MF3d

JD.com (NASDAQ:JD) (OTCPK:JDCMF) is China’s biggest e-Commerce company by revenue. Although Alibaba (BABA) does far more profit, JD holds inventory directly, resulting in slimmer margins. Still, JD’s massive revenue numbers make it one of China’s true eCommerce giants. It is relatively unique among Chinese eCommerce companies in having a strong focus on quality. Both AliExpress and TEMU have been criticized for a lack of quality in some products; JD is considered to have the best average product quality of all the Chinese eCommerce marketplaces. This quality control comes at a price, though: to ensure that all of its goods are legitimate and that the quality control is high, JD has to hold inventory on its own shelves, which results in lower margins than Alibaba or PDD can boast.

As a result of its relatively high expenses, JD has the lowest total profit out of itself, Alibaba and PDD Holdings. JD having a lower market cap than those companies is justified. However, it is also the cheapest of the three stocks mentioned, as the table below demonstrates.

|

JD |

Alibaba |

PDD Holdings |

|

|

Adjusted P/E |

8.4 |

8.6 |

16.3 |

|

GAAP P/E |

12.2 |

17.2 |

18 |

|

Price/sales |

0.28 |

1.4 |

4.5 |

|

Price/book |

1.33 |

1.33 |

6.2 |

|

Price/cash flow |

4.2 |

7 |

12 |

As you can see, JD has the lowest multiples out of itself, PDD Holdings and Alibaba. Despite this, it has a higher growth grade than Alibaba in Seeking Alpha Quant, with its year over year earnings growth rate being a full 130%. So, JD looks like it offers a good combination of growth and value.

When I last covered JD stock, I called it a buy on the grounds that it was cheap while still growing and delivering decent profits. I held the stock at that time, but sold it when it went above $30, notifying readers in advance in a comment. Today, with JD stock nicely below $30 and not too far above the levels I bought it at, I still consider it a buy. In fact, I have even more conviction in the stock than I had when I last wrote about it. Although JD is still 20% higher than it was when I last wrote about it, certain aspects of China’s economic recovery are more certain now than they were then. For this reason, I now consider JD stock a strong buy. In this article, I will explore the reasons for my increased bullishness on JD stock.

The Buyback

By far the biggest catalyst, JD has going for it right now is its ongoing buyback program. In the first quarter, the company bought back $1.2 billion worth of stock. With a $40 billion market cap, JD retired approximately 3% of its shares per year. To put that into perspective, Apple’s (AAPL) $100 billion buyback has the capacity to retire about 2.8% of that company’s shares in a year, if every dollar of the budget is spent in that timeframe. JD will retire 12% of its shares this year if it continues buying them back at the first quarter pace. The more shares are retired, the more earnings per share, all other things the same. So, JD’s big buyback could be thought of as a growth catalyst.

Global Expansion Underway

Another thing that changed at JD since I last covered it is the company’s geographic focus. As I noted in my last article, JD has historically been a domestic-market oriented company, focused mainly on the China market. It has never had a large global export market like Alibaba and PDD have. To the extent that it has been involved in global trade, it has been an importer rather than an exporter.

That’s beginning to change.

Earlier this month, Seeking Alpha reported that JD was interested in acquiring the UK delivery company Evri. Before that, the company released a quarterly report that touted the company’s efforts in helping Chinese brands expand overseas. Finally, in December of 2023–less than one year ago–the company launched JD Global Sales, in the strongest indication to date that the company is eying global markets.

So far, JD’s global presence is smaller than Alibaba or PDD’s, but that could change. In the first quarter, JD announced that it was providing supply chain and logistics services for MINISO in Australia and Malaysia. MINISO is a vendor of household products, such as tableware, food containers, and scent diffusers. It is already doing good business in Australia and Malaysia. It is also trying to expand into the United States, with new locations in Texas and Florida.

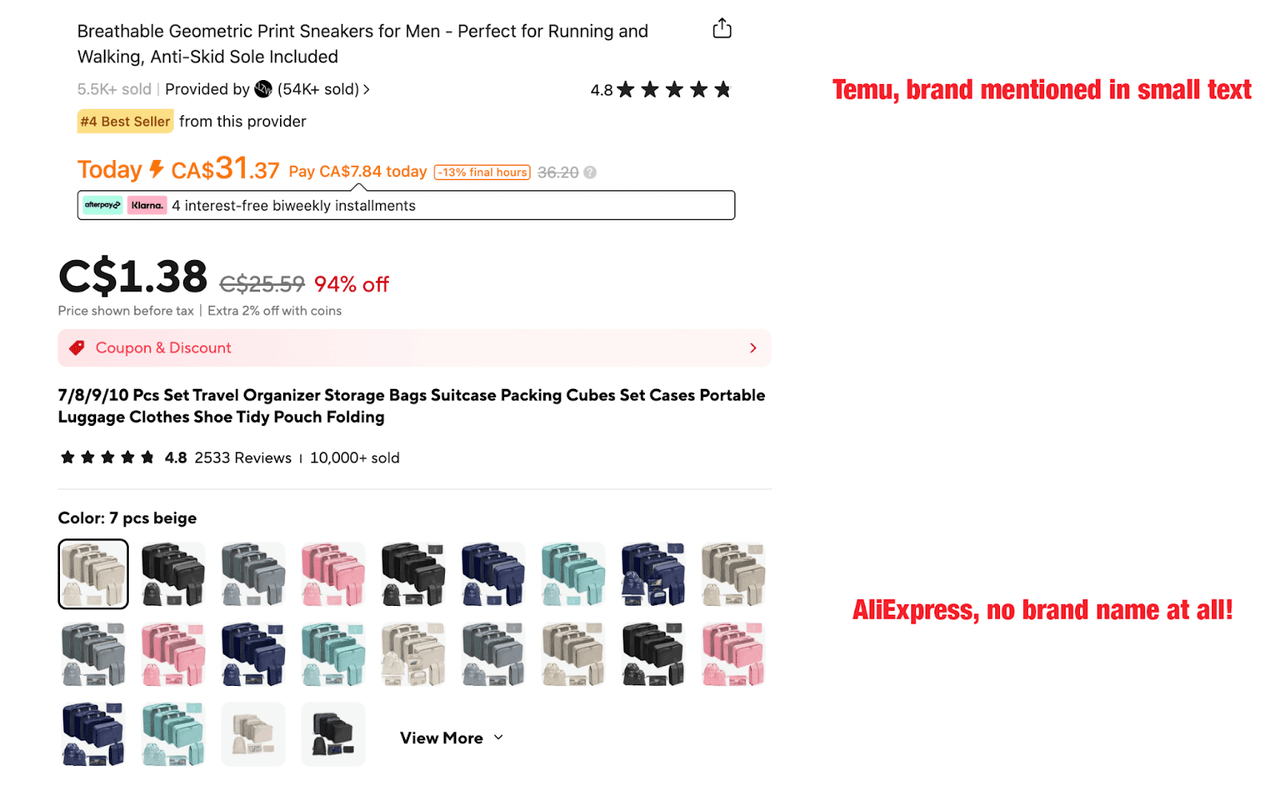

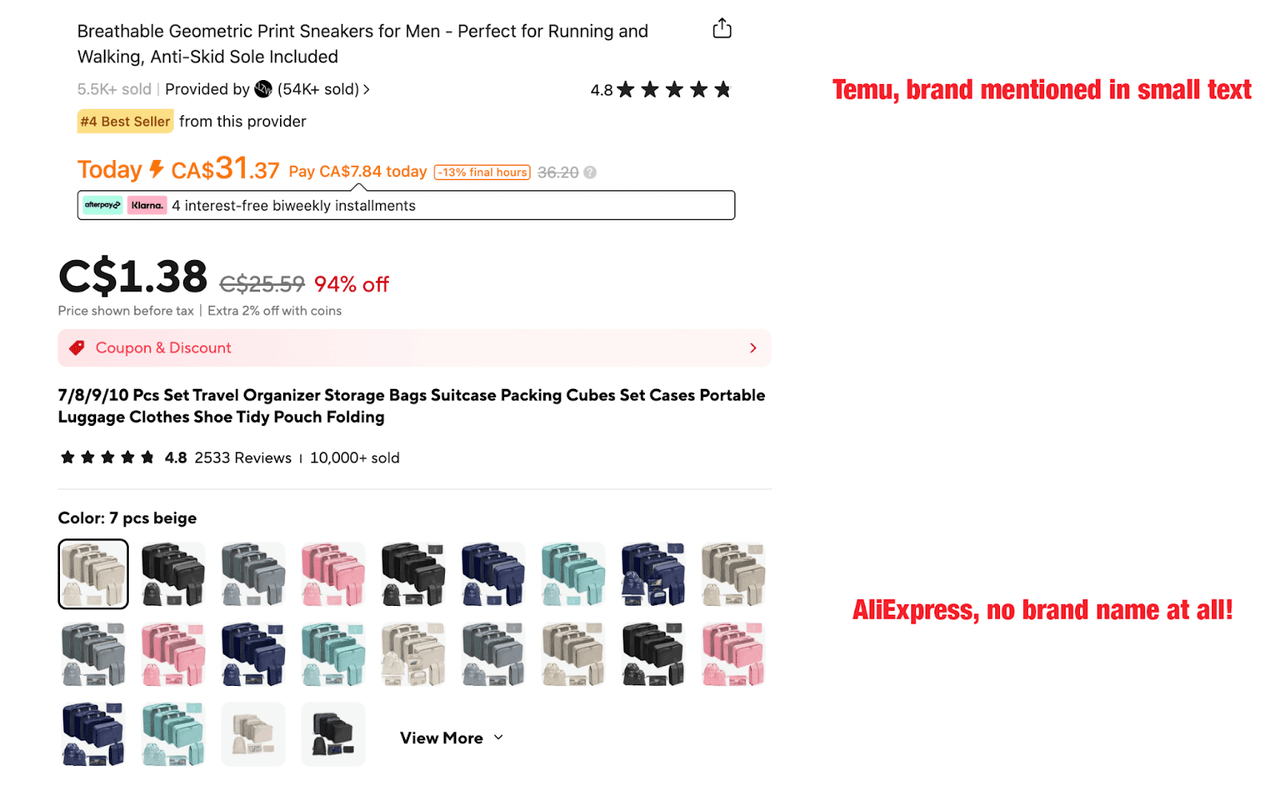

JD’s approach to global commerce is different from those of Alibaba and PDD. It does not host an AliExpress/TEMU-like app where global customers buy products. Instead, it provides back end logistics for companies that sell primarily on their own websites. This would appear to give JD an advantage in partnering with ambitious companies that want to build their own brands. As you can see in the screenshot below, AliExpress and TEMU give brands very little room to put their own identity on product listings. They pretty much just have their name listed in a small font above the product. JD’s logistics service leaves vendors free to sell on their own websites and apps and gives them more room to meaningfully differentiate themselves. This could be an advantage with certain vendor-partners, particularly the more ambitious ones that want to build differentiated high-moat brands.

AliExpress and TEMU Listings (The author)

So far, JD is being tight-lipped about the results of its overseas expansion. For example, in its fourth quarter 2023 release, it simply stated that JD Logistics helped a “major Chinese technology company” deliver sales in Europe. The company did not report revenue from the partnership, nor did it include a geographic breakdown of its overall earnings. For this reason, we can’t model how much money JD is likely to earn from its global expansion with any precision. Nevertheless, the fact that it is doing such an expansion is promising: the global segment was the fastest growing one at competitor Alibaba last year.

China’s Macro Picture is Improving.

Turning to the domestic side of things, JD now has a catalyst in the form of China’s return to high economic growth. Economists are expecting China to overshoot its 5% growth target for the first half. China’s global trade is back to positive growth, after receding in 2023. Online retail sales are growing at 12.4%. These are all positive signals for JD’s business. High GDP and even higher retail sales growth mean that China’s consumers are getting richer and spending a rising percentage of their income online. Rising global trade means that global export markets continue to represent opportunity for JD. So, China’s economic picture bodes well for the company.

Growth, Profitability and Valuation

Having looked at the macro factors affecting JD as well as its international growth catalyst, we can now start to value the stock. First, let’s check out the growth and profitability picture.

JD scores a C- on growth in Seeking Alpha Quant, with its revenue up 4.98% and its earnings up 130% in the trailing 12-month period. The five year compounded figures are better:

-

Revenue: 17.9% CAGR.

-

EBITDA: 49% CAGR.

-

Net income: 50% CAGR.

-

Adjusted net income: 112% CAGR.

-

Free cash flow: 24% CAGR.

The company’s long-term growth trend is certainly a good one, but, of course, the recent revenue deceleration is a negative. With the newfound competition in China’s eCommerce space, it’s unlikely that the company will return to its historical growth rates in its domestic operations. The international market is a powerful catalyst that could lead to growth acceleration.

JD scores an A+ on profitability in Seeking Alpha Quant. Some highlighted metrics include:

-

An 8.85% gross margin.

-

An 11.5% return on equity.

-

A 1.91 asset turnover ratio.

These are pretty good profitability metrics. The company’s net and free cash flow margins are rather low, but that’s to be expected for a company like JD that holds so much inventory.

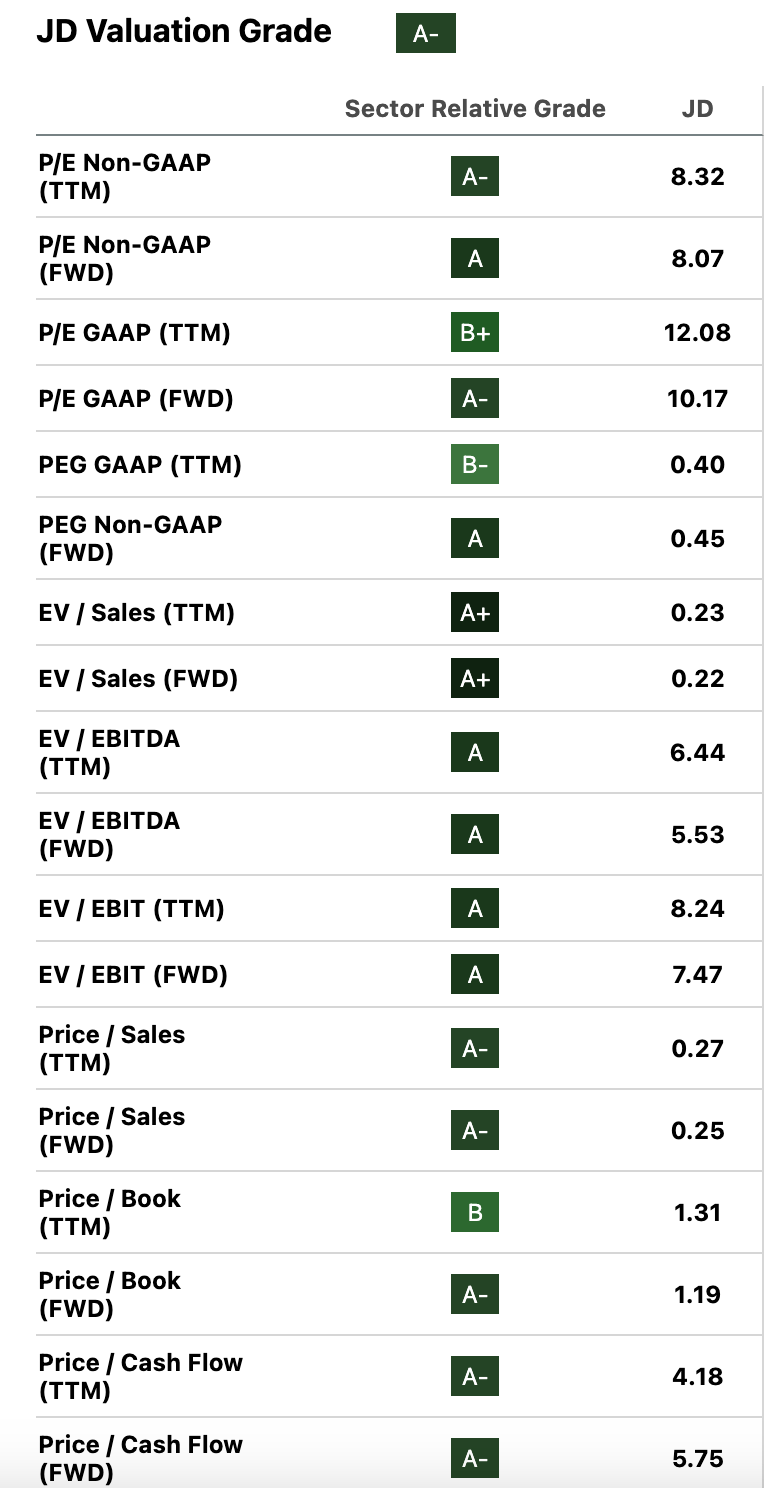

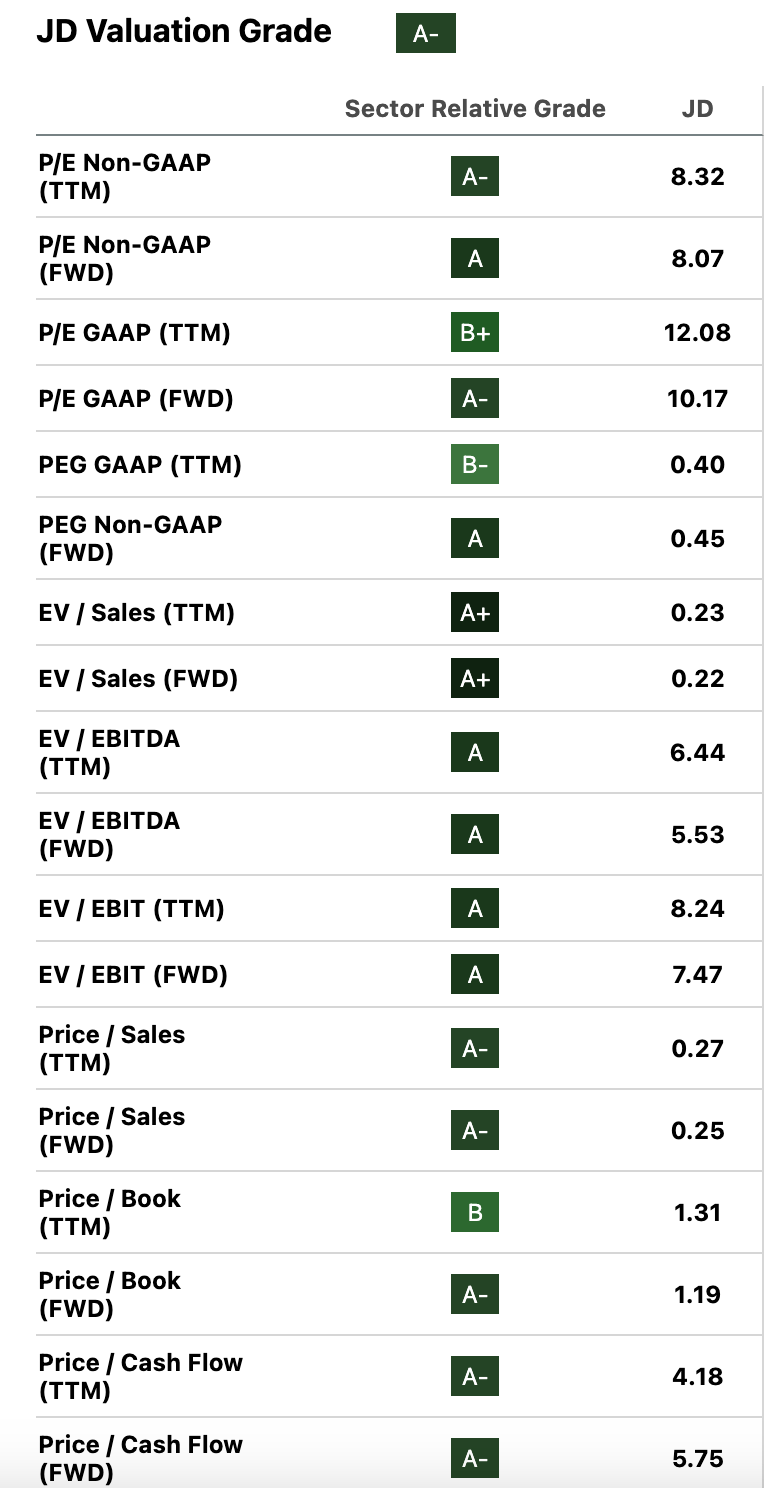

JD’s multiples are all very low, especially by the standards of technology companies. Below, you can see some select multiples for the stock, courtesy of Seeking Alpha Quant.

JD valuation (Seeking Alpha Quant)

Pretty cheap. Additionally, we can do a basic discounted cash flow valuation of JD, by simply discounting its trailing 12-month free cash flow assuming no growth.

In the trailing 12-month period, JD delivered $4.10 in free cash flow per share. The 10-year treasury yield is 4.5%, we should add a 5.5% risk premium to it to account for risk factors like a potential Taiwan war and rising competition in Chinese eCommerce. So we get a 10% discount rate. If you discount $4.10 at 10%, you get a $40.10 price target, or 49.5% upside. So, JD appears to be undervalued at today’s prices.

Conclusion

JD is one of the cheapest tech stocks in the world right now. Going by multiples, it is cheaper than Alibaba. Going by discounted cash flows with ultra-conservative assumptions, it has 49.5% upside. This cheap valuation means that the company’s big buyback is likely to retire a lot of shares, and boost EPS. True, JD faces geopolitical and competition risks. But it’s so cheap, it doesn’t even have to grow to be worth the investment. I consider the stock a high conviction buy today.