On Tuesday, Deutsche Bank analyst Matt O’Connor downgraded the Wall Street giant’s stock from a buy to a hold rating. The reason: The company had done so well over the past year there was nowhere left for it to go. There is “less upside to JPM in the near/medium term as a lot of good news seems priced in,” O’Connor wrote in a note published Tuesday.

The stock has had a stellar 2024 so far. JPMorgan’s stock is up 30%, far outpacing the 18% of the BKX, the index that tracks the major banks, and a raft of its competitors.

Some of JPMorgan’s rivals are also having good years: Wells Fargo is up 19%, Bank of America is up 20%, and even the embattled Citigroup, in the midst of a nearly total turnaround, is up 16%.

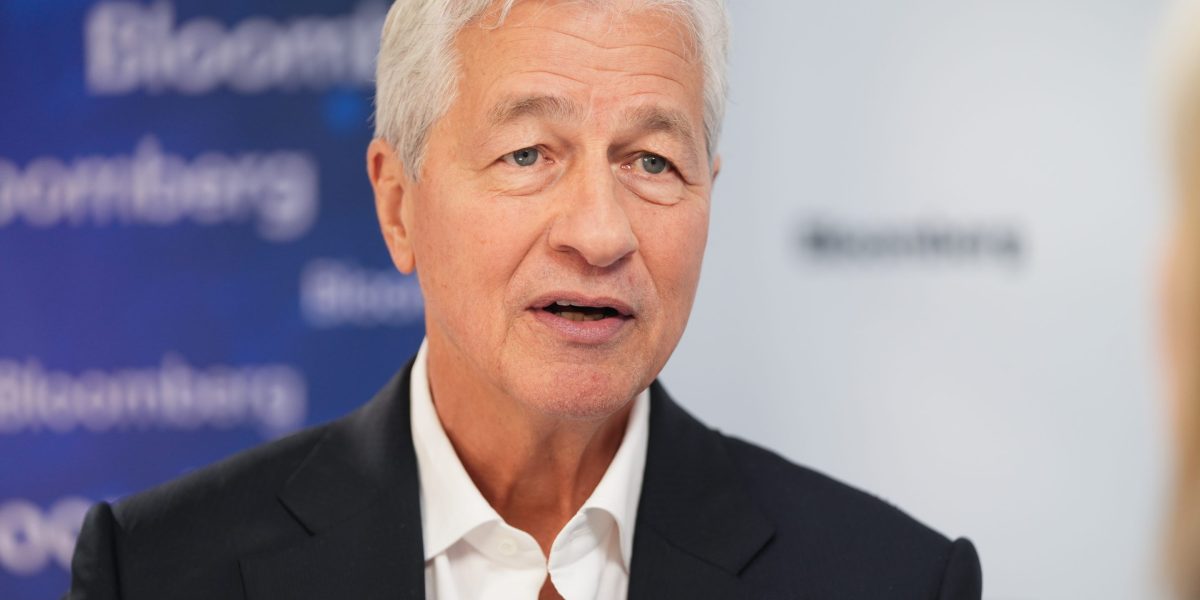

But none have matched JPMorgan, which under the leadership of Wall Street’s éminence grise, Jamie Dimon, has thrived. Much of the bank’s success is due to its strong net interest income (the difference between how much a bank makes in interest and how much it has to pay in interest), high investment banking fees, and its sprawling consumer banking segment, none of which went unnoticed by O’Connor.

“JPM’s strong capital generation and execution have made shares a good stock to own over time,” he wrote.

But as the saying goes, all good things must come to an end. JPMorgan’s plum net interest income—$22.9 billion in the second quarter—will take a hit as the Fed lowers interest rates, as it’s widely expected to do later this month, according to O’Connor. The bank also faces broader challenges like “continued sluggish industry-wide loan growth,” he wrote.

O’Connor called 2025 a “transition year from an earnings point of view,” expecting flat earnings per share growth next year. He still maintained a $235 price target for JPMorgan, which, based on its current price of $22.23, assumes about a 5.7% upside—enough to get a return but certainly not at the appetizing rate seen so far this year.

JPMorgan did not immediately respond to a request for comment.

In the same note, O’Connor upgraded JPMorgan’s competitors Wells Fargo and Bank of America from a hold to a buy. Just as JPMorgan performed so strongly, leaving it little room for any further significant upside, the opposite can be said of its two rivals. A few blips on their otherwise upward trajectory made it a good moment to buy.

Wells Fargo had a strong early part of the year before dropping 13% from $60.01 to $52.12 over a five-day span from July 30 to Aug. 5. Shares have since recovered to around $58.90 at the time of publication. For Deutsche Bank, that turbulence was a good opportunity. “Recent weakness has created a better entry point in our view,” O’Connor wrote.

Meanwhile, Bank of America, which has had a strong year, has had a rocky few weeks after disclosures that Warren Buffett’s Berkshire Hathaway has sold some $6.2 billion worth of shares, according to O’Connor. Berkshire Hathaway started reducing its position in Bank of America in mid-July. Over the time, the firm sold roughly 150 million shares of the bank, trimming its position by about 15%. But where Buffett cashed out with a sale, Deutsche Bank saw only an “attractive valuation” ripe for purchase.

In our new special issue, a Wall Street legend gets a radical makeover, a tale of crypto iniquity, misbehaving poultry royalty, and more.

Read the stories.