US Treasury Secretary Janet Yellen is scheduled to handle Congress right this moment, specializing in the potential dangers the crypto business poses to the monetary system. Her ready remarks, which have been launched earlier than her look earlier than the Home Monetary Companies Committee, spotlight a complete analysis of economic system dangers, with a selected emphasis on the challenges and uncertainties posed by digital property.

Janet Yellen Calls For Crypto Regulation

In her statement, Yellen particularly factors out, “The Council is focused on digital assets and related risks such as from runs on crypto-asset platforms and stablecoins, potential vulnerabilities from crypto-asset price volatility, and the proliferation of platforms acting outside of or out of compliance with applicable laws and regulations.”

This assertion underscores the Treasury’s rising concern over the steadiness and regulatory compliance of the market. Yellen’s testimony comes at a essential time for the crypto business, which continues to navigate by means of high-profile setbacks, together with the notable collapse of the FTX trade. Yellen had beforehand in contrast this occasion to the “Lehman moment” for crypto, drawing parallels to the 2008 monetary disaster.

The testimony will cowl 5 major areas recognized by the Monetary Stability Oversight Council (FSOC), which Yellen leads. These areas embody dangers from the banking and nonbank monetary sectors, climate-related monetary stability dangers, cybersecurity threats, the influence of synthetic intelligence in monetary providers, and the particular dangers related to digital property. The inclusion of digital property as a key focus space displays the FSOC’s recognition of the numerous challenges posed by the market’s volatility and regulatory compliance points.

Moreover, Yellen will emphasize the necessity for legislative motion, particularly concerning the regulation of stablecoins and the spot market that aren’t thought of securities. “Applicable rules and regulations should be enforced, and Congress should pass legislation to provide for the regulation of stablecoins and of the spot market for crypto-assets that are not securities. We look forward to continuing to engage with Congress on this,” the assertion learn.

The FSOC’s 2023 annual report, which already highlighted issues concerning the worth volatility and interconnectedness throughout the crypto business, aligns with the factors Yellen is anticipated to make in her testimony. The report and Yellen’s remarks are more likely to spur legislative and regulatory our bodies to focus extra intensively on the sector.

Moreover, US Congress is about to incorporate discussions on SAB 121, an SEC bulletin that has sparked debate throughout the neighborhood. This bulletin requires banks and corporations that custody crypto to file buyer holdings as liabilities on their steadiness sheets. The decision of this challenge is essential for the business, because it straight impacts how crypto property are accounted for and controlled.

At press time, Bitcoin traded at $43,025.

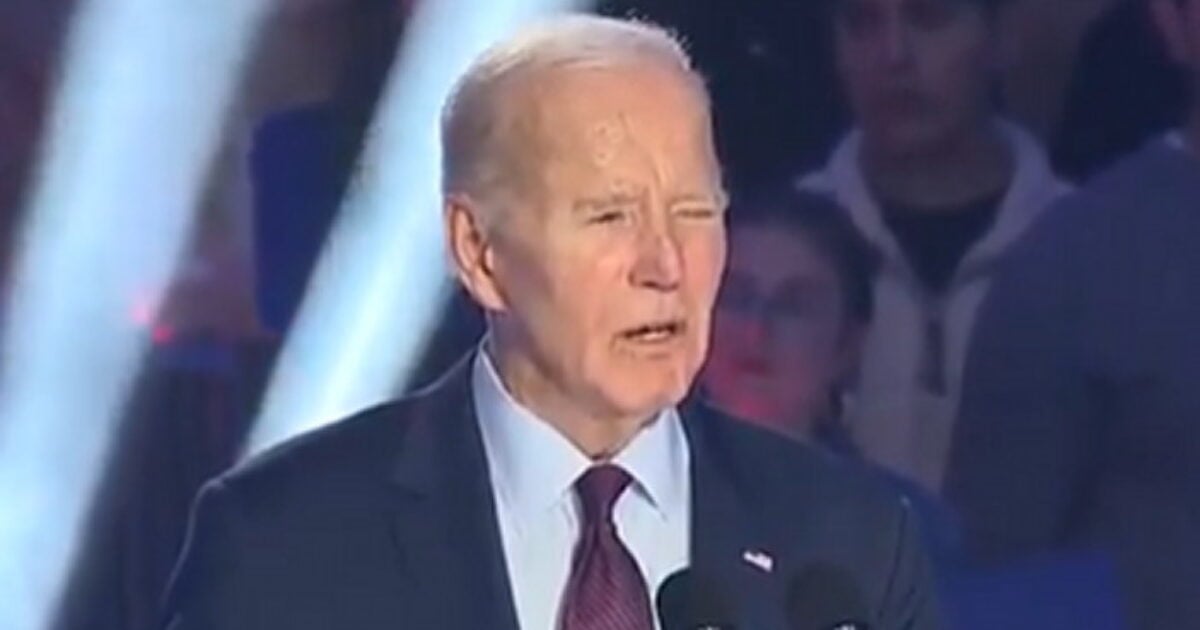

Featured picture from Junior Scholastic, chart from TradingView.com