Welcome to TechCrunch Fintech (previously The Interchange)! On this version, I’m going to have a look at a fintech being offered in a hearth sale, a gaggle of startup raises, and extra!

To get a roundup of TechCrunch’s largest and most necessary fintech tales delivered to your inbox each Sunday at 7:30 a.m. PT, subscribe here.

The massive story

The saga continues. In mid-Might, TC’s Manish Singh reported that founders of ZestMoney had resigned from the startup. The Indian fintech, whose capability to underwrite small ticket loans to first-time web prospects, as soon as drew the backing of many high-profile traders, including Goldman Sachs. By December, ZestMoney was shutting down following unsuccessful efforts to discover a purchaser. Then, final week, the corporate, which was as soon as valued at $450 million, was offered to DMI in a “fire sale.”

Evaluation of the week

One of the vital enjoyable components of being a reporter is monitoring firms’ development through the years. In 2020, I wrote about Briq’s $10 million Series A and its mission to deliver fintech to the development business. Final week, I coated its $8 million Sequence B extension at a $150 million valuation, in addition to its AI-related development plans. In 2021, I reported on Argentinian funds infrastructure startup Pomelo’s $9 million seed raise. Final week, I coated its $40 million Series B financing and the truth that it grew income by 200% in 2023. I really like watching firms I reported on on the early phases nonetheless within the recreation, and rising! That is how traders should really feel.

{Dollars} and cents

Christine Corridor was busy final week!

Digital Onboarding grabs $58M to help banks with profitable customer engagement: Communications from monetary establishments is usually paper-based, which regularly results in between 25% and 40% of recent checking accounts closed throughout the first 12 months. This SaaS startup desires to repair this.

Kashable banks $25.6M to offer employment-based lending: Extra employers are including monetary merchandise to their worker advantages and perks, and plenty of startups have jumped into this sector to assist. Fintech firm Kashable is the newest.

Tandem gives ‘modern couples’ app to manage finances together and separately: Meet Tandem — a brand new fintech startup that addresses the primary monetary milestones for {couples} and grows with the connection – which simply raised $3.7 million.

What else we’re writing

African neobank Kuda tried to raise $20M at flat valuation in 2023, missed user milestone projection by 3M: Earlier this month, Kuda co-founder and CEO Babs Ogundeyi informed customers that the Nigerian on-line challenger financial institution had reached nearly ₦56 trillion (~$60 billion) in transaction worth since its 2019 launch. Ogundeyi additionally mentioned that Kuda had achieved a notable milestone, with 7 million retail and enterprise prospects as of right now. Nonetheless, the determine falls in need of the fintech’s projections when it sought contemporary funding final 12 months.

Different high-interest headlines

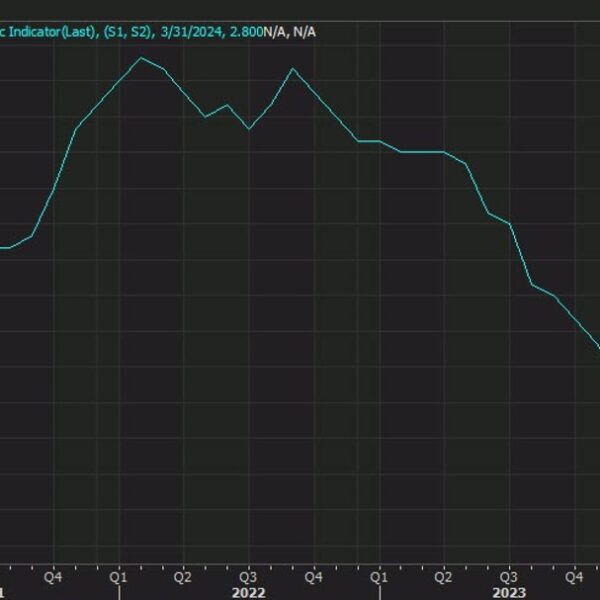

Stripe, Flexport, TikTok, and other startups were investing in startups. That has largely stopped: “Stripe’s investments through mid-2021 signaled its intent to expand internationally and grow beyond its core e-commerce business. Stripe acquired Nigeria-based Paystack in 2020 — extending its reach in Africa — after participating in the payment startup’s Series A in 2018.” That stage of investing has slowed dramatically, in line with CB Insights information.

Cross-border payments fintech Neo hits profitability after year of rapid growth: “The Barcelona-based fintech which provides a one-stop-shop multi-currency account for corporate treasurers recorded an annual revenue in excess of €5 million and an annual profit of €1 million,” experiences Fintech Finance Information.

Podcasts price trying out

The other side of AI hype: Alex Wilhelm and I do fast dives into the raises of Pomelo, Briq and Tandem, and way more!

Back in the Unicorn Club with Cowboy Ventures’ Aileen Lee: Alex Wilhelm and I invited Cowboy Ventures’ Aileen Lee to talk by means of her massive new article concerning the unicorn world.

ICYMI: I had a blast interviewing pre-seed investor All over the place Ventures’ Jenny Fielding. Click on beneath to hear!

Comply with me on X @bayareawriter for breaking fintech information, posts about espresso and extra.