Regardless of Bitcoin’s surging worth, block trades present restrained exercise. The market sees extra promoting calls and shopping for places, signaling cautious dealer sentiment.

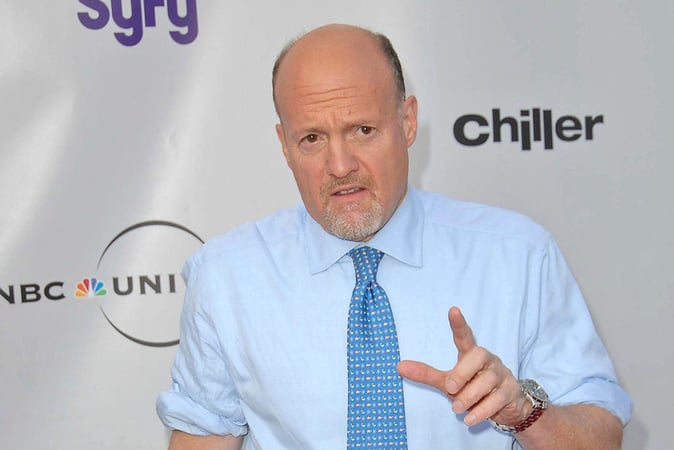

A traditionally indicative sign for bearish positions is now suggesting optimistic prospects for Bitcoin (BTC) bulls. Traders on the earth’s largest cryptocurrency are eagerly anticipating a vital regulatory choice on a US exchange-traded fund (ETF) product. Jim Cramer, former hedge fund supervisor and CNBC’s Mad Cash host, asserted in a latest TV phase that Bitcoin was “topping out”, a sentiment he expressed simply days after declaring Bitcoin’s enduring significance.

Cramer emphasised an easy strategy, advising these desirous about Bitcoin to immediately purchase the cryptocurrency. Regardless of Cramer’s view, Bitcoin witnessed an 8% enhance on Monday, briefly reaching $47,100, marking its highest stage since April 2021.

JIM CRAMER ALERT🚨🚨🚨:

“I think Bitcoin’s topping out.”#Bitcoin🚀🚀🚀 pic.twitter.com/mt8TwwtPDL

— Swan Media (@Swan) January 9, 2024

Cramer’s evolving stance on Bitcoin and cryptocurrencies has develop into a focus for traders and market analysts, typically serving as a counter-indicator in crypto circles. This phenomenon has given rise to what’s colloquially generally known as the “reverse Cramer” impact, whereby his predictions are met with a stage of skepticism.

A notable occasion was in June when his suggestion to exit the crypto markets coincided with a major shopping for alternative. In hindsight, it turns into evident that the market was present process an prolonged consolidation section throughout that interval.

On Monday, January 8, the Bitcoin worth surged previous $47,000 amid rising pleasure across the Bitcoin ETF approval.

A Take a look at Bitcoin Choices Knowledge

Trying on the Bitcoin choices information, Jim Cramer won’t be utterly mistaken relating to the topping out of Bitcoin worth.

Current developments within the cryptocurrency market recommend an imminent arrival of Trade-Traded Funds (ETFs), making a surge in FOMO sentiment, particularly throughout US buying and selling hours. Bitcoin, responding to this anticipation, reached a brand new excessive of $47,000.

Nevertheless, the choices market is delivering combined alerts. Quick-term Implied Volatilities (IVs) skilled a major decline, with the present At-The-Cash (ATM) possibility IV for the eleventh of June dropping under 90%, marking a 30% lower inside a couple of hours. Different phrases within the choices market additionally displayed notable declines.

In distinction to the heightened exercise in Bitcoin’s worth, block trades through the breakout to new highs have been comparatively restrained. The market noticed a dominance of promoting calls and shopping for places, indicating a cautious strategy amongst merchants.

A noteworthy facet is the participation of institutional traders who initiated brief positions within the ETF market throughout its peak momentum. This strategic transfer raises questions concerning the future trajectory of the market and introduces a component of uncertainty amid the anticipation surrounding ETFs. The interaction of those components provides complexity to the evolving panorama of cryptocurrency buying and selling.