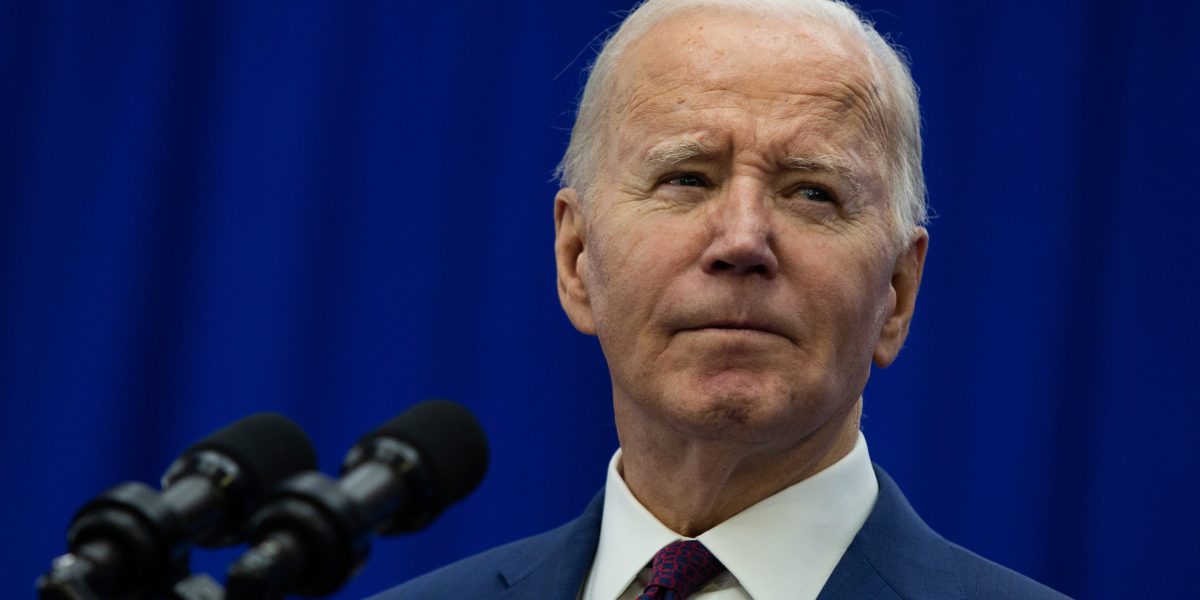

U.S. President Joe Biden put ahead quite a lot of crypto associated taxes and rules which he says might generate nearly $10 billion subsequent 12 months, and over $42 billion over the subsequent decade, in line with his proposed 2025 budget launched Monday. Among the many proposals are an excise tax on Bitcoin mining.

Any agency utilizing computing assets to mine digital belongings can be topic to an excise tax equal to 30% of the prices of electrical energy used, the proposal states. The proposed tax would come into impact after December 31, 2024, and be launched in three phases: 10% within the first 12 months, 20% within the second 12 months and 30% within the third 12 months.

“The Budget saves billions of dollars by closing other tax loopholes that overwhelmingly benefit the rich and the largest, most profitable corporations,” together with “closing a loophole that benefits wealthy crypto investors,” the proposal continued.

If applied, miners must report the quantity and kind of electrical energy they use, in addition to how a lot they paid if bought it from an exterior supply. In the meantime, miners who lease computing energy —as is widespread in so-called mining swimming pools—can be required to report the worth of the electrical energy of the corporate that leased it to them. The worth would then function the tax base.

Biden administration is proposing a 30% tax on electrical energy utilized by #bitcoin miners, even in case you are off-grid utilizing your personal photo voltaic and wind era. The entire causes they supply are pretextual, their actual cause is that they wish to suppress Bitcoin and launch a CBDC. pic.twitter.com/juNHvO2NBx

— Pierre Rochard (@BitcoinPierre) March 12, 2024

Critics of the proposals embrace Republican Senator Cynthia Lummis, who voiced opposition to the tax proposal on X. Whereas the inclusion of crypto on the finances suggests the administration could also be bullish on crypto, a 30% tax would destroy the mining trade’s presence within the U.S., she tweeted.

The White Home 2025 finances is extremely bullish on crypto belongings, some may even say they consider it’s going to the moon.🚀

However a proposed 30% punitive tax on digital asset mining would destroy any foothold the trade has in America.

— Senator Cynthia Lummis (@SenLummis) March 11, 2024

Bitcoin mining is a rising enterprise within the U.S. for the reason that Chinese language Communist Celebration banned miners working in China in Might 2021. The trade has taken off in Texas particularly thanks partially to the state’s low-cost energy. Using Bitcoin’s tailwinds this bull run, shares within the eleven publicly-traded U.S. miners have been hovering over the previous 12 months, with CleanSpark ($CLSK) up 270% over the previous six months, in line with CoinGecko knowledge.

In the meantime, Dave Rodman, crypto lawyer and founding father of The Rodman Legislation Group, additionally voiced frustration on the proposals. He informed Fortune over e mail “I find it truly laughable that “wealthy crypto investors” are included within the laundry record of the oligarch degree class in that assertion…The federal government acknowledges the financial energy that web3 will wield however they give attention to suppressing it whereas extracting from it.”

Biden’s name for a mining tax got here as a part of a proposed finances, which many contemplate extra of a want record or a political assertion, since new income measures should originate within the U.S. Home of Representatives, which is at present managed by Republicans hostile to his agenda.

This isn’t the primary time the Biden administration has sought to curb mining operations. Biden pitched the identical tax final March in his 2024 finances proposal, and has just lately been pressurizing miners to disclose the extent of energy consumed with an emergency, obligatory survey, however was forced to retract it final month, following authorized backlash.

Based on preliminary estimates revealed by the Division of Power final month, the trade might account for between 0.6% and 2.3% of complete annual U.S. electrical energy use. For context, final 12 months, Utah consumed roughly 0.8%, and Washington state, house to just about 8 million individuals, consumed 2.3%. In Texas, Bitcoin mining has already raised electrical energy prices for non-mining Texans by $1.8 billion per 12 months, or 4.7%, in line with Wood Mackenzie.

Additional proposals that might have an effect on crypto embrace line gadgets for making use of wash sale guidelines to digital belongings, reporting necessities for monetary establishments and digital asset brokers and new international crypto account reporting guidelines, together with crypto in mark-to-market guidelines.