Summary:

-

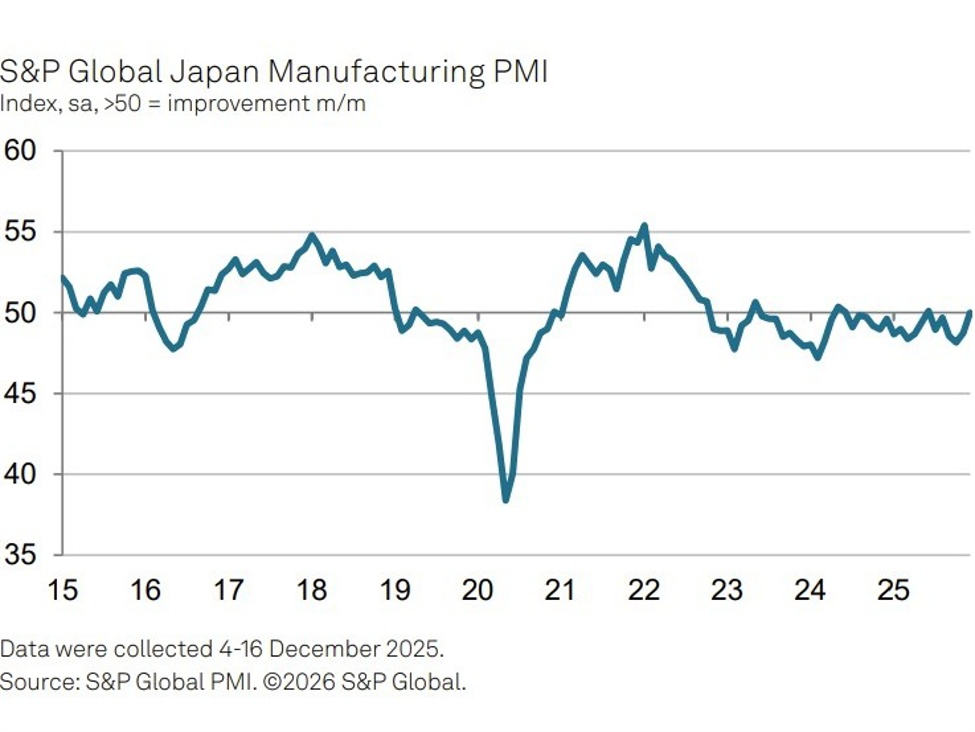

Japan’s manufacturing PMI returned to neutral territory in December

-

New orders fell at the slowest pace in 19 months

-

Output stabilised and employment growth accelerated modestly

-

Input prices rose at the fastest rate since April

-

Firms remained cautiously optimistic heading into 2026

Japan’s manufacturing sector showed clear signs of stabilisation at the end of 2025, with business conditions improving to their strongest level in more than a year, according to the latest S&P Global survey data. While demand remained subdued overall, the pace of decline in new orders slowed sharply, production stabilised, and employment continued to expand, signalling tentative momentum heading into 2026.

The headline Japan Manufacturing PMI rose to 50.0 in December from 48.7 in November, marking the first reading at the neutral threshold in five months and ending a prolonged period of deterioration. The improvement was driven primarily by a much slower contraction in new business, which fell at its weakest pace in 19 months. Some manufacturers reported stronger-than-expected sales linked to new projects and improved customer spending.

Output volumes were broadly steady, with production declining only marginally and at the slowest pace seen during the recent six-month downturn. Purchasing activity also fell at a reduced and only marginal rate, while inventory reductions continued as firms adjusted to muted demand. Stocks of finished goods declined at one of the fastest rates seen since 2020, reflecting cautious inventory management.

Employment trends provided a further source of support. Manufacturers added staff for a fourth consecutive month, with job creation accelerating slightly as firms positioned for a potential recovery in demand. This helped reduce outstanding workloads, although the pace of backlog clearance eased to its slowest level in 18 months, suggesting capacity pressures are beginning to stabilise.

Price dynamics, however, emerged as a key area of concern. Input costs rose at their fastest pace since April, driven by higher raw material prices, rising labour costs, and the impact of a weak yen on imported inputs. Delivery times continued to lengthen due to material shortages and shipping delays, though the deterioration in supplier performance remained modest. Faced with rising costs, firms passed on expenses to customers, lifting output prices at a solid pace in December.

Business confidence remained positive despite slipping from November’s recent high. Optimism about the year-ahead outlook stayed above the long-run average, with firms expecting new product launches and improved demand — particularly across autos and semiconductors — to lift production in 2026. That said, manufacturers continued to flag risks from sluggish global growth, demographic pressures, and persistent cost inflation.

—

USD/JPY update: