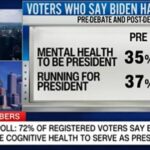

This 12 months seems to be to be a a lot better one for the U.S. economy than enterprise economists had been forecasting just some months in the past, based on a survey launched Monday.

The financial system seems to be set to develop 2.2% this 12 months after adjusting for inflation, based on the Nationwide Affiliation for Enterprise Economics. That’s up from the 1.3% that economists from universities, companies and funding companies predicted within the affiliation’s prior survey, which was performed in November.

It’s the newest sign of energy for an economy that’s blasted through predictions of a recession. Excessive rates of interest meant to get inflation underneath management had been supposed to pull down the financial system, the pondering went. Excessive charges put the brakes on the financial system, resembling by making mortgages and credit card bills dearer, in hopes of ravenous inflation of its gas.

However even with charges very excessive, the job market and U.S. family spending have remained remarkably resilient. That in flip has raised expectations going ahead. Ellen Zentner, chief U.S. economist at Morgan Stanley and president of the NABE, stated a variety of things are behind the 2024 improve, together with spending by each the federal government and households.

Economists additionally greater than doubled their estimates for the variety of jobs gained throughout the financial system this 12 months, although it could nonetheless seemingly be down from the earlier one.

Providing one other increase is the truth that inflation has been cooling since its peak two summers in the past.

Whereas costs are greater than prospects would really like, they’re not growing as shortly as they had been earlier than. Inflation has slowed sufficient that a lot of the surveyed forecasters count on rate of interest cuts to start by mid-June.

The Federal Reserve, which is in control of setting short-term charges, has stated it is going to likely cut them several times this year. That will calm down the stress on the financial system, whereas goosing costs for stocks and other investments.

In fact, fee adjustments take a notoriously very long time to snake by way of the financial system and take full impact. Which means previous hikes, which started two years in the past, may nonetheless in the end tip the financial system right into a recession.

In its survey, NABE stated 41% of respondents cited excessive charges as probably the most important threat to the financial system. That was greater than double another response, together with fears of a attainable credit score crunch or a broadening of the wars in Ukraine or the Middle East.