Irina Starikova/iStock via Getty Images

Italgas S.p.A. (OTCPK:ITGGF) is the third-largest gas distribution company in Europe, with leadership in Italy and Greece.

Gas distributors and operators don’t often figure among fancy investments. After all, we are talking about boring and frequently regulated businesses, with huge infrastructure that require a lot of capex. Usually, they are debt-heavy and their stock underperforms the market. However, dividend investors often pile into these businesses because of their steady and reliable returns.

In this article, we will look at Italgas because the stock is currently in a dip which may deliver interesting capital gains coupled with high returns.

Italgas: the company

First of all, Italgas currently dominates 35% of the Italian natural gas distribution market and it plans on topping 40% at the end of 2029. Recently, Italgas entered an exclusivity period with 2i Rete Gas, the second largest gas distributor in Italy, to perform due diligence to submit a binding offer for the whole share capital. If this deal goes through, we will have Italgas become a true monopoly in Italy.

Let’s make a point clear. Italgas distributes gas, taking it from the transport networks and delivering it to the final customer. The company neither imports gas nor produces it. It doesn’t even transport it through high-pressure (>5bar) pipelines or other means and it doesn’t stock it. However, it does distribute it to small and medium-sized enterprises and homes through its low-pressure distribution network.

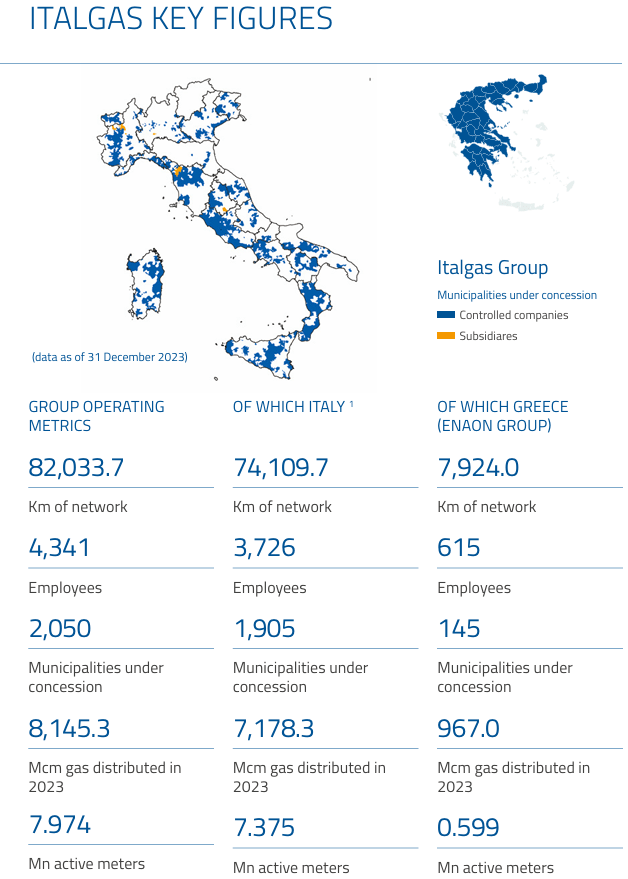

Here below we can see some of Italgas’ current key figures.

Italgas 2024 shareholder guide

If the deal with 2i Rete Gas goes through, Italgas will double its network in Italy from 74,000 km to almost 150,000 km.

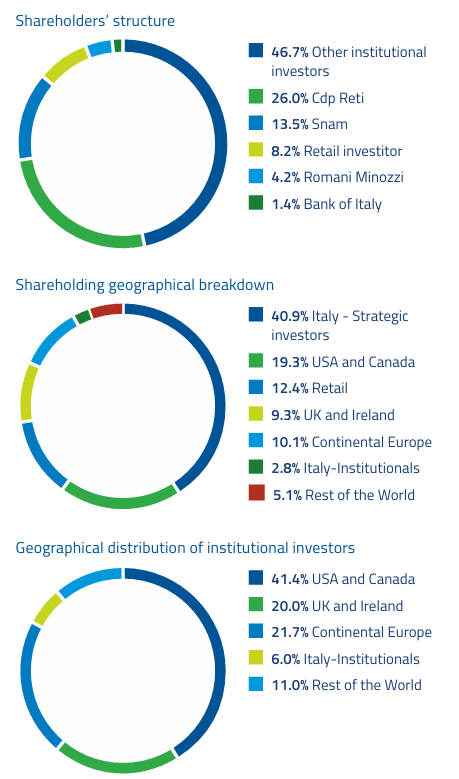

Italgas’ shareholder structure must also be understood. The company’s largest shareholder is the Italian holding company Cdp Reti, which is a joint venture of the Italian Institution for Economic Development CDP owned by the Ministry of Economy and Finance and the Chinese State Grid Corporation. Then, Italgas sees among its main shareholders Snam (OTCPK:SNMRY) which is the main Italian operator for transport and dispatching of natural gas. Over 41% of the institutional investors in Italgas come from the U.S. and Canada, another 20% comes from the UK and Ireland and another 21.7% is made up of European institutional investors. This is no surprise, as infrastructure plays such as Italgas are often favored by institutional investors such as pension funds and similar.

Italgas 2024 shareholder guide

Now, with the energy transition taking place around the globe and, particularly, in Europe, many may think Italgas will soon run out of business because of its gas-related activities.

Regarding these concerns, we should be aware of the larger picture. First of all, natural gas is far cleaner than oil and coal to produce electricity. Secondly, the infrastructure Italgas owns and operates can work properly with biogas and green hydrogen.

Let me explain why.

Italgas has invested in its “Power-to-Gas” technology which is a further element of convergence of gas and electricity, where the company enables the storage and transport of surplus energy from renewable sources, which can be converted into renewable gases such as green hydrogen and synthetic methane.

According to the European Commission, Italy can replace about 9% of the current NG imports with biomethane and the country has the infrastructure to supply biomethane to transport in the existing 1,063 CNG filling stations. Currently, Italy is the second largest European biogas producer, second only to Germany. This gives Italgas a strategic positioning in one of the key technologies that will be needed to achieve the zero-carbon emission goals.

Moreover, Italgas is creating the first technological showcase of the entire green hydrogen chain (hydrogen production, on-site storage, use for public mobility, and local users) in Sardinia, which will be the first energy community in Italy and the EU. Excess renewable energy will be used to produce gas to be stored in a plant, rather than being dissipated. This is what green hydrogen is: it will be produced using renewables instead of natural gas. Today, green hydrogen costs 5-6 times more than natural gas. But as production costs for renewable sources are decreasing, Italgas expects that by 2030 hydrogen could fall below 35 EUR per MWh. The “Power-to-Gas” project already converts renewable energy into green hydrogen and is thus instrumental in this promising development.

From 2023 to 2029, Italgas plans on spending around €7.81 billion in capex, including €1.5 billion allocated for Atem tenders. The Group has also started diversifying by investing in the gas distribution network in Greece and water distribution and aims at holding around 10% of the Italian market by the end of the plan. Greece will see its network expand from 7,500 km in 2022 to 11,000 km by the end of the plan. This will require around €1 billion. Water distribution will see Italgas commit over €400 million for M&A operations and network enhancement and maintenance.

Italgas’ Outlook

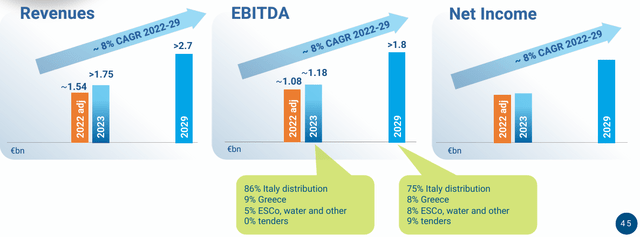

According to its expansion plan, Italgas aims to grow revenues, EBITDA, and net income at an 8% CAGR. Of course, if the deal with 2i Reti goes through, we will have a significant change in Italgas’ financials. 2i Reti currently earns around $800 million in revenue, which will increase Italgas’ current revenue by over 40%.

Italgas 2023-2029 Strategic Plan Presentation

With regulated businesses, steady and regular growth is usually expected. But what matters more is the capital structure. Is Italgas operating efficiently?

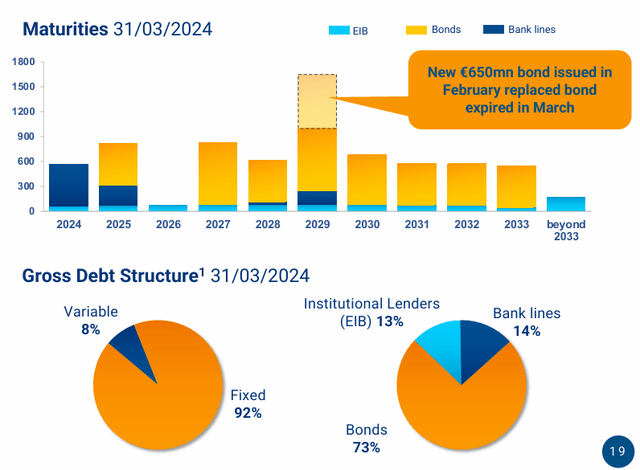

First of all, around 92% of Italgas’ debt is at fixed rates, and at the end of 2023, its cost of debt was just 1.4%. However, the average cost of debt from 2023 to 2029 is expected to increase to around 3% by the end of the plan, taking into account the current market context. Of course, if interest rates go down, things may change.

Italgas Q1 2024 Results Presentation

At the end of Q1 2024, Italgas reported a net financial debt of €6.5 billion. In 2023 Italgas reported €1.2 billion in EBITDA and this year we should have around €1.3 billion in EBITDA. This is a debt/EBITDA ratio of 5, which would be high if we were not talking about a regulated utility. But with such a low cost of debt and low risks for its operations, this leverage doesn’t trouble me at all.

Moreover, during Q1 2024, the company actually decreased its debt by €88 million, because of lower LT financial debt, partially offset by higher ST debt.

As far as cash flows go, Italgas ended Q1 2024 with €115 in FCF, net of €45 million spent on M&A activities. The operating cash flow was €342 million, almost three times as much YoY. Currently, the company is involved in big investments and M&As and this may need further financing. But as the company’s revenues grow, Italgas will be able to keep its investment-grade while expanding its balance sheet.

Dividend policy

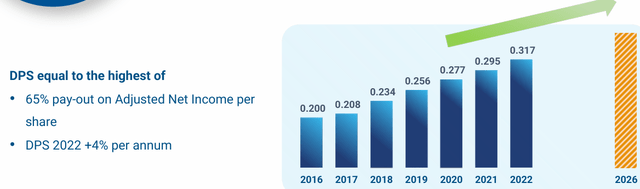

One of the reasons investors put their money in Italgas is because of its attractive and sustainable returns for its shareholders. The risk profile is rather low because of its dominant position in a regulated market coupled with a strong capital structure. Italgas has a dividend policy that extends to 2026 and that provides for the distribution of a dividend equal to the greater of the pay-out of 65% of adj. net income per share or the 2022 DPS ( €0.317) increased by 5% per year.

Italgas 2023-2029 Strategic Plan Presentation

This means the dividend will usually go up at least 4%. This year the dividend paid on the 2023 results was actually higher: €0.352, which is an 11% increase.

Italgas unfortunately has no Quant ratings available. So, we can’t really see how its dividends are rated. However, its consistent dividend growth history since its 2016 IPO, coupled with a rather safe payout ratio and a 10% FCF yield, makes me believe this dividend yielding 7.5% would be rated above a B.

Capital gains

As I said at the beginning, Italgas is currently trading downwards. It all started on May 20th, when the annual dividend was paid. The stock price corrected accordingly and moved down from €5.41 to €5.10. Usually, after the annual dividend, the stock experiences some weakness. This time, the news regarding the possible acquisition of 2i Rete Gas weighs as well as investors pricing in a possible dilution or an increase in debt. As a result, Italgas is currently trading at its 5-year lows, which were broken only momentarily during COVID-19.

This is an interesting situation because it gives us a good margin of safety coupled with a decent upside.

Considering the company has a market cap of €3.83 billion and trades at a fwd PE of 8.15, with a profit margin close to 18%, and a return on equity of 18.4%, we are before a profitable and reliable company whose shares are currently undervalued.

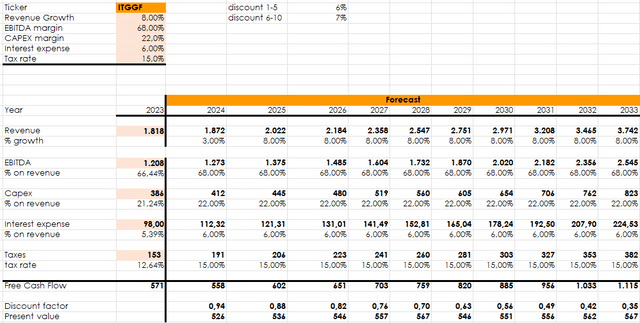

Running a FCF projection, we could be before a company that could generate over €1.1 billion in FCF in ten years, excluding M&A activity. Overall, in 10 years, it could deliver around €8 billion in FCF, according to the estimates I share below.

Author, with data from ITGGF reports

Don’t get me wrong. I don’t expect Italgas to generate so much FCF. The reason is simple: M&As and capex are unpredictable. However, its steady top-line growth is a reliable indicator that this company thrives in its regulated environment and has the operating scale to generate profits as its size grows.

I consider Italgas able to generate at least €4 billion in cash over the next decade, net of M&As and other events. This means it would take about a decade to earn back in FCF the current market cap of €8.3 billion Italgas is trading at. Dividends will be lower than that. But capital gains should probably appear as the stock usually trades above €5.3. As a result, I rate the stock as a buy and consider it as an option to replace my well-in-the-green position in the electric utility A2A.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.