Along with portfolio administration, Jellyverse will function JellySwap, a decentralized trade that can function house to its native crypto JLY.

Jelly Labs AG and Fintonomy LTD, the businesses growing the preliminary protocols for Jellyverse, a decentralized finance community constructed on the Ethereum Digital Machine (EVM)-compatible layer-2 DeFiMetaChain (DMC), have introduced the completion of their joint seed funding spherical.

In keeping with a press launch shared with Coinspeaker, the 2 firms secured $2 million from undisclosed traders to bolster the event of Jellyverse and drive the evolution of the subsequent part within the DeFi ecosystem – DeFi 3.0.

Jellyverse to Present Portfolio Administration Companies

Each Jelly Labs AG and Fintonomy LTD have been diligently engaged on a groundbreaking answer to attach real-world worth feeds – particularly these associated to conventional belongings like securities and commodities – with decentralized finance functions. The businesses goal to handle these challenges out there with Jellyverse.

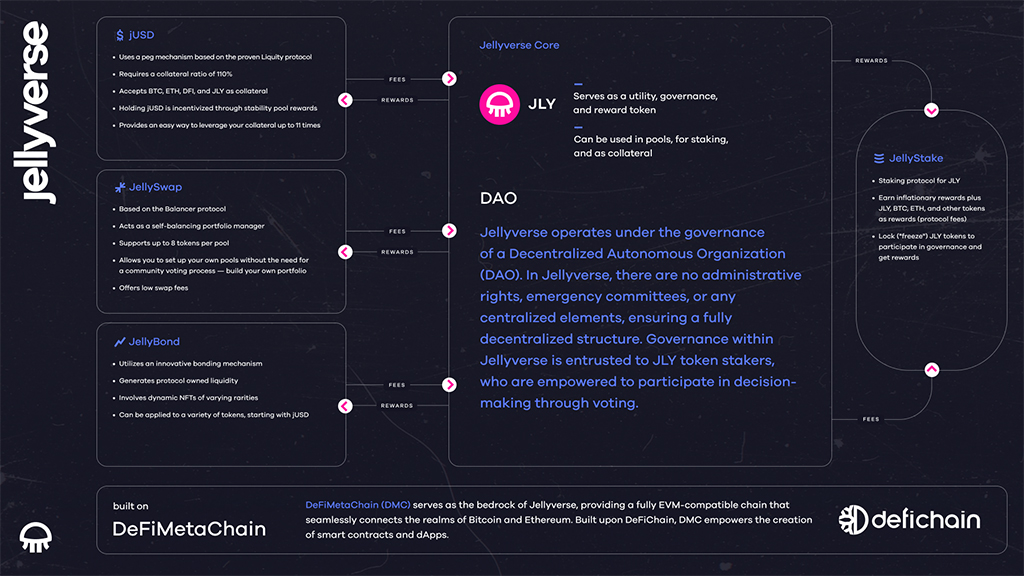

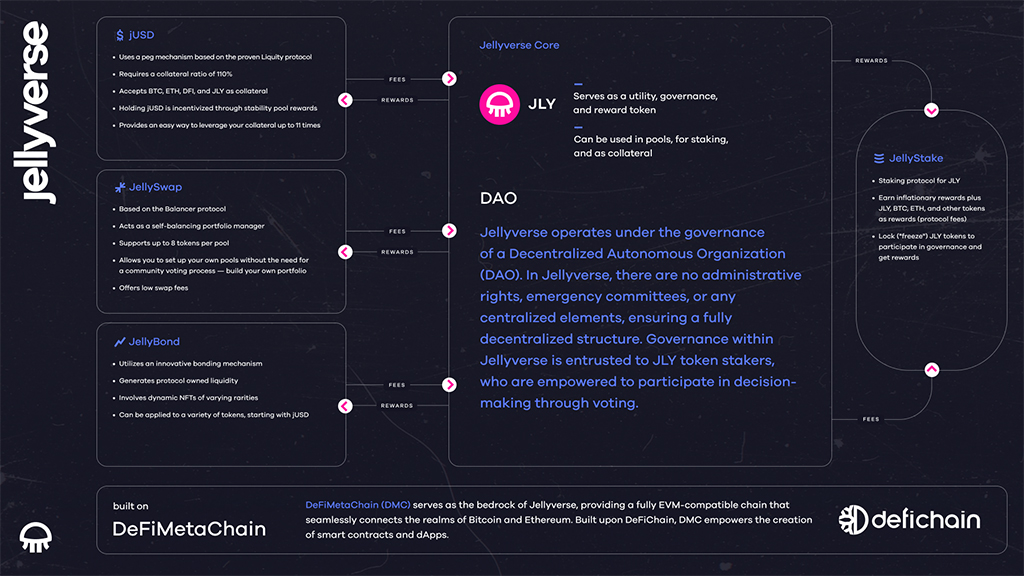

In keeping with the discharge, the protocol initiated by the crew behind the event of DeFiChain Accelerator might be absolutely developed and ruled by an on-chain decentralized autonomous group (DAO). Upon completion, customers can count on a set of groundbreaking merchandise, together with decentralized portfolio administration providers, bonds, lending, and extra refined staking options.

“Jellyverse merges the pinnacle of past DeFi achievements with a fresh perspective. We present decentralized assets that pioneer a novel way to diversify your crypto portfolio, complemented by self-balancing multi-token pools,” stated Santiago Sabater, the Co-Initiator of Jellyverse.

The portfolio administration function will introduce tokens designed to trace real-world worth feeds, empowering traders to create advanced portfolios comprising a number of belongings whereas incomes yields.

Progressive Options of Jellyverse

Along with portfolio administration, Jellyverse will function JellySwap, a decentralized trade (DEX) that can function house to its native crypto JLY. The DEX might be designed with prolonged functionalities to function as a non-custodial portfolio supervisor and liquidity supplier.

Customers also can stake their favourite crypto belongings in JellyStake, together with JLY tokens, to obtain further incentives, together with rewards and elevated voting energy.

Upon launch, Jellyverse will debut with a stablecoin dubbed jUSD based mostly on the “rigorously tested and proven stability mechanisms from LUSD by Liquidity protocol”. In keeping with the press launch, customers can borrow jUSD towards DFI, dETH, JLY, and different cryptocurrencies.

The Jellyverse ecosystem may even function jAssets, user-generated tokens backed by digital belongings that replicate the costs of shares, commodities, or ETFs by real-time worth feeds. The providing will permit customers to discover the standard monetary markets not directly to develop their crypto portfolio.

Jelly Labs AG and Fintonomy LTD stated the product providing might be developed alongside a neighborhood crew and built-in into the Jellyverse ecosystem by a future governance approval.

One other fascinating function to be added to the Jellyverse community is dubbed JellyBond. In keeping with the discharge, the protocol will introduce the primary bonding mechanism to the DeFiChain, providing amplified yield to token holders and producing protocol-owned liquidity on the identical time.