-Oxford-

As the stock market continues to hover near all-time highs, investors have to be especially careful of high-valuation stocks that stand to crumble at the slightest whiff of unfavorable interest rate policy or macroeconomic news. I’m rotating more and more of my portfolio out of high-quality growth names and more into an assortment of cash and “growth at a reasonable price” stocks.

One software company that is long overdue for a correction, in my opinion, is Intuit (NASDAQ:INTU). Intuit is already one of the most well-known software brands for everyday consumers in the U.S., as the maker of popular tax filing software application TurboTax. Beyond TurboTax, the company also operates the small business accounting software Quickbooks (which competes against the likes of Workday (WDAY) and Netsuite (now owned by Oracle) for larger enterprises), as well as other smaller platforms like Mailchimp and Credit Karma that it acquired.

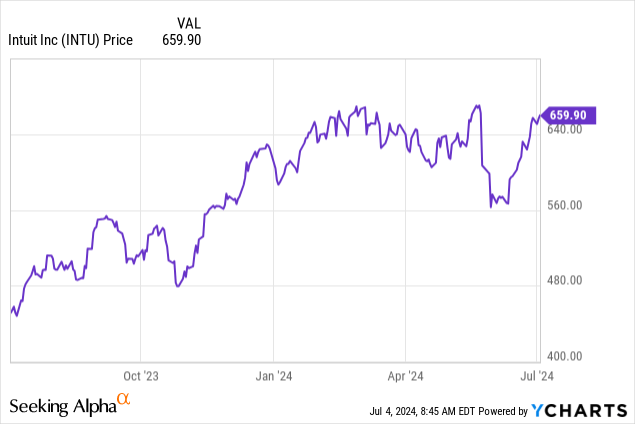

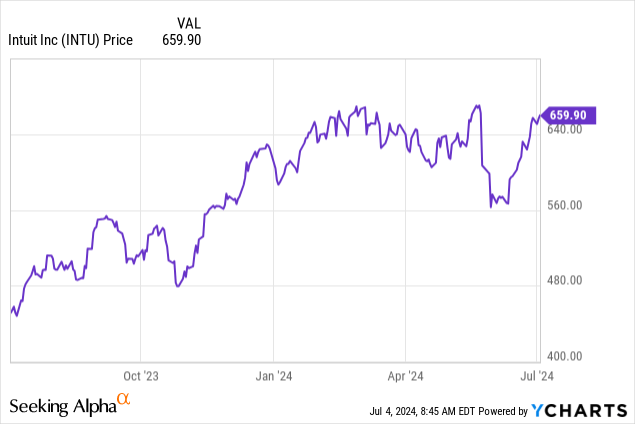

Over the past year, Intuit has seen its share price skyrocket more than 40%, and year to date, the stock has risen just about ~10%. In my view, this is a house of cards that is liable to crumble.

I’ll cut to the chase: largely based on valuation, I have a sell rating on Intuit. The company just passed its most important quarter (Q3, which includes the consumer tax filing deadline in which the majority of annual revenue is earned) and has virtually no major catalysts left for the remainder of the year, and is facing an uphill battle to defend its gargantuan price. Take advantage of the recent rebound rally after a post-Q3 earnings dip to lock in gains.

TurboTax Live is the main driver for Intuit’s growth, but it is already being tapped

We’ll first knowledge Intuit’s strengths: for a large, multi-product portfolio software company that has been around for decades, Intuit has done a fantastic job at stoking growth through new initiatives.

The biggest recent driver for Intuit’s share price skyrocketing is revenue growth in the consumer group driven by TurboTax Live. More and more of Intuit’s customers are being upsold from being simple DIY filers and into the assisted group, where taxpayers still file the majority of their taxes by themselves but are given live web consultation sessions with TurboTax professionals.

Per CEO Sasan Goodarzi’s remarks on the recent fiscal Q3 (April quarter) earnings call on the growing traction of TurboTax Live:

TurboTax Live, our assisted offering, including our do-it-with-me and full service tax offerings for both consumers and businesses is our largest durable growth opportunity. We expect TurboTax Live customers to grow 12% and revenue to grow 17% in fiscal 2024. TurboTax Live revenue is expected to be $1.4 billion, representing approximately 30% of total Consumer Group revenue growing at a significant scale. This gives us confidence that we can digitize a very manual, disaggregated, and high priced assisted category.

Now, let me spend a few minutes going deeper in several areas. First, TurboTax Live full service is resonating with consumers as we continue to innovate, making it simpler for customers to get their taxes done virtually. We expect TurboTax Live full service customers to double this fiscal year, with those new to TurboTax to triple. Our full service offering has a product recommendation score of 85, one of the highest at Intuit. Our learnings and insights from this season bolster our confidence in the continued opportunity we have to disrupt the assisted tax category.

Second, we expect TurboTax to gain share with higher ARPR filers, as we strategically prioritized focusing on the assisted tax segment and higher value customers over the pay-nothing and lower ARPR segment. Third, Intuit Assist, our GenAI powered financial assistant, played a big role in our TurboTax experience this year. With Intuit Assist, we are creating a future of done for you, where the hard work is done automagically on behalf of our customers with a gateway to human expertise, fueling their financial success.”

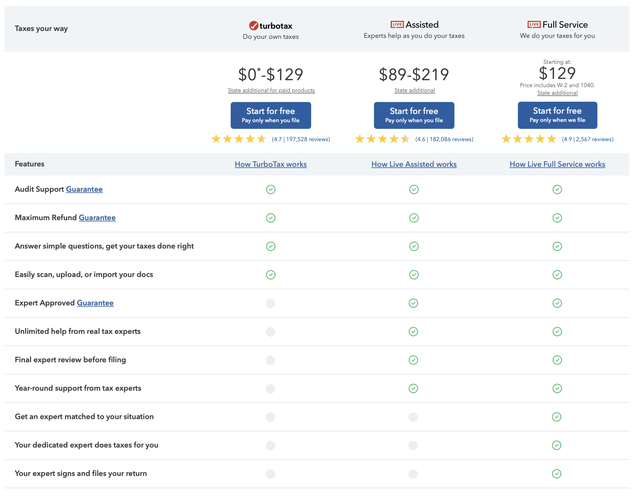

This represents a major upselling opportunity for TurboTax, as simpler filers often pay next to nothing, versus $129 for a fully assisted tax professional:

Intuit price comparison (Intuit.com)

Here’s the problem, however. TurboTax Live has already been fully operational for the current tax season. Hopes that an “Intuit AI” product will drive greater attach rates on TurboTax Live products next tax season are overblown (isn’t the point of paying extra to get human guidance?), and so the strength of the Live offering is already baked into current results and current share prices.

Further, Intuit still faces one of its ongoing challenges: extreme seasonality in which 40%+ of the company’s annual revenue, and 80%+ of the consumer group’s revenue, is generated in Q3. There aren’t many catalysts for Intuit to prove that it can continue to command its high multiples for several quarters now.

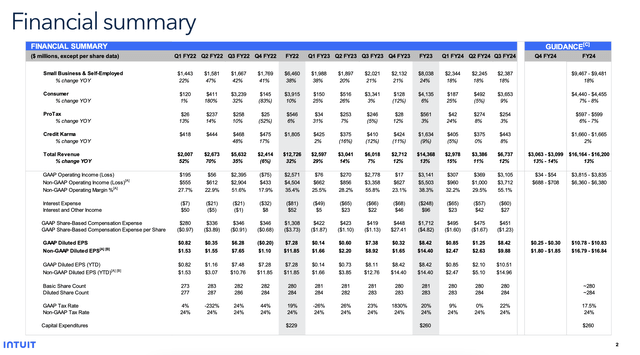

Another risk worth pointing out: while Intuit has been driving strength in the Small Business segment (largely Quickbooks, the SMB-oriented accounting software) which generates more than half of its revenue, this has been due to pricing increases and a mix shift to higher-priced offerings. While the fact that the small business segment has maintained 18% revenue growth in each of the past three quarters is impressive, the SMB segment is also much more exposed to churn than enterprise clients. Other software companies with a larger SMB concentration (such as ZoomInfo (ZI) and BigCommerce (BIGC)) are reporting challenges with retention. Challenges here may further complicate the growth narrative for Intuit.

Operating margins are contracting

We’d also expect that with higher-priced tax packages having greater attach rates that Intuit would be driving higher operating margins as well. Unfortunately, this is not the case.

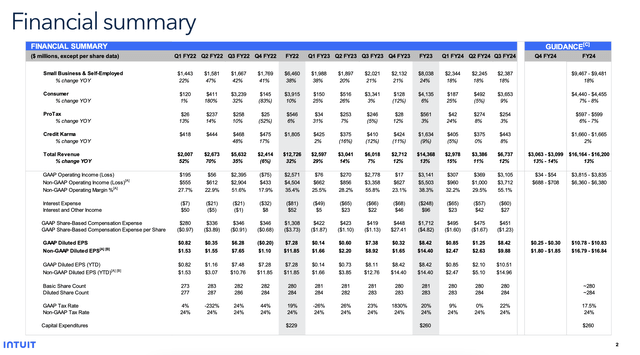

Intuit Q3 trended metrics (Intuit Q3 data sheet)

As shown in the chart above, Intuit’s pro forma operating income in Q3 clocked in at 55.1%: which is certainly impressive compared to other tech names, but is also down -80bps y/y. The company doesn’t expect operating margin expansion until 2025, but this hints that the recent product mix shifts into TurboTax Live offerings aren’t exactly as accretive from a bottom-line standpoint.

Sky-high valuation

The biggest reason to avoid Intuit, however, is that its share price is already bloated.

From a revenue standpoint: at current share prices near $660, Intuit trades at a market cap of $184.47 billion. After we net off the $4.34 billion of cash and $5.95 billion of debt on Intuit’s most recent balance sheet, the company’s resulting enterprise value is $186.08 billion.

This is a 11.4x EV/FY24 revenue multiple against the company’s $16.16-$16.20 billion revenue guidance for this year, and a 10.2x EV/FY25 revenue multiple against Wall Street’s consensus expectations of $18.17 billion in revenue (+12% y/y) next year. Enterprise software peers growing in the mid/low teens are currently trading in the ~4-6x revenue multiple range.

And on a P/E basis, Intuit is at a 39x FY24 P/E against even the high end ($16.84) of its guidance the year, or a 35x FY25 P/E against consensus if $19.13 (+14% y/y) next year.

Any way we slice it: Intuit’s growth rates don’t justify its heady premiums.

Key takeaways

With a highly seasonal business that has already exercised its biggest growth driver (TurboTax Live) in the most recent tax season that just passed the rearview mirror, I find it difficult to believe that Intuit can continue to retain its enormous valuation multiples and not see a correction. Take caution here.