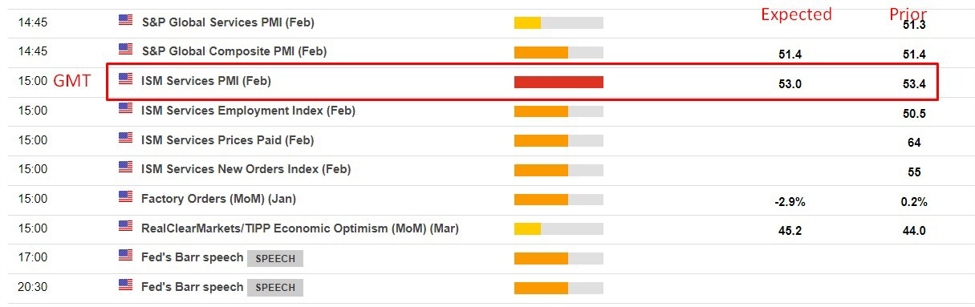

ISM companies is due at 10 am US Jap time.

This

snapshot from the ForexLive financial information calendar, access

it here.

The vary of expectations for that is 51.0 to 54.3.

Control any companies inflation info on this launch, whereas items costs have been steadily dropping companies have been an element holding the speed of inflation up.

***

Why is information of such ranges essential?

Information outcomes that fall exterior of market high and low expectations have a tendency to maneuver markets extra considerably for a number of causes:

-

Shock Issue: Markets usually worth in expectations based mostly on forecasts and former traits. When information considerably deviates from these expectations, it creates a shock impact. This will result in speedy revaluation of belongings as buyers and merchants reassess their positions based mostly on the brand new info.

-

Psychological Affect: Buyers and merchants are influenced by psychological components. Excessive information factors can evoke robust emotional reactions, resulting in overreactions out there. This will amplify market actions, particularly within the brief time period.

-

Threat Reassessment: Surprising information can result in a reassessment of danger. If information considerably underperforms or outperforms expectations, it could change the perceived danger of sure investments. As an illustration, better-than-expected financial information might cut back the perceived danger of investing in equities, resulting in a market rally.

-

Triggering of Automated Buying and selling: In at this time’s markets, a good portion of buying and selling is completed by algorithms. These automated programs usually have pre-set situations or thresholds that, when triggered by sudden information, can result in large-scale shopping for or promoting.

-

Affect on Financial and Fiscal Insurance policies: Information that’s considerably off from expectations can affect the insurance policies of central banks and governments. For instance, weaker information will gas hypothesis of nearer and bigger Federal Open Market Committee (FOMC) fee cuts. A stronger consequence will diminish such expectations.

-

Liquidity and Market Depth: In some circumstances, excessive information factors can have an effect on market liquidity. If the info is sudden sufficient, it would result in a short lived imbalance in patrons and sellers, inflicting bigger market strikes till a brand new equilibrium is discovered.

-

Chain Reactions and Correlations: Monetary markets are interconnected. A major transfer in a single market or asset class as a consequence of sudden information can result in correlated strikes in different markets, amplifying the general market affect.