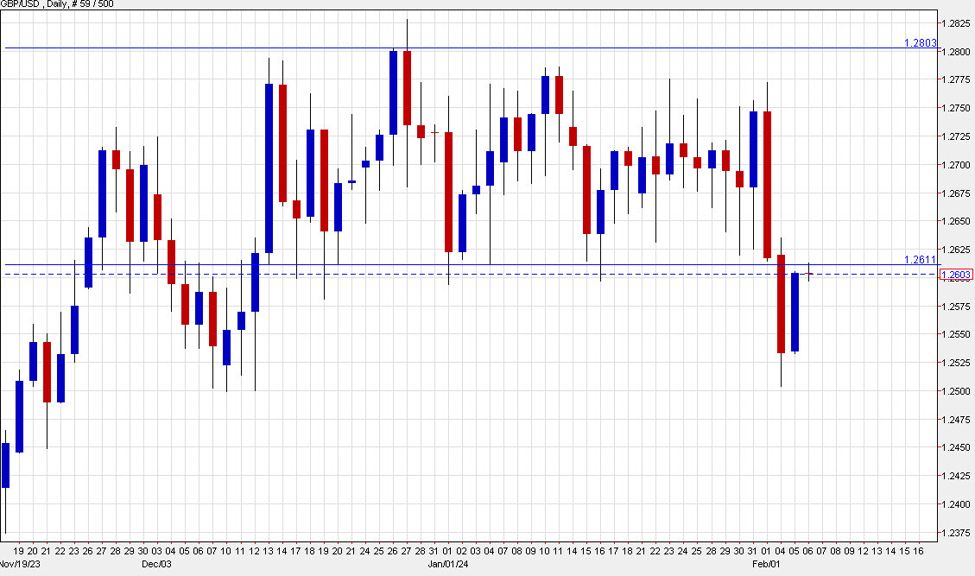

Cable might be the most-interesting chart on my radar in the intervening time.

It spent practically two months in a 200-pip vary from roughly 1.2600 to 1.2800. And it was a unstable interval for broader markets with the greenback usually strengthening however that seemingly balanced out on this pair by danger property enhancing. The Fed grew incrementally extra hawkish (much less dovish?) however the Financial institution of England matched it regardless of weaker home fundamentals.

The pair was testing the top quality late final week when the underside fell out on a hawkish Powell and powerful non-farm payrolls. It a clear break and follow-through all the way down to help on the December lows.

Nonetheless the greenback bought off broadly immediately and this pair rebounded to the underside of the vary (or within the vary relying the way you take a look at it). That raises an opportunity that it was a false breakout or the institution of a a wider 300-pip vary all the way down to 1.2500.

For now, I feel it is a basic re-test of the previous vary that ought to resolve decrease however it should want some assist. Eyes are on the US facet of the equation this week with a pair of essential Treasury auctions within the subsequent two days (10s and 30s) together with CPI benchmark revisions. That might set a broader US greenback tone and eventually give this pair some life.