Via an interview with JPMorgan Chase CEO Jamie Dimon on CNBC:

- still believes that the odds of a “soft landing” for the economy are around 35% to 40%

- making recession the most likely scenario

- Dimon added he was “a little bit of a skeptic” that the Federal Reserve can bring inflation down to its 2% target because of future spending on the green economy and military

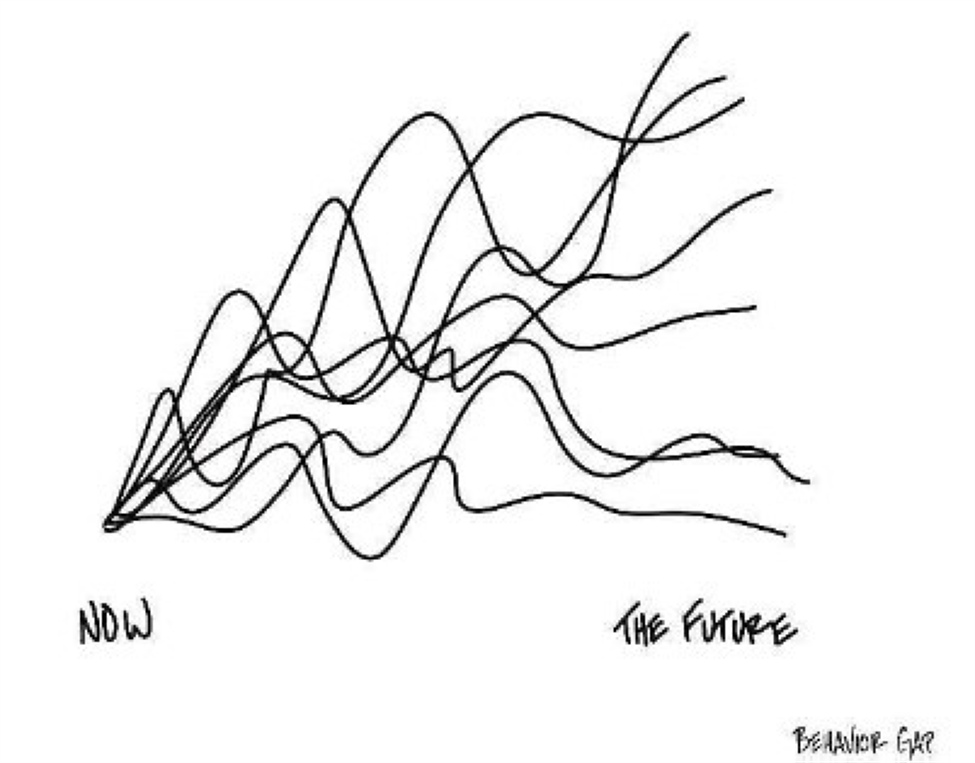

- “There’s a lot of uncertainty out there”

- “I’ve always pointed to geopolitics, housing, the deficits, the spending, the quantitative tightening, the elections, all these things cause some consternation in markets.”

- “I’m fully optimistic that if we have a mild recession, even a harder one, we would be okay. Of course, I’m very sympathetic to people who lose their jobs. You don’t want a hard landing.”

A couple of points on this. Without specifying timing the forecast takes on less value. I am sure Dimon is referring to this cycle, the near to medium term. But, he didn’t say.

Anyway, all of those factors Dimon points to are valid. But the US economy keeps on chugging along strongly. Indeed, the latest I’ve seen from Dimon’s firm, data August 5 is:

- 2Q24 GDP growth came in at 2.8% q/q saar compared to expectations of 1.9% and above last quarter’s 1.4%. Notably, the core PCE index rise to 2.9% was slightly firmer than expected but was below the 3.7% increase in 1Q, while consumer spending was a solid 2.3%. Overall, the report points to less softness than the 1Q print suggested. While the U.S. economy has cooled from its 4.1% pace in 2H23, growth averaged a solid pace of 2.1% in 1H24.

Someone said this, or something like it:

“Prediction is very difficult, especially if it’s about the future.”