Thomas Barwick/DigitalVision via Getty Images

Investment Thesis

Shares of Intrepid Potash (NYSE:IPI) have been “dead money” lately, staying at around $20 per share for the past few months. While the tangible book value is clearly higher than the stock price, the market is clearly negative on Intrepid Potash by assigning it a big discount to NAV. As potash prices continue to decline, I believe the bottom is in and that a cyclical rebound will help lift Intrepid Potash up from $20 per share. Thus, given strong pent-up demand and declining capex from the market, I expect the supply/demand balance to stabilize and cash flows to steadily grow from current levels.

Company Overview

The company is mainly a producer of potash, a compound made of potassium that is used in fertilizers to support crop growth. These products according to the annual report are “essential for customer success in agriculture, animal feed and the oil and gas industry”. They are the “only U.S. producer of muriate of potash (sometimes referred to as potassium chloride or potash), which is applied as an essential nutrient for healthy crop development, utilized in several industrial applications, and used as an ingredient in animal feed”.

Intrepid Potash has 3 mines outlined in their annual report, “HB solution mine in Carlsbad, New Mexico, our solution mine in Moab, Utah and our brine recovery mine in Wendover, Utah.” These mines utilize the solar evaporation technique to produce salts, and according to their website “provides one of the safest, lowest cost, environmentally friendly production methods for potash and salt”.

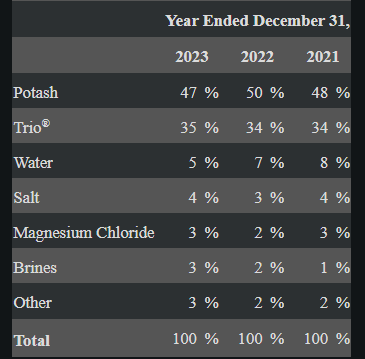

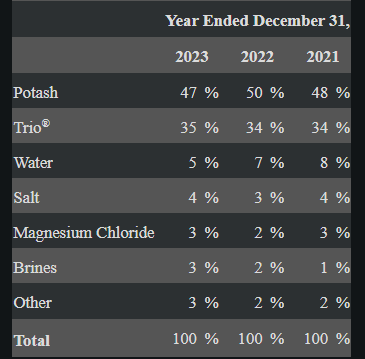

Main products that Intrepid Potash has are Potash, Trio, and water. For the purpose of this analysis, I will be focused on potash and analyzing its potential upside from current cyclical lows. The company sells potash in three markets, “the agricultural market as a fertilizer input, the animal feed market as a nutrient supplement, and the industrial market as a component in drilling and fracturing fluids for oil and gas wells and an input to other industrial processes” (Annual Report, Page 3).

For 2023, sales from Potash made up 47% of sales, Trio 35%, and Water the remaining 18%.

Annual Report

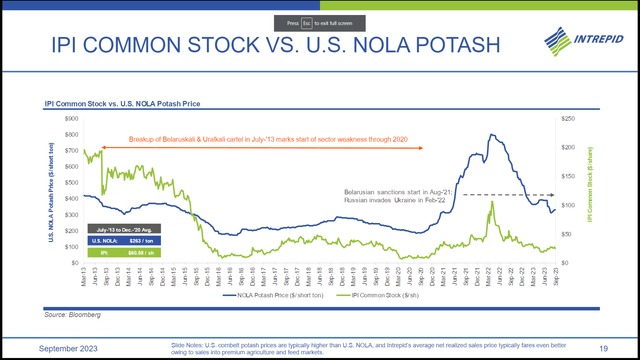

My overall assessment of the business is that it is an average business that is significantly affected by the price of potash. Investors can see according to their presentation their stock closely follows potash prices. So, I believe a main driver of shareholder return will be analyzing the market and industry of potash and figuring out whether the potash cycle is nearing the bottom.

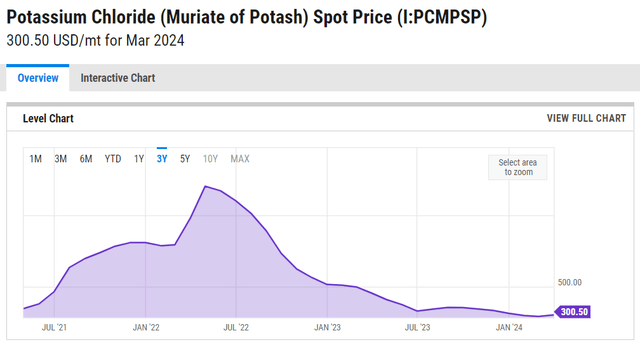

Since the spike of potash prices in the middle of 2022, the cyclical correction inevitably came as producers pushed production and supply up to meet the sudden shortage due to the Russian-Ukraine war. Now, shares have seem to found a floor around $20 as potash prices continue to test new lows. However, my belief is that potash prices have bottomed and can eventually swing up due to future supply constraints and growing demand.

Low Potash Prices Discourage Expenditures

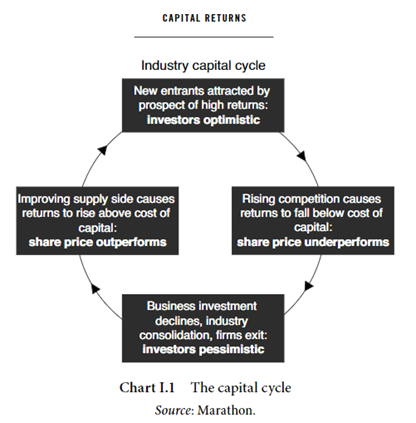

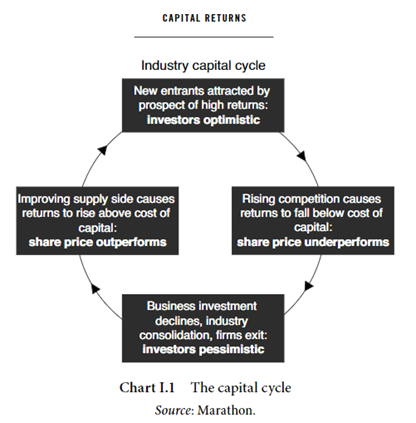

As a student of commodity cycles, I generally believe that the best time to buy commodities is when they are priced at cyclical lows. This means the higher-cost producers suddenly face pressure to cut costs and capex, leading to eventual supply constraints. Eventually, as demand begins to outpace supply I expect the commodity price to rise again, giving investors returns. This is the classic capital cycle that Edward Chancellor mentions in his book Capital Returns: Investing Through The Capital Cycle.

Medium

The price of potash has steadily declined since 2022, reaching a recent low of around $300/metric ton. Reasons for this decline include “Supply and demand fundamentals, as well as some resolution of the ongoing impacts and uncertainties associated with the Russia-Ukraine conflict, have been contributing factors”, according to FarmDoc Daily.

Now that Potash prices have reached such low levels, I believe a lot of the major producers are suddenly pressured to cut costs and capex significantly. In the future, I expect less capital to flow in and if prices remain this low capital may actually start to flow out of the potash industry, signaling a bottom in the cycle. As of now, we see the flow of capital entering potash slowing down as many producers are decreasing capex YoY. According to Republic of Mining,

Nutrien Ltd. is indefinitely suspending plans to ramp up its potash production, cutting its capital expenditure and reducing its profit forecast yet again, as a prolonged slump in the global fertilizer market takes its toll on the Canadian giant.

As potash prices continue to decline, producers are decreasing capex spend YoY signaling their unwillingness to put capital in an industry where the returns on capital are unattractive. Intrepid Potash has announced in their press release,

Our capital expenditures for 2023 totaled $65.1 million, which was at the lower-end of our guidance range of $65 to $75 million. For 2024, our capital expenditure guidance range is $40 to $50 million.

I believe as business investment declines, new supply coming in to the potash market will eventually slow down as high-cost producers may be forced to shut down operations. We are seeing the start of what I think is a cyclical bottom in potash prices, and it may persist for some time. Although near-term prices may face pressure, I think long-term the growing demand will steadily outpace limited supply, lifting potash prices and giving Intrepid Potash investors returns from here.

Pent-Up Demand Is Attractive

While future supply may slow down in the future, I think that all the pent-up demand for fertilizer will eventually push prices up, as now potash and other fertilizers are incredibly cheap. When potash was over $1,000 per metric ton in 2022, many buyers may have delayed or used stockpiled potash instead of buying in the open market to save on costs. Now that potash is cheaper, I think a lot of buyers want to stock up on cheap potash for a rainy day, so demand should grow consistently strong in the future.

According to Progressive Farmer, the consumption rebound can be expected due to more affordable fertilizer prices,

Fertilizer consumption in recent years has fallen globally due to this same issue of affordability with the high price of nutrients. Rabobank estimates 2023 was a much calmer year than 2022 with global fertilizer usage up 3% in 2023 after a 7% decline in 2022.

The outlook for 2024 suggests potash application could increase to about 5%, according to Rabobank. With the fertilizer prices at lower levels and affordability more positive, the world’s farmers are expected to increase sales into 2024.

My take is that farmers are now interested in buying potash at more affordable levels, after delaying buying in 2022 when it was expensive. And, the war in Ukraine is still happening which makes it more urgent for farmers to get in now while they still can. After record profits in 2022 for farmers due to elevated crop prices, (soybean, corn, rice) I think they can now afford to buy big, and potash is something they are likely to stock up on now for the future.

A lot of other fertilizers are moving up in price, which leads me to believe demand for cheap fertilizer is strong. According to Progressive Farmer,

Seven of the eight major fertilizer prices were higher compared to a month earlier, marking the fourth week in a row that prices were mostly higher. DTN designates a significant move as anything 5% or more.

Urea pushed considerably higher, up 7% from last month. The nitrogen fertilizer had an average price of $564/ton.

When the tide rises, all boats should rise and eventually I expect the price of potash to follow its peers upwards. In conclusion, cheap potash prices actually in of themselves stimulate buying as farmers are ready to stock up. With a growing global population and long-term demand for effective fertilizer, I expect pent-up demand to help push prices up and deliver returns to potash investors.

Q1 Earnings, What to Expect

The company will release Q1 2024 earnings on May 8, 2024. A quick recap on what to look out for:

- Revenue and adjusted EBITDA may be weak as lower potash prices pressure fundamental growth, expect sales to come in at around $63 million with GAAP EPS of -$0.21

- Slowing capex numbers and higher free cash flow, as the company has given guidance on winding down investments

- Progress on replacement well and other initiatives to correct overall declining production trend

- Updates on payments from XTO and overall partnership progress

Overall, I expect the quarter to be typical and in-line with consensus estimates. I’d want to see progress on ramping up production as well as how the low potash prices have affected fundamental performance. At $20 per share I don’t think the stock could go any lower as all the pessimism is already priced in, but investors may want to wait after Q1 earnings before buying to see additional details.

Valuation – $35 Price Target

The stock is cheap and can be appropriately valued based on net assets. It trades at .35x book, and most of it is tangible assets. I estimate the NAV to be the sum of current assets and net PPE, which would be ~$150 million + ~$350 million to get around $500 million in tangible assets. Subtract total liabilities of $84 million to get a NAV of $416 million, or $35 per share.

I believe current assets should be worth around their stated values, because the cost approach is a fair indication of what those current assets could sell for. Net PPE stated values should be reasonable because it accounts for depreciation, so in an arms-length transaction it should sell for around $350 million. I focused on current assets and Net PPE because I believe these assets are tangible and properly valued on a cost basis.

At 3.38x FWD cash flow (according to Seeking Alpha), the stock is pretty cheap and looks to have found a floor of around $20 per share. It looks like markets are unwilling to price the stock below $20 as it would be significantly too far below liquidation value. Despite a lack of positive free cash flow now, I believe in the future the free cash could eventually turn positive which would be a major catalyst for the stock to move up on. As supply slows and demand grows, higher potash prices should allow operating cash flow to eventually exceed capex, and once free cash flows through investors can see the cyclical rebound is happening.

While in the near-term the fundamentals may be ugly, the long-term setup is attractive and I think $20 per share is very cheap and a significant discount to stated net asset value. For the truly patient, this undervalued stock could be poised to spring and eventually the valuation gap can close on positive free cash flow.

Risks

Commodity cycles are extremely hard to predict and it’s possible that further lows persist in potash prices. It may take patience for the thesis to play out as in the short-term potash prices are hard to predict due to a number of variables that affect the supply and demand equilibrium. However, given that the company has no debt they should be fine to weather the storm, so bankruptcy risk is not a problem.

If competitors continue to ramp up production it may cause continued oversupply in the potash market. This would invalidate my thesis as I expect low potash prices to discourage future expenditures, and cause supply to contract. However, if competitors aren’t rational and continue to dump money into producing and investing in potash then the market may continue to be oversupplied with potash.

It’s possible that farmers don’t find potash all that attractive anymore, and are leaning towards new substitute fertilizers. Recent news shows that scientists may have found a natural alternative to potassium fertilizer. In the future, new technology in fertilizer could potentially displace potash as a source of potassium. Global warming and extreme weather events could also negatively impact demand for potash as crop yields are expected to be poor, reducing the need for potassium fertilizer.

Buy Intrepid Potash

I believe the bottom is in for potash prices, and that an eventual cyclical rebound will help lift Intrepid Potash up. A combination of reduced capex spending from the larger potash producers and pent-up demand should reduce oversupply and allow potash prices to stabilize upwards. Given Intrepid Potash has a strong balance sheet and no debt, they should be able to weather this storm and come out the other side stronger with positive free cash flow. For the truly patient, this stock could be a coiled spring that delivers returns to shareholders.