gt29/iStock through Getty Photos

This text collection goals at evaluating ETFs (exchange-traded funds) relating to previous efficiency and portfolio metrics. Opinions with up to date information are posted when obligatory.

IUSG technique

iShares Core S&P U.S. Progress ETF (NASDAQ:IUSG) began investing operations on 07/24/2000 and tracks the S&P 900 Progress Index. It has 470 holdings, a 12-month trailing yield of 1.09%, and an affordable expense ratio of 0.04%.

The S&P 900 index is a mix of the S&P 500 (SP500) and S&P MidCap 400. As described by S&P Dow Jones Indices, S&P 900 constituents are ranked in Worth and Progress kinds utilizing three valuation ratios and three development metrics. The valuation ratios are guide worth to cost, earnings to cost and gross sales to cost. The expansion metrics are gross sales development, earnings development, and momentum. By building, 33% of the guardian index constituents solely belongs to every type, and 34% belongs to each kinds.

The expansion type subset serves as S&P 900 Progress Index and is rebalanced yearly. It’s capital-weighted, with an adjustment for constituents belonging to each kinds. For instance, an organization with a Worth rank higher than its Progress rank is given a bigger weight within the Worth Index than within the Progress Index. The fund’s turnover price in the latest fiscal yr was 36%. As there isn’t any S&P 900 ETF, this text will use as a benchmark iShares Russell 1000 ETF (IWB), which represents a really shut inventory universe.

IUSG portfolio

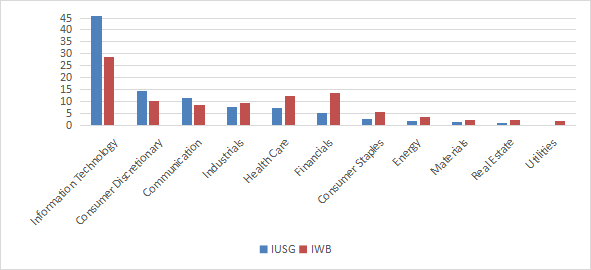

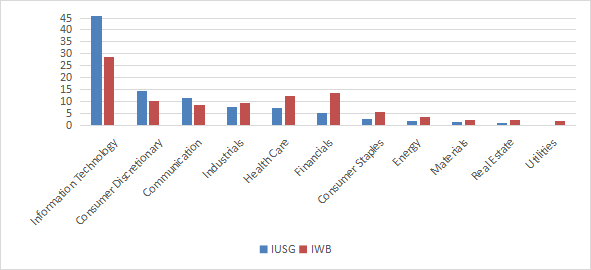

Eligible securities theoretically embrace massive and mid-cap shares. Nonetheless, massive and mega-caps symbolize over 85% of the fund’s asset worth. The portfolio is obese within the data know-how sector (45.7% of asset worth), adopted by shopper discretionary (14.4%) and communication companies (11.7%). Different sectors are beneath 8%. In comparison with the benchmark, IUSG largely overweights know-how, and underweights all sectors that aren’t within the high 3 listed above.

IUSG sector breakdown in % of asset worth (Chart: creator; information: iShares)

The portfolio may be very concentrated: the highest 10 issuers, listed within the subsequent desk with development metrics, symbolize 55.5% of asset worth. The highest 3 names Apple, Microsoft and NVIDIA weigh about 30% collectively.

|

Ticker |

Title |

Weight% |

EPS development %TTM |

EPS development %5Y |

Gross sales Progress %TTM |

Gross sales Progress %5Y |

|

Microsoft Corp. |

12.07 |

22.94 |

35.37 |

11.51 |

13.98 |

|

|

Apple Inc. |

9.98 |

9.20 |

15.55 |

-0.47 |

7.59 |

|

|

NVIDIA Corp. |

8.65 |

585.45 |

48.41 |

125.85 |

39.06 |

|

|

Amazon.com, Inc. |

6.38 |

1162.74 |

23.55 |

11.83 |

19.80 |

|

|

Alphabet Inc. |

5.91 |

27.47 |

21.56 |

9.36 |

17.53 |

|

|

Meta Platforms, Inc. |

4.49 |

73.52 |

14.46 |

15.69 |

19.29 |

|

|

Eli Lilly & Co. |

2.43 |

-16.40 |

13.74 |

19.56 |

9.69 |

|

|

Broadcom Inc. |

2.3 |

-8.30 |

2.37 |

12.94 |

11.43 |

|

|

Tesla, Inc. |

1.94 |

18.64 |

67.74 |

18.80 |

35.15 |

|

|

Superior Micro Gadgets, Inc. |

1.34 |

-40.86 |

10.43 |

-3.90 |

28.49 |

* The 2 shares collection of Alphabet Inc, listed by the fund as distinct holdings, have been grouped within the desk.

Fundamentals

IUSG is rather more costly than the benchmark relating to valuation ratios and has higher development metrics, in step with the underlying index description. The biggest gaps are in value/guide (for valuation) and in money stream development (for development), as reported beneath.

|

IUSG |

IWB |

|

|

P/E TTM |

32.24 |

24.27 |

|

Worth/Guide |

9.12 |

4.19 |

|

Worth/Gross sales |

5.38 |

2.72 |

|

Worth/Money Circulate |

22.12 |

16.75 |

|

Earnings development |

25.79% |

20.73% |

|

Gross sales development % |

12.79% |

8.65% |

|

Money stream development % |

16.92% |

8.55% |

Knowledge supply: Constancy.

In my ETF opinions, dangerous shares are corporations with a minimum of two pink flags amongst: dangerous Piotroski rating, adverse ROA, unsustainable payout ratio, dangerous or doubtful Altman Z-score, excluding financials and actual property the place these metrics are unreliable. With this assumption, dangerous shares weigh solely 4.7% of asset worth, which is a wonderful level. Moreover, in accordance with my calculation of combination high quality metrics (reported within the subsequent desk), portfolio high quality is considerably superior to the benchmark. The return on belongings is particularly spectacular.

|

IUSG |

IWB |

|

|

Altman Z-score |

13.05 |

3.75 |

|

Piotroski F-score |

6.79 |

5.99 |

|

ROA % TTM |

18.98 |

6.08 |

Efficiency

Since 8/1/2000, IUSG has underperformed IWB by 84 bps in annualized return, as reported within the subsequent desk. Furthermore, the utmost drawdown and historic volatility (measured as normal deviation of month-to-month returns) level to the next danger.

|

Complete Return |

Annual Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

IUSG |

361.60% |

6.69% |

-63.27% |

0.35 |

17.56% |

|

IWB |

455.03% |

7.53% |

-55.38% |

0.42 |

15.66% |

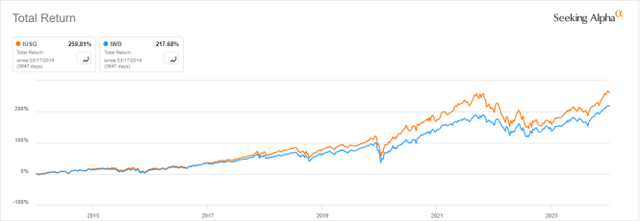

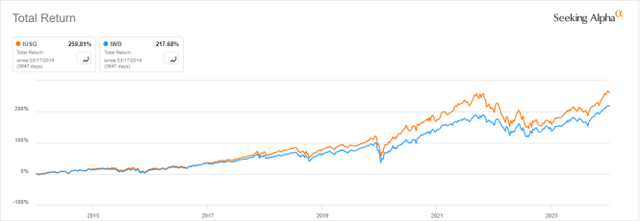

However, the expansion fund has outperformed the Russell 1000 over the past 10 years:

IUSG vs IWB, 10-year return ( In search of Alpha)

IUSG vs. rivals

The subsequent desk compares traits of IUSG and 5 fashionable development ETFs primarily targeted on massive corporations:

- Invesco QQQ Belief ETF (QQQ)

- Schwab U.S. Massive-Cap Progress ETF (SCHG)

- Vanguard Progress ETF (VUG)

- iShares Russell 1000 Progress ETF (IWF)

- iShares Morningstar Progress ETF (ILCG).

|

IUSG |

QQQ |

SCHG |

VUG |

IWF |

ILCG |

|

|

Inception |

7/24/2000 |

3/10/1999 |

12/11/2009 |

1/26/2004 |

5/22/2000 |

6/28/2004 |

|

Expense Ratio |

0.04% |

0.20% |

0.04% |

0.04% |

0.19% |

0.04% |

|

AUM |

$16.41B |

$252.60B |

$26.11B |

$222.21B |

$88.05B |

$2.07B |

|

Avg Day by day Quantity |

$61.87M |

$19.67B |

$134.31M |

$343.10M |

$482.13M |

$4.17M |

|

Holdings |

470 |

102 |

251 |

211 |

447 |

397 |

|

High 10 |

55.49% |

47.32% |

55.22% |

55.55% |

52.27% |

53.15% |

|

Turnover |

36.00% |

22.08% |

9.00% |

5.00% |

14.00% |

28.00% |

IUSG is the second-smallest fund of this listing (measured in belongings beneath administration) and in addition the second least liquid in greenback quantity. Its price is among the many most cost-effective, on par with SCHG, VUG and ILCG.

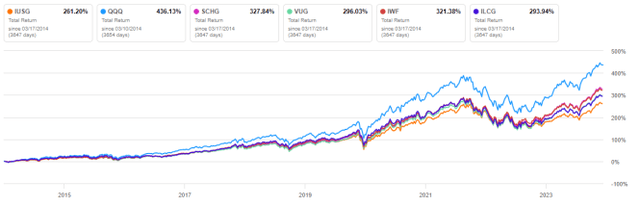

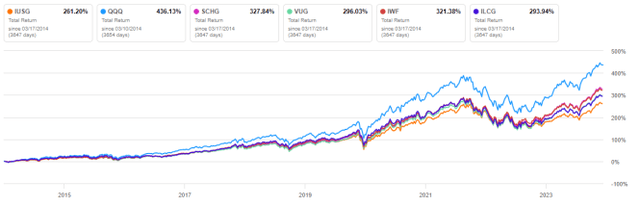

The subsequent chart plots 10-year whole returns. The Nasdaq 100 ETF is forward of the competitors, and IUSG is the worst performer.

IUSG vs rivals, 10-year returns (In search of Alpha)

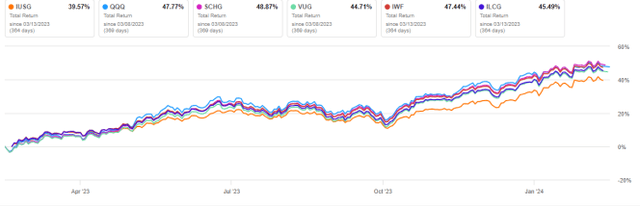

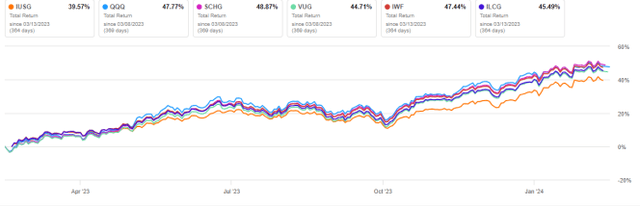

IUSG has additionally been lagging over the past 12 months:

IUSG vs rivals, trailing 12 months (In search of Alpha)

Takeaway

iShares Core S&P U.S. Progress ETF implements a scientific technique based mostly on six valuation and development metrics. Like most massive cap development funds, it’s obese in know-how and in its high holdings. High quality metrics look engaging, but IUSG has underperformed a big and mid-cap benchmark since inception, and quite a few fashionable development funds over the past 10 years. Amongst them, the Nasdaq 100 ETF QQQ is forward of the competitors, adopted by Schwab U.S. Massive-Cap Progress ETF (SCHG) and iShares Russell 1000 Progress ETF (IWF).