Andriy Onufriyenko/Second by way of Getty Pictures

The KraneShares Electrical Autos and Future Mobility Index ETF (NYSEARCA:KARS) invests in firms whose companies contain the manufacturing of electrical automobiles and/or parts components of these automobiles. This consists of all kinds of shares, from automobile manufacturing, autonomous driving, lithium, copper, and battery manufacturing, and electrical automobile infrastructure. The fund is passively managed and tracks the Bloomberg Electrical Autos Index.

Because of its superior forecasted earnings and money move development versus opponents, in addition to its distinctive set of holdings and sector allocation, KARS is an EV ETF we like. Nevertheless, our near-term outlook for the EV trade is pessimistic, giving us a maintain ranking on KARS for now.

Why put money into Electrical Autos?

Quickly Rising Market

Electrical Autos are rising quickly of their gross sales in addition to of their share of the general automotive market. In 2021, gross sales of latest electrical automobiles grew by 108% in comparison with 2020. In 2022, 10 million electrical vehicles will likely be bought worldwide. With regards to market share, there was fast development as properly in the previous few years up till 2023. The electrical automobile’s share of the general automobile market moved from 4% in 2020 to, 9% in 2021, up to 14% in 2022, earlier than retreating to 12% in 2023. Moreover, governments are more and more passing legal guidelines that favor EV consumption over the long run, California and Washington State’s latest laws outlawing the acquisition of gas-powered automobiles by the yr 2035 are good examples.

Why Now could be Not the Proper Time for EVs

The downside in demand skilled in 2023 might be attributed to many causes. Issues about EV journey vary, restricted charging networks, and their discount in efficiency in colder temperatures are all culprits. Nevertheless, what we see as the most important points for EV demand within the close to time period embody early adopters being fulfilled of their demand, excessive costs & poor financial sentiment, and excessive rates of interest.

Early adopters of latest applied sciences are usually folks known as “innovators” – know-how geeks that not solely have an inherent curiosity within the new developments but in addition are inclined to have greater disposable earnings which they’ll use to buy these things out of the gate when costs are highest. These shoppers have been largely chargeable for the fast development in market share EVs have been capable of attain over the past a number of years, however the dip in that market share in 2023 is nice proof that demand from that phase has been happy.

For EVs to proceed rising their share of the general market, they must begin being adopted by extra mainstream shoppers. Proof exhibits that these shoppers are concerned with buying EVs. In keeping with a research carried out by JD Power in June 2023, 61% of shoppers are contemplating EVs for his or her subsequent automobile buy. Nevertheless, JD Energy additionally discovered that 78% of EVs bought are in what they take into account the “premium segment” of the automobile market, which comes with a better price ticket.

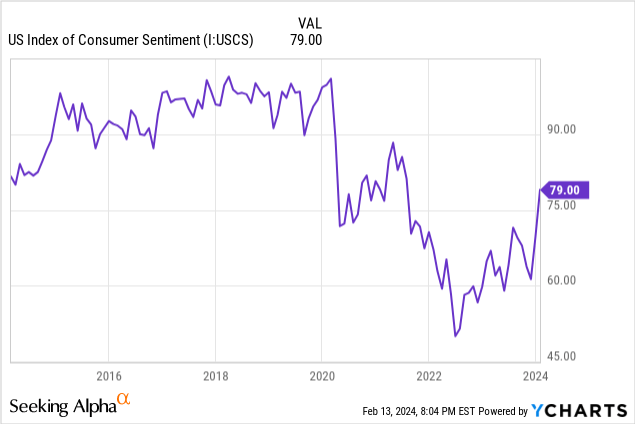

Elon Musk, the CEO of Tesla, has even suggested that “There are lots of people who want to buy our cars. They just can’t afford it“. Low client sentiment in regards to the financial system usually is one present rationalization for this. The College of Michigan Client Sentiment Index, a measure that has been used as a month-to-month gauge of client confidence within the U.S. financial system since 1978, hit an all-time low in June 2022. The index has been on a gradual improve since then however remains to be 6.7% under its common of 84.3 over the past 10 years, at the moment sitting at 79.0. Getting this measure again above its common, and People feeling optimistic in regards to the financial system is a vital metric to look at on the subject of demand for not solely excessive costs however unfamiliar purchases reminiscent of EVs.

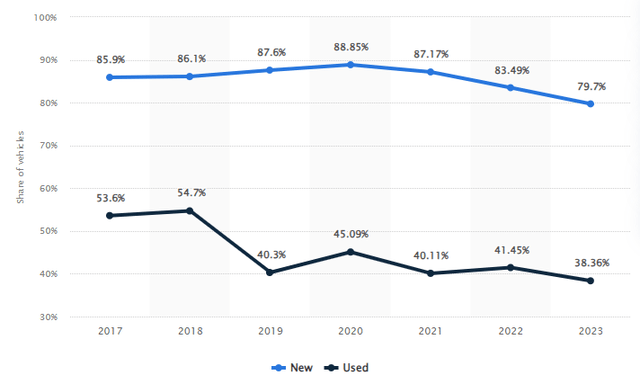

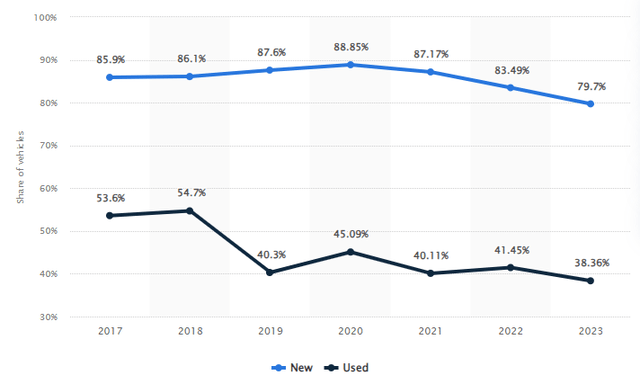

Lastly, greater rates of interest have slowed demand within the automotive market usually. With 79% of new vehicles bought requiring some form of financing, greater rates of interest trigger automotive funds to be greater, making shoppers much less prone to make these purchases. Seeing rates of interest come down will make us extra optimistic in regards to the auto market usually.

Proportion of Autos Requiring Financing (Statista)

Comparability of EV ETFs

The desk under (information from Searching for Alpha) compares KARS, to 2 different EV ETFs, DRIV, the International X Autonomous And Electrical Autos ETF, and CARZ, the First Belief S-Community Future Autos & Tech ETF.

| Ticker | Whole Property Underneath Administration | Weighted Common Market Cap | Forecasted 5-12 months Earnings Progress | Forecasted Money Circulate Progress | 5-12 months Whole Returns (Each day) | Internet Expense Ratio |

| KARS | $114,134,130 | $18,808 | 19.3% | 21.0% | 44.3% | 0.72% |

| CARZ | $38,716,583 | $106,096 | 13.0% | -0.4% | 79.1% | 0.70% |

| DRIV | $639,090,634 | $32,867 | 12.6% | 0.1% | 96.5% | 0.68% |

A few issues stick out off the bat. DRIV has by far probably the most property, doubtless resulting from its outperformance over the past 5 years. DRIV and KARS are invested in a lot smaller firms on common, and the charges on these funds are all inside 4 foundation factors of one another. One massive benefit for KARS is its a lot greater forecasted 5-year earnings development, which is sensible because of the fund’s comparatively decrease common market capitalization. We view this positively as sooner or later the upper earnings development of the KARS portfolio needs to be mirrored in its returns.

The massive purpose we favor KARS to DRIV and CARZ is because of its sector and nation allocations. The 33% weighting to China is reflective of actuality, in 2022 the nation accounted for 59% of EVs sold worldwide. This can be a giant distinction from the 4.3% and 4.4% weightings to China in CARZ and DRIV, respectively. Moreover, we see that KARS has a a lot greater weighting to Fundamental Supplies and Industrials in comparison with the opposite two funds, with a big underweight to know-how.

| Ticker | Fundamental Supplies Publicity | Communication Companies Publicity | Client Cyclical Publicity | Monetary Companies Publicity | Industrials Publicity | Know-how Publicity |

| KARS | 24.8% | 0.0% | 40.6% | 1.5% | 22.7% | 10.4% |

| CARZ | 5.2% | 5.0% | 23.5% | 0.0% | 6.7% | 59.6% |

| DRIV | 10.7% | 5.2% | 35.3% | 0.7% | 17.7% | 30.4% |

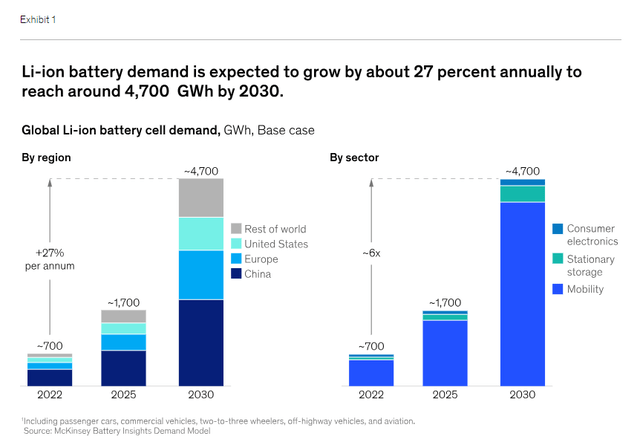

We like this, as battery producers, uncommon earth miners, and part producers are key components of the electrical automobile trade which are forecasted to see intense development. For instance, lithium-ion battery cell demand is predicted to develop 27% per year until 2030, with the overwhelming majority of that development coming from transportation.

Two KARS holdings enjoying into this pattern are Pilbara Minerals Restricted (OTCPK:PILBF), which owns the world’s largest exhausting rock lithium operation, and Albemarle Company (ALB), the world’s largest supplier of lithium for electrical automobile batteries on the planet.

Concerning the Bloomberg Electrical Car Index

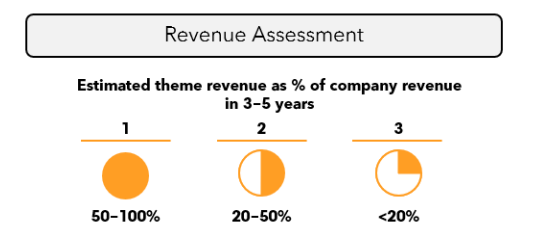

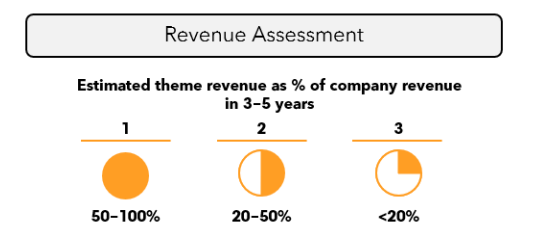

To be able to be chosen into the index, a safety should rank inside the “Gold Tier” of the Bloomberg Electrical Autos ecosystem. Being ranked within the Gold Tier is based on a mixture of income and thematic evaluation. A agency should attain a rating between 2-4 when including the income and thematic scores. Beneath is an illustration of how the income evaluation is made.

Bloomberg

The thematic rating is extra subjective, with Bloomberg Intelligence rating corporations throughout many information factors to formulate a view on their potential to execute inside a selected thematic & aggressive panorama. These information factors embody the flexibility to ramp up manufacturing and meet demand, entry to capital, buyer relationships, and trade status. A thematic rating of 1-3 is given, with 1 being probably the most related to the theme and three being the least related. To be able to attain an general rating of 2-4, it may be seen {that a} agency will need to have some mixture of excessive income expectations and low theme relevancy, excessive theme relevancy, and decrease income expectations, or rank in the course of each. Total, we like this system because it locations significance on income to drive returns and worth creation whereas additionally balancing the significance of firms being robust gamers inside the theme and ecosystem they function in.

Holdings

See the desk under for KARS’ high 15 holdings and their weights.

| KARS Holdings As of 2024-02-15 | |

| Firm Title | % of Internet Property |

| APTIV PLC | 4.43 |

| NIDEC CORP | 4.4 |

| CONTEMPORARY A-A | 4.09 |

| PANASONIC HOLDINGS CORP | 3.93 |

| TESLA INC | 3.89 |

| SAMSUNG SDI CO LTD | 3.56 |

| BYD CO LTD -A | 3.48 |

| LI AUTO INC-CLASS A | 3.41 |

| RIVIAN AUTOMOTIVE INC-A | 2.92 |

| MAGNA INTERNATIONAL INC | 2.91 |

| ECOPRO BM CO LTD | 2.88 |

| PILBARA MINERALS LTD | 2.77 |

| ALBEMARLE CORP | 2.64 |

| POSCO FUTURE M CO LTD | 2.63 |

| DR ING HC F PORSCHE AG | 2.53 |

Aptiv PLC (APTV) is the fund’s high holding, weighted at 4.43%. Aptiv generates most of its revenue from its Sign and Energy Options phase, which creates full automobile electrical programs together with wiring and cable assemblies. It additionally has a a lot sooner rising phase known as Superior Security and Consumer Expertise which gives superior software program, computing, and sensing programs for automobiles. We like this phase mixture because it gives a secure and extra goods-based income whereas additionally investing in software-based options that may contribute more and more to income development.

Nidec Company (OTCPK:NJDCY) is the “world’s number one comprehensive motor manufacturer”, constructing motors on the most important and tiniest scales. Automotive components are a considerable phase of their enterprise and have the quickest anticipated common gross sales development price of any of their segments at 29% per year from 2020 to 2025.

Dangers of Investing in KARS

Investing in a fund with a big allocation to China might be worrisome because of the unsure political setting, and the federal government’s potential to affect winners in losers within the financial system. Nevertheless, China may be very dedicated to transitioning their financial system to run on electrical automobiles, and we see them being general supportive of the trade.

And, with a fund like KARS, its low publicity to know-how will trigger it to underperform when the sector does properly, as we’ve got seen lately. That is very true when the fund’s allocation to Magnificent 7 firms is simply 3.8%, in comparison with 15.8% for DRIV and 23.1% for CARZ.

We envision the returns of the fund will decide up as soon as the buyer begins to really feel higher in regards to the financial system. An enormous signal of this will likely be CPI coming in decrease than anticipated as inflation has accomplished a variety of injury to the buyer. Additionally, decrease inflation figures will enable the Fed to drop charges, reducing financing prices for automobile purchasers. We will likely be watching the CPI and client sentiment figures as we proceed to observe this fund.

Conclusion

We like KARS as an EV ETF, resulting from its excessive forecasted earnings development in comparison with friends and differentiated nation and sector allocation that traces up with the fact of the EV market. Nevertheless, near-term issues in regards to the financial system and the EV market usually are purpose for pause. Primarily based on this, KARS is rated a maintain for now.