Bloomberg (gated) with the report on Reserve Financial institution of Australia inside paperwork displaying how rising rates of interest have impacted family and companies.

In short:

- home tourism

demand slipped from excessive ranges - customers have continued to commerce right down to cheaper

merchandise, or bought fewer gadgets, as a consequence of cost-of-living pressures - personal sector wage progress appeared to have

stabilized at “around” 4% - neighborhood companies

organizations seeing …“Price‐of‐dwelling

pressures stay acute for his or her constituents” - “Extra

individuals than standard are looking for help from neighborhood companies

organizations, together with wage earners and households with mortgages

who’ve sought meals help.”

None of this could come as a shock. There may be nothing the RBA may do about most of the components that drove costs larger, reminiscent of supply-chain pressures and the leap in vitality costs. What the RBA can do, although, is figure (through larger rates of interest) to strain home demand decrease. Which is what they’ve accomplished. Its hitting some members of the neighborhood tougher than others, after all.

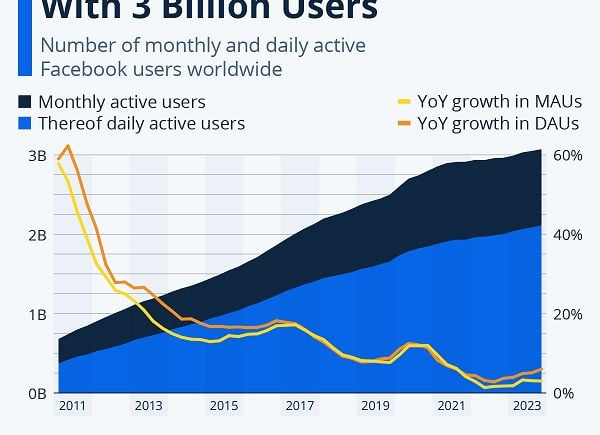

The RBA will stay targeted on driving inflation decrease, its one in every of their solely two jobs. Charges look like set to remain larger for longer:

RBA money charge