When IVP just lately introduced the closing of its 18th fund, I known as Eric Liaw, a longtime basic companion with the growth-stage agency, to ask a couple of questions. For starters, wringing $1.6 billion in capital commitments from its buyers proper now would appear much more difficult than garnering commitments in the course of the frothier days of 2021, when IVP introduced a $1.8 billion automobile.

I additionally questioned about succession at IVP, whose many bets embody Figma and Robinhood, and whose founder and earlier buyers nonetheless loom massive on the agency – each figuratively and actually. A current Fortune story famous that footage of agency founder Reid Dennis stay scattered “in all sorts of places throughout IVP’s San Francisco office.” In the meantime, footage of Todd Chaffee, Norm Fogelsong and Sandy Miller – former basic companions who are actually “advisory partners” – are combined in with the agency’s basic companions on the agency’s web site, which, visually a minimum of, makes much less room for the present era.

Not final, I needed to speak with Liaw about Klarna, a portfolio firm that made headlines final month when a behind-the-scenes disagreement over who ought to sit on its board spilled into public view. Right here’s a part of our chat, edited for size and readability. You’ll be able to hearken to the longer dialog as a podcast here.

Congratulations in your new fund. Now you’ll be able to chill out for a few months! Was the fundraising course of any kind of troublesome this time given the market?

It’s actually been a uneven interval all through. When you actually rewind the clock, again in 2018 after we raised our sixteenth fund, it was a “normal” setting. We raised a barely greater one in 2021, which was not a traditional setting. One factor we’re glad we didn’t do was increase an extreme quantity of capital relative to our technique, after which deploy all of it in a short time, which people in our trade did. So [we’ve been] fairly constant.

Did you’re taking any cash from Saudi Arabia? Doing so has turn into extra acceptable, extra widespread. I’m questioning if [Public Investment Fund] is a brand new or present LP.

We don’t usually touch upon our LP base, however we don’t have capital from that area.

Talking of areas, you had been within the Bay Space for years. You may have two levels from Stanford. You’re now in London. When and why did you make that transfer?

We moved about eight months in the past. I’ve really been within the Bay Space since I used to be 18, after I got here to Stanford for undergrad. That’s extra years in the past than I care to confess at this level. However for us, growth to Europe was an natural extension of a method we’ve been pursuing. We made our first funding in Europe again in 2006, in Helsinki, Finland, in an organization known as MySQL that was acquired subsequently by Solar [Microsystems] for a billion {dollars} when that was not run of the mill. Then, in 2013, we invested in Supercell, which can be based mostly in Finland. In 2014, we grew to become an investor in Klarna. And [at this point], our European portfolio at present is about 20 corporations or so; it’s about 20% of our energetic portfolio, unfold over 10 completely different nations. We felt like placing some toes on the bottom was the fitting transfer.

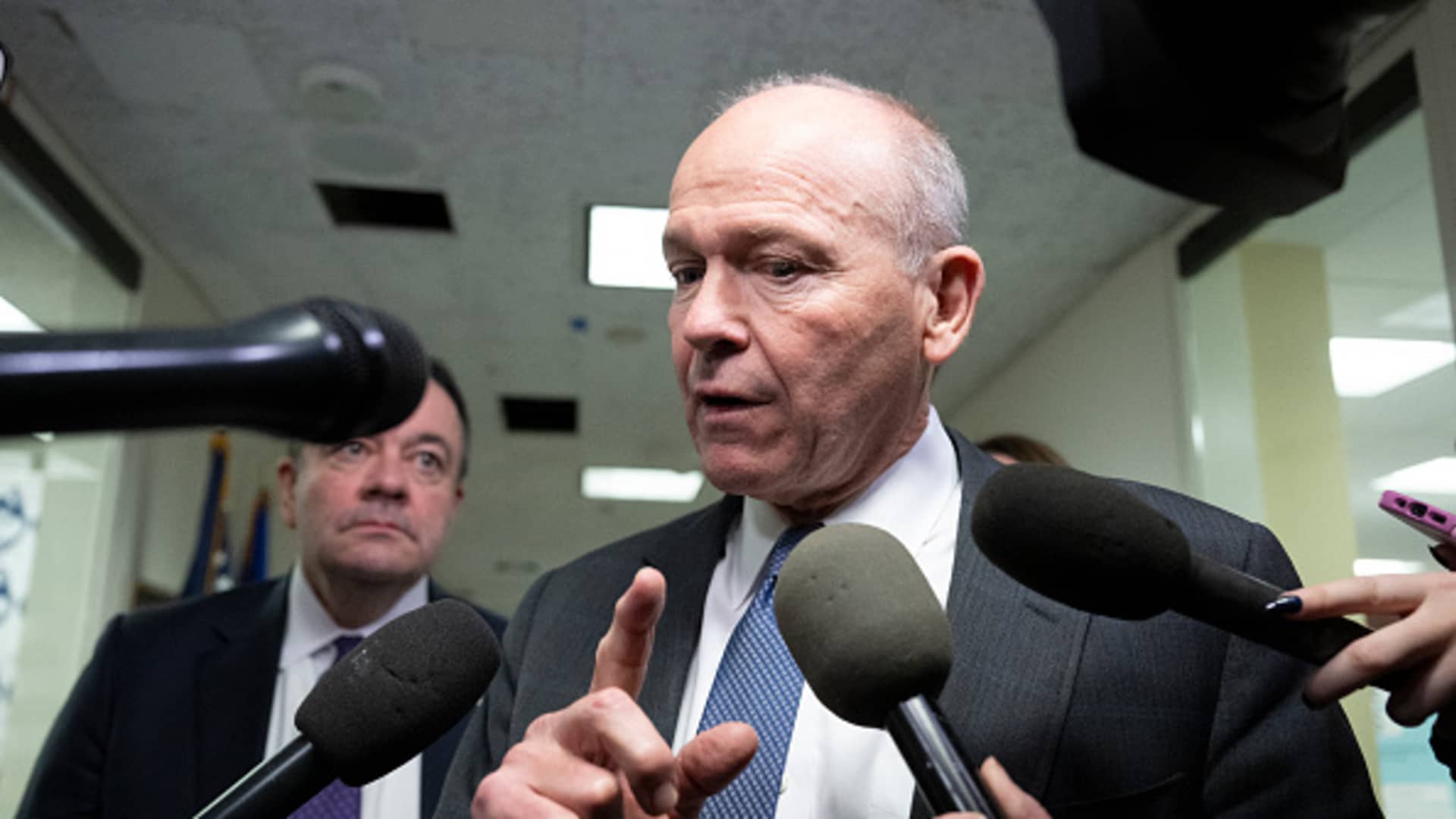

There was lots of drama round Klarna. What did you make of The Info’s studies about [former Sequoia investor] Michael Moritz versus [Matt Miller], the Sequoia companion who was extra just lately representing the agency and has since been changed by one other Sequoia companion, Andrew Reed?

We’re smaller buyers in Klarna. We aren’t energetic within the board discussions. We’re enthusiastic about their enterprise efficiency. In some ways, they’ve had the worst of each worlds. They file publicly. They’re topic to lots of scrutiny. Everybody sees their numbers, however they don’t have the foreign money [i.e. that a publicly traded company enjoys]. I believe [CEO and co-founder] Sebastian [Siemiatkowski] is now way more open about the truth that they’ll be a public entity sooner or later within the not-too-distant future, which we’re enthusiastic about. The reporting, I suppose if correct, I can’t get behind the motivations. I don’t know precisely what occurred. I’m simply glad that he put it behind them and may concentrate on the enterprise.

You and I’ve talked about completely different nations and a few of their respective strengths. We’ve talked about client startups. It brings to thoughts the social community BeReal in France, which is reportedly in search of Sequence C funding proper now or else it might sell. Has IVP kicked the tires on that firm?

We’ve researched them and spoken to them previously and we aren’t presently an investor, so I don’t have lots of visibility into what their present technique is. I believe social is difficult; the prize is very large, however the path to get there’s fairly onerous. I do assume each few years, corporations are in a position to set up a foothold even with the energy of Fb-slash-Meta. Snap continues to have a powerful pull; we invested in Snap fairly early on. Discord has carved out some area out there for themselves. Clearly, TikTok has finished one thing fairly transformational all over the world. So the prize is huge nevertheless it’s onerous to get there. That’s a part of the problem of the fund, investing in client apps, which we’ve finished, [figuring out] which of those rocket ships has sufficient gasoline to interrupt by means of the ambiance and which is able to come again right down to earth,

Concerning your new fund, that Fortune story famous that the agency isn’t named after founder Reid Dennis as proof that it was constructed to survive him. But it additionally famous there are footage of Dennis all over the place, and others of the agency’s previous companions, and now advisors, are very prominently featured on IVP’s web site. IVP talks about making room for youthful companions; I do marvel if that’s really taking place.

I’d say with out query, it’s taking place. We’ve got a powerful tradition and custom of offering individuals of their careers the chance to maneuver up within the group to the best echelons of the final partnership. I’m lucky to be an instance of that. Lots of my companions are, as properly. It’s not solely the trail on the agency, nevertheless it’s an actual alternative that folks have.

We don’t have a managing companion or we don’t have a CEO. We’ve had individuals enter the agency, serve the agency and our LPs, and in addition as they get to a unique level of their lives and careers, take a step again and transfer on to various things, which by definition does create extra room and duty for people who find themselves youthful and now are reaching that prime age of their careers to assist carry the establishment ahead.

Can I ask: do these advisors nonetheless obtain carry?

You’ll be able to ask, however I don’t need to get into economics or issues alongside that dimension. So I’ll quietly decline [that question]. However we do worth their inputs and recommendation and their contributions to the agency over a few years.

There’s clearly a valuation reset happening for each firm seemingly that’s not a big language mannequin firm, which is lots of corporations. I’d guess that offers you simpler entry to high corporations, but in addition hurts a few of your present portfolio corporations. How is the agency navigating by means of all of it?

I believe by way of corporations which are elevating cash, those which are most promising will at all times have a alternative, and there’ll at all times be competitors for these rounds and thus these rounds and the valuations related to them will at all times really feel costly. I don’t assume anybody has ever reached an awesome enterprise final result feeling like, ‘Man, I got a steal on that deal.’ You at all times really feel barely uncomfortable. However the perception in what the corporate can turn into offsets that feeling of discomfort. That’s a part of the enjoyable of the job.