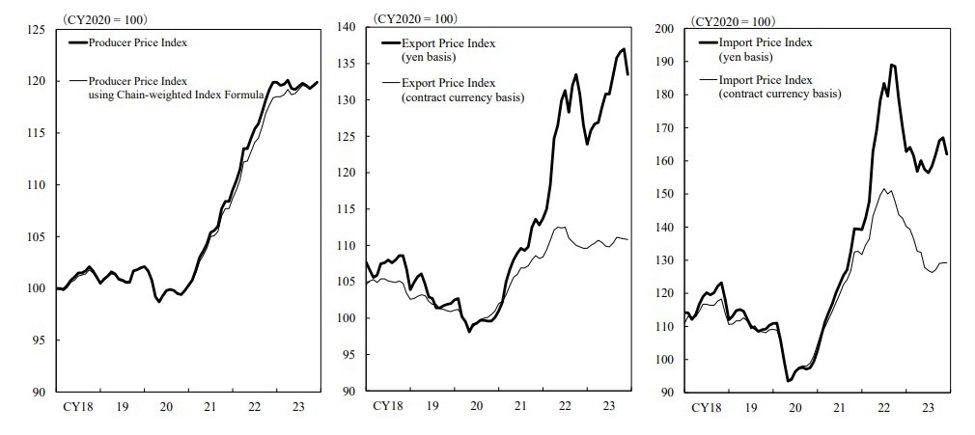

Japan’s PPI is also called the Company Items Value Index, For December 2023:

+0.3% m/m

+0.0% y/y

- anticipated -0.3%

- prior +0.3%

—

The Producer Value Index (PPI) in Japan is also called the Company Items Value Index (CGPI)

- its a measure of the common change over time within the promoting costs obtained by home producers for his or her output

- is calculated by the Financial institution of Japan

Not like the Client Value Index (CPI), which measures the worth change that buyers see for a basket of products and providers, the CGPI focuses on the change within the costs of products bought by corporations.

The PPI displays a few of price pressures confronted by producers

- its based mostly on a basket of products that represents the vary of merchandise produced throughout the Japanese financial system, together with objects comparable to:

- uncooked supplies like metals and chemical substances

- semi-finished items

- and completed merchandise

- totally different weights are assigned to every class throughout the index based mostly on its contribution to the general financial system.

- it doesn’t account for the standard enhancements in items and providers over time, which could result in overestimation of inflation

- moreover, it displays solely the costs of domestically produced items, leaving out the impression of imported items

The PPI can be utilized as a information to inflationary pressures within the financial system:

- If producers are going through greater prices, they might move these on to customers, resulting in greater client costs.