Barry Williams/Getty Photographs Information

My Thesis for Kongsberg Gruppen ASA

An fascinating but disturbing piece of reports I just lately got here throughout confirmed that the variety of international conflicts in 2023 rose sharply over the earlier 12 months – by 28%, to be exact. Whereas I’m not shocked that this may certainly be the case, simply from studying day by day information headlines, it does current a chance to put money into the enterprise of struggle. Crass as which will appear, it’s a actuality that struggle may be worthwhile.

Which may be unpalatable to many traders, so this text is especially addressed to those that don’t thoughts investing in struggle; on this case, utilizing a comparatively obscure (to retail traders within the U.S., that’s) Norwegian protection contractor referred to as Kongsberg Gruppen (OTCPK:NSKFF) (OTCPK:KBGGY) as a long-term automobile of selection as we stand on the verge of what may very effectively be probably the most good storm from a world battle standpoint. And that’s the place my thesis arises from, as you’ll see within the subsequent part.

Concerning the Firm

Over 200 years outdated, Kongsberg is a 50% Norwegian government-owned supplier of high-end maritime, protection, aerospace, and digital applied sciences. This $11 billion enterprise primarily earns its dwelling from maritime gross sales, which contribute about 50% of its whole working revenues per the latest report, but it surely originated as a weapons producer for the Norwegian Armed Forces within the early nineteenth century, finally being awarded a contract to produce the U.S. Military in 1893 with an improved model of the unique Krag-Jorgensen bolt-action rifle. The corporate’s Protection & Aerospace section is a really shut second to Maritime, bringing in NOK 16 billion towards the protection section’s NOK 20 billion.

At this time, the corporate has its fingers in a number of pies, nonetheless with a heavy tilt towards maritime however with protection racing to catch up, which is the important thing level of my thesis that this firm is firmly on a development path, and with better profitability in sight due to the continued will increase in protection spending.

First, let’s have a look at the numbers as they stood on the finish of the fourth quarter of fiscal 12 months 2023.

Highlights from the This fall Presentation

In its This fall-23 report launched earlier this month and linked above, the corporate crossed a major top-line milestone of NOK 40 billion, or about $3.8 billion, in annual gross sales. That’s being pushed by a development fee of nearly 10% a year over the past decade, and one solely wants to take a look at shorter and shorter timeframes to see that its present development fee is stronger than ever. That’s one of many causes I used to be very shocked to see {that a} vital participant within the protection ecosystem of Europe had zero protection on In search of Alpha – thus, the chance.

Kongsberg had certainly one of its greatest years in current instances. Contributing strongly to the most important income milestone I discussed, This fall working revenues got here in at NOK 11.9 billion, with its largest section – Maritime – posting a powerful 21% YoY development fee. Its different segments grew much more strongly, albeit from smaller bases.

Extra related to my funding case is that protection and aero grew a lot quicker at round 29%. It additionally has higher margins, with an 18.2% EBITDA margin towards maritime’s 12%. Nonetheless, for the reason that firm data a major quantity of D&A and impairments, it’s greatest to take a look at the EBIT margins, which got here in at 9.6% for maritime and a powerful 14.9% for protection and aero.

All of this info may be discovered within the Q4 presentation, so I’m not going to regurgitate what an investor is already more likely to know or can shortly discover. What I’d prefer to discover is the trajectory for the protection and aero section and any potential upside that traders can hope to reap the benefits of. This, to me, goes to be the core development engine for the brand new Kongsberg because it navigates its third century in existence.

Protection & Aerospace

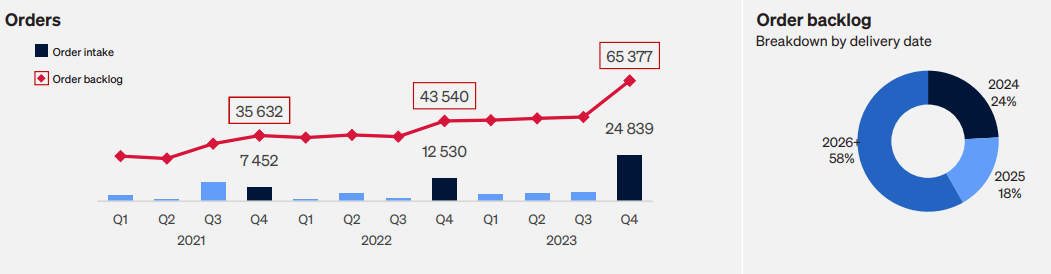

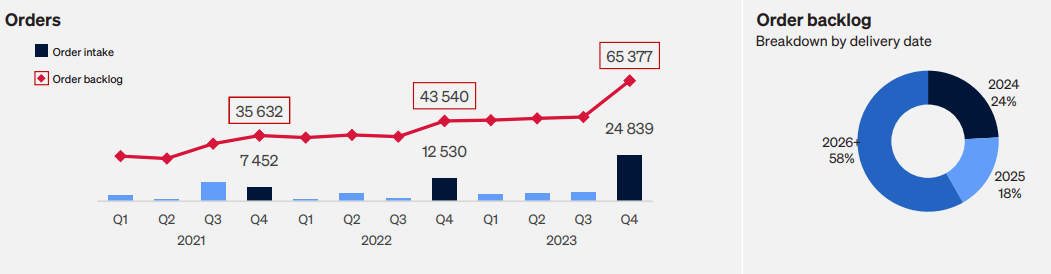

The very first thing I checked out was how a lot of the overall order consumption and backlog this section was reporting. On a full-year foundation, the system-wide determine of NOK 65.4 billion is closely tilted towards the protection section, which accounts for NOK 37.7 billion of that, or very near 60%. In distinction, the maritime section solely accounted for NOK 22.4 billion, or 34%. Shifting to the ultimate quarter, discover that the consumption for protection contributes a a lot larger 79% as of This fall, with maritime’s contribution dropping to fifteen%.

Why does that matter? It issues as a result of protection and aero is slowly taking over the lion’s share of income contribution. Maritime introduced in NOK 20 billion in working income for the complete 12 months and NOK 5.6 billion for This fall, whereas protection solely introduced in NOK 16 billion however virtually matched maritime over the past quarter with NOK 5 billion.

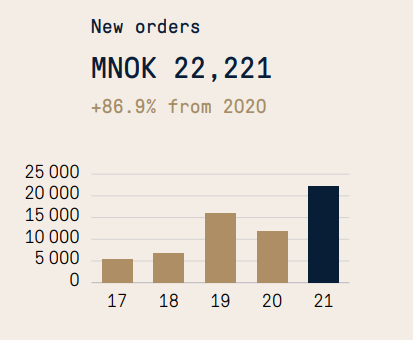

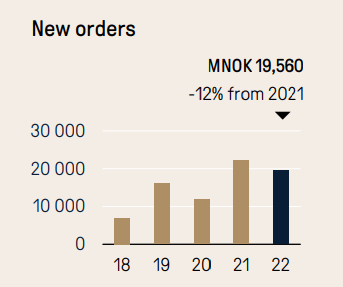

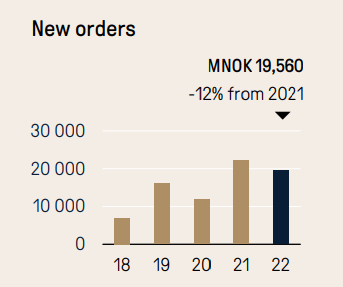

Additional validating the significance of the protection and aero section is the truth that it grew strongly over the FY20-FY21 interval, then went into adverse development in FY21-FY22 earlier than coming in sturdy as soon as once more within the FY-22-FY23 interval (linked within the earlier part.)

Kongsberg Gruppen

Kongsberg Gruppen

One of many causes for that development spurt so as intakes (beforehand referred to as new orders) is the truth that the Norwegian authorities bumped its protection spending in 2021, a few of that surge going to Kongsberg from a big missile order for the then-new fleet of F-35s, in addition to sturdy consumption from each Norway and Germany for submarine fight methods.

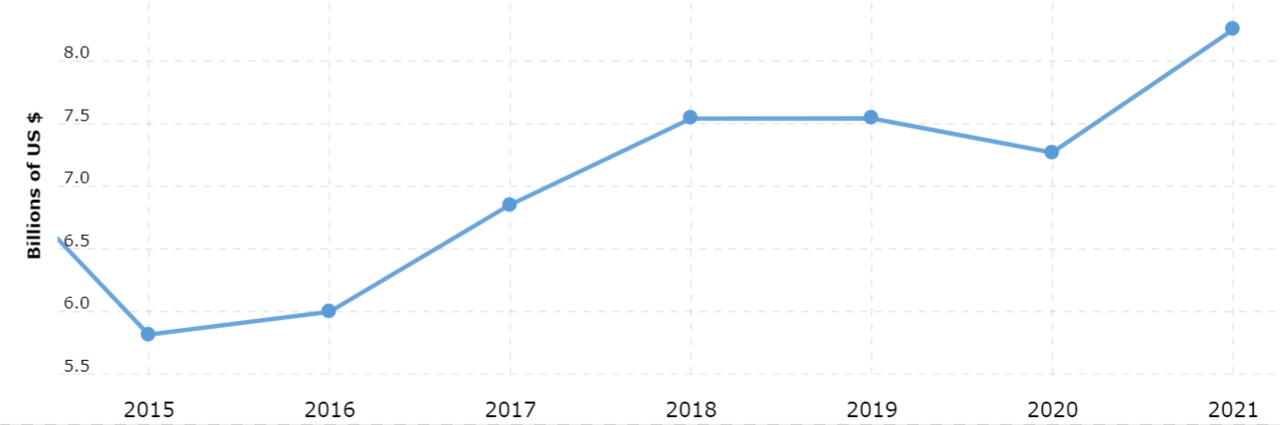

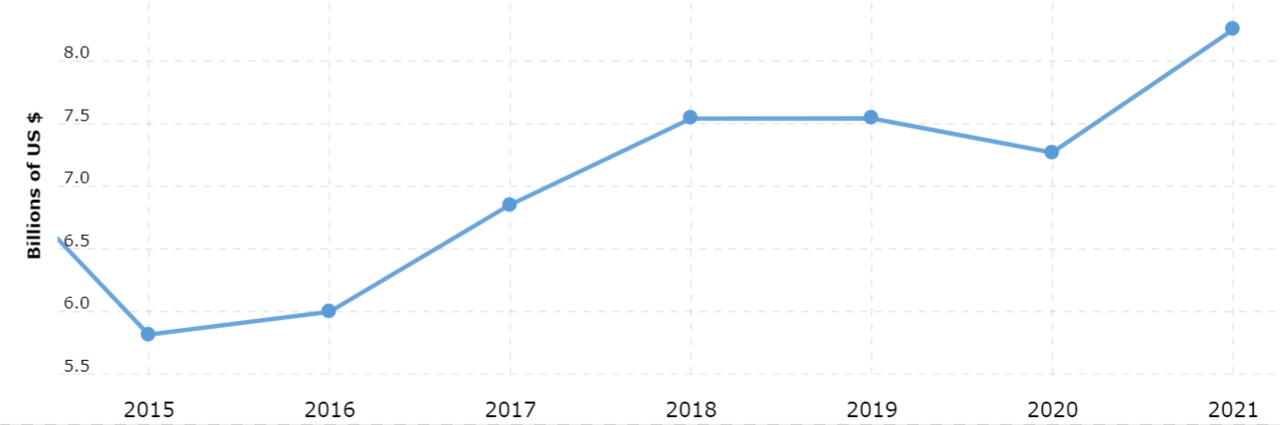

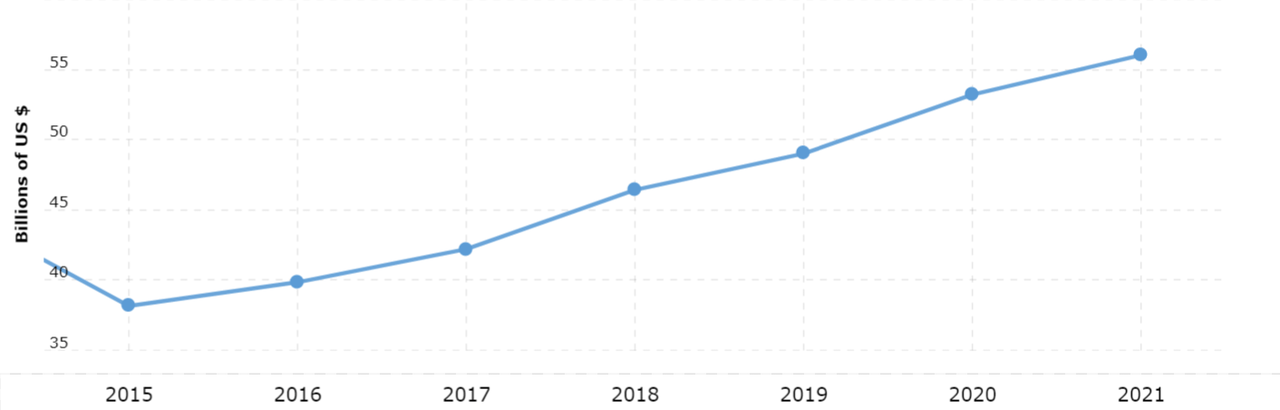

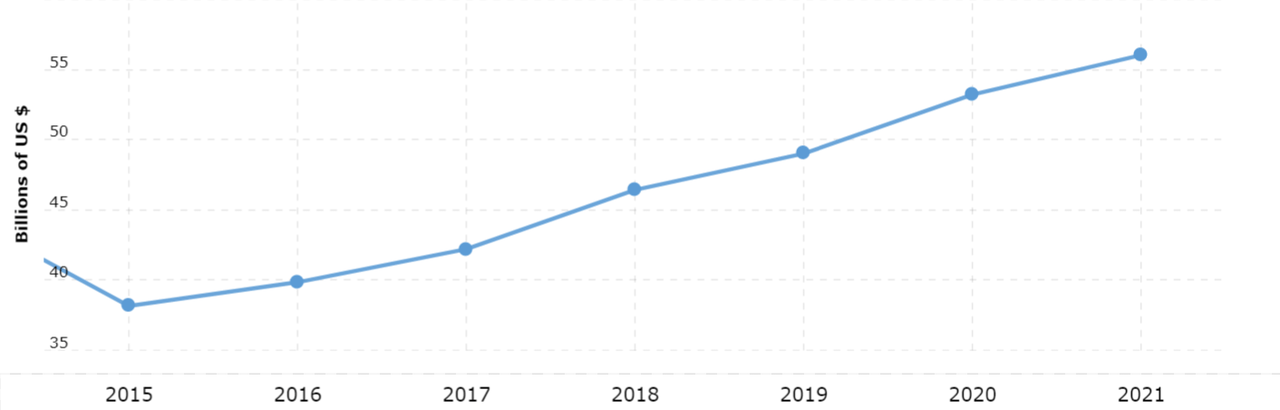

I’ll strengthen the case additional. We will see beneath how Norway’s and Germany’s protection budgets have grown over the previous decade.

Norway Protection Funds – MacroTrends

Germany Protection Funds – MacroTrends

Of word additionally was the extension of the very helpful framework settlement with the US Military for Kongsberg to produce its Generally Remotely Operated Weapon Stations, or CROWS. This land and sea distant weapons system or RWS is an apparent hit with the U.S. navy, with provide numbers touching 18,000 units as of September 2023, and the corporate having signed its “fourth five-year indefinite delivery/ indefinite quantity (IDIQ) contract worth $1.4bn awarded in October 2022.” The framework settlement dates again to 2007, making this the seventeenth 12 months working for that vital protection income stream.

One sentence from the protection and aero section of their FY-23 presentation actually caught my eye:

Strong market exercise and effectively positioned for substantial order consumption going ahead.

That’s placing it mildly, to say the least. With conflicts on the rise, as identified at the beginning of this text, and the truth that order consumption for protection is surging for Kongsberg, it’s clear that this would be the greatest breadwinner for the corporate, and I see FY-24 presumably being 12 months of the large transition.

In fact, maritime will ably help that with its steadier cadence, but it surely’s time for protection and aero to take centerstage.

Phase Profitability and General Shareholder Features

I’ve at all times mentioned that income development is usually a panacea for practically all different issues, and that’s true for a protection contractor as a lot as a pet retailer, as outlined in my latest article on BARK, Inc. (BARK). Income development is at all times a very good factor, however provided that the majority of that makes it all the way down to the underside line, with extra earnings going again into shareholders’ fingers within the type of fairness, dividends, and capital appreciation from share buybacks.

To start that evaluation, let’s have a look at what sort of margins this 200-year-old firm is placing up.

We’ve already seen a powerful EBIT print in This fall/FY-24 at roughly 15% for each of these intervals – and once you couple that with a excessive order consumption and the equally sturdy backlog of NOK 65 billion as on the finish of This fall-23, you’re a really sturdy internet revenue trajectory. That is supported by the truth that Kongsberg expects greater than 40% of that backlog to be delivered over the subsequent two years, with the remainder anticipated the 12 months after. That’s a fairly sturdy three-year steering, and it provides traders a good quantity of visibility into revenues in addition to earnings.

Kongsberg This fall-23 Presentation

Loosely translating that into anticipated EBIT, at a 15% margin we’re NOK 9.8 billion in pre-tax income. It’s additionally vital to notice that this 15% is definitely down from the year-ago margin of 18.7%, however that’s because of the undertaking combine having shifted over the previous 12 months. Nonetheless, it continues to be a major driver of general EBIT margins for the corporate, which is within the 10% to 12% vary.

The opposite main optimistic I see by way of better visibility into the corporate’s income and, subsequently, its profitability, is the book-to-bill ratio. Whereas the maritime section reported suboptimal book-to-bill ratios of 0.86 for the quarter and 1.11 for the complete 12 months, primarily because of the decrease order consumption for newbuilds, protection recorded a quarterly bill-to-book ratio of 4.95, which is extraordinarily encouraging, to say the least.

To elaborate, book-to-bill is the connection between order consumption and reported income. Not solely does it provide visibility into ahead revenues, but it surely additionally acts as an indicator of the bigger protection market and the place it’s headed. For Kongsberg, meaning the order consumption for the fourth quarter is almost 5 instances reported income, and we already know that over 40% of that shall be recorded within the coming eight quarters of FY-24 and FY-25.

With a 15% EBIT margin, this section goes to raise the corporate’s complete profitability profile over the subsequent few years. As an investor, that ought to get you excited, but it surely additionally comes at a premium, as we’ll see beneath

Kongsberg Valuation

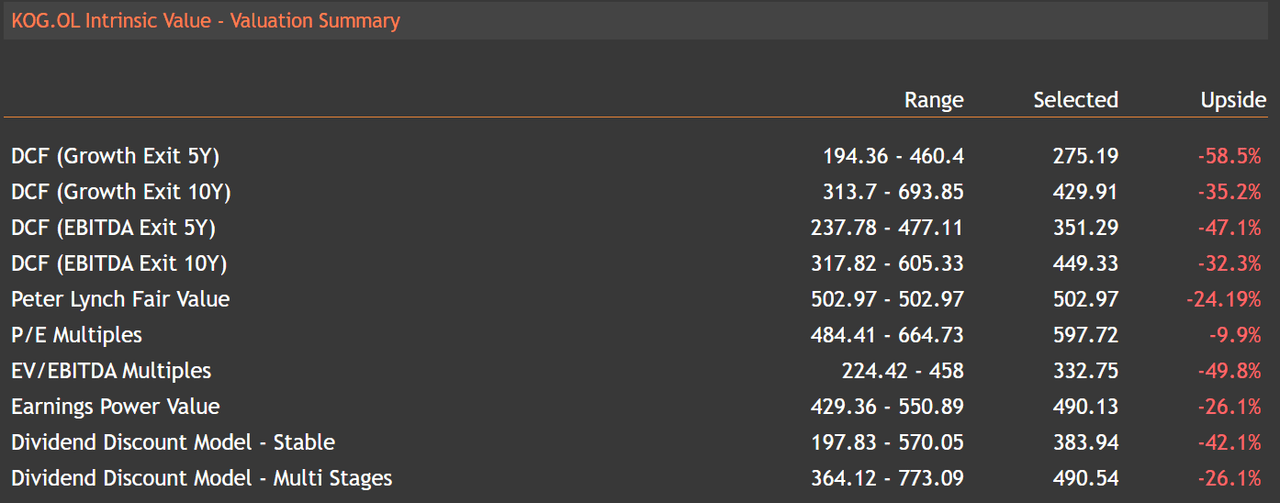

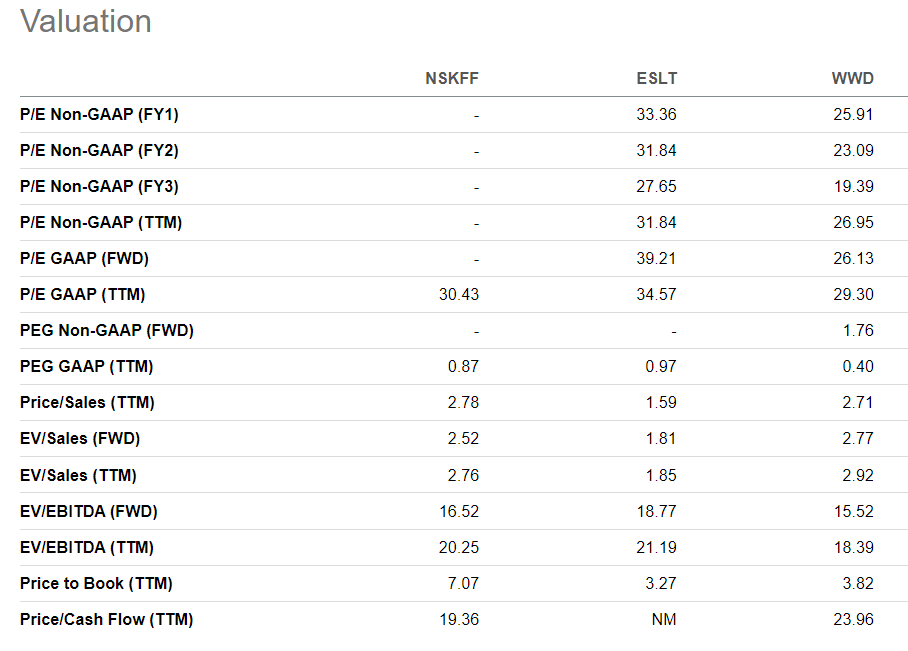

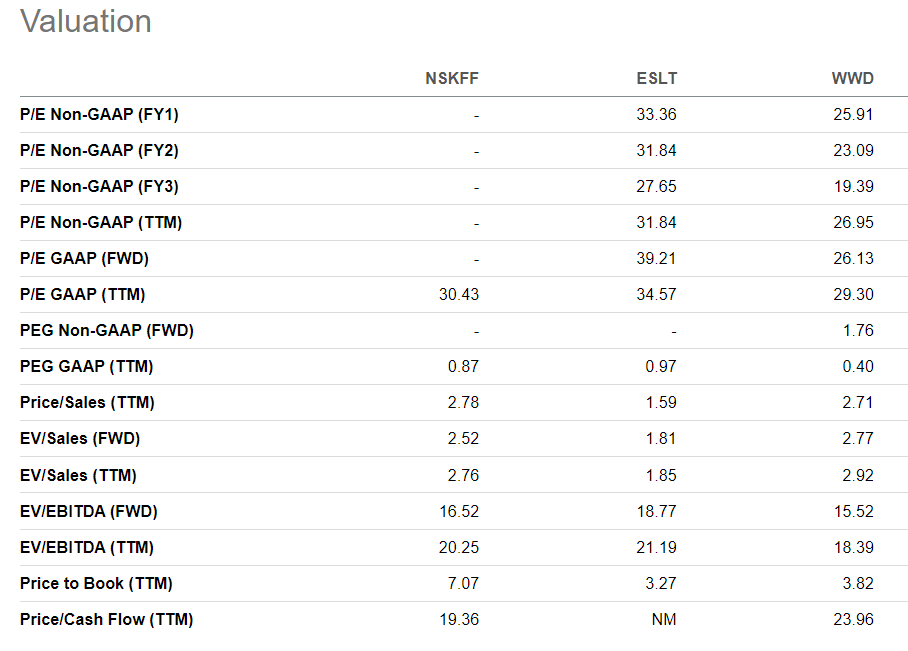

Based on ValueInvesting.io, varied DCF and different valuation fashions agree on one factor – the inventory is pricey regardless of the way you have a look at it.

The issue is, the information within the desk above tells me little or no about the true potential of the corporate. Shares can usually look costly when utilizing standard valuation metrics (therefore the investor’s must obsessively interact with them in all their prolific plurality); that one desk actually provides me 10 good the explanation why NOT to purchase the inventory – however right here I’m touting a Purchase – a Sturdy Purchase a that! Why?

The reply, for my part, is two-fold.

On the one aspect, the market is mostly cautious of bubbles, and though Kongsberg’s efficiency this previous 12 months has been phenomenal, to say the least, by no means does it characterize a bubble. All it does is characterize a significant shift within the want for each developed nation – and rising nation, for that matter – to defend its borders – in any respect prices. Army spending is clearly on the rise, and as a key participant in Europe, throughout which nations are aggressively rising their collective budgets, Kongsberg is likely one of the direct beneficiaries of that elevated spending, and authorities contracts are sometimes long-lived, as we noticed from the extension of the CROWS settlement.

On the opposite aspect is the true worth development of an funding made now in Kongsberg – although valuations are excessive. I’m the primary to confess that the 22x EV to ahead EBIT a number of the corporate is at present buying and selling makes it appear to be it’s approaching the valuations of Nvidia (NVDA) with a 27x multiple or Microsoft (MSFT) at 29x forward EBIT, however should you take into account the sturdy income visibility over the subsequent a number of years and the sturdy ahead EBIT development fee of +23%, it doesn’t look costly. At a present Enterprise Worth of roughly NOK 120 billion and FY-28 EBIT projected at NOK 9.25 billion utilizing a really, very conservative 15% EBIT development fee over the subsequent 5 years, you’d be paying lower than 13 instances FY-28 EBIT. That is towards a present EBIT development fee of practically 40% YoY (NOK 4.6 billion from NOK 3.3 billion within the prior interval) throughout the corporate. The 25% EBIT development fee for protection and aero will dampen a few of that EBIT development, however 13 instances the five-year ahead EBIT projection is a steal.

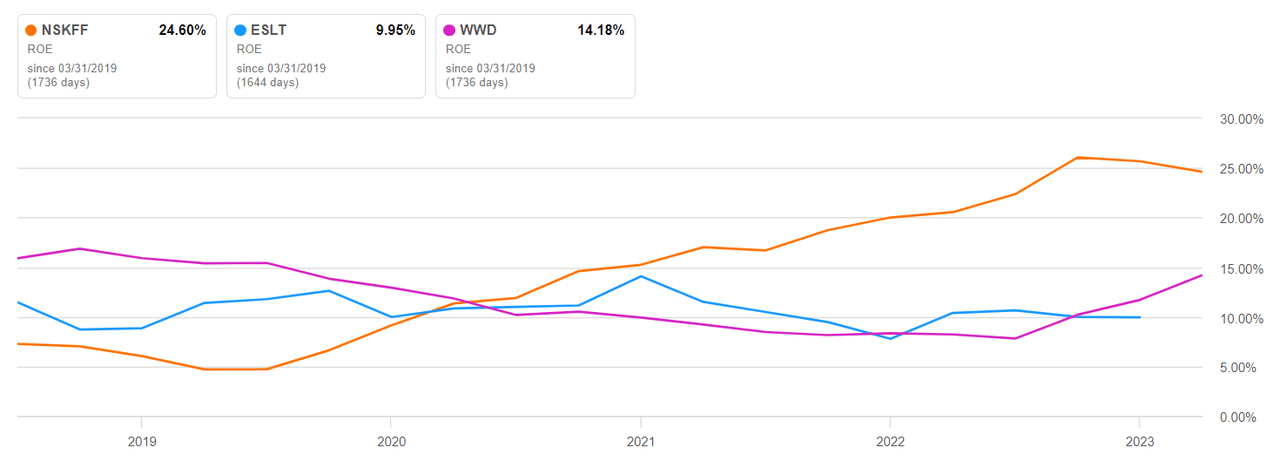

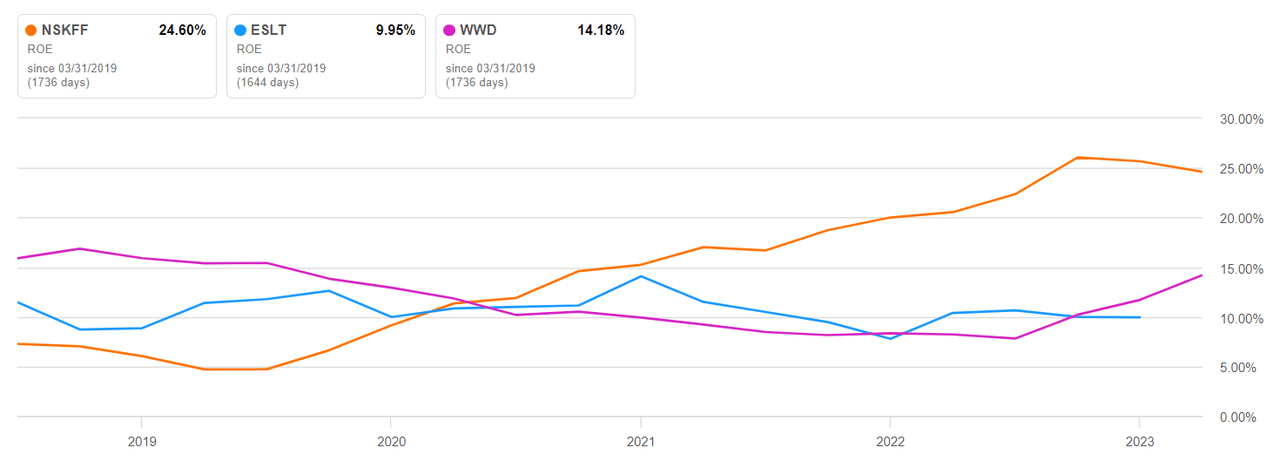

Should you have been to pin me down for a good worth estimate, I would say an EV/EBIT a number of of round 20x could be par for the course. Woodward Inc. (WWD), a U.S. aerospace contractor, trades at around that level, with Elbit Methods (ESLT) buying and selling even higher. On FY-28 ahead EBIT estimates of NOK 9.25 billion, as calculated above, I would peg Kongsberg at about NOK 185 in Enterprise Worth, representing an upside potential of about 55%. In ADR phrases, that might translate to roughly $97 per ADR.

Certain, I’d love this inventory much more at a less expensive worth, so that you may wish to both greenback price common into a bigger place or search for opportune dips in market sentiment. Nonetheless, even on the present father or mother/ADR ranges of NOK 670 and $63, that is price a glance.

The Bonus Funding Alternative

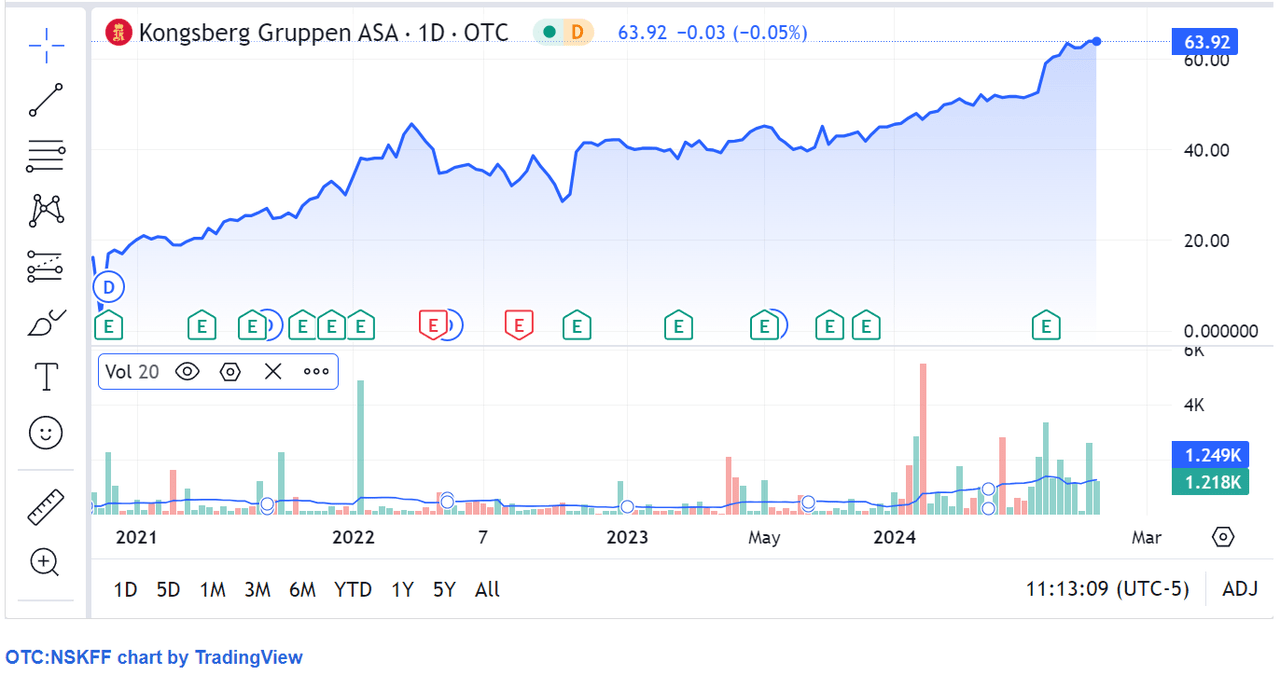

The extra alternative right here is that the inventory (the ADR, to be exact), not to mention the corporate, is barely identified by U.S. retail traders. Simply wanting on the firm’s follower base of below 500 on In search of Alpha tells me that this firm wants extra publicity to retail traders in the US. That additionally creates one other drawback – illiquidity for the ADRs. Simply have a look at the common quantity, per Yahoo! Finance, of the father or mother itemizing versus the ADRs – practically 182k for KOG.OL towards 634 for the OTC equal.

Nonetheless, you’ll be able to see that volumes are trending properly for the ADRs. Discover the upward quantity pattern for the reason that begin of the 12 months. That tells me the comparatively small pool of present traders are probably rising their positions considerably based mostly on optimistic expectations (quantity trending up even earlier than earnings) that have been then validated by Kongsberg’s newest quarterly/full-year report.

For my part, a variety of this optimistic sentiment may be attributed to the positive factors in protection and aero, greater than something. It additionally implies that on the profitability entrance, protection’s stronger EBIT profile will provide a sizeable enhance to general internet revenue for the group. In fact, the drop in EBIT because of the altering mixture of tasks dealt with by the section is a adverse, however, as we noticed earlier, it’s nonetheless a number of proportion factors larger than the system-wide common.

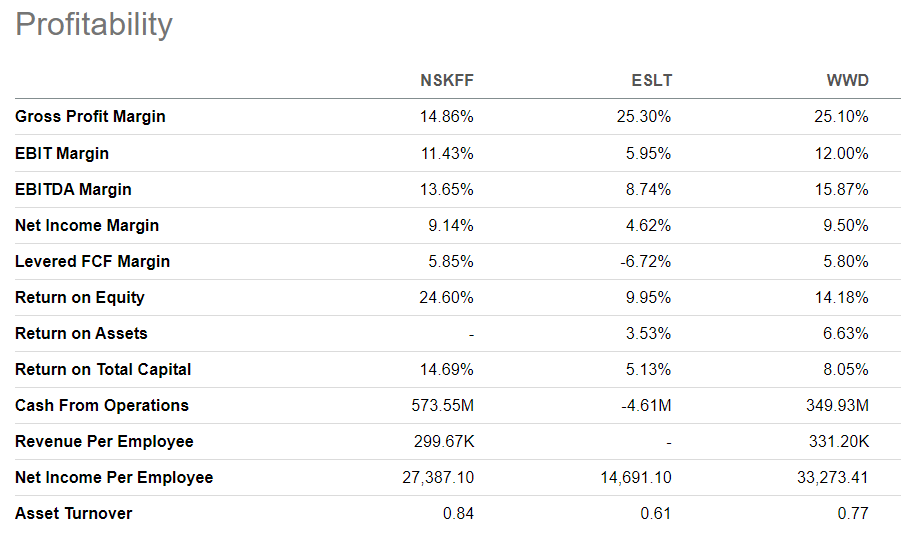

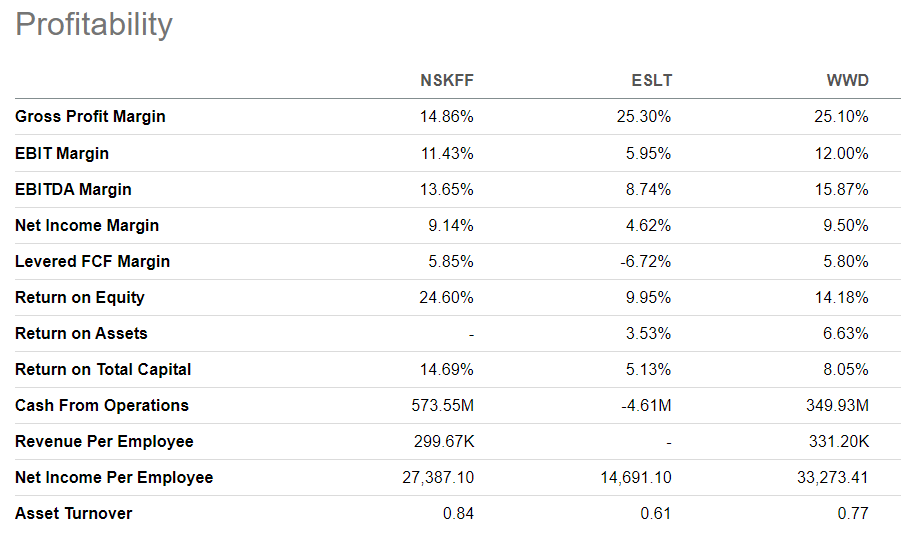

That’s the place the longer term upside comes from, for my part. Sure, the inventory may look costly at this degree, however should you evaluate it to a U.S. peer like Woodward Inc. and even an Israeli counterpart like Elbit Methods Ltd. – each of which have at the very least a number of thousand followers on In search of Alpha – you’ll see that its valuation is kind of comparable. In different phrases, it’s buying and selling at ranges which are par for the course.

In search of Alpha

And this side actually pops out once you acknowledge the truth that the corporate isn’t any slouch relating to bottom-line and core profitability.

In search of Alpha

I particularly level to the corporate’s sturdy money flows and return on fairness. You wish to see your funding maintain constructing fairness in an excellent situation, and Kongsberg has been in a position to maintain that needle transferring fairly effectively. Right here’s what we’re on that entrance:

NSKFF Return on Fairness v Opponents

All issues thought-about, my take is that the expansion within the firm’s protection section is what drives future upside at this time limit, and I don’t consider that’s totally priced in. The explanation is perhaps the weak retail investor curiosity within the U.S. for this ADR, however that’s rising stronger, and I consider if extra traders have a look at the hidden alternative, buying and selling volumes will rise, and we’ll have higher liquidity sooner or later, so you’ll be able to construct a comparatively giant place with out worrying about having a transparent exit plan. It’s best to at all times have that plan in place, after all, however you’ll have the ability to do it with more and more bigger positions as investor consciousness and buying and selling volumes develop. So long as Kongsberg can ship constant income development over the subsequent two to 3 years, this ADR might offer you fairly a good-looking return.

On the flip aspect is the danger that this received’t occur. I’m not seeing any vital dangers to the enterprise or its metrics, per se, however a gradual subsiding of worldwide battle (attempting very exhausting to maintain a straight face right here) is a fabric danger to the corporate’s skill to maintain posting sturdy income development over the subsequent few a long time.

Fortuitously (or sadly, for these concerned in such conflicts), I don’t see that occuring within the close to to medium time period. There’s an amazing quantity of acted-on in addition to pent-up geopolitical stress on this planet proper now. Governments are wound tight, which reveals of their protection finances will increase. Numerous sources revealed final 12 months that we hit an all-time excessive of $2.24 trillion in worldwide military expenditures, rising by a major 13% for Europe.

I don’t see that spending being curtailed for the foreseeable future. To me, that’s a good-enough indication of the sturdy draw back safety that comes with corporations working within the protection house. I’m comparatively new to In search of Alpha, so I’m unsure too many individuals will see this text and admire the funding alternative right here. My solely hope is that SA stalwarts within the aerospace and protection area, like Dhierin Bechai, whose work I very a lot admire, decide up this concept and unfold it to their followers. Extra market participation means larger buying and selling volumes, resulting in extra liquidity, presumably much less volatility, and a rising curiosity on this extremely regarded European protection contractor.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please concentrate on the dangers related to these shares.