Center-class Individuals have one factor on their minds as 2023 ends and the nation prepares to enter an election yr: the financial system. Extra particularly, their very own private funds.

Greater than their households, work pressures, well being care prices, or politics, the highest concern for 39% of Individuals making $50,000 to $150,000 was cash, in accordance with a survey printed Tuesday by investing app Stash. Survey respondents needed to work at the least 30 hours weekly and self-identify as both “hard-working,” “industrious,” “ambitious,” or “self-made.”

The notion that individuals prioritize their very own monetary standing over every other political or social subject was immortalized within the well-known quip by former political strategist James Carville, who mentioned, “It’s the economy, stupid.” The road, which he mentioned whereas engaged on President Invoice Clinton’s first presidential marketing campaign in 1992, turned a staple of American politics, meant to remind political candidates to concentrate on voters’ monetary well-being above all else.

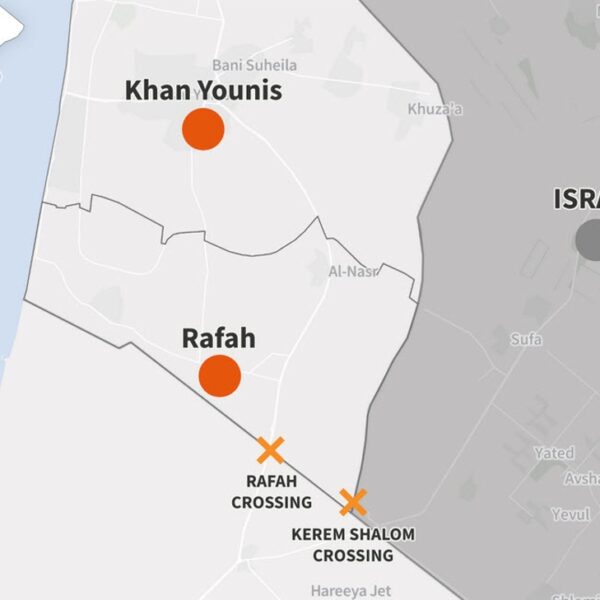

Solely 4% of respondents mentioned political and social points had been their high concern. The survey was performed over two weeks in October, when the nation was consumed by numerous political crises. The Home lacked a speaker on the time due to Kevin McCarthy’s ouster, and the struggle between Israel and Hamas erupted, which risked dragging the U.S. into one other overseas coverage quagmire.

The apparent strength of the U.S. economy, after the Fed had diminished the runaway inflation of 2022 with out rising unemployment, did little to assuage the fears of many respondents. Sixty-one p.c mentioned they had been very involved concerning the financial system. However the rising variety of constructive financial indicators created some optimism. Thirty-five p.c mentioned they thought the financial system would enhance over the subsequent few months.

“People are both uneasy about the economy now, even though consumer sentiment ticked up this month, while being optimistic about the future for themselves and their families,” Sarah Spagnolo, Stash’s managing editor and head of name, instructed Fortune. “While the data doesn’t speak to this, one might infer that the stabilizing of prices and inflation, and possibly lower interest rates in the future, are helping to shift consumer sentiment. Prices rose so quickly, it’s also possible that people simply need time to adjust and recalibrate.”

That sentiment is beginning to develop into extra widespread amongst major financial institutions as properly, after a yr and a half of fears a recession was imminent. In October the U.S. financial system grew at its fastest rate in two years, signaling if not outright power, at the least important resilience.

Even these rosy forecasts did little to dampen the issues amongst most middle-class Individuals. Millennials and Gen X remained significantly anxious concerning the financial system, with 57% and 71% respectively saying they had been pessimistic about it enhancing within the coming months. “Both groups are likely burdened with tremendous family and personal responsibilities,” Spagnolo mentioned.

Gen X reported having their funds consumed by bank card debt and the necessity to save for retirement. Millennials, then again, confronted the identical monetary challenges whereas including that additionally they needed to take care of aging relatives and save for the elusive dream of buying a home.

That query of why Americans are so apprehensive concerning the financial system regardless of evidence to the contrary has vexed numerous economists, pollsters, and political consultants in current months.

As middle-class Individuals fret over their very own funds, they’re properly conscious of those that are higher off than they’re. Overwhelmingly, middle-class Individuals thought concerning the rich. Eighty-nine p.c of respondents reported spending a while occupied with how wealthy individuals earn a residing. For youthful generations, like millennials and Gen Z, that quantity was even increased: A virtually unanimous 95% mentioned they thought concerning the matter. That development may not be fully stunning as middle-class households noticed their median income grow more slowly than that of upper-income households over the previous 50 years. On account of these developments, the earnings hole between the 2 is bigger than it has been in many years. As we speak a family within the high 1% earns at the least $650,000 yearly, or 4 to 13 instances what the individuals surveyed make a yr.

Spagnolo argues the rationale individuals are preoccupied with the rich is as a result of they hope to emulate them. “Money is something we know people have a lot of anxiety about, and they want ways to lessen that anxiety and to achieve the success they see in other people,” she mentioned.