After more than a year of pleas from Wall Street, Federal Reserve Chair Jerome Powell has finally indicated that he will begin cutting interest rates. In a highly anticipated keynote address at an annual symposium in Jackson Hole, Wyoming on Friday, Powell said that his confidence that inflation is returning to the Fed’s 2% target has grown, and there is no longer a reason to keep rates elevated to fight it.

“The time has come for policy to adjust,” he said, noting that “the upside risks to inflation have diminished and the downside risks to employment have increased.”

Powell’s comments come after inflation fell to a 3-year low of 2.9% in July, and the unemployment rate rose to 4.3%, triggering a key recession indicator called the Sahm Rule.

After focusing mainly on the price stability side of its dual mandate for more than two years, Powell emphasized that the Fed is now more cognizant of rising risks to the labor market. “We do not seek or welcome further cooling in labor market conditions,” he said.

Looking ahead, Powell said that the timing and pace of upcoming interest rate cuts will depend on incoming data, but he noted that “the direction of travel is clear.”

“We will do everything we can to support the strong labor market as we make further progress toward price stability with an appropriate dialing back of policy restraint,” he said, adding “there is good reason to think that the economy will get back to 2% inflation while maintaining a strong labor market.”

Stephen Brown, deputy chief North America economist at Capital Economics, said the “unmistakably dovish” tone in Powell’s on Friday speech is a sign that a larger-than-forecast 50 basis point interest rate cut is now possible in September, at least if the unemployment rate rises further in August.

However, Brown argued that the rise in the unemployment rate in July was likely due to “temporary factors,” which means unless August’s jobs report is dismal, a 25 basis point rate cut next month is the most likely outcome.

Are investors overly optimistic?

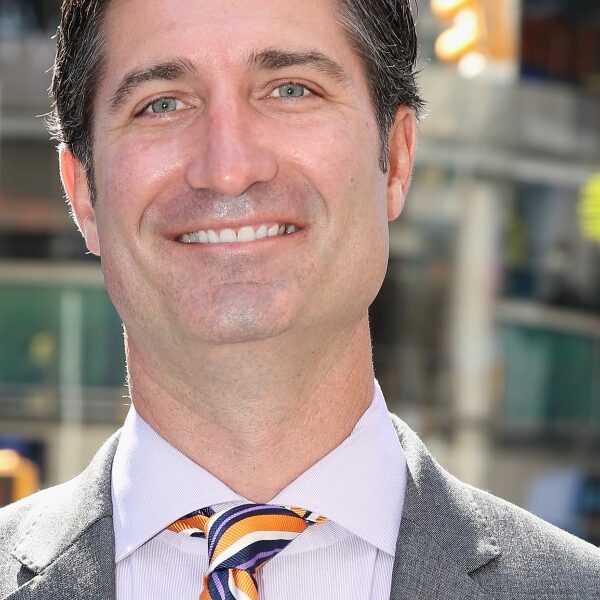

Glen Smith, chief investment officer at GDS Wealth Management, also argued that a 25 basis point rate cut is now all but guaranteed in September. He said that after Powell’s speech, it appears the long-awaited and often-dismissed economic “soft landing” is now finally here, with the Fed coming in to support the economy. But how much support the Fed plans to give is still in question.

“While a September rate cut is essentially a done deal at this point, the more important question is whether this will be a one and done rate cut, or if it will be the beginning of a more substantial cutting cycle, and that will be determined by the economic data over the next two to three months,” Smith told Fortune via email.

When it comes to future policy easing after next month, Smith warned that markets may be too excited. “We remind investors that the market has a history of being too optimistic about rate cuts,” he said.

Brian Coulton, Fitch Ratings’ chief economist, echoed that view. “There does not seem to be a serious concern about the risk of an imminent recession and a wave of job losses – i.e. the sort of concerns that could justify rapid rate cuts. Rather it’s about the diminishing threat of elevated wage growth keeping inflation too high,” he told Fortune via email. “The policy easing path post September will be a gradual one.”

Bond traders’ interest rate expectations in September didn’t change much after Powell’s press conference. The bond market was already pricing in 100% odds of a rate cut next month, including a 32.5% chance of an outsized 50 basis point rate cut, according to CME Group’s FedWatch tool, and little changed after Powell’s speech.

The stock market certainly responded well to Powell’s dovish tone on Friday, however. The Dow Jones Industrial Average rose 1% by 11:45 am ET, while the S&P 500 and tech-heavy Nasdaq surged 0.85% and 1.1%, respectively.

Consumers, on the other hand, won’t see an immediate benefit from Powell’s upcoming rate cut. Ted Rossman, senior industry analyst at Bankrate, like others, noted that the Fed will lower interest rates gradually, meaning it will take time to see lower consumer borrowing costs for the most part.

“We’ve already seen a significant drop in mortgage rates. The average 30-year fixed mortgage rate has fallen from about 8% last October to 6.62% today. But that’s still high relative to the past two decades,” he said, adding “We’ve yet to see a meaningful drop in credit card or auto loan rates.”