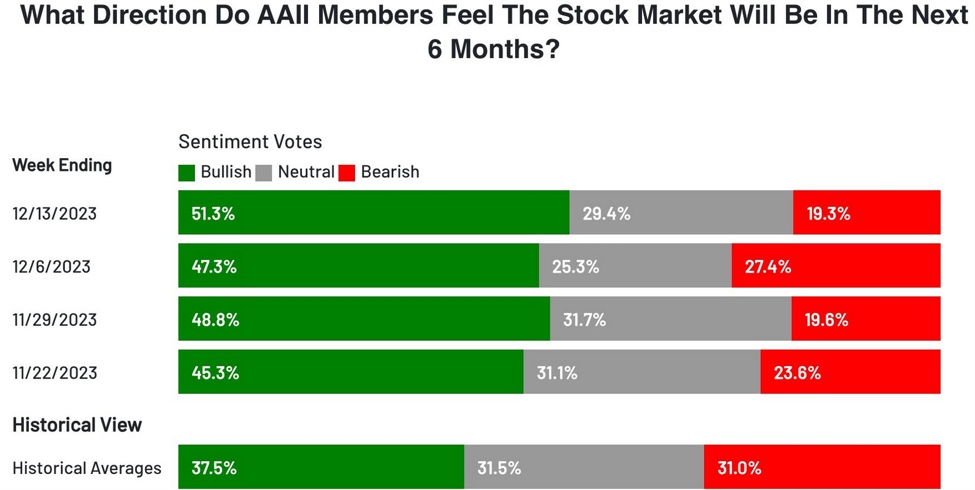

Probably the most-underrated indicators on the earth is the AAII Sentiment Survey, which has been operating since 1987 and measures sentiment of American buyers. It was a screaming contrarian purchase in October 2022 in what turned out to be a sensational rally for tech shares.

Now it is beginning to look bubbly.

The extent of pessimism at 19.3% is slightly below the late-November studying however it’s at its lowest stage in virtually six years. In the meantime, bullishness is at a five-month excessive. Observe that 5 months in the past, the S&P 500 peaked in July earlier than falling considerably into late October.

I would not need to be outright bearish right here on a contrarian commerce however I feel there’s a nice setup for rotation away from mega-cap tech and in the direction of worth and highly-indebted sectors. That pattern ought to lengthen in early January as effectively, with many buyers who’re lengthy mega-cap tech unwilling to promote now as a result of they will not need to set off a tax invoice for this yr.

That sort of pondering is unfolding in equities now with shares of the largest tech names now dragging the Nasdaq Composite 0.4% decrease led by NLFX down 2.3%, MSFT -2.5%, AMZN -1.7%, GOOG -1.7% and NVDA -0.9%.