In 2023, Jumia revised its adjusted EBITDA loss steerage thrice: $100 million to $120 million in Q1; $90 million to $100 million in Q2; and $80 million to $90 million in Q3, aiming for a 57% to 61% year-over-year discount if met.

The corporate exceeded these expectations and considerably outperformed in that regard. It ended the 12 months with $58.2 million in adjusted EBITDA loss, marking a 68% lower from 2022, and This autumn concluded with lower than $1 million in adjusted losses, a 99% lower. Jumia’s working loss decreased by 90% to $4 million that quarter and by 64% to $73 million for all the 12 months, resulting in an improved liquidity place, closing the 12 months with $121 million according to its Q4 2023 and full-year financials.

These losses have been decreased primarily by decreased tax provisions in particular international locations, a nonrecurring occasion that occurred within the final quarter of 2023. Additionally, vital decreases in gross sales and promoting bills, down 63% year-over-year, and basic and administrative bills, down 54% year-over-year, contributed. For the latter, Jumia’s notable exit from the meals supply enterprise in This autumn led to layoffs and departmental restructuring, leading to a 17% lower in workers prices inside G&A bills year-over-year.

“We’ll continue looking for more efficiencies whether on a daily, monthly, or weekly basis. We keep on finding new opportunities to be a bit leaner and to spend a bit less money not only on staff but also on tools, logistics, and so on. In some countries, we’ve identified that we could be a bit leaner in some departments. It’s an ongoing optimization and we’re running adjustments, so it’s business as usual for us,” Jumia CEO Francis Dufay stated on a name with TechCrunch.

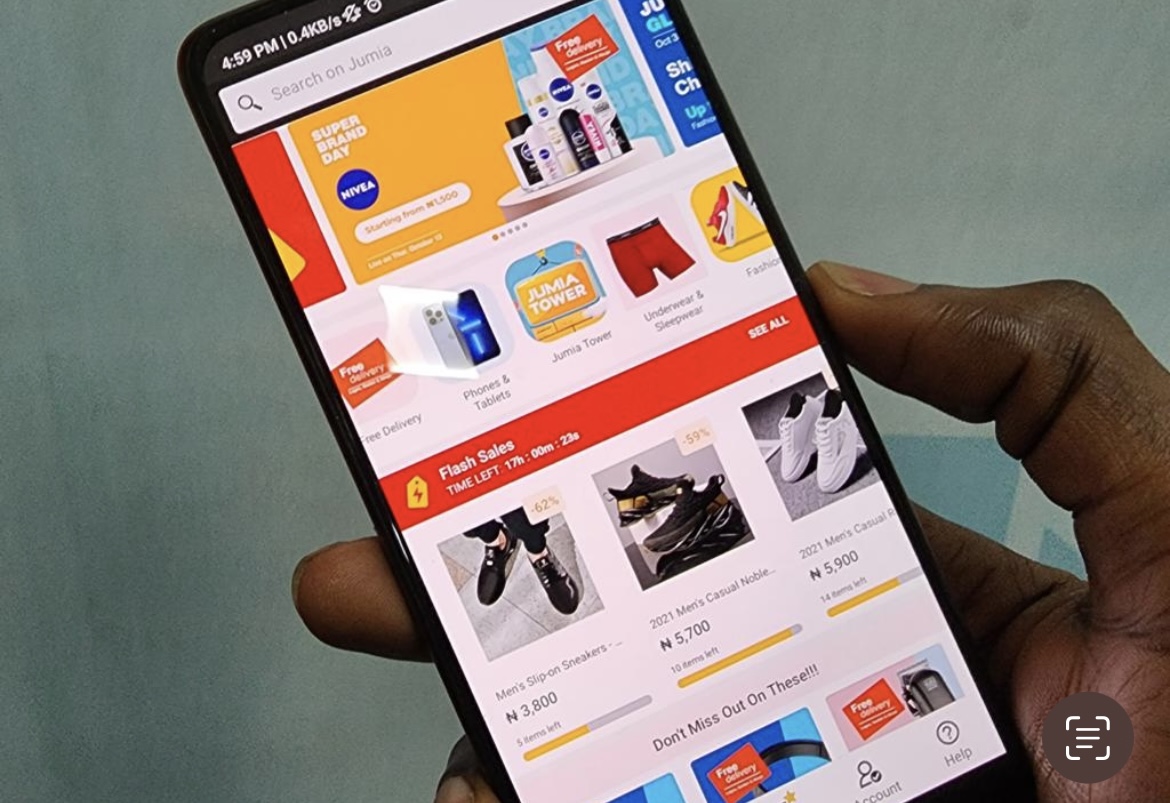

Along with macroeconomic situations comparable to forex devaluations impacting customers’ buying energy, Jumia’s strategic selections, together with exiting the meals supply sector and decreasing buyer incentives, contributed to a 4% lower in orders to six.6 million, a 16% discount in energetic prospects to 2.3 million, and an 8% decline in GMV (gross merchandise worth) year-over-year to $233 million.

However, the corporate stays optimistic that its give attention to bodily items, comparable to electronics and vogue objects, will drive enhancements in these metrics whereas preserving losses minimal. A slight indicator is the rise in quarterly energetic prospects, orders, and GMV by 16%, 17%, and 42%, respectively, quarter-over-quarter, primarily fueled by profitable Black Friday and Christmas gross sales campaigns. There’s additionally the rise within the common order worth for bodily items, climbing from $40.6 in 2022 to $45.5 in 2023, which seemingly cushioned the affect on the corporate’s income experiencing a modest 2% year-over-year decline to $59.4 million.

“In 2024, we expect to improve our economics further and reduce cash utilization better than in 2023 and get back to growth on the orders and GMV excluding foreign exchange impact,” stated Dufay. “We will maintain the same strategy on the marketing side so that we will be very prudent and conservative on all expenditures and the whole cost base, and with that, we believe that we have everything it takes to grow profitably.”

Buyers have proven approval for Jumia’s cost-cutting measures all year long, with its share worth rallying up greater than 35% on the time of publication.

In the meantime, JumiaPay’s Whole Fee Quantity (TPV) stood at $59.3 million in This autumn 2023, marking a ten% lower year-over-year. Nonetheless, transactions surged, reaching 3 million, a 41% improve year-over-year; 45% of orders on the Jumia platform in This autumn 2023 have been accomplished utilizing JumiaPay, up from 31% in This autumn 2022.