peepo

Investment Thesis

NASA’s CLPS/VLT program provides significant growth opportunities for Luna Intuitive Machines (NASDAQ:LUNR), and the company boasts a strong leadership team that achieved the launch of the first commercial lander in February 2024. This success has positioned the company to secure additional contracts from NASA, making it a strategically important asset. If you’re seeking an innovative technology stock in the space sector with a low market cap and a clear trajectory for growth, this is the stock for you. The company aims to at least double its revenue year-over-year in 2024, and we have a buy rating for this company.

NASA space program provides strong growth tailwind

LUNR participates in NASA’s Artemis program, where NASA aims to bring humans back to the Moon and eventually enable human exploration of Mars. This Artemis program heavily relies on partnerships with the private sector to achieve its goals in a cost-effective manner, and its total spending is expected to reach $93 billion by 2025.

CLPS is a vital component of the Artemis mission. The creation of the Commercial Lunar Payload Services (CLPS) program facilitates the delivery of scientific instruments and equipment to the Moon for data collection in anticipation of human landings. The CLPS has $2.6 billion contract value through 2028. There are 14 companies selected for this program, with LUNR being one of them.

In addition to CLPS, Lunar Terrain Vehicle (LTV) program is also an important component, in which astronauts will travel around the lunar surface in these vehicles. This program has a maximum potential contract value of $4.6 billion. Only three companies have been selected by NASA for this program: Intuitive Machines, Lunar Outpost, and Venturi Astrolab.

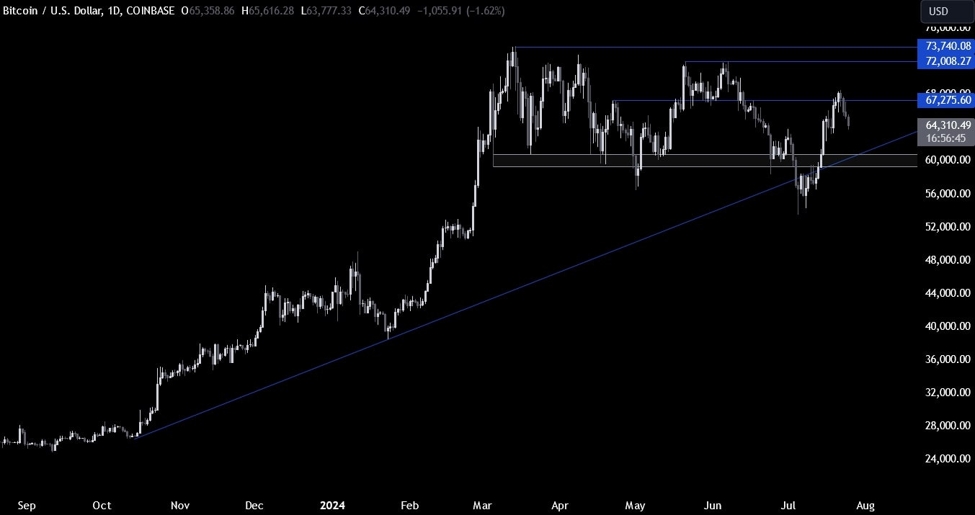

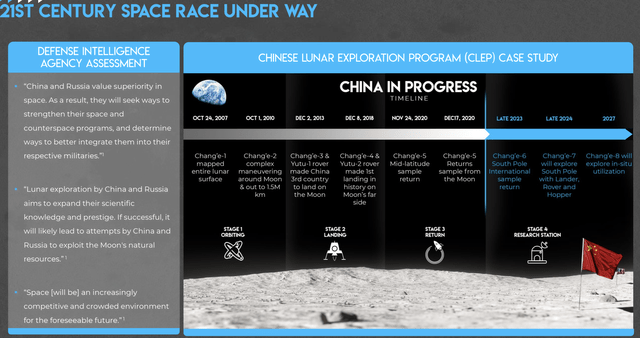

Not only that LUNR participates in program that have a combined max contract value of $7.2 billion, these contract value might see increase in the future because of the competition from China and Russia. As shown in the following picture, the national security imperative will mandate government spending in the space sector.

China’s Lunar Exploration Progress (LUNR investor deck)

LUNR is led by a strong leadership team

The current leadership team has a deep background in the space industry and strong ties with NASA. CEO Stephen Altemus is the former deputy director of the Johnson Space Center, and he also held the position of director of engineering, with over 25 years of experience at NASA. CTO Dr. Tim Crain, lead on NASA’s Project Morpheus. Project Morpheus was a NASA initiative that started in 2010 with the goal of developing a vertical takeoff and vertical landing (VTVL) test vehicle known as the Morpheus Lander.

A successful company always starts with a strong leadership team. LUNR went public in the first quarter of 2023, and has been in the market for over one year now, and there are results from this leadership team showing that LUNR is the emerging leader in this space. In addition, they have a bold vision for the company to establish lunar infrastructure and foster a diverse lunar economy.

In May 2024, LUNR is named TIME100 most influential companies.

On Feb. 22, the unmanned Odysseus spacecraft from Houston-based Intuitive Machines, soft-landed on the moon. It joined the U.S., Russia, India, Japan, and China as part of a rarefied group that has achieved the feat—the first ever commercial company to do so, and the first U.S. landing on the moon since the 1970s.

LUNR is a leader in the space industry

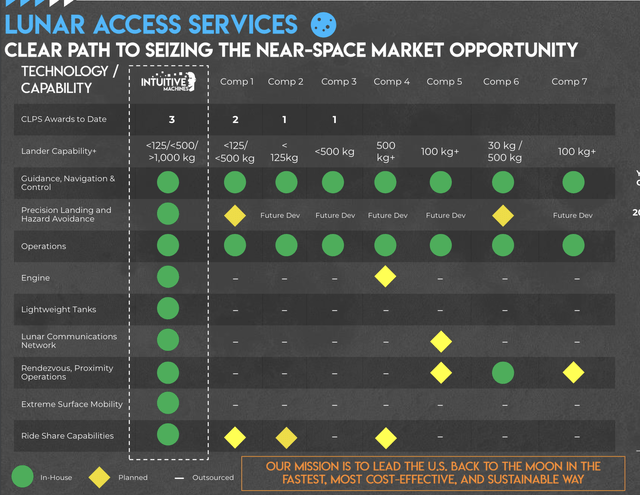

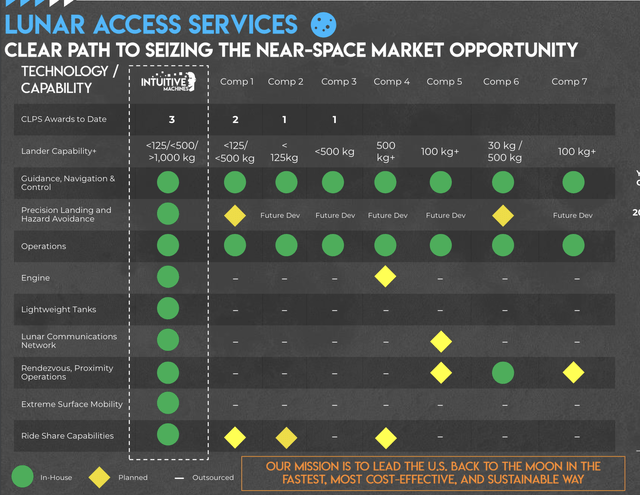

LUNR’s competitiveness in CLPS program

NASA has selected 14 companies to be the CLPS provider.

NASA’s CLPS Providers (NASA)

According to the audit report of the CLPS program, the Orbit Beyond task was terminated two months after the award, and Masten Space Systems filed for bankruptcy in 2022.

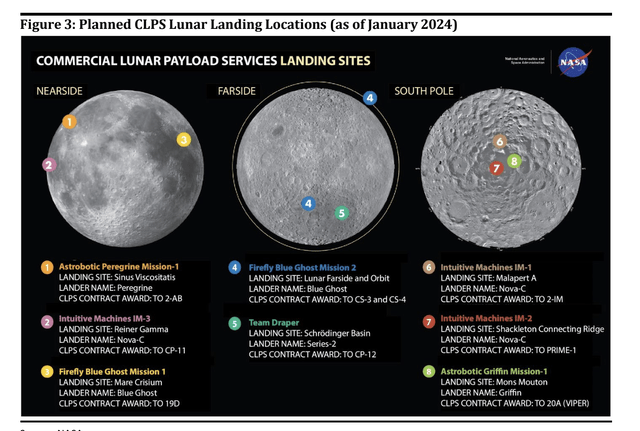

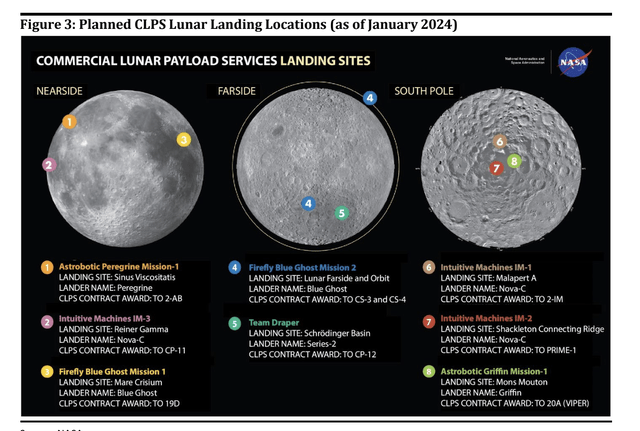

The CLPS contract has a maximum value of $2.6 billion through 2028. However, the proposed budget is only $2.19 billion through 2028. Since 2018, NASA has awarded 10 delivery task orders to 6 of the 14 eligible vendors (see Appendix B).6 However, the Orbit Beyond task order was terminated 2 months after award, and another vendor, Masten Space Systems, filed for bankruptcy in 2022. The remaining eight task orders, including the two recently launched missions, have a total value of approximately $1 billion. Figure 3 depicts the 8 planned flights’ lunar landing locations.

There are two aspects that attests LUNR’s leadership.

(1) LUNR has been awarded 3 out of 8 of the existing CLPS contracts, captured almost 40% of the contract.

NASA CLPS Schedule (NASA)

(2) LUNR is currently the only provider where its lander successfully landed on the moon.

Astrobotic’s Peregrine lander launched in January 2024 but failed to make it to the lunar surface because it suffered a propellant leak issue. Firefly and TeamDraper’s landers are yet to be launched to know the results. In 2020, Orbit Beyond informed NASA that it would be unable to complete the awarded task. On the contrary, LUNR’s lander successfully landed on the moon but tipped over on the side.

Space exploration is a very expensive activity, these companies are developing space technologies under NASA’s funding. Successful attempts will be very important to gain crucial experience and keep getting funded by NASA for future contracts. The current 14 selected providers will eventually be consolidated to a handful of companies mastering the space technology. With the current track of record, LUNR is highly likely to be one of them.

LUNR is one of the three companies awarded the LTV contract

According to this official NASA news:

NASA has selected Intuitive Machines, Lunar Outpost, and Venturi Astrolab to advance capabilities for a lunar terrain vehicle (LTV) that Artemis astronauts will use to travel around the lunar surface, conducting scientific research during the agency’s Artemis campaign at the Moon and preparing for human missions to Mars.

LUNR is the only company that holds both CLPS and LTV contracts with NASA, which underscores its technological leadership as recognized by the agency.

LUNR is the only company that has full space technology stack in house

LUNR’s Technology Capability (LUNR Investor Deck)

As illustrated in the image above, LUNR is the only company with technological capabilities that span from landers and navigation to extreme surface mobility and ride-share capabilities. Other competitors either have to outsource this technology or are planning to develop it in-house. This distinction sets LUNR apart from its competitors.

In LUNR’s recent lander launch, the landing on the Moon was delayed by two hours due to a failure of the laser rangefinders on the lander. However, the company was able to quickly deploy a software patch that utilized NASA’s Doppler LIDAR as a workaround. LUNR’s full-stack in-house technology is a key factor that contributed to the speed of diagnosing the issue and finding a solution to ensure a successful landing. These technologies can be improved over and over again during its future launch activities funded by NASA while its competitors are trying to develop it.

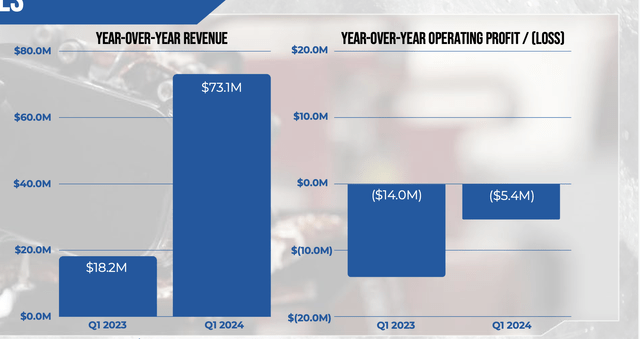

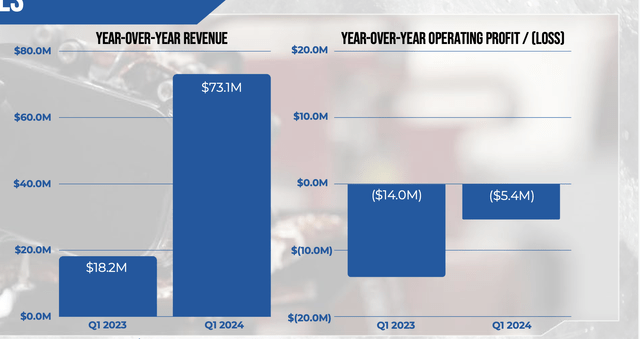

Review of the FY2024Q1 Result

In its latest FY2024Q1 earnings, its revenue grew 4X YOY to $73.1 million, and it also narrowed its operating loss significantly from ($14 million) to ($5.4 million).

LUNR Q1 Result (LUNR Investor Relations)

This result is driven by a variety of factors, including: IM-1 mission success and its OME III contract revenue. LUNR ended this quarter with $55 million cash, which is sufficient to support its operation for the next 12 months.

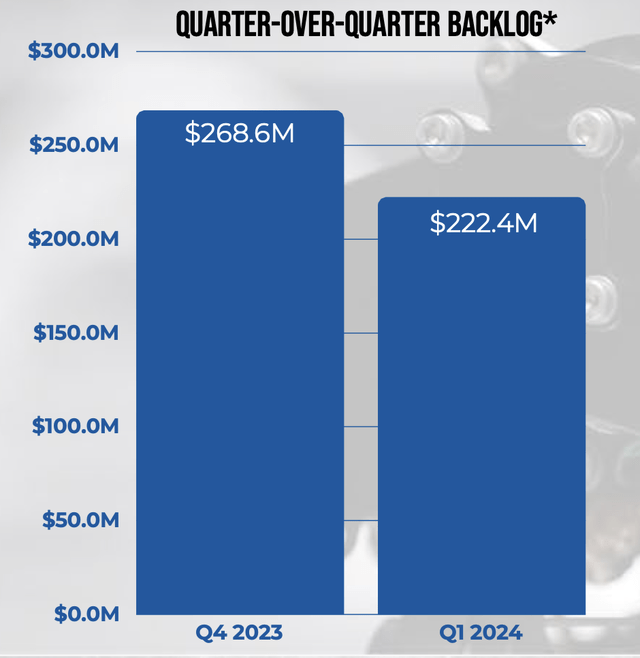

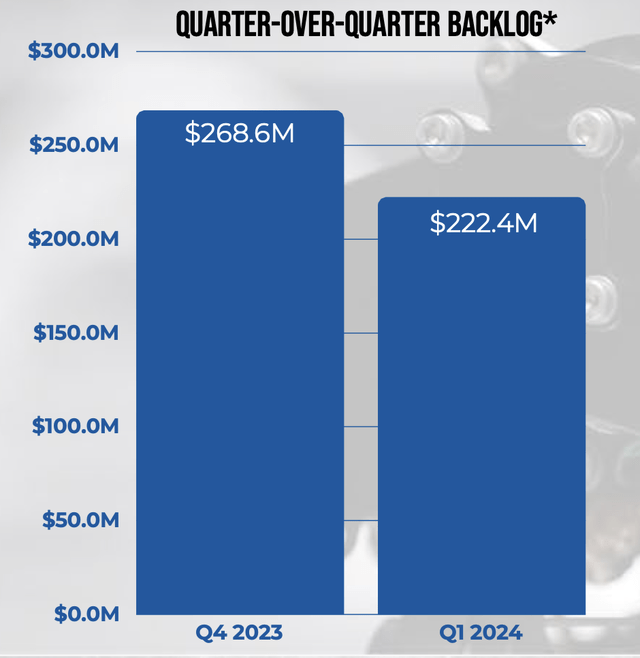

In sum, this quarter delivered multiple positive developments including revenue growth, cash flow improvement and successful IM-1 mission. However, on the negative front, the contracted backlog are down quarter over quarter by 46.2 million. However, the management team still expects the contracted backlog to expand this year from the next CLPS awards and others.

LUNR Contracted Backlog (LUNR Investor Relations)

For the upcoming FY2024Q2 report, investors should pay attention to the following key metrics from the company.

- The operating cash flow: any further improvement on this metric is the key for multiple expansion.

- The contracted backlog: the backlog is the total revenue the company expected to realize in the future, and the number will tell the expected growth rate in the future.

- The updates for the IM-2 mission: this is the second lunar landing mission, scheduled for later this year.

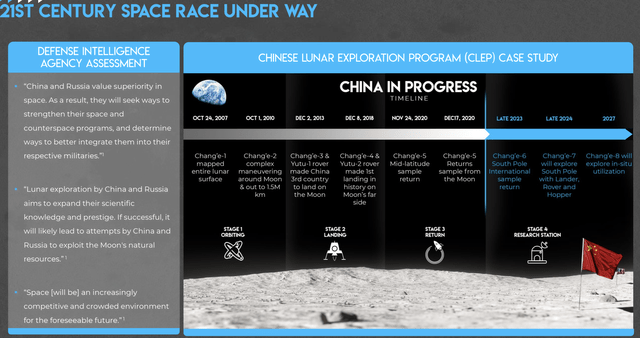

Valuation

LUNR is a fast-growing company, and the company expects the revenue to grow 2.5X – 3X YOY to $200M ~ $240M. The growth are impressive and not expected to slow down in FY2025 either as the company gets more contract awards from NASA, however, the company is still not profitable, its lunar lander launch activities are still losing money. For example, in its latest Q1 earnings, its operating loss was $5.4 million. It’s one of the few companies that can delivery landers to the moon, and hence we think market will place more emphasis on the revenue growth and free cash flows when applying multiples to this company. The company is still cash flow negative, so there won’t be any multiple expansions in the future because of this unless cash flow becomes positive.

Based on SA’s valuation data:

LUNR is currently valued at 2.89 EV / Sales (FWD) and 0.97 Price / Sales (FWD).

LUNR received $30 million from NASA as a prime contractor to conduct a Lunar Terrain Vehicle Services Feasibility Assessment In 2024. The Phase-2 award is expected in mid-2025, which will provide additional growth opportunities for the company and represents a significantly larger potential than the CLPS program. The SA’s revenue estimate, LUNR is projected to generate $392.45 million in revenue in FY2025, nearly double the lower guidance for FY2024. Using the same multiples, we anticipate that the stock price could rise to $8 by the end of FY2025.

RISK

As a leader in space technology, a setback from a launch failure could lead to a significant decline in the stock price.

LUNR successfully conducted one launch in February 2024; however, this does not guarantee the success of its future launches. The stock has experienced significant volatility since going public. If the scheduled launch later in 2024 were to fail, negative sentiment toward the company could lead to a substantial decline in the stock price. Conversely, if the second launch is successful, it may generate enthusiastic demand from investors, potentially resulting in quick and substantial capital gains. Therefore, the stock’s performance is likely to remain highly volatile during these initial launch attempts.

NASA is fostering a competitive commercial environment for the space industry, so it is not surprising if another strong competitor emerges and impacts the company’s profits.

The space industry is highly competitive, and NASA is actively encouraging this environment. LUNR is an emerging company in this developing sector, and it is likely that other companies on NASA’s provider list could return with stronger results. Investors should keep a keen eye on the launch activities and result from other providers as well.

Conclusion

LUNR’s revenue will likely at least double year-over-year in 2024. LUNR is the only company that holds both CLPS and LVT contracts from NASA and has developed all its space technology in house. This is a rare opportunity for someone looking for an innovative technology company in the space sector with a low market cap, a clear trajectory for growth and an achieved leadership team. We have a buy rating for this company.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Growth Idea investment competition, which runs through August 9. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!