It is a Buy BUT not yet. Let me explain. Meta Platforms, Inc. (META) remains one of the most popular and closely watched stocks on the market, known for its innovation and dominance in the tech space. But with META trading near its all-time highs earlier this year, many investors are asking: Is it time to buy, hold, or sell?

In this article, I’ll outline my detailed ‘Buy the Dip’ strategy for META—a long-term investment plan rooted in patience, planning, and a calculated reward-to-risk ratio. My approach targets price levels that may attract institutional buyers, assuming META’s stock price falls significantly from current levels.

This plan, shared for educational purposes only, reflects how I prepare for potential opportunities rather than relying on speculation or chasing price momentum. Alongside this article, I’ve also included a video analysis of META on the daily timeframe, which further illustrates the rationale and methodology behind my approach. Watch my video below;

How the Buy the Dip Plan Works

In the video (see below), I discuss META’s current price action and volume profile levels, as well as the potential for a 37% decline from its all-time high of $602. While this may seem like a significant drop, it aligns with historical market behavior during corrections and reflects where institutions may step in to buy.

Here’s the structured plan:

-

First Buy (Light Allocation):

- Price: $471.46 (22% drop from the high).

- Allocation: 25 shares or “X”.

-

Second Buy (Medium Allocation):

- Price: $438.53 (27% drop from the high).

- Allocation: Double the first buy (50 shares or 2X).

-

Third Buy (Heavy Allocation):

- Price: $395.53 (34% drop from the high).

- Allocation: Triple the first buy (75 shares or 3X).

-

Stop Loss:

- Once all three buy orders are filled, the stop loss is set at $380.27, representing a 10% loss relative to the weighted average entry price of $422.52.

-

Take Profit:

- Target price is $591.53, a 40% gain above the weighted average entry price.

Why These Price Levels?

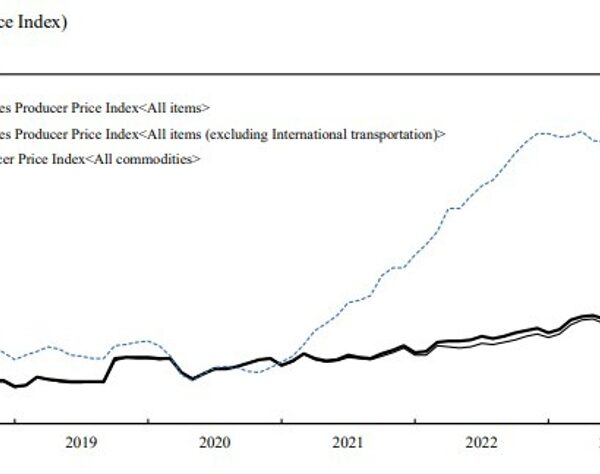

The price levels in this plan are not arbitrary; they are based on volume profile analysis, which highlights areas of significant institutional buying and selling interest. Specifically:

-

Volume Profile Insights:

Historical analysis of META’s price action during summer 2023 showed a strong consolidation period supported by high volume at key levels (as indicated by the Point of Control, or POC).- The red POC line (visible in the video) represents a key support level where buyers have previously stepped in.

- The purple line, a key volume support zone, has seen anxious buyers before, and it’s likely to attract institutional interest if META dips below it.

- Other historic volume profile analysis not shown in the video above, for simplicity.

-

Scaling Entries:

By scaling the buy orders at different price levels, I reduce the risk of committing too much capital too early while positioning myself to take advantage of deeper price declines. The result is a weighted average entry price that improves the reward-to-risk ratio.

The Numbers Behind the Plan

- Total Position Size: $63,000 (150 shares if all orders are filled).

- Risk: $6,338 (10% stop loss).

- Potential Reward: $31,689 (40% profit target).

- Reward-to-Risk Ratio: 4 to 1.

Scaling Note: Although the reward-to-risk ratio is 4:1, the total potential profit is five times the loss due to the scaling approach, which allocates more capital at lower price levels.

Flexibility and Adjustments

While this plan provides a structured framework, it is not rigid. For example:

- If META’s price only hits two buy orders and starts climbing, I may adjust the stop loss or take partial profits above $500 to lock in gains while leaving some “runner” shares for further upside.

- Flexibility is key, but the goal is to adhere to the core principles of risk management and reward-to-risk optimization.

Summary and Key Takeaways

- META’s stock is neither a clear buy nor a sell at current levels, but if it dips significantly, I see a compelling opportunity to buy the dip with a well-structured plan.

- This plan leverages professional analysis, patience, and discipline, targeting key price levels where institutions are likely to buy.

- The approach ensures that risk is limited (10%) while the reward potential is substantial (40%).

Video Analysis: Buy the Dip on META

In my accompanying video, I provide a detailed chart analysis of META on the daily timeframe, illustrating the volume profile levels, POC, and the rationale behind each buy level. I also discuss how scaling works using the Levitan Method, inspired by Fibonacci ratios, to optimize entry prices.

Final Note:

This journal entry is shared for educational purposes only and is not financial advice. Whether buying or selling META, always do your own research and tailor your strategy to your risk tolerance and goals.

Stay tuned to ForexLive.com for more insights and updates!

Disclaimer: The views expressed in this article are my own and do not constitute financial advice.

Is META Stock a Buy or Sell? Its AI says it’s in the game.

📢 Meta News Summary: Quick & Dirty for Investors 📢

🕒 Today at a Glance

- 📣 IBM CEO on Trump: Advocates for less regulation and more innovation as a win for businesses. (Yahoo Finance, 11:30AM)

Meta-Specific Highlights

- 📊 Stock-Split Watch: Could Meta be next? Investors speculate on the possibility of a stock split. (Motley Fool, 5:26AM)

- 🕶️ Smart Glasses Rivalry: Meta faces new AI smart glasses competition from Xiaomi, Baidu, and Rokid. (Insider Monkey, 6:45PM & 2:52PM)

- 🌐 Metaverse Spotlight: Hedge funds rank Meta as one of the best metaverse stocks. (Insider Monkey, 3:08PM)

- 💸 Activist Hedge Fund Boost: ValueAct ups its Meta stake with a $121M investment, backing Zuckerberg’s AI vision. (Benzinga, 3:00PM)

AI & Innovation Trends

- 🤝 Defense Tech Partnership: Meta collaborates with Palantir on artificial intelligence for defense. (Motley Fool, Nov-15-24, 5:00PM)

- 📉 EU Antitrust Fine: Meta hit with an $800M fine but continues to push AI investments. (Insider Monkey, Nov-16-24, 1:57AM)

Industry-Wide Big Tech Insights

- 📵 Online Safety Pushback: Big Tech, including Meta, seeks to sink the new Kid Safety Bill. (Wall Street Journal, 5:30AM)

- 🌟 ETF Growth: Nvidia, Meta, Apple, and Microsoft are top drivers for ETF potential. (Motley Fool, 5:21AM)

- 📈 Waiting Game: Big Tech traders adopt a cautious stance as Trump begins his second term. (Bloomberg, 10:08AM)

💡 Investor Takeaways

- Meta is balancing regulatory headwinds with innovation, particularly in AI and smart devices.

- New rivals in AI smart glasses could impact its competitive edge, but hedge funds and activist investors remain bullish.

- A potential stock split could reignite retail investor interest.

📬 TL;DR: Meta stays dynamic in AI and metaverse innovation but faces competition and regulatory pressure. Smart glasses and AI defense are areas to watch!

📊 Meta Investors: Quick & Dirty Highlights 📊

🔍 Valuation & Growth

- P/E Ratio: 26.09 – Pricey but not outrageous for big tech.

- Forward P/E: 21.90 – Expected growth keeps it attractive.

- PEG Ratio: 1.45 – Solid balance between price and growth.

- EPS Growth This Year: 🚀 +52% – Exceptional earnings growth!

- EPS Next Year: 📈 +11.91% – Slower growth but still healthy.

💵 Financial Strength

- Market Cap: 💰 $1.34 Trillion – A true tech titan.

- Book Value (P/B): 8.50 – High, but typical for tech.

- Cash per Share: $29.30 – Solid liquidity cushion.

- Debt-to-Equity: 0.30 – Low debt; strong balance sheet.

📈 Performance Metrics

- EPS Surprise: 🎉 +15.43% last quarter – Beating expectations!

- Sales Growth (TTM): 📊 +23% YoY – Sales machine is rolling.

- Sales Past 5 Years: 🔥 +20% CAGR – Strong multi-year growth.

- Stock SMA20: -3.85% 🔴 Short-term dip but SMA200: +8.41% 🟢 Long-term uptrend.

💡 Dividends & Shareholder Perks

- Dividend Yield: 0.36% – Tiny but consistent.

- Payout Ratio: Minimal – Most profits reinvested in growth.

📊 Summary for Investors

- The Good: 🚀 Strong earnings growth, low debt, and excellent long-term performance.

- The Risks: 🔴 Premium valuation and short-term weakness (recent SMA20 drop).

- Bottom Line: Meta’s fundamentals remain robust for long-term investors. Short-term traders, beware of volatility!

💬 TL;DR: Big tech powerhouse with growth momentum and financial strength. Keep an eye on dips for strategic entries! 📉➡️📈

📊 Meta Insider Trading Summary: Quick & Dirty for Investors 📊

💼 Key Insider Sales (October – November 2024):

-

Jennifer Newstead (Chief Legal Officer):

- Recent Sale: Nov 5, 2024

- Price: $567.70

- Shares Sold: 901

- Value: $511,498

- Remaining Shares: 30,581

- ⚠️ Frequent seller with significant activity in October.

- Recent Sale: Nov 5, 2024

-

Javier Olivan (Chief Operating Officer):

- Recent Sale: Nov 1, 2024

- Price: $567.58

- Shares Sold: 413

- Value: $234,411

- Remaining Shares: 10,294

- Consistent seller at prices in the mid-$570 range.

- Recent Sale: Nov 1, 2024

-

Mark Zuckerberg (CEO):

- Recent Sale: Oct 30, 2024

- Price: $600.17

- Shares Sold: 420

- Value: $252,073

- Remaining Shares: 518,004

- 🚨 Largest insider holding but occasional sales in October.

- Recent Sale: Oct 30, 2024

-

Peggy Alford (Director):

- Recent Sale: Oct 28, 2024

- Price: $582.50

- Shares Sold: 873

- Value: $508,522

- Remaining Shares: 5,295

- Recent Sale: Oct 28, 2024

📈 Trends & Takeaways

-

Consistent Sales Near $570-$600 Levels:

Multiple insiders, including Newstead, Olivan, and Alford, have been selling in this price range, indicating confidence in current valuations or rebalancing of positions. -

Mark Zuckerberg:

Despite periodic sales, Zuckerberg retains the largest insider stake, showing continued alignment with shareholder interests. -

Frequent Activity from Legal & Operational Insiders:

Newstead and Olivan show repeated sales over the past months, likely linked to planned selling programs (Form 4).

💡 Investor Insight:

- Insider sales aren’t necessarily bearish but may indicate valuation comfort at current levels (~$570-$600).

- Monitor sales volume trends alongside earnings and market sentiment for broader context.

📬 TL;DR: Insiders, including the CEO, are trimming positions but retain significant stakes, indicating stability rather than concern. A potential price dip could present buying opportunities! 📉➡️📈

Stay tuned to ForexLive.com for more insights and updates!

Disclaimer: The views expressed in this article are my own and do not constitute financial advice.