Jane Street Group LLC boosts its Bitcoin exposure with a $276 million investment in BlackRock’s iShares Bitcoin Trust (IBIT). Revealed in a recent 13F filing for the fourth quarter of 2025, the substantial acquisition underscores the resilience of institutional Bitcoin demand despite the weak sentiment and price action.

As a designated market maker for major crypto exchange-traded products, Jane Street plays a critical role in maintaining liquidity within the Bitcoin ETF ecosystem. This accumulation aligns with wider institutional trends, similar to how BlackRock acquires stakes in other ecosystem plays like Bitmine to bolster its product lines.

iShares Bitcoin Trust ETF Jane Street Group Source: Quiverquant

EXPLORE: What is the Next Crypto to Explode in 2026?

Jane Street’s IBIT Position Signals Smart Money Accumulation

The filing data indicates that Jane Street utilized market fluctuations in late 2025 to bolster its inventory. While retail sentiment wavered during the quarter, on-chain and ETF data suggests that Bitcoin ETF holders maintained strong conviction, often holding positions through significant price corrections. By adding $276 million to its IBIT holdings, Jane Street effectively doubled down on the asset class at discounted relative valuations.

As an authorized participant for multiple spot Bitcoin ETPs, the firm’s accumulation serves a dual purpose: ensuring sufficient inventory to facilitate the creation and redemption of shares, and maintaining a proprietary directional stance. The scale of this acquisition, amidst a period often characterized by tax-loss harvesting, stands in contrast to competitors who reduced exposure.

For instance, recent reports highlighted how Harvard cut its Bitcoin ETF holdings in favor of an Ethereum rotation, showcasing the divergent strategies among top-tier allocators.

Harvard cut their Bitcoin ETF stake by 21% and added $87M to Ethereum

this is not what institutional adoption looks like

if Harvard understood Bitcoin, they’d be adding now while it’s down 45% from highs

not trimming positions

instead they’re selling Bitcoin and buying… pic.twitter.com/8wVjWasSr9

— Jackson (@macrojack21) February 17, 2026

DISCOVER: Best Solana Meme Coins By Market Cap 2026

Strategic Positioning for Future Market Cycles

Jane Street’s substantial buy order challenges the short-term narrative that ETF outflows signal weakening institutional interest. Instead, it suggests that market makers and sophisticated quant funds view periods of net outflow as liquidity events suitable for accumulation. With approximately 3,000 employees globally and a massive trading footprint, Jane Street’s capital allocation is often viewed as a leading indicator for smart money flows.

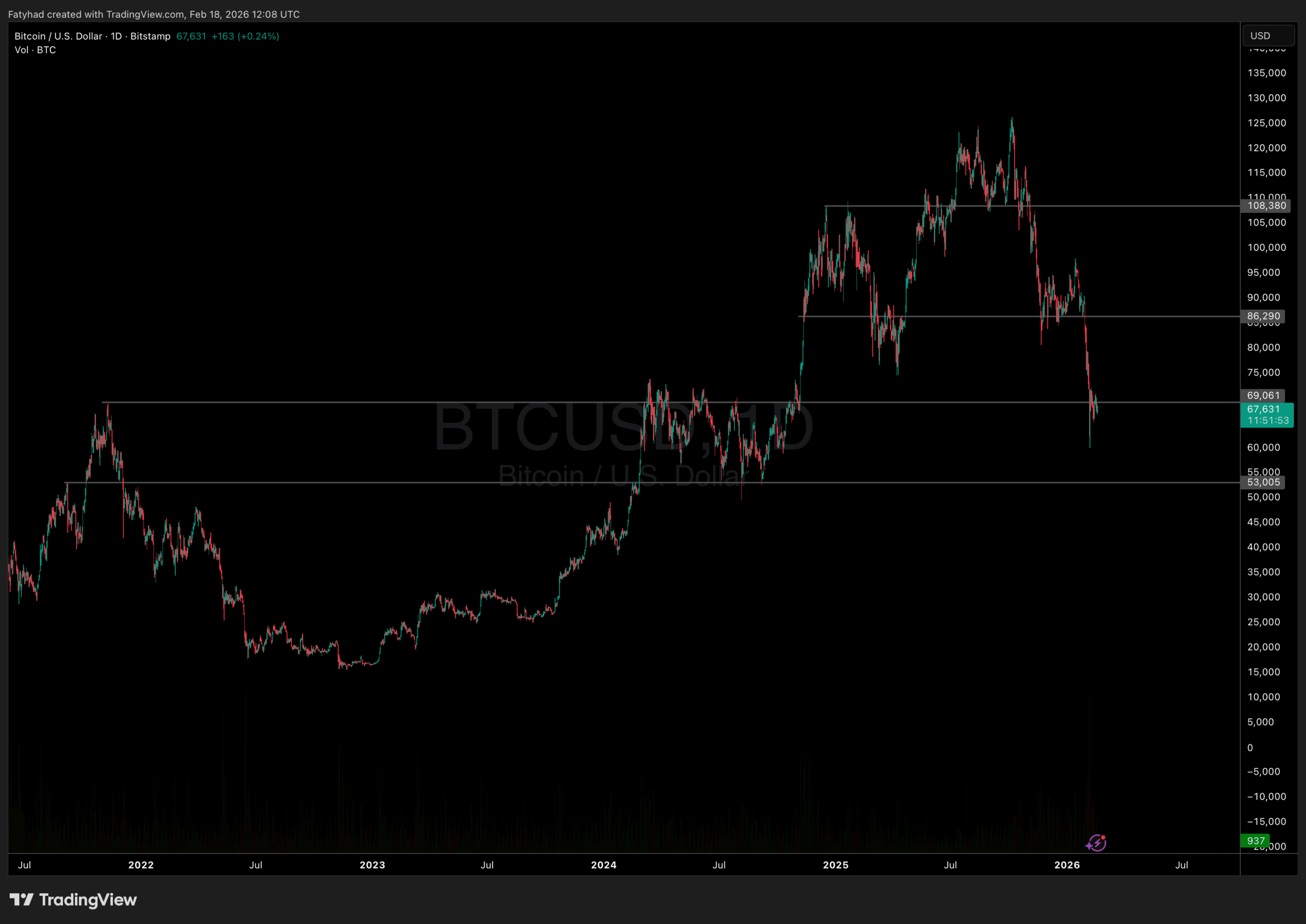

Bticoin Price Analysis Source: TradingView

Bitcoin’s recent price action looks like a consolidation phase after failed breakout attempts. BTC has repeatedly faced resistance around the $70K–$71K zone, while buyers step in near the mid-$60Ks, creating a clear range. Weak spot volumes and softer ETF flows have slowed momentum, but the broader structure remains intact as long as support holds.

Traders should watch for either a clean break above resistance to restart upside momentum or a drop below the $60K support that could trigger a deeper correction.

As Bitcoin matures into a standard portfolio offering, the line between operational inventory for market making and long-term investment holding is increasingly blurred. This latest 13F disclosure reinforces the belief that top-tier trading firms remain steadfastly committed to the asset class irrespective of short-term price fluctuations.

EXPLORE: 10 New Upcoming Binance Listings to Watch in February 2026

Jane Street Boosts Bitcoin as Institutions Stay Cautious While Bitcoin Hyper Expands the Ecosystem

Bitcoin price remains in a delicate phase as institutional strategies continue to diverge. Jane Street Group LLC boosts its Bitcoin exposure through a large IBIT position, while other allocators, including Harvard, have shifted part of their focus toward Ethereum.

The broader picture points to cautious but consistent accumulation, with investors waiting for confirmation of a sustained uptrend or signs of further downside. Recent price action reflects hesitation rather than clear directional conviction, as support and resistance levels continue to define the market.

At the same time, projects like Bitcoin Hyper are working to improve the broader Bitcoin ecosystem through a Layer-2 solution built around a monitoring-first rollup architecture. The project emphasizes transparency by integrating real-time visibility into network performance, execution flow, and settlement processes from the start.

This approach allows developers, operators, and users to verify network health independently. The Bitcoin Hyper presale lists HYPER at $0.0136758 in this phase, with $31.5 million raised and staking rewards currently around 37%.

Join Bitcoin Hyper community on Telegram and X.

DISCOVER: How to Buy Bitcoin Hyper – 2026 ICO Guide

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Daniel Frances is a technical writer and Web3 educator specializing in macroeconomics and DeFi mechanics. A crypto native since 2017, Daniel leverages his background in on-chain analytics to author evidence-based reports and deep-dive guides. He holds certifications from The Blockchain Council, and is dedicated to providing “information gain” that cuts through market hype to find real-world blockchain utility.