Key Notes

- Bitcoin reached a new record price of $125,559.

- The global crypto market cap touched a new ATH of over $4.26 trillion.

- Long-term holders have been selling Bitcoin since mid-June.

The volatile crypto market has been rising alongside gold, which is a preferred investment choice in times of uncertainty, with Bitcoin (BTC) reaching a new all-time high.

The US government shutdown triggered a shift from the US dollar to safe-haven assets, such as gold and Bitcoin, as investors anticipated a declining USD value.

Gold reached a record high of $3,897 per ounce on Oct. 2. Similarly, Bitcoin broke to a new ATH of $125,559 early on Oct. 5, with a market cap of almost $2.5 trillion.

Bitcoin currently has a 58.5% market dominance over the sector’s $4.26 trillion market capitalization, according to data from CoinMarketCap. The CMC fear and greed index is still hovering in the neutral zone.

Are Long-Term Holders Selling?

Bitcoin’s rise was mainly triggered by short-term investors. For instance, the US-based spot BTC exchange-traded funds recorded $3.24 billion in net inflows last week.

This pushed the total inflows of these investment products above the $60 billion mark.

Another catalyst could be the expectations of what the community calls “Uptober” — referring to a potentially bullish October, triggering FOMO among investors.

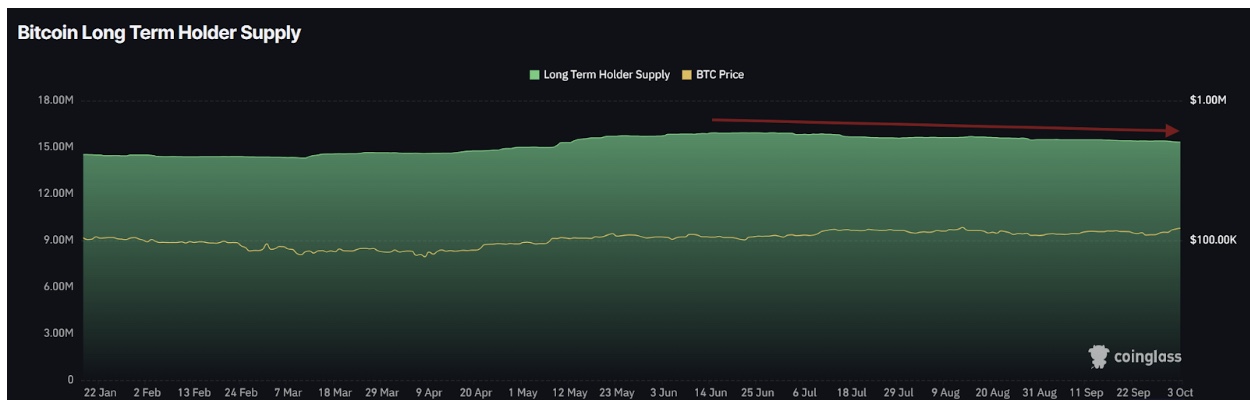

On the other hand, the Bitcoin long-term holder supply has been on a downtrend since mid-June. According to data from Coinglass, the LTH supply fell from 15.92 million BTC on June 15 to 15.32 million BTC on Oct. 3.

Long-term Bitcoin holders have been selling since mid-June | Source: Coinglass

The LTH supply shows that the market confidence in Bitcoin’s future value has been decreasing, as some investors might be expecting a major price correction.

Moreover, Coinglass data shows that the Bitcoin Net Unrealized Profit/Loss indicator rose from 0.51 to 0.56 last week.

While the NUPL is still in the neutral zone, its rise to the 70 mark could trigger profit-taking among investors, leading to a market correction.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Wahid has been analyzing and reporting on the latest trends in the decentralized ecosystem since 2019. He has over 4,000 articles to his name and his work has been featured on some of the leading outlets including Yahoo Finance, Investing.com, Cointelegraph, and Benzinga. Other than reporting, Wahid likes to connect the dots between DeFi and macro on his newsletter, On-chain Monk.