NurPhoto/NurPhoto through Getty Pictures

Introduction

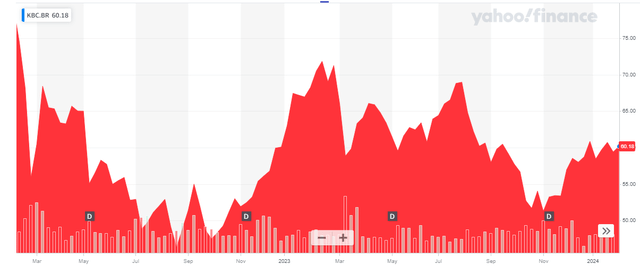

Because it has been some time since I discussed KBC Group (OTCPK:KBCSF) (OTCPK:KBCSY), the latest publication of the full-year outcomes for 2023 is an effective second to inspect the efficiency of the Belgian financial institution/insurance coverage firm.

KBC Group has its major itemizing in Belgium the place the corporate is trading with KBC as its ticker symbol. The Brussels itemizing has a mean quantity of 625,000 shares per day (for a financial worth of roughly 36M EUR), making it essentially the most liquid itemizing and I might strongly advocate to make use of the Euronext Brussels itemizing to commerce within the firm’s inventory. As KBC Group reviews its monetary leads to Euro and has its major itemizing in the identical foreign money, I’ll use the EUR as base foreign money all through this text.

The financial institution’s web site incorporates a ‘obtain solely’ hyperlinks, however you’ll find all of the related data I’ll be referring to here.

Regardless of the turmoil, KBC posted a good set of leads to This fall

The monetary sector hasn’t had a straightforward 2023 however luckily most European banks weren’t hit by the fallout brought on by the problems within the US banking sector. I additionally just like the mannequin of providing banking companies and insurance coverage companies beneath one roof as cross-selling of merchandise may be fairly worthwhile.

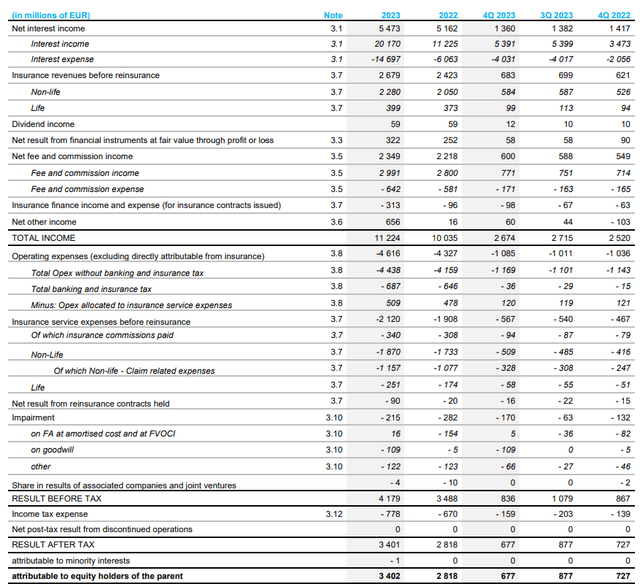

However in fact, the principle focus has been on the evolution of the web curiosity earnings. And KBC Group has really performed a fairly good job in defending its internet curiosity margin. Whereas the stress elevated in direction of the top of the 12 months, the FY 2023 outcomes point out a pleasant 6% improve within the internet curiosity earnings, which jumped to five.47B EUR.

Trying on the different parts that make up the 2023 outcomes, we see the full insurance coverage income elevated to 2.68B EUR whereas the bills associated to the insurance coverage actions have been simply 2.12B EUR leading to a optimistic contribution of roughly 560M EUR. The earnings assertion above additionally clearly exhibits the financial institution has its mortgage loss provisions beneath management. Whereas it recorded a 215M EUR impairment cost, in extra of half that cost was associated to the impairment of goodwill on the stability sheet. The ‘different impairment’ expenses have been primarily associated to intangible fastened property.

The robust credit score threat surroundings was boosted by a 155M EUR launch of beforehand recorded provisions for geopolitical and rising dangers and that launch totally compensated for the 139M EUR recorded mortgage loss provisions throughout FY 2023 and that is why the earnings assertion above exhibits a provision launch of 16M EUR on monetary property. Whereas we should not financial institution on this taking place once more sooner or later (the mortgage loss provisions will normalize), it didn’t have a serious affect on the financial institution’s reported internet earnings as the opposite impairment expenses have been increased than normal which implies the full impairment cost was simply 67M EUR decrease than within the earlier 12 months.

The online earnings generated throughout 2023 was 3.4B EUR which works out to an EPS of 8.04 EUR per share. KBC Group is proposing to pay a dividend of 4.15 EUR per share (topic to the usual dividend tax in Belgium of 30%).

Trying ahead to the 2024 efficiency

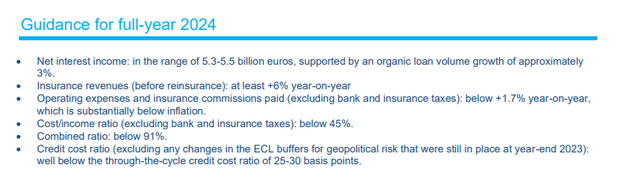

The financial institution has additionally supplied an preliminary steering for 2024. It expects a internet curiosity earnings of 5.3-5.5B EUR and the midpoint of this steering represents a small 1.5% lower in comparison with the FY 2023 internet curiosity earnings. Nonetheless, the anticipated insurance coverage income will doubtless offset the affect of the decrease internet curiosity earnings.

The mortgage loss provisions ought to stay very low: as you’ll be able to see above, KBC Group is guiding for a credit score value ratio ‘effectively under’ the through-the-cycle value ratio of 25-30 bp. With a complete quantity of 306B EUR in monetary property on the stability sheet, assuming a 15 bp credit score value ratio would lead to whole impairment expenses of 450M EUR. I feel 15 bp is fairly conservative contemplating the financial institution’s latest credit score value ratios for the interval 2020-2023 have been respectively 0.60%, -0.18% (a internet launch), 0.08% and 0.00% in 2023. Odds are KBC can preserve the credit score value ratio under 10 bp through which case there must be no noticeable affect on the financial institution’s earnings assuming no different goodwill or intangible asset impairments are needed.

This means we will count on the financial institution’s earnings to stay comparatively secure in 2024. Nonetheless, if I am making use of the upper credit score value ratio, I anticipate a small earnings lower in direction of 7.75-7.85 EUR per share. A decrease credit score value ratio would clearly increase the earnings outcome.

Funding thesis

I at the moment haven’t any direct place in KBC Group however I’ve a somewhat substantial lengthy place in a mono-holding whose solely asset is a stake in KBC Group, so I not directly have publicity. Buying and selling at simply over 60 EUR per share, KBC Group just isn’t costly in any respect because the inventory is buying and selling at roughly 7.5 occasions the 2023 earnings and at lower than 8 occasions my anticipated 2024 internet earnings. The dividend yield of virtually 7% is interesting as effectively and given the low payout ratio of round 50%, that dividend is sustainable, even when the EPS would present a slight lower in 2024.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please pay attention to the dangers related to these shares.