Oil merchants face a modified world heading into the brand new week. With the sudden eruption of struggle in Israel, following shock assaults by Hamas, concern and uncertainty in markets might drive up crude oil costs.

“The battle poses a danger of upper oil costs, and dangers to each inflation and the expansion outlook,” Karim Basta, chief economist at III Capital Administration, told Reuters.

Hedge-fund supervisor Pierre Andurand, a high vitality dealer, noted on X on Sunday that many individuals had requested him “if the Hamas assaults on Israel will have an effect on oil costs.”

Whereas Andurand doesn’t anticipate a big effect on oil provide or a big worth spike within the subsequent few days, he acknowledged that world oil inventories are low “and the Saudi and Russian manufacturing cuts will result in extra inventories attracts over the subsequent few months. The market will ultimately need to beg for extra Saudi provide, which I consider, won’t occur sub $110 Brent.”

Brent crude is at present priced at about $88, having jumped more than 3% because the assaults on Israel. In September, the U.S. Power Data Administration provided its short-term energy outlook, writing that with Saudi Arabia’s prolonged manufacturing minimize by way of 12 months’s finish, its forecast “averages $93 {dollars} per barrel” within the fourth quarter, with worth declines starting subsequent 12 months as inventories construct.

In fact, that was earlier than this weekend’s eruption of violence. The company’s subsequent outlook is due this week.

Andurand famous that “during the last 6 months we’ve seen a really massive improve in Iranian provide” because of the weak enforcement of sanctions.

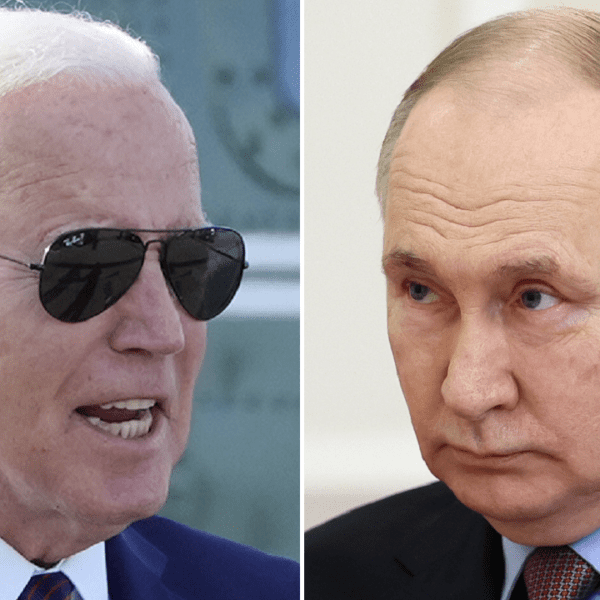

Iran, after all, is a giant backer of Hamas, and, on condition that, Andurand believes there’s a “good chance” that the Biden administration will start extra strictly imposing sanctions on Iranian oil exports. That may “additional tighten the oil market,” he wrote.

“Iran stays a really huge wild card,” Helima Croft, chief commodities strategist at RBC Capital Markets and a former CIA analyst, told Bloomberg. “Israel will escalate its long-running shadow struggle towards Iran” and “what’s unpredictable is how Iran would reply to such an intensification.”

When sanctions had been imposed on Iran in 2011, the nation threatened to dam the Strait of Hormuz, a slender delivery route that handles roughly a 3rd of the world’s waterborne oil, according to Bloomberg. Iran backed away from the menace, with the U.S. carefully monitoring the waterway for indicators of disruption. However the opportunity of such a situation, nevertheless excessive, hints on the form of uncertainty merchants face.

Chamath Palihapitiya, CEO of VC agency Social Capital, prompt oil costs had been sure to leap, writing on Sunday: “How does oil not spike once more now on the again of two sizzling wars (Israel-Hamas and Russia-Ukraine) and a 1.5M barrel manufacturing minimize by OPEC with an SPR [Strategic Petroleum Reserves] that’s on the identical stage it was within the mid Nineteen Eighties?”

“There’s positively going to be a concern commerce put in place,” Phil Flynn, analyst at Value Futures Group in Chicago, told MarketWatch. “Whereas within the quick time period there isn’t a affect straight on provide, it’s apparent how issues play out over the subsequent 24 to 48 hours might change that.”