- There are six Fed officials speaking on Thursday, October 16, 2025, including Waller

- BofA sees China deflation easing slowly, CPI likely to stay negative in Q4

- ICYMI: US to expand stakes in key firms to counter China’s industrial policy, Bessent says

- European Central Bank President Lagarde and side kick Lane both speak on Thursday

- BoA say China loan demand weak, infrastructure may lift Q4 credit. But, pushing on string?

- Governor of the Bank of Canada Macklem is scheduled to speak on Thursday, October 16, 2025

- Australia’s jobless rate jumps to 4.5%, fuelling RBA rate-cut bets for November – recap

- BOJ’s Tamura says the Bank should lift rates closer towards neutral

- Central bank heads from Japan, China, South Korea held a three way meeting

- PBOC sets USD/ CNY reference rate for today at 7.0968 (vs. estimate at 7.1186)

- ANZ forecast gold to US$4600 and silver to US$57.50

- Bessent: Administration expects that Japan stop importing Russian energy

- Australian September unemployment rate 4.5% (expected 4.3%)

- ICYMI: Trump says India will stop buying Russian oil, vows to pressure China next

- Japan machinery orders +1.6% y/y (expected +4.8%)

- Japan fin min Kato on FX: Will monitor for excessive fluctuations and disorderly movements

- Bank of Japan Deputy Governor Uchida is expected to speak Thursday, October 16, 2025

- Japanese politics – LDP head Takaichi will hold a meeting with a minor party today

- Sterling faces double hit from BoE rate-cut risk and fiscal fragility, analysts warn

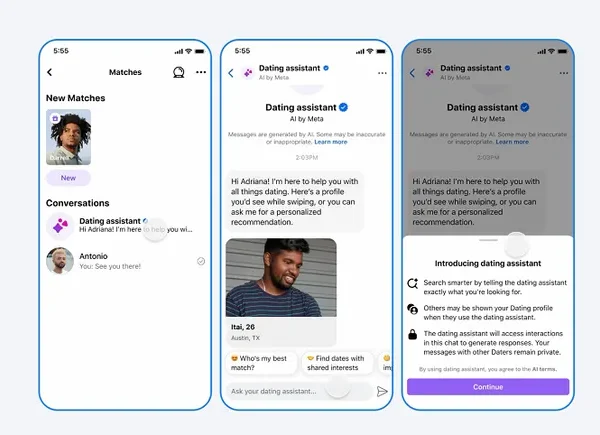

- Goldman see AI investmnt sustainable, future productivity gains far outweigh current capex

- Barclays sees 2% U.S. growth pace through 2026, flags risks from tariffs and jobs

- Trump admin eyes over 10,000 federal job cuts amid shutdown, CNBC reports

- New Zealand data – Food Price Index (September) -0.4% m/m (prior also +0.3%)

- A senior IMF official has urged the BoJ to keep its monetary policy loose

- RBA Kent says within neutral estimates, neutral not good guide to near-term path right now

- Oil – private survey of inventory shows a HUGE headline crude oil build vs draw expected

- JPMorgan expects easing in US/China trade tensions at South Korea APEC talks

- investingLive Americas FX news wrap 15 Oct: USD falls, but China remains a concern.

- RBA Gov Bullock: Data giving us time to think whether there is more easing to come or not

Asia session wrap – RBA signals, soft jobs shock, yen steadies.

It was an eventful session for Australia-watchers, with a series of central bank comments followed by a surprisingly weak labour report that sharply shifted rate cut expectations.

Australia:

Reserve Bank of Australia Governor Michele Bullock struck a measured tone late in the U.S. day, suggesting little urgency for another rate cut at the Bank’s upcoming November 3–4 meeting. She noted improving consumption trends and did not sound alarmed about the slight cooling in labour market conditions.

Soon after, Assistant Governor Christopher Kent said financial conditions are beginning to loosen following this year’s three rate cuts, with credit now flowing more easily to households and businesses. He acknowledged that while policy is less restrictive, the outlook remains uncertain and the RBA will continue reassessing its stance as new data arrive.

That data came quickly. And it was a jolt.

September’s employment report showed the jobless rate jumping to 4.5%, the highest since late 2021 and above the 4.3% expected, while net employment rose just 14,900 versus forecasts of +17,000. The rise in participation drove the unemployment rate above the RBA’s projected year-end peak, marking a clear loosening in labour conditions.

Markets reacted swiftly: a November rate cut is now priced above 75%, compared with roughly 30% before the release. The Australian dollar slumped around 0.4% to US$0.6485 or so, three-year bond futures rallied, and the ASX 200 touched record highs on renewed easing bets.

Traders caution that the final call will depend on Q3 CPI data due October 29, but inflation would need to reaccelerate meaningfully to prevent a November move. The labour report effectively undercuts recent RBA messaging that the easing cycle was nearly done.

Japan:

Finance Minister Shunichi Kato reiterated his familiar warnings against excessive currency volatility, saying Tokyo will “thoroughly monitor” FX markets in coordination with U.S. Treasury Secretary Scott Bessent, with whom he reaffirmed commitments to exchange-rate stability. Bessent said separately that the yen should settle at an appropriate level if the Bank of Japan maintains sound policy.

The comments, coupled with hawkish remarks from BoJ Board Member Toyoaki Tamura, who again called for rate hikes amid rising inflation risks, supported the yen. USD/JPY fell to around 150.50.

China:

China headlines were dominated by state-backed investment themes. Shenzhen launched a 5 billion yuan semiconductor fund to target weak points in the domestic chip supply chain, including computing power, storage, optoelectronics, sensors, and advanced manufacturing equipment.

Separately, analysts expect central and state-owned enterprises to boost investment in Q4 as cash flow improves. SOE revenues rose 0.2% year-to-date through August — the first annual growth this year — while China State Grid alone invested over 420 billion yuan in fixed assets through September, with full-year spending expected to top 650 billion yuan for the first time.

FX and commodities:

The U.S. dollar weakened broadly, with the yen, euro, sterling, kiwi, loonie, and franc all firmer. The Aussie underperformed following the weak jobs data. Gold tested back above US$4,240, benefiting from the softer greenback and rising expectations of policy easing.

Asia-Pac

stocks:

- Japan

(Nikkei 225) +0.98% - Hong

Kong (Hang Seng) -0.21% - Shanghai

Composite +0.34% - Australia

(S&P/ASX 200) +0.9%