In brief:

-

Asian equities advanced as risk sentiment improved

-

Australian services PMI slowed but price pressures intensified

-

NVIDIA unveiled Rubin platform and Vera Rubin superchip at CES

-

Japan’s monetary base fell for first time in 18 years last year

-

US dollar weakened further after soft ISM data on Monday

-

AUD and NZD extended gains on risk and commodities

-

Oil eased slightly; gold little changed

-

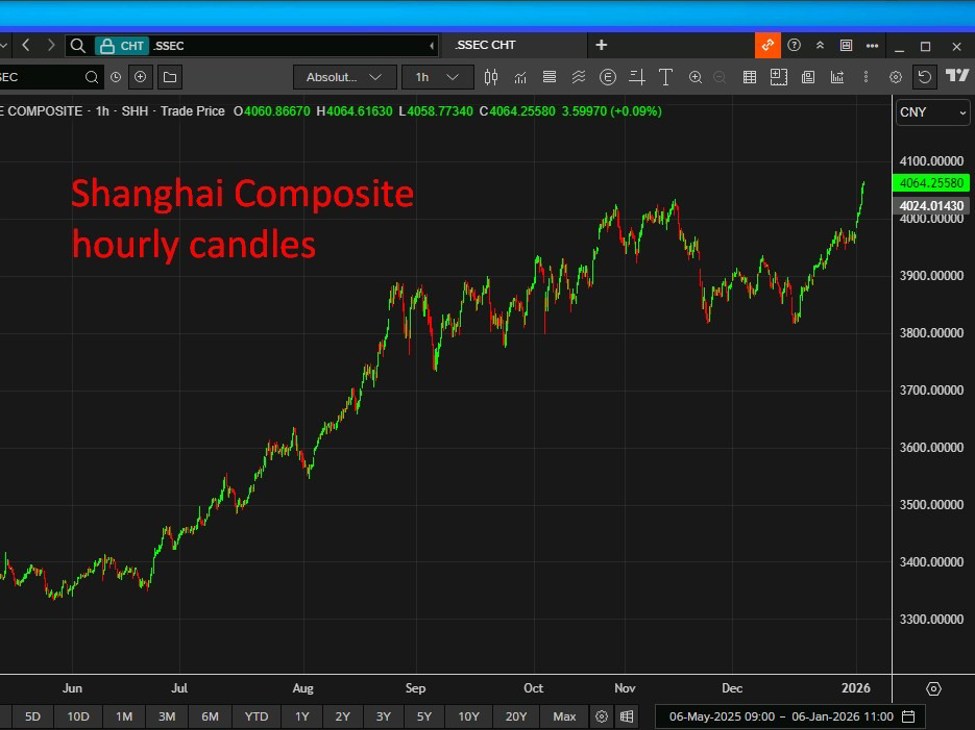

Chinese stocks rallied to four-year highs

News and data flow across the Asia session was relatively light, but risk sentiment leaned constructive. Asian equities pushed higher while the US dollar extended losses from the prior session, as markets digested a mix of softer US data and key macro and corporate developments.

In Australia, the December services PMI pointed to slowing momentum but persistent inflation pressures. The index slipped to 51.1 from 52.8 in November, signalling slower growth even as new business and hiring remained firm. Input and output prices continued to intensify, reinforcing concerns that services-led inflation pressures could linger into 2026, a dynamic likely to remain on the radar for the Reserve Bank of Australia. Note, we get November CPI data released Wednesday Australia time (see point above for more detail).

Corporate focus remained on CES 2026 in Las Vegas, where NVIDIA unveiled its next-generation Rubin platform. The launch was anchored by the Vera Rubin superchip, which integrates a CPU and dual GPUs and is designed for agentic AI and advanced reasoning models. Chief executive Jensen Huang said the new AI server systems, due to go on sale in the second half of the year, deliver a tenfold cost reduction versus the prior Blackwell generation. NVIDIA also highlighted deeper integration of connectivity and memory-storage technologies, a strategy Huang said has helped position the firm as both a leading networking hardware provider and the world’s largest producer of computing semiconductors.

In Japan, data from the Bank of Japan showed the country’s monetary base contracted in 2025 for the first time in 18 years, reflecting the BOJ’s exit from ultra-loose policy. Liquidity fell sharply in December, reinforcing expectations of continued bond tapering and further rate hikes as policy normalisation progresses.

In FX markets, the US dollar remained on the back foot following Monday’s weaker-than-expected ISM manufacturing data, which outweighed initial haven demand linked to US military action in Venezuela. EUR/USD and GBP/USD edged higher, with sterling also supported by a slight acceleration in the UK BRC shop price index to 0.7%. USD/JPY was little changed, while AUD/USD and NZD/USD extended gains on improved risk appetite and firmer commodity prices.

Oil prices eased marginally, gold was broadly unchanged, and Chinese equities surged to a four-year high.

Asia-Pac

stocks:

- Japan

(Nikkei 225) +0.69% - Hong

Kong (Hang Seng) +1.6% - Shanghai

Composite & CSI 300 both +1% nad more - Australia

(S&P/ASX 200) -0.3%