Markets:

- Gold down $45 to $4453

- WTI crude oil down 83-cents to $56.30

- S&P 500 down 0.3%

- US 10-year yields down 3 bps to 4.15%

- USD leads, CAD lags

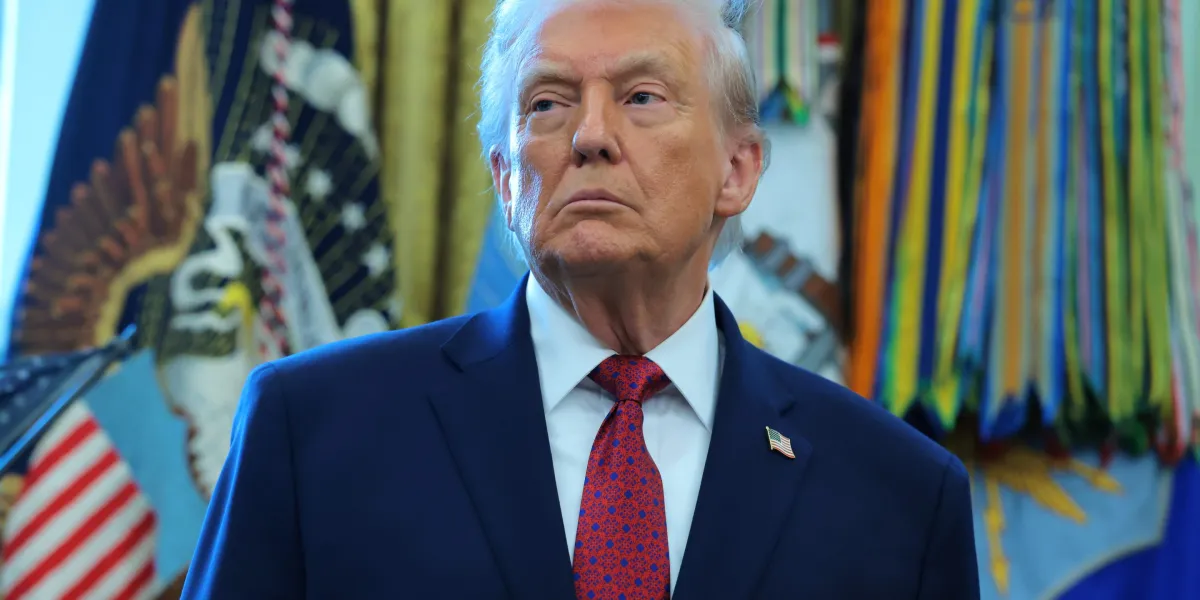

The early trade was generally risk positive and at midday, the S&P 500 hit a fresh all-time record. The President threw some cold water on that as he talked about defense companies halting dividends and buybacks. He also talked about banning institutional ownership of single family homes.

In reality, he doesn’t have the power to do either of those things but its wasn’t exactly a pro-stock market message. Moreover, there is building angst about the potential Supreme Court decision on tariffs. Many of the names sold off today would get hurt if the court upholds tariffs, or outlines a way for the President to implement them in some other way.

The US dollar generally climbed but the moves in FX weren’t overly large. The dollar bid was helped by an in-line ADP reading and a strong ISM services report. That was balanced by a weak JOLTS reading. It all adds some intrigue to Friday’s non-farm payrolls report but the pre-data numbers so far have been good.

Commodities were major movers again as silver rose above $80 only to get slammed lower before recovering somewhat. Gold also declined on the day in a round of profit taking.

Oil fell again as the market continues to digest Venezuela and Trump’s team continues to talk about taking Venezuelan oil, selling it, and holding it in US banks for returning it to Venezuela when it sees fit.