leezsnow/iStock Unreleased via Getty Images

Krispy Kreme, Inc. (NASDAQ:DNUT), the well-recognized donut producer, is continuing on the company’s strategic expansion path to 100 thousand access points with geographical expansion and the rollout with McDonalds (MCD) in the United States. The company’s recently reported Q2 results came in nearly in line with expectations, continuing the long-term growth story well ahead of accelerated incoming growth.

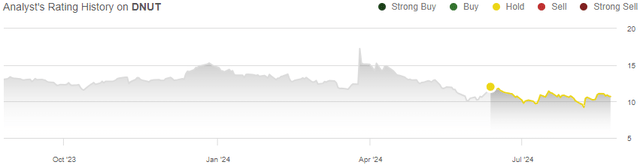

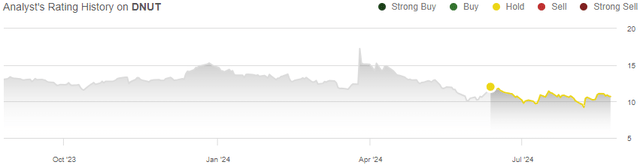

In my previous article, “Krispy Kreme Partners With McDonalds To Accelerate Growth”, I initiated the stock at a Hold rating as the growth story seemed to be very fairly valued. Since the article was published on the 12th of June, Krispy Kreme’s stock has lost -8% of its value compared to S&P 500’s return of 4% in the same period.

My Rating History on DNUT (Seeking Alpha)

Q2 Report Shows Fair Momentum Ahead of Better Catalysts

Krispy Kreme reported the company’s Q2 earnings on the 8th of August, sending the stock up 13% for the day. Ahead of the McDonalds rollout that’s expected to start scaling from H2 forward, Krispy Kreme’s revenues still grew at a good 7.3% pace in the quarter into $438.8 million with slight growth acceleration quarter-on-quarter. In the US segment, revenues grew by 8.2% organically, with international sales growth still trailing at just a 3.9% organic growth with new entries into countries still waiting to scale better. The revenues beat Wall Street’s consensus estimate by $4.8 million.

Total adjusted EBITDA grew 12.1% year-on-year into $54.7 million with the margin scaling 60 basis points into 12.5%; the growth is slowly improving Krispy Kreme’s margin profile. The operating income margin still came in at just 1.6%, still making future margin improvements critical for the company. The gross margin of 27.0% was also still at quite a weak level, being nearly stable year-on-year, only enabling the operational scaling to improve Krispy Kreme’s margin profile moderately unless the company increases pricing or achieves synergies from a significantly higher scale. The adjusted EPS of $0.05 was in line with Wall Street’s expectations in the quarter.

I believe that the quarterly results were fine in light of the ongoing growth story into new access points. Year-on-year, access points grew by 2981 into 15853 even before the McDonalds partnership has started to rapidly scale Krispy Kreme’s reach. Underlying profitability increased slowly, showing upcoming growth’s likely good impact on margins. The revenue growth was still understandably much more moderate than can be expected in the mid-term through the new expansion into new countries and McDonald’s restaurants. The stock’s 13% rally still seems weird in my opinion, as the financials came in nearly as expected at a nearly consistent growth rate.

Sale of Majority Stake in Insomia Cookies

On the 22nd of July, Krispy Kreme announced to have sold the majority of the Insomnia Cookies brand to Verlinvest and Mistral Equity Partners, ending the strategic alternative process for the business.

In the transaction, valuing Insomnia Cookies at a total $350 million enterprise value at double of Krispy Kreme’s 2018 acquisition sum of the brand, Krispy Kreme sold most of the holding leaving a 34% minority stake and receiving a total of $172.4 million for the sale.

After the sale of the majority stake, Krispy Kreme updated the company’s financial guidance to exclude Insomnia Cookies’ financials with the Q2 report – the company now expects revenues of $1650-1685 million at an organic 5-7% growth, as well as adjusted EBITDA of $215-220 million representing quite a good organic growth – overall, the guidance expects a similar results from the remaining Krispy Kreme as prior to the sale.

I believe that the transaction looks good on the surface. While revenues aren’t separately reported for the Insomnia Cookies brand, around 12.3% of total bakeries and shops at the end of 2023 were related to the brand, making the $350 million enterprise value have a similar appreciation as the market values the total Krispy Kreme business. The transaction notably strengthens Krispy Kreme’s heavy balance sheet, still leaving the company with a share of the brand but allowing for a better focus on the core Krispy Kreme brand’s upcoming expansion.

Krispy Kreme’s International Scaling Continues

Since my previous article, Krispy Kreme has also announced the expansion into Spain and Morocco, expecting 500 access points throughout key cities in Spain and a much smaller entry into the Moroccan market; after the previous announcement of expansion into Germany, it seems that Krispy Kreme is very ambitiously expanding into especially the European market, starting with countries with the largest potential. With established partnerships with local Moroccan suppliers, the expansion into Morocco also makes sense.

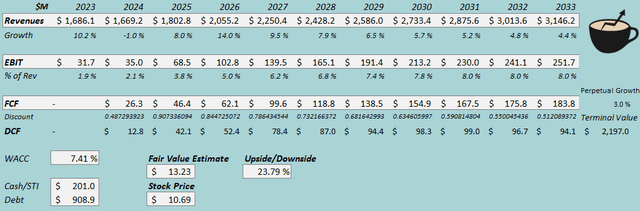

Updated Valuation

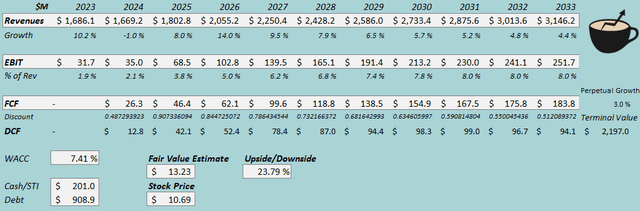

I updated my discounted cash flow [DCF] model, primarily affected by the sale of the Insomnia Cookies majority stake. I have added $172.4 million of cash to the company, but subtracted growth from 2024 and 2025 due to the divestment of the majority stake.

After 2025, I estimate slightly more elevated growth than previously with the great ongoing international expansion and the streamlined focus on the Krispy Kreme brand. I now estimate a total CAGR of 6.4% from 2023 to 2033 and 3% perpetual growth afterwards.

I have kept the EBIT margin estimates and cash flow conversion estimates nearly the same as previously, still expecting good operating leverage through the new access point expansion. For more thorough explanations, I refer to my previous article.

DCF Model (Author’s Calculation)

The estimates put Krispy Kreme’s fair value estimate at $13.23, 24% above the stock price at the time of writing – the stock is now valued more attractively than previously, but still at a fair margin of safety in my opinion. The fair value estimate is up from $11.33 previously.

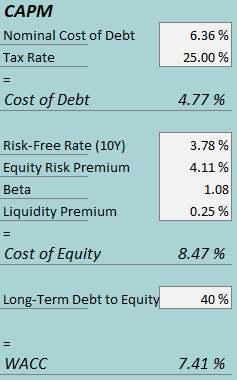

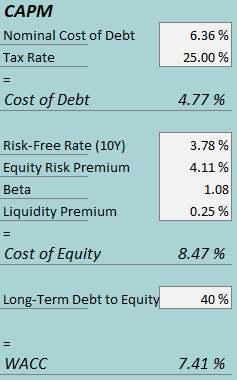

CAPM

A weighted average cost of capital of 7.41% is used in the DCF model. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q2, Krispy Kreme had $14.5 million in interest expenses, making the company’s interest rate 6.36% with the current amount of interest-bearing debt. I again estimate quite a high 40% long-term debt-to-equity ratio.

To estimate the cost of equity, I use the 10-year bond yield of 3.78% as the risk-free rate. The equity risk premium of 4.11% is Professor Aswath Damodaran’s estimate for the US, updated in July. I have kept the beta estimate at 1.08. With a liquidity premium of 0.25%, the cost of equity stands at 8.47% and the WACC at 7.41%.

Takeaway

Krispy Kreme’s streamlined growth focus continued in Q2 with good revenue and earnings growth ahead of the better McDonald’s and international growth catalysts. The company also finalized the strategic alternative process for the Insomnia Cookies brand with a good valuation, still leaving Krispy Kreme with a third of the brand. As the company’s international expansion shows great signs with expansion into Spain and Morocco, and as the McDonald’s catalyst is nearing, the valuation has gotten more attractive. Still, as the undervaluation comes at a mostly fair margin of safety, I remain with a Hold rating for Krispy Kreme.