Justin Sullivan

Intel Company (NASDAQ:INTC) has been lagging its competitors for years. Now, a long time even! Intel’s high smaller and extra agile opponents, like Superior Micro Units, Inc. (AMD) and NVIDIA Company (NVDA), have taken vital market share from Intel within the extremely profitable CPU, GPU, server, gaming, and different market area. Intel’s market cap is simply $200 billion, whereas Nvidia has a valuation of $1.17 trillion now. Even AMD has surpassed Intel with its $220 billion valuation regardless of having fewer than 50% of Intel’s gross sales.

Intel is affordable now. Furthermore, Intel is underrated. On the identical time, Intel has made vital strides within the CPU, GPU, AI, and server markets. Intel’s newest announcement of an enormous $25 billion chip factory in Israel is a part of its international effort to extend chip manufacturing sooner or later significantly. Intel is constructing enormous chip vegetation globally because it plans to reassert itself as a dominant chip large able to posting progress. Intel’s revenues and profitability will doubtless improve greater than anticipated, resulting in a number of expansions, greater EPS, and a considerably greater inventory worth in future years.

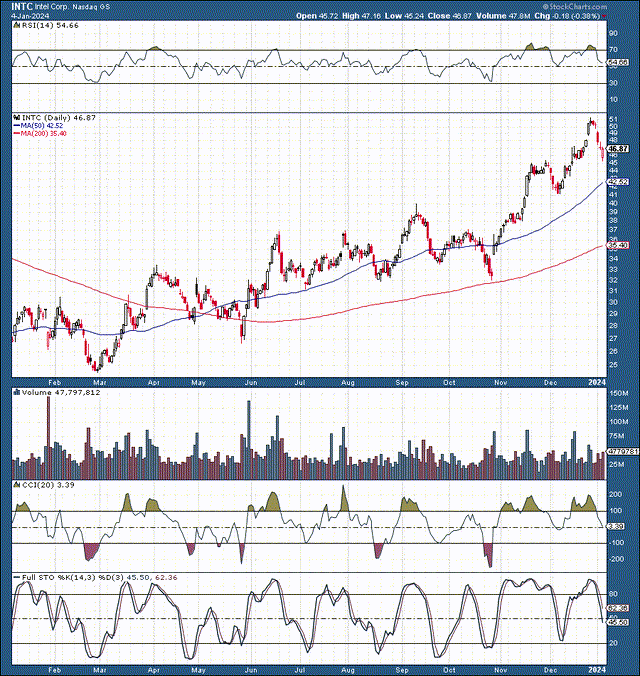

Technically – A New Bull Market Started

Intel’s bull market started after bottoming round $24 in late 2022. We noticed a profitable retest of $25 in late February final 12 months. We have seen a sturdy and constructive uptrend established since then. We proceed seeing greater highs and better lows. Momentum continues bettering. Whereas Intel could also be overheated technically within the close to time period, in the long run Intel inventory doubtless has appreciable upside forward.

Israel $25 Billion Manufacturing facility – Glorious Deal For Intel

Below the deal, Intel will obtain a $3.2 billion grant from the Israeli authorities for its $25 billion chip facility. The Israeli authorities subsidizes practically 13% of Intel’s plant prices, which is great for Intel. The growth plan for its Kiryat Gat website is an instrumental section of Intel’s plans to determine a extra resilient international provide chain.

Along with its huge Israeli chip facility, Intel is constructing huge European and American factories. In Germany, Intel plans to spend greater than 30 billion euros ($33 billion) to develop two chipmaking vegetation. Berlin guarantees vital subsidies to make the event enticing for Intel. In 2022, Intel stated it could make investments as much as $100 billion to construct probably the world’s largest chip-making advanced in Ohio.

Why is Intel constructing these huge factories? Properly, it is not as a result of Intel has extra capital mendacity round. International demand for chips continues to extend, and Intel stays essentially the most vital producer.

Intel Has A Lot Of Chips to Ship

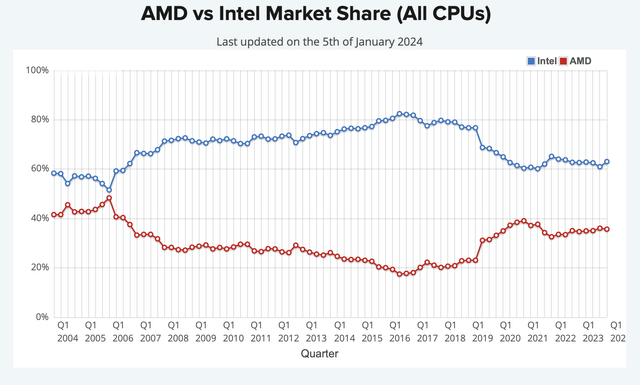

Intel has a 63% to 44% market share benefit over AMD throughout all CPU merchandise. Furthermore, Intel has a couple of 75% to 23% CPU lead within the profitable laptop computer market. Intel’s colossal lead is within the server market, the place it enjoys a 98% to 2% market share benefit over AMD.

Intel is named the built-in GPU king, nevertheless it’s lately gained market share within the discrete GPU market. The discrete GPU market has been a duopoly dominated by AMD and Nvidia. Whereas Nvidia continues dominating with about an 84% market share, Intel now has a 4% share on this extremely profitable market. Furthermore, Intel can enhance merchandise and improve its share within the GPU area in future quarters.

Intel’s Growing AI Potential

Intel was first thought of one of many AI laggards, however being essentially the most vital chip producer globally, Intel ought to grow to be one of the crucial necessary beneficiaries of AI. Intel Labs is shaping the next generation of AI by pioneering developments that may unlock the true potential of AI. It isn’t stunning that Intel is rising as one of many clear leaders of the AI revolution. Intel’s revenues are huge, and it has unequalled R&D spending, a lot of it going to analysis and higher implement AI.

Intel has one of the crucial intensive R&D budgets globally, with $12 billion spent on R&D within the first three quarters. Intel ought to spend about $16 billion on R&D for the complete 12 months, and it’ll have an analogous price range for subsequent 12 months. Intel’s elevated spending ought to allow it to emerge as one of many dominant chip gamers within the age of AI, successfully competing with AMD, Nvidia, and different high gamers within the AI race.

Intel’s AI analysis has enabled it to achieve significant feats in Novel AI techniques, neuromorphic computing, cognitive AI, probabilistic computing, human-AI collaboration, pure language processing, graphic neural networks, automated machine studying, and extra.

Intel Inventory Is Nonetheless Low cost

First, Intel has finished a wonderful job of surpassing consensus estimates in earlier quarters. Last quarter, Intel beat income estimates by $560 million and crushed EPS projections, practically doubling the forecast to $0.41. Its subsequent earnings report is anticipated post-market on January twenty fifth.

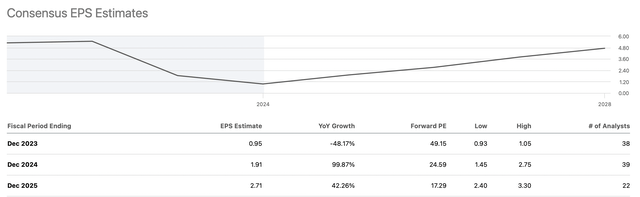

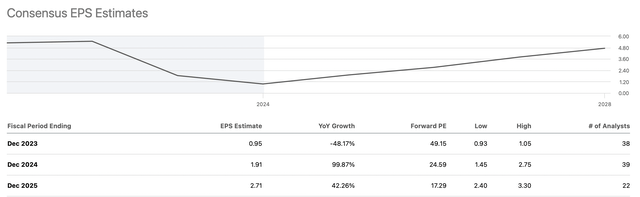

EPS Development More likely to Enhance

EPS estimates (SeekingAlpha.com)

Intel’s consensus EPS estimates counsel earnings needs to be round $2 per share this 12 months. Nevertheless, greater estimates suggest Intel can hit the higher-end vary of analysts’ estimates, probably reaching $2.20-2.50 in EPS this 12 months. Additionally, Intel can obtain the upper finish of subsequent 12 months’s EPS estimates. Intel’s EPS needs to be round $3 subsequent 12 months, with vital, sustainable EPS progress potential after that. Attributable to bettering and rising gross sales, Intel’s EPS ought to proceed bettering, resulting in a number of expansions and a significantly greater inventory worth as we advance.

The place Intel’s inventory could possibly be sooner or later:

| Yr | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Income Bs | $62 | $70 | $77 | $84 | $91 | $99 | $107 |

| Income progress | 15% | 13% | 10% | 9% | 8% | 9% | 8% |

| EPS | $2.40 | $3.20 | $4 | $4.80 | $5.66 | $6.50 | $7.42 |

| EPS progress | 140% | 33% | 25% | 20% | 18% | 15% | 14% |

| Ahead P/E | 20 | 22 | 20 | 21 | 19 | 18 | 17 |

| Inventory worth | $64 | $88 | $96 | $119 | $124 | $134 | $145 |

Supply: The Monetary Prophet.

Threats to Intel

Regardless of my bullish outlook, there are considerations relating to Intel. AMD and Nvidia are nonetheless the innovation and know-how leaders of their respective industries. Due to this fact, whereas Intel participates in essential markets, it would not essentially make it a frontrunner within the area. Intel faces intense competitors and should innovate extra, particularly given the corporate’s monumental R&D price range. Intel additionally must execute properly and keep away from future setbacks.

A vital part of Intel’s success is its administration staff. Intel’s administration has a excessive bar forward and should handle successfully, main the corporate to extend gross sales and profitability. Intel could also be its personal most vital threat. Buyers ought to think about these and different dangers earlier than investing in Intel.