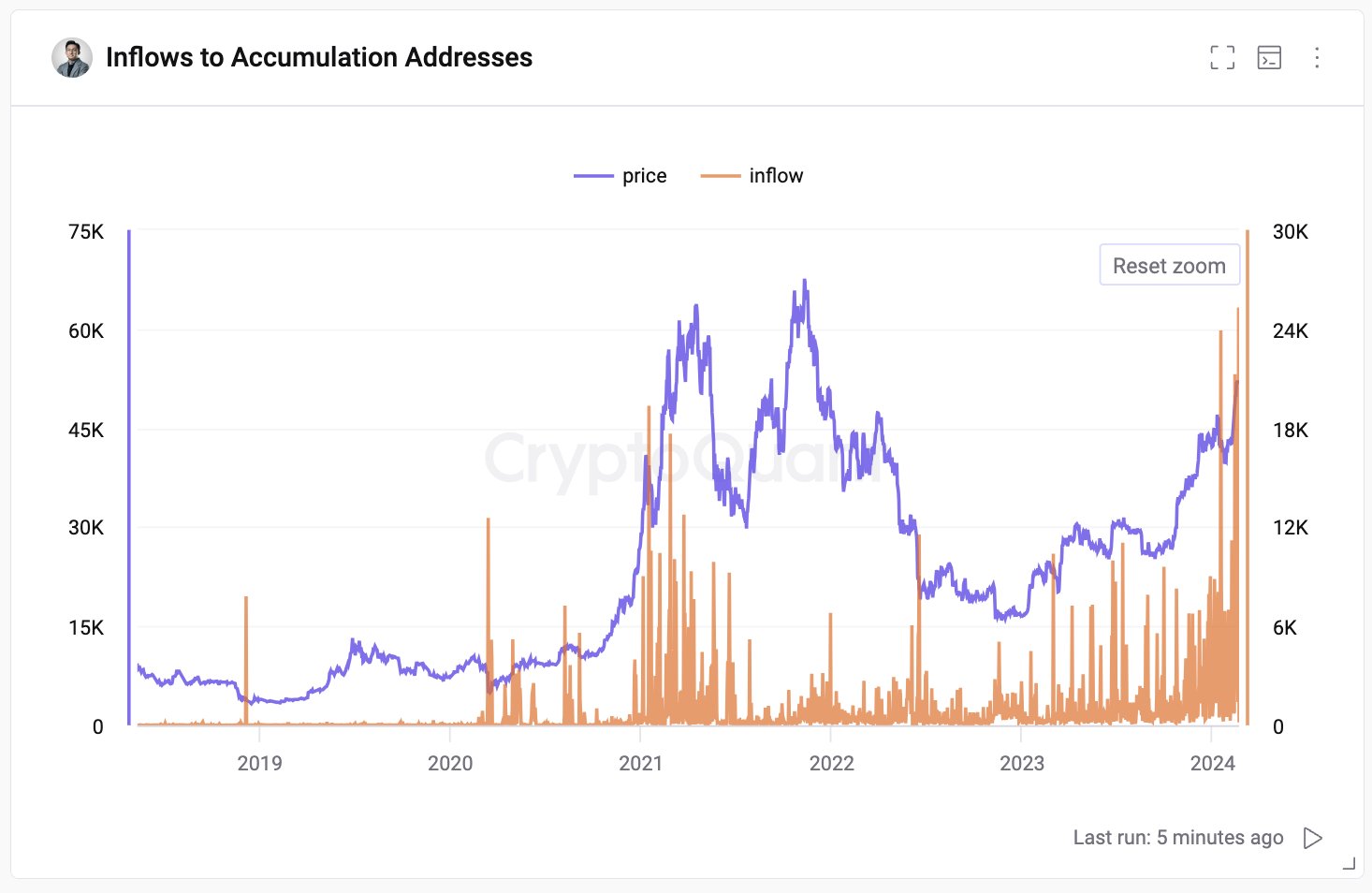

Now, right here is the chart shared by the CryptoQuant founder that shows the Bitcoin influx knowledge for these accumulation addresses over the previous couple of years:

The worth of the metric appears to have been fairly excessive in current days | Supply: @ki_young_ju on X

Right here, “inflow” is of course a measure of the entire quantity of Bitcoin coming into right into a pockets that matches the standards of an accumulation deal with. From the graph, it’s seen that the indicator has registered a big spike only in the near past.

Throughout this newest spike, the indicator, in actual fact, set a brand new report as a whopping 25,300 BTC (nearly $1.3 billion) flowed into these wallets. This naturally means that these HODLers have been shopping for huge just lately.

An in depth inspection of the chart reveals that this newest spike isn’t the one massive spike the indicator has noticed this 12 months, as it could seem that the metric has been registering massive values because the spot ETFs have been authorized final month.

The earlier ATH of the metric coincided proper with the spot ETF launch. Thus, these indicator spikes could also be partly due to institutional shopping for associated to the ETFs.

Regardless of the case, the buildup addresses increasing their holdings, which is a constructive signal, as these HODLers, who’ve by no means bought earlier than, would possibly proceed to carry robust shortly, primarily locking these cash out of the obtainable provide.

BTC Worth

Bitcoin has struggled prior to now day as its value has retraced in direction of the $51,100 mark.

Appears to be like like the worth of the coin has registered some decline within the final 24 hours | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, CryptoQuant.com, chart from TradingView.com