ronstik

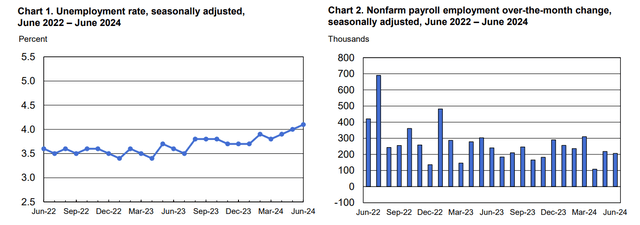

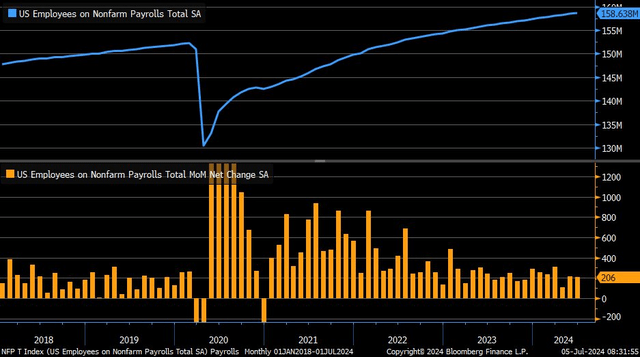

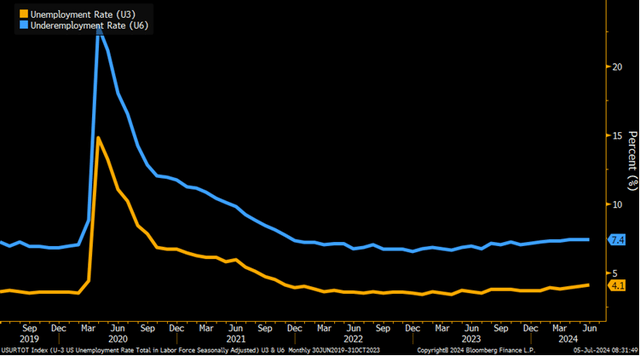

June payrolls verified at 206,000, slightly above consensus expectations of 190,000, but lower from 272,000 a month ago. The unemployment rate ticked up once again to 4.1% from 4.0% in May, now the highest since November 2021. Revisions were significantly negative at –111,000 in the previous two months, making it the fourth time in the last five months that jobs were slashed from previous monthly reports.

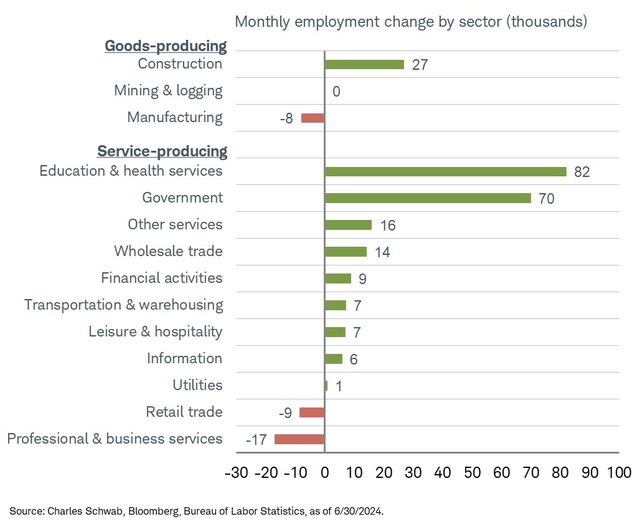

US private payrolls increased by just 136,000, well below the 190,000 forecast, and government jobs increased by 70,000. 74% of jobs gained last month were from the government, education, and health care.

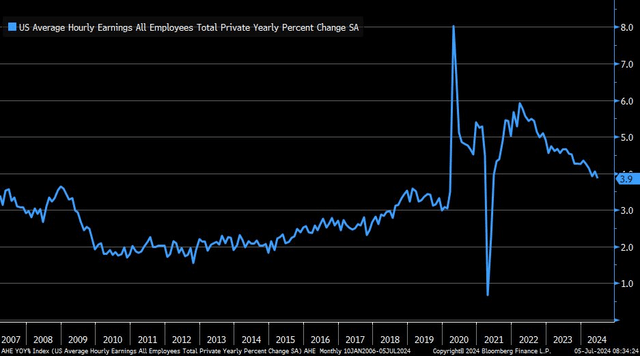

Average hourly earnings rose by 0.3% month-over-month, leading to a 3.9% gain, while the average workweek was unchanged month-over-month at 34.3 hours. The Labor Force Participation Rate was on the money at 62.6%, the highest since April, and a tick above the rate from May. The U-6 underemployment rate was 7.4%, the highest since November of 2021.

While the establishment survey beat economists’ forecasts, the household survey came in at just 116,000. But that is an improvement from a 408,000-employment decline seen in May. Notably, manufacturing payrolls dropped by 8,000. Full-time workers fell by 28,000 and the number of those employed with part-time work jumped by 50,000.

All told, it was an in-line employment update.

June NFP Report Close to Expectations, Weak Private Payrolls

BLS: Unemployment Rate Inches Up, Negative May-June Jobs Revisions

Another Month of Solid Payroll Gains

Both the U-3 Headline and U-6 Underemployment Rates Are Trending Up

Average Hourly Earnings Dip to +3.9% YoY

Most of the Employment Gain Came From Education, Health Care, and Government

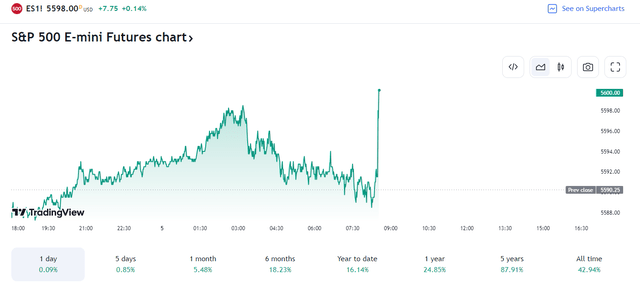

The market response was not too much to write home about. Equity futures increased modestly – they were close to the unchanged mark in advance of the 8:30 a.m. ET release. The bond market did catch a bit of a bid – the rate on the US 10-year Treasury note fell to 4.31%, down a few basis points from earlier in the morning.

The US Dollar Index increased modestly to slightly higher than 105. Bitcoin, which was under extreme selling pressure overnight, didn’t respond much to the May employment report.

Equity Futures Hit All-Time Highs Following the June Jobs Report

Interest Rates Dip Post-NFP

It’s clear that the jobs market continues to cool with a rising unemployment rate, though headline payroll gains are still apparent. We see from other labor market indicators, such as recent JOLTS reports and Employment subindexes within various PMI surveys (such as those from the ISM and S&P Global), that the labor market is healthy, but much less tight compared to a year ago. The Fed must be on guard against further deterioration in the jobs market – if we see a trend lower in monthly positions added, then a rate cut will certainly be warranted sooner rather than later.

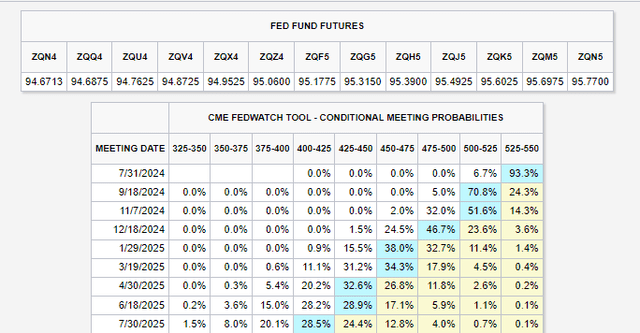

As it stands, there’s a minute change of a cut at the July 31 FOMC gathering before the August Jackson Hole Economic Symposium. The first quarter-point ease likely comes at the September 18 Fed meeting, while the second cut may not arrive until after the general election.

Strong Odds of a September Cut

Looking ahead, we have another busy week of macro data on tap. NY Fed Inflation Expectations hit on Monday morning next week before Tuesday’s monthly NFIB Small Business Optimism survey. The next big macro data point then comes on Thursday morning with the release of June CPI – another month of generally cooling inflation is seen, but all eyes will be on shelter prices, vehicle price trends, and the always-volatile insurance component.

Also be on guard for potential volatility around the weekly Initial Jobless Claims update – filings for unemployment insurance have risen lately in yet another sign of a softened economy. Then on Friday, the July preliminary University of Michigan Surveys of Consumers hits Friday morning along with PPI. Earnings season begins a week from today when several of the big banks post Q2 results to the street.

Economic Data to Come

The Bottom Line

There weren’t many surprises in the June jobs report. Private payrolls were light and there was a large gain in government jobs. The unemployment rate inched up, while average hourly earnings were about in line with estimates. Stock and bond futures didn’t swing too wildly as indications show that the economy is cooling off, heading into the second half.