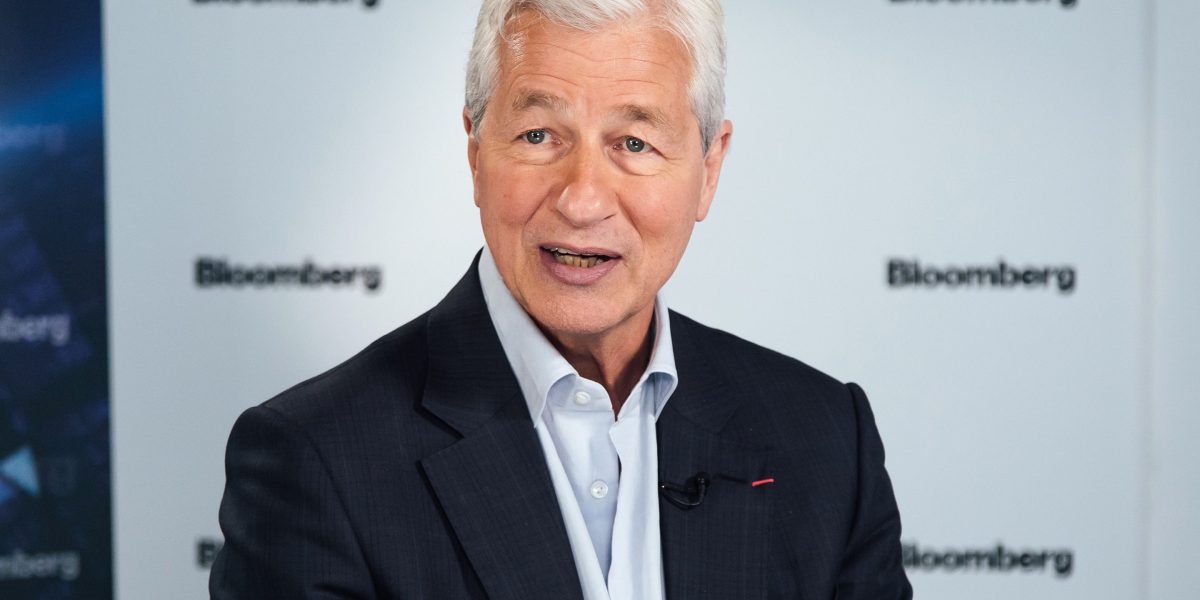

The dean of Wall Street CEOs is inexperienced. JPMorgan Chase in the present day struck an settlement with three New York Metropolis pension funds with investments within the financial institution valued at $478 million to reveal the ratio of its clear power to fossil gasoline financing. In response to the NYC funds, the metric will give traders a extra complete view as to how the financial institution is progressing on its net-zero emissions objectives and whether or not it’s ratcheting up its clean-energy financing actions over time.

JPMorgan’s settlement with the three NYC funds, which handle a mixed $193 billion in property, will consequence within the withdrawal of their shareholder proposal, which they’ve levied in opposition to six main banks. It makes JPMorgan the primary of those banks to strike a take care of traders. The others—Bank of America, Citigroup, Goldman Sachs, Morgan Stanley, and Royal Financial institution of Canada—nonetheless have proposals pending and the NYC Comptroller’s workplace has been participating with them. The pension funds in January announced that they have been launching the drive to prod the banks to supply up extra knowledge on their local weather transition commitments.

Bloomberg New Vitality Finance research found that to ensure that common international temperature will increase to stay under 1.5 levels Celsius, which is optimum, the ratio of investments in low-carbon power to fossil fuels wants to succeed in a minimal of 4 to 1 by 2030. From there, the ratio wants to extend to six to 10 within the subsequent decade, and 10 to 1 afterward. In 2021, Bloomberg analysis discovered that for each greenback spent supporting fossil fuels, 0.8 supported low-carbon power. JPMorgan’s estimated ratio was 0.7.

A JPMorgan spokesperson mentioned it will take time to determine how greatest to reveal the metric traders are asking for.

“We found common ground with the NYC Comptroller on disclosing a clean energy financing ratio with an understanding that it is going to take us some time and resources to develop a decision useful approach,” mentioned a spokesperson in a press release to Fortune. “We will engage with NYC and our shareholders to provide the market more clarity and transparency about our activities and what financing the transition truly looks like.”

The financial institution in 2021 introduced a $1 trillion goal to finance initiatives to assist foster the transition to a low-carbon financial system. Nevertheless, the funds identified in their proposal that JPMorgan presents extra financing to fossil fuels than different banks, ponying up $434 billion since 2016, regardless of a dedication to attaining net-zero emissions by 2050, mentioned the NYC funds.

The transfer comes simply weeks after J.P. Morgan Asset Administration and State Street have been roundly criticized for leaving the Local weather Motion 100+, a coalition of traders centered on working collaboratively to focus on the businesses which might be additionally the heaviest emitters of greenhouse gasses. Since then, Pacific Funding Administration Firm (Pimco) introduced that it will additionally depart the group, bringing the overall property underneath administration which have departed to $19 trillion. (BlackRock shifted its participation in C100+ to BlackRock Worldwide.)

The asset administration companies pointed to their independence in withdrawing from C100+, noting that the group was beforehand centered on agitating for clearer disclosure and never searching for particular motion from. That technique is about to alter with the second part technique this 12 months. It additionally coincides with a motion towards anti-ESG proposals and rhetoric which have led conservative teams and politicians to criticize monetary companies companies for catering to “wokeness” to the detriment of monetary returns.

A Local weather Motion spokesperson instructed Fortune that antitrust legal guidelines aren’t meant to cease traders or firms from working collectively on objectives discovered to not be anti-competitive “that they have each independently decided is in their interest.”

The group cited an analysis from the Columbia Middle on Sustainable Funding that discovered that antitrust regulation was having a chilling impact on “necessary private-sector action to address climate and other sustainability-related challenges.”

The Wall Avenue Journal reported this week that BlackRock has deserted the time period “ESG” from its public statements and that CEO Larry Fink isn’t utilizing it in his annual letters anymore. As a substitute, “transition investing” is the brand new work-around for speaking about ESG, the Journal reported.

Nonetheless, whatever the phrases firms use to debate it, traders—significantly pension funds—stay centered on climate-change danger and interesting with firms on their net-zero commitments. In 2023, there have been a report 643 environmental or social associated shareholder proposals filed at public firms, a high-water mark that’s anticipated to persist in 2024, in response to a report from investor advisory agency Institutional Shareholder Providers.

Local weather change-related points are anticipated to generate probably the most proposals from shareholders to firms, the ISS report discovered, and a few traders are asking monetary companies companies to report any misalignment between shopper greenhouse gasoline emissions and 2030 net-zero targets.