RazoomGames

JBS S.A. (OTCQX:JBSAY) is the most important meatpacking firm on the earth. The corporate is the primary international processor and vendor of beef and poultry and quantity two in pork. The corporate has additionally expanded downstream to value-added merchandise like ready meals, sausages, and many others.

In my view, JBS reveals a historical past of nice capital allocation choices which have consolidated its market energy through the dimensions of buying, operations, and gross sales. This market energy is obvious within the firm’s rising margins and working returns on capital regardless of working in commoditized markets. Additional, the corporate’s technique of rising downstream is enormously aided by its upstream value benefits.

JBS is leveraged, however its debt has long-dated maturities and is principally fastened curiosity. Additional, given the corporate’s return on property, leveraging in these situations turns into a price enhancer.

Due to latest margin issues precipitated by higher-than-normal correlation on its finish markets, the corporate is buying and selling at what I think about an attractive a number of of common previous earnings, leaving future development in scale and market energy as an upside alternative.

Indicators and origins of scale moat

JBS’ historical past reveals two indicators of a robust and rising moat.

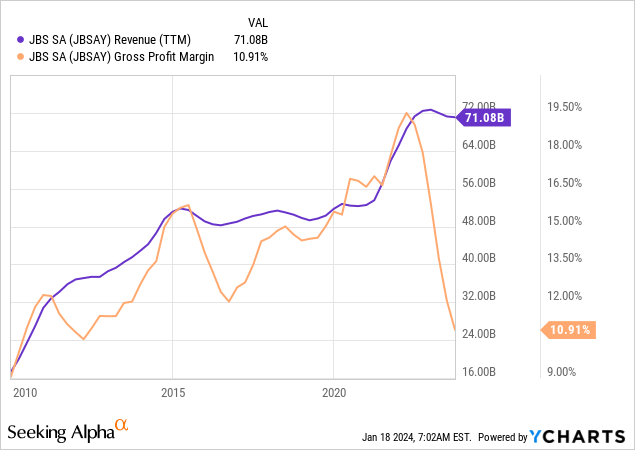

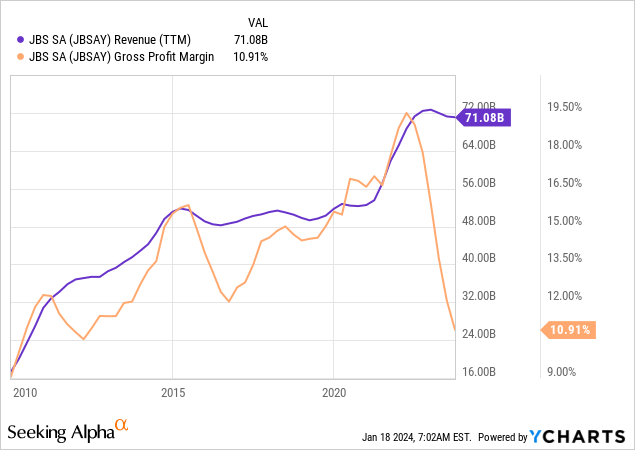

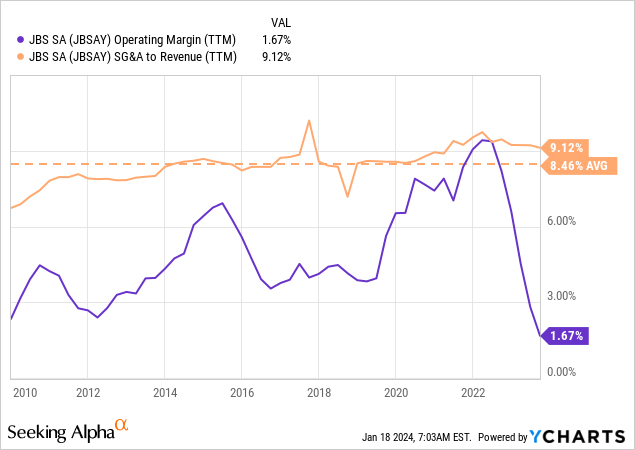

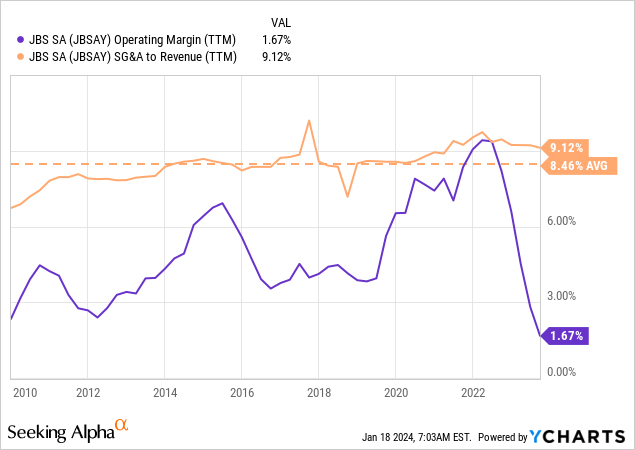

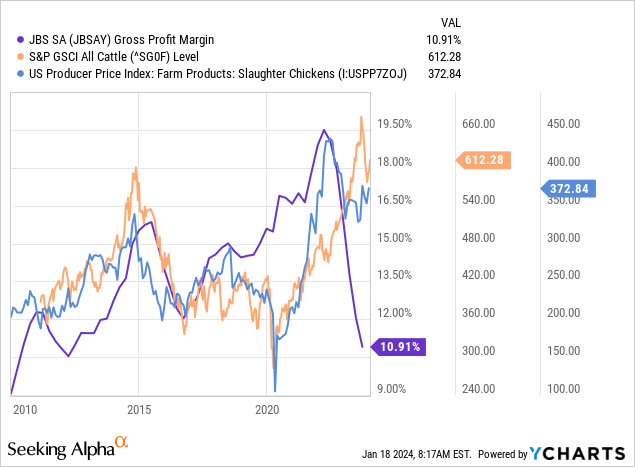

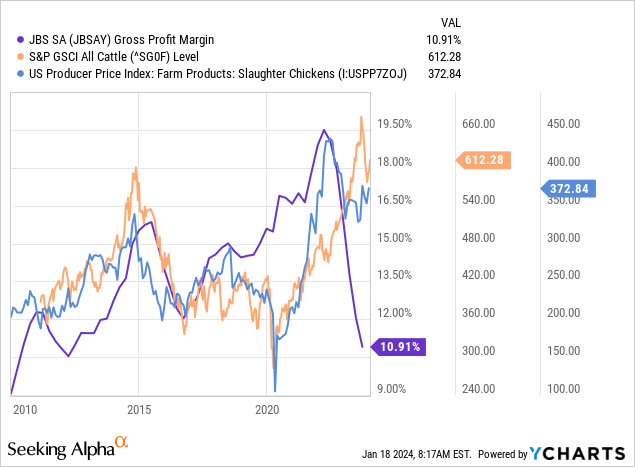

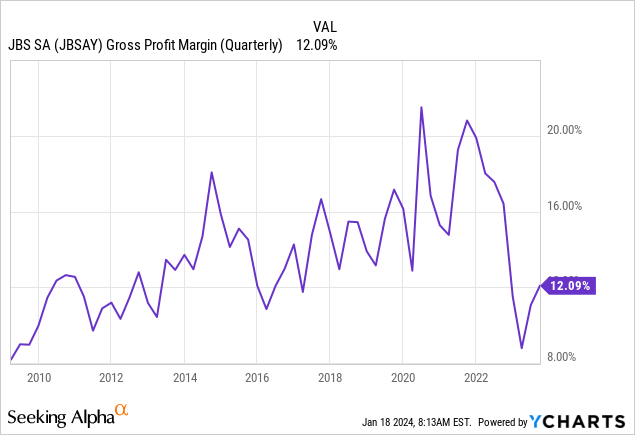

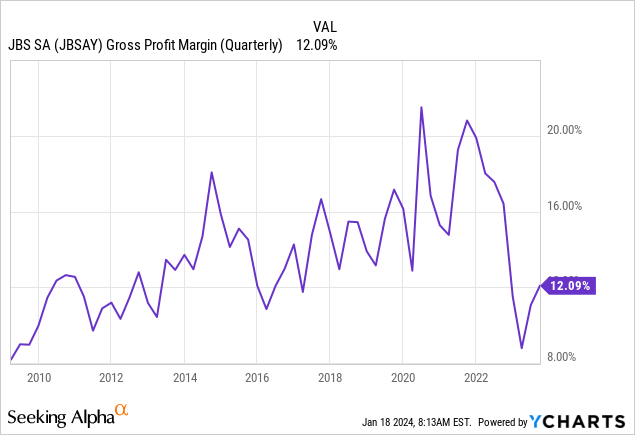

The primary one, within the chart under, is rising gross margins, which, coupled with extra managed SG&A to income ranges, has additionally elevated the corporate’s working margins (second chart under). The sudden fall in 2023 was irregular and it’ll obtain particular remedy in a later part.

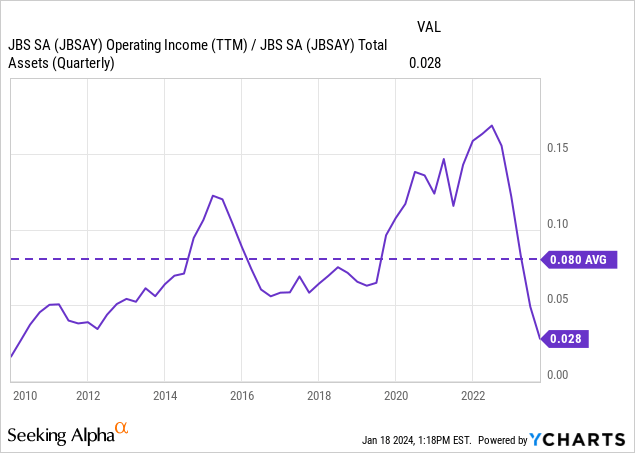

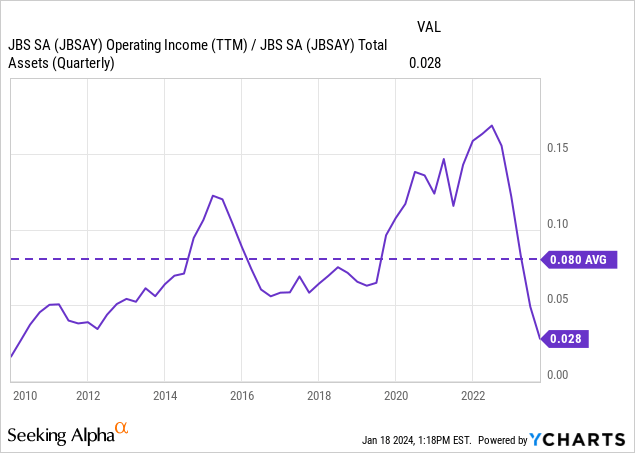

The second signal of market energy is the rise in returns on capital. I prefer to calculate returns on capital as working earnings over complete property, which isn’t a generally used determine. The reason being that working earnings displays returns earlier than capital is split between debt and fairness. In my view, dividing web earnings by complete property (classical return on property or ROIC) is mindless, as web earnings belongs to fairness, whereas property belong to fairness and debt.

These charts inform us that JBS has been rising its aggressive place in its markets, at the very least for the previous 15 years. This starkly contrasts with JBS working in a commodity market, the place margins are typically skinny as a result of the merchandise aren’t differentiated.

In my view, JBS has constructed its margins and aggressive energy through scale. The corporate is the most important meals firm on the earth by income and the most important processor of beef and poultry, second in pork. In lots of nations, it’s primary by a big margin. The corporate operates in North America, South America, Europe, and Australia and sells in each continent.

Scale brings a number of benefits to JBS:

- It’s a monopsony or oligopsony in most areas working inside every nation. Because of this meat producers (cattle ranchers, poultry and pork factories, and many others.) have little alternative than promoting to them. This permits JBS to set the acquisition phrases (worth, funds, and many others.). In Brazil, the most important beef exporter on the earth, institutions with lower than 50 heads management 75% of the nation’s herd. These sellers have a scarcity of working capital, lack of transportation, and lack of market-wide info. JBS is a huge in comparison with them.

- It may arbitrage processed meat throughout many components: nation of import and export, local weather, feed prices, credit score availability, qualities, import permissions, and many others.

- It’s approach much less uncovered to frequent commodity cycles between areas. All meat industries (specifically beef) undergo from over and under-supply cycles. However these cycles are circumscribed to a single geography and meat line (beef, poultry, or pork). Throughout oversupply, producers are cash-strained, and costs fall. JBS should purchase in these areas whereas promoting in high-price, under-supplied areas.

- Diversifying throughout exporting areas and nations can supply its clients increased provide safety and provide chain simplicity. JBS can supply McDonald’s or Walmart a single supplier window serving their worldwide markets, simplifying a posh provide chain (meat might be essentially the most perishable, disease-prone, and controlled product in a grocery store). As soon as a provider controls a adequate quantity of provide, market energy strikes to the provider. If JBS controls 40%+ of the meat purchases of a giant chain or nation, the lack of that relationship might be catastrophic for the client.

- Conventional scale-based value benefits like bigger, extra environment friendly services. It is a small part provided that 80%+ of COGS in JBS’ provide chain is the meat product itself.

Leveraging scale downstream

JBS can wield the upstream processing benefit, shifting downstream to extra value-added merchandise. That has been the corporate’s second strategic pillar (in addition to rising scale).

This benefit seems in lots of areas. JBS’ uncooked supplies are cheaper than their opponents should buy from different meat processors. It may additionally subsidize its value-added merchandise by decreasing the processing margin of these uncooked supplies. It may strain opponents to behave appropriately by threatening their provide in the event that they buy from JBS. Lastly, it may possibly ask for retail house in grocery store chains as a result of it’s already a pivotal provider.

Nonetheless, competitors downstream requires a unique method, due to branding. JBS’s benefit within the processing market relies on scale and pricing. This works as a result of suppliers and purchasers are involved with high quality, worth, and repair. Within the branded, consumer-oriented, value-added merchandise market, a moat might be constructed utilizing low-cost and backed uncooked supplies, however finally, a model has to emerge. This has been the profitable case of Seara and Friboi in Brazil, Pilgrim’s Satisfaction within the US, and Swift in lots of international areas.

Monetary leverage

JBS is closely leveraged. The corporate sustains $14 billion in web money owed, with lower than $10 billion in fairness. Nonetheless, I consider this degree of leverage is each sustainable and fascinating.

Beginning with sustainability. JBS’ common maturity is 12 years, which means most of its debt could be very long-term. Most significantly, 90%+ of that debt is fastened curiosity, with a mean value of 6.3%, or 1/2% above long-term US authorities bonds. This implies the corporate is not going to undergo from spikes in curiosity prices, and if charges lower again to (unsustainably) low ranges, then it may possibly repurchase and refinance.

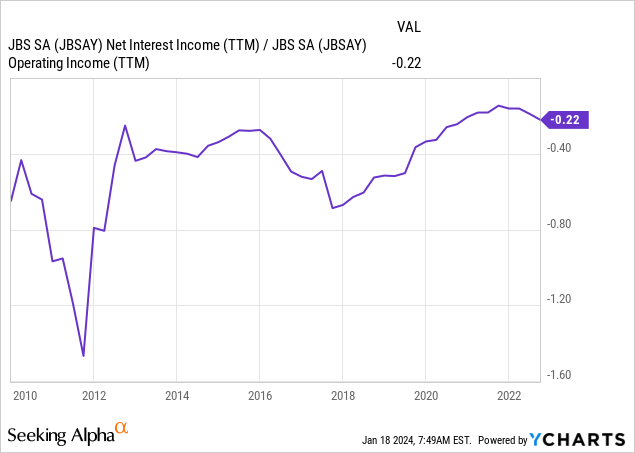

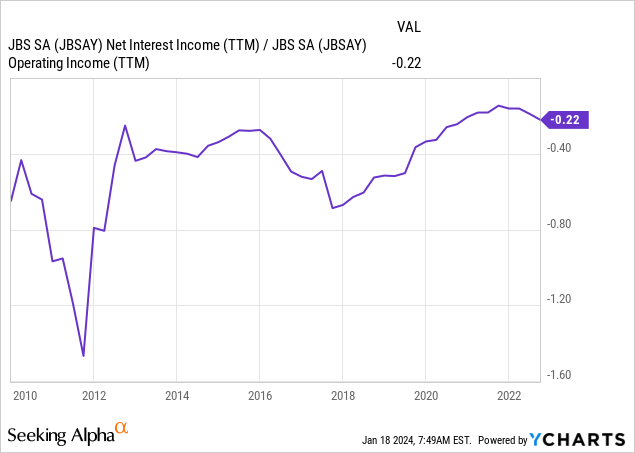

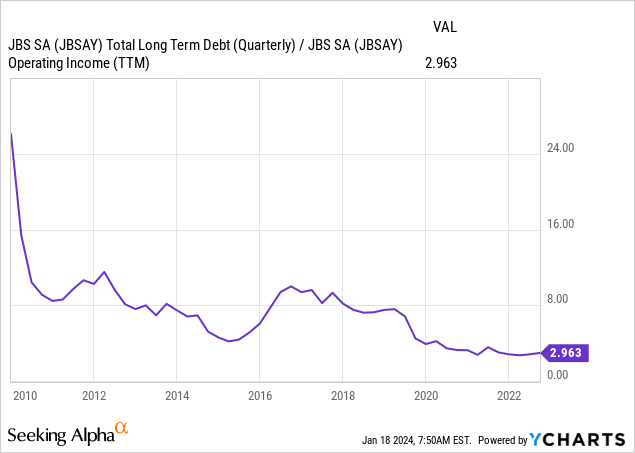

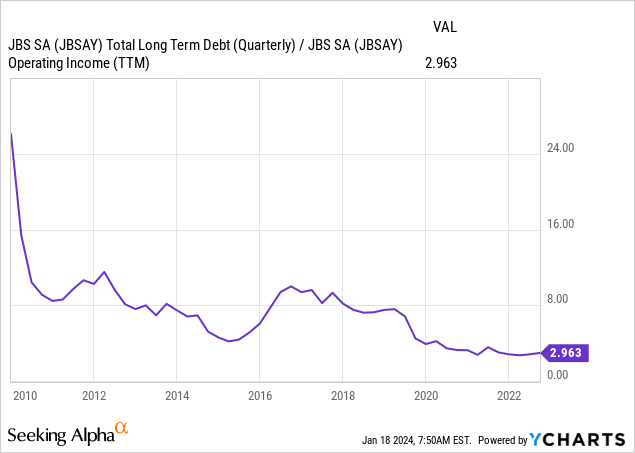

Additional, till earlier than the latest margin drawback, the corporate was constantly lowering the load of curiosity and debt in comparison with its working capability. Within the charts under, I’ve eliminated 2023, which can be handled individually.

Lastly, in coping with desirability, I consider JBS is right in leveraging.

A precondition is that the debt is sustainable, and we’ve seen it’s, primarily due to lengthy maturity and glued curiosity.

The next situation is that the price of the debt (the common 6/7%) is under the working return the corporate can acquire from the property financed by that debt. Returning to the working earnings / complete property chart within the first part, the common ratio was 8% for the previous 13 years (together with 2013). If we confer with the previous decade alone, the ratio was 9.5%. Additional, that ratio confirmed a rising pattern, which I related to scale.

Because of this JBS has obtained between 8% and 9.5% common returns on all of its capital and may finance a part of that capital at very long-term maturities for six to 7%. Additional, as a result of the corporate is taking right capital allocation choices, that new capital is just not lowering however rising the combination working return on capital, additional widening the hole. That is accretive to fairness.

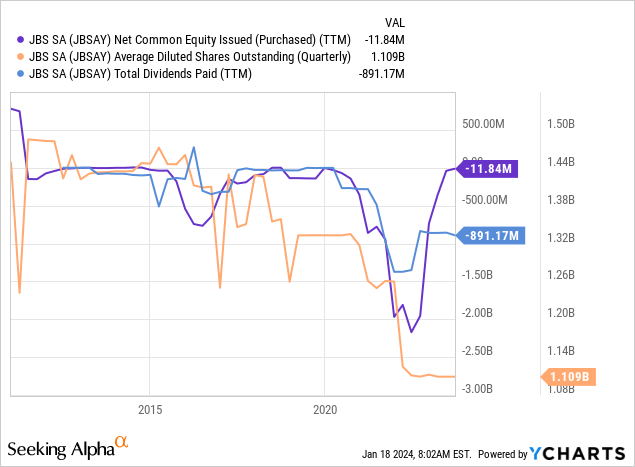

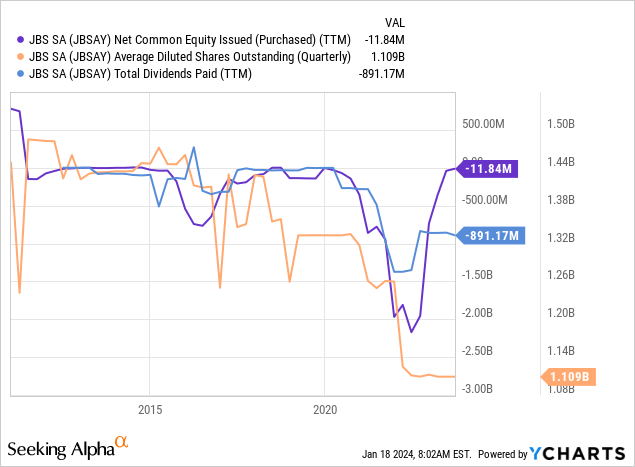

The corporate might have financed extra of its acquisitions through fairness, nevertheless it determined purposely to take debt, and return fairness to shareholders within the type of continued dividends and share buybacks.

The latest margin lower

In most of the above charts, every little thing works properly till 2023, when gross margins collapse, carrying the remainder with them (working margins and leverage ratios).

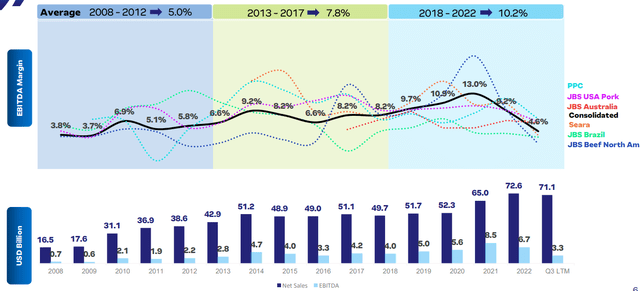

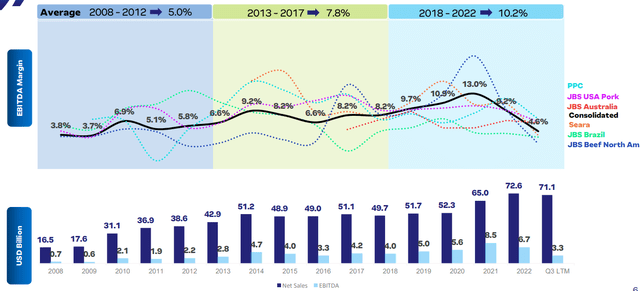

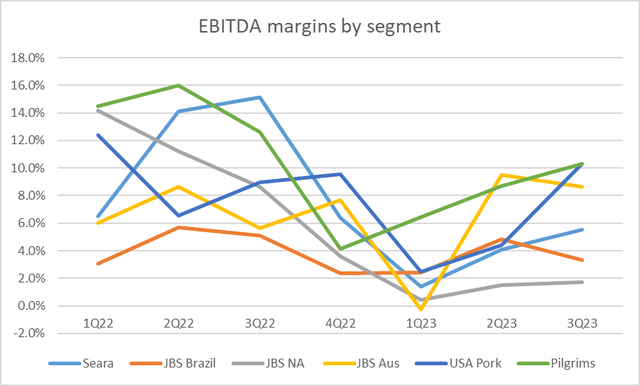

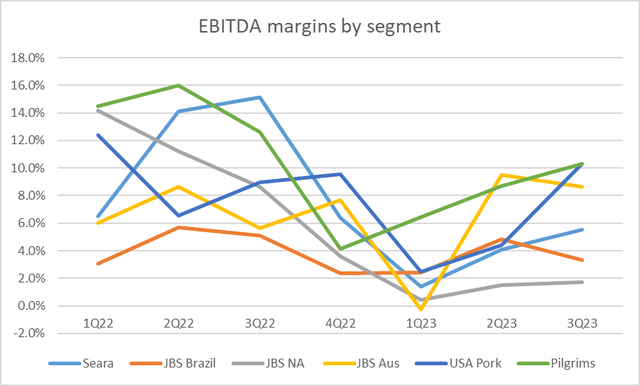

JBS claims that its geographical and protein diversification makes it resilient to particular cycles as a result of when some markets-geographies are extra strained, others aren’t. Within the web page under, from the company’s presentation, the margins are separated by phase, exhibiting how the pattern is rising regardless of totally different markets present process bearish cycles.

JBS EBITDA margin and absolute values, mixture and by phase (JBS IR presentation)

This declare has been vindicated for the previous 13 years, with margins typically rising regardless of bearish actions in cattle and poultry costs.

Nonetheless, the corporate claims that in 1Q23, all of its finish markets underwent a big margin fall. The corporate’s administration claims that previously 50 quarters, solely 4 occasions has there been such a low dispersion of margin path, and three occasions of these 4, it has been constructive. Administration declare is, subsequently that this was a 1 in 50 occasion.

If we zoom into quarterly-level knowledge, we are able to see that the falling pattern twisted in 2Q23, and margins are recovering on the mixture degree (first chart). Additional, on the quarterly phase degree (second chart), a number of segments are again to 2022 profitability. That’s the case of US Pork, JBS Australia, JBS Brazil, and, in some type, Pilgrims. The laggards are nonetheless Seara (value-added merchandise in Brazil) and JBS North America (with the nation present process the decrease portion of the cattle cycle).

JBS EBITDA margins by phase (JBS fundamentals spreadsheet)

Valuation multiples

I don’t consider that JBS can rapidly (or completely) return to the profitability it achieved throughout 2020-2022 as a result of it coincided with an enormous inflationary bout and a generalized bullish cycle throughout all commodities. That sort of profitability as a substitute marks a cyclical peak.

Additional, provided that JBS already controls an unlimited portion of the worldwide meat market, I have no idea how far more returns it may possibly extract by scaling much more within the processing house. Greater returns on capital ought to come from investments in value-added merchandise.

Happily, we don’t have to assume extra development or profitability for JBS valuation to be compelling.

As commented earlier than, for the previous decade, JBS averaged a return on property of 9.5%. The last decade consists of two cycle peaks (2014 and 2022) and two cycle valleys (2016-18, 2023-24). Coupled with an asset degree of $40 billion, this suggests common working income of $3.8 billion.

The typical working margin all through that interval has been 5.6%, leading to an analogous $3.9 billion working income when multiplied by the present $70 billion income degree the corporate has reached.

Evaluating this degree of profitability with an EV of $27 billion already yields a lovely 7x EV/EBIT a number of.

For fairness returns, we should always take away round $1.4 billion the corporate is paying on its debt to achieve a $2.5 billion common pre-tax revenue.

Taxes are a sophisticated matter due to JBS’ international operations. The typical efficient provision price has averaged 40% for the previous decade. This would go away $1.5 billion in common web earnings, yielding a 7x P/E ratio.

Given JBS’ moat on its markets, historical past of profitable capital allocation, and alternatives downstream, sustained by a robust stability sheet (by way of maturities and curiosity value), a 7x EV/EBIT and a 7x P/E ratio are enticing.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.