BOJ governor Ueda’s remarks had been a driving issue for value motion on Tuesday however the remainder of it has been dictated by actions within the bond market. And that hasn’t been too useful for USD/JPY route this week. Treasury yields have additionally chopped round and the motion yesterday was a very good instance of that.

Yields had been initially decrease however recovered strongly in US buying and selling with 10-year yields rising to a excessive of 4.19%. It’s now down 2 bps to 4.158% however general, nonetheless protecting above the 200-day transferring common of 4.10%. I’d say that continues to be the important thing line within the sand for the bond market.

In flip, USD/JPY has seen forwards and backwards motion however is protecting above its personal 100-day transferring common (purple line) on the steadiness.

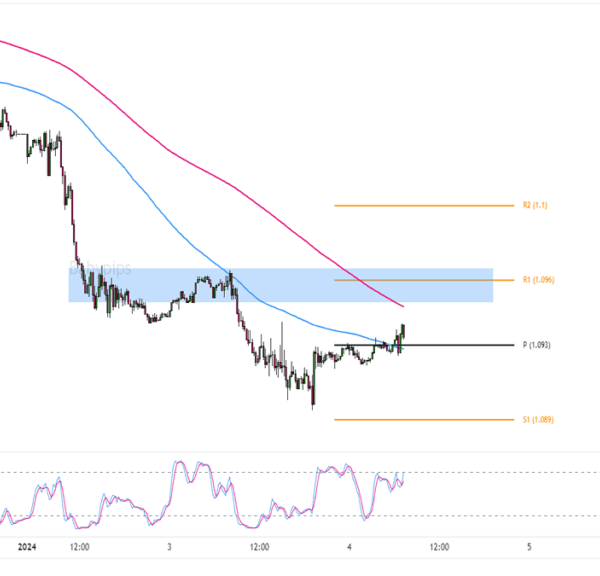

USD/JPY every day chart

The important thing technical stage is seen at 147.51 and because the upside momentum to begin the brand new yr hinges on value staying above that. The near-term image tells a extra complicated story this week although. Consumers and sellers are battling it out with value motion now sitting in between key technical ranges.

The 100-hour transferring common is seen at 147.93 whereas the 200-hour transferring common is seen at 147.46. The spot value is sitting in between that, highlighting a extra impartial near-term bias at the moment.

If something, the extra up and down however sideways motion in USD/JPY this week is a mirrored image of the strikes within the bond market as nicely.

I’d argue that the technicals are actually the perfect information in deciphering what could come subsequent for each Treasury yields and USD/JPY, as outlined by the degrees above. But when there may be any takeaway, it’s that USD/JPY continues to be tied carefully to the bond marketplace for now.