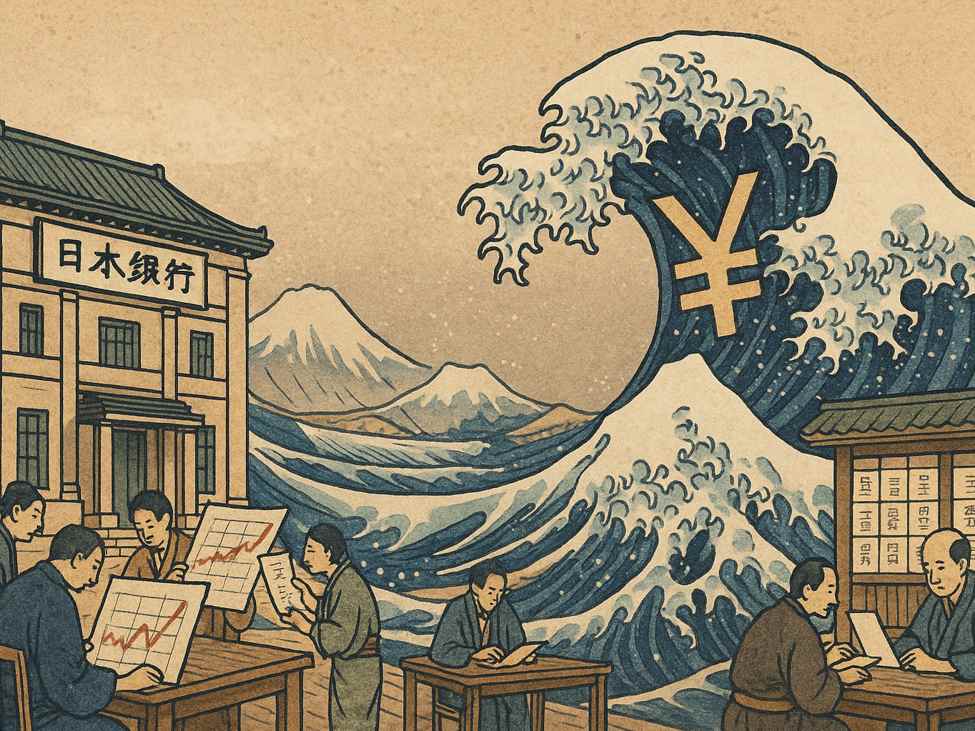

A senior member of Japan’s government advisory panel spoke again on Sunday. He signalled that Tokyo is prepared to intervene more aggressively in the currency market to offset the economic strain caused by a weakening yen — a stance that aligns with Prime Minister Sanae Takaichi’s concerns about inflation.

Takuji Aida, who also serves as chief economist at Crédit Agricole, said on NHK that the administration is likely to step up action in foreign-exchange markets and stressed that Japan has ample foreign-reserve capacity to do so. He described the nation’s economic position as stable enough to support intervention.

Aida’s warnings build on comments he made last week, when he cautioned that FX intervention could come earlier than markets anticipate. The ¥160 per dollar level remains viewed as a symbolic threshold after authorities intervened several times in 2024, but Aida said policymakers may act sooner if volatility becomes disorderly.

—

As a side note, today could be a good day for some sort of intervention with Japanese markets closed. That’ll thin out trade somewhat. I think its more likely over the US holidays later this week, but we’ll soon find out!