On-chain information suggests a Bitcoin indicator could lastly type a sample traditionally related to bull runs.

Bitcoin Lengthy-Time period Holders Have Reversed Their Pattern Not too long ago

Based on information from the market intelligence platform IntoTheBlock, the latest exercise of the hodlers has been typical for bull markets prior to now. IntoTheBlock defines “hodlers” as buyers who’ve held their Bitcoin since a minimum of one yr in the past.

Extra particularly, the addresses which have saved their cash nonetheless on the blockchain for a minimum of a yr (that’s, they haven’t concerned the cash in any transactions) qualify as long-term holders (LTHs).

Be aware that the cutoff for the LTHs utilized by different analytics corporations ranges between 5 to 6 months, which differs from the one-year threshold utilized by IntoTheBlock.

The hodlers embody essentially the most relentless fingers of the sector, who don’t promote simply irrespective of whether or not FUD has enveloped the market or an attractive profit-taking alternative has appeared.

As such, the instances that the LTHs begin promoting could be notable. One technique to observe the habits of the hodlers is thru the mixed quantity of BTC they at present carry of their wallets.

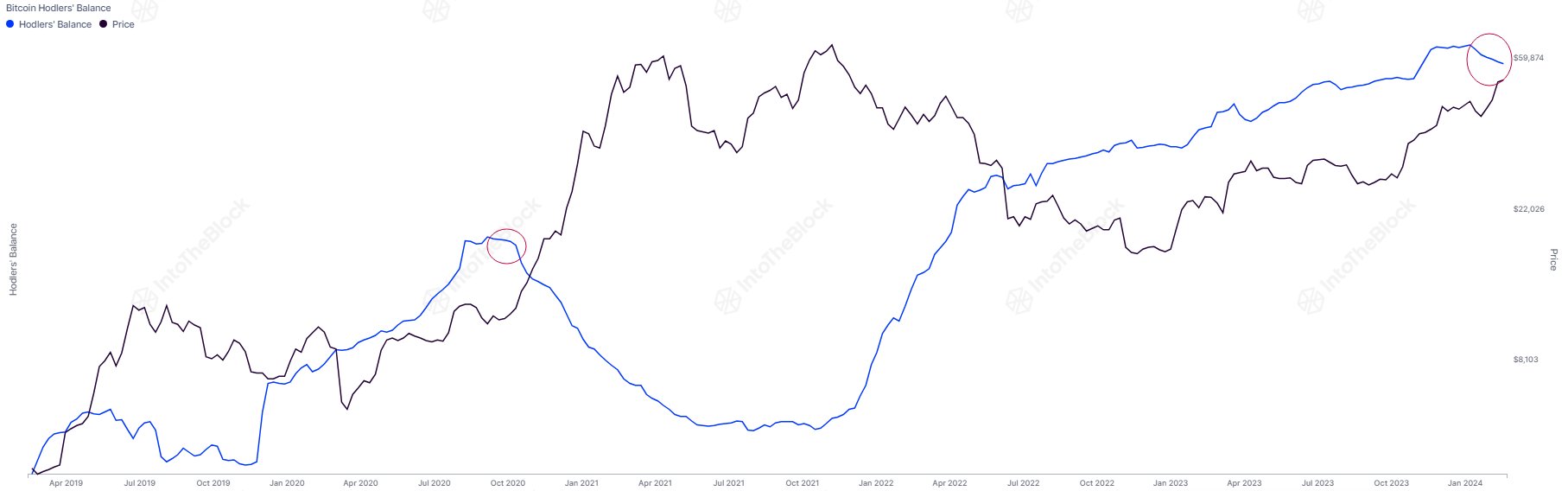

Here’s a chart that exhibits the development within the whole Bitcoin stability of the hodlers over the previous couple of years:

Seems to be like the worth of the metric has been heading down in latest weeks | Supply: IntoTheBlock on X

As displayed within the above graph, the Bitcoin hodlers had been constantly including to their stability for the reason that finish of the 2021 bull run, till very just lately, the place the indicator’s development seems to have gone by means of a reversal.

One thing to bear in mind is that any will increase within the metric don’t counsel that purchasing is occurring within the current. Quite, they suggest that some shopping for occurred a yr in the past, and these cash have matured sufficient to grow to be part of the cohort.

This identical delay, although, isn’t related to selling. When the holders shift their cash, their age immediately resets again to zero, thus resulting in them being faraway from the group.

As such, it will seem that the LTHs have taken to promoting just lately. “Long-term BTC holders have sold approximately 200k BTC from their collective balances since the beginning of the year, marking nearly 3 months of consecutive net decreases,” notes the analytics agency.

Curiously, an analogous sample was witnessed because the 2021 bull run kicked off, as IntoTheBlock has highlighted within the chart. It might seem that the LTHs had additionally stopped accumulating again then and had taken to promoting like they’ve now.

In whole, the Bitcoin hodlers went on to scale back their holdings by 15% all through the bull run, whereas to date within the present rally, they’ve shed about 1.5% of their reserves.

BTC Worth

On the time of writing, Bitcoin is buying and selling across the $51,000 degree, down 2% over the previous week.

The worth of the asset seems to have been declining just lately | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, IntoTheBlock.com, chart from TradingView.com