Bill Oxford

Introduction

After buying GE Aerospace (GE) last week, I have 24.5% aerospace & defense exposure. As my portfolio holds more than 95% of my net worth, it’s fair to say roughly a quarter of my wealth depends on this industry.

While one could make the case that I have gone too far, I beg to differ.

- Most of my aerospace & defense exposure is anti-cyclical.

- My commercial exposure includes businesses with an ultra-wide business moat, including engine-producing GE Aerospace and RTX Corp. (RTX), which encompasses Pratt & Whitney and Collins Aerospace.

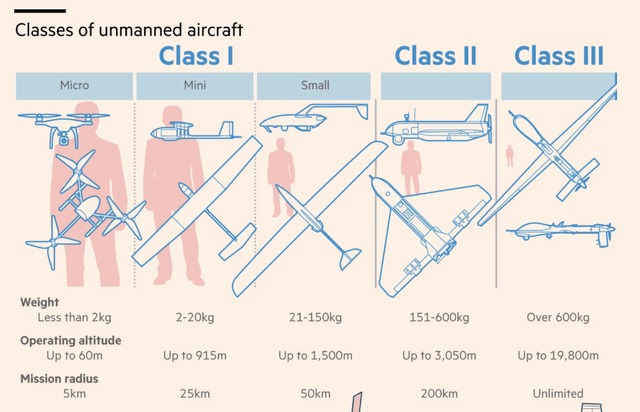

The reason I’m bringing this up is because there are some risks as well. Especially the defense industry is prone to disruption, as the war in Ukraine has shown how effective low-cost drones can be when it comes to defending even against main battle tanks. Being on top of these risks is a key part of my job.

As smaller companies can build cheap lethal weapons, it could hurt the position of established defense players.

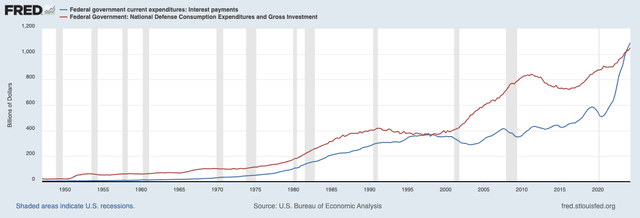

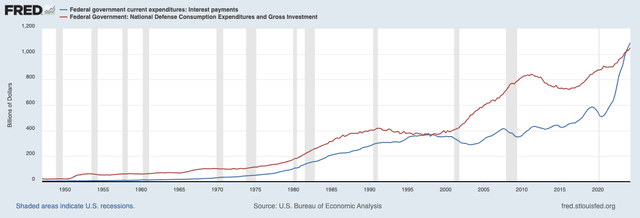

Another factor is government spending. Because of the surge in inflation after the pandemic and aggressive short-term borrowing, the Federal government is currently spending more than $1 trillion on interest payments on an annualized basis. This is more than the entire national defense consumption budget. This budget consists of Department of Defense (DoD) military activities, defense-related atomic energy activities of the Department of Energy, and defense-related activities of other agencies.

Federal Reserve Bank of St. Louis

Although it is unlikely the government will neglect its defense capabilities, it is one of the reasons why some people prefer to avoid defense contractors.

In light of these developments, I’ll use this article to explain why defense contractor L3Harris Technologies (LHX) remains one of my favorite long-term investments – across the entire dividend growth space.

My most recent article on this company was written on August 9, which isn’t that long ago. Back then, I went with the title “Cash Flow King – L3Harris Remains A Significantly Undervalued Dividend Growth Gem.”

That article was based on new tensions in the Middle East, the company’s 2Q24 earnings, and diversification benefits.

In this article, I’ll go one step further and really focus on what sets LHX apart in light of disruptor risks and a changing demand environment. For that, I’ll use the latest in-depth CNBC interview with the company’s CEO, its recent presentation at the Jefferies Global Industrial Conference, and other major developments that explain why LHX is such a special company.

So, as we have a lot to discuss, let’s dive into the details!

L3Harris Is All About Diversification

My largest defense investment is Lockheed Martin (LMT). One of the biggest disadvantages of that investment is the dependence on the F-35 fighter jet. This jet accounts for roughly 26% of the company’s total sales.

While I have a lot of faith in that program, the size of it poses a risk.

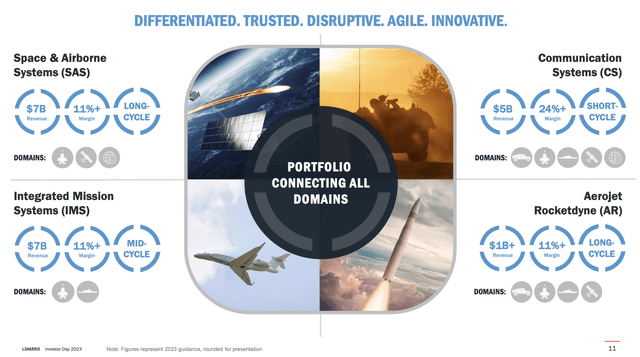

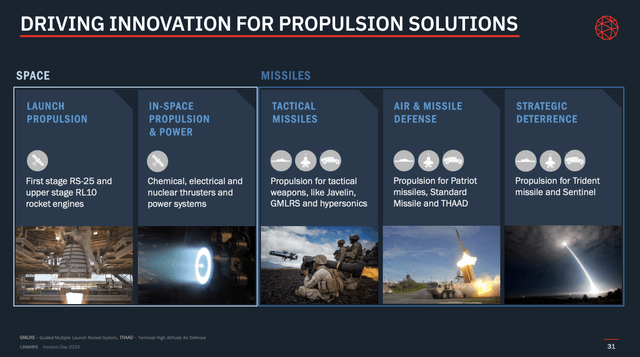

L3Harris is different, as it has a different place in the defense supply chain. Although it builds products that are ready for use, it is also a critical supplier to the nation’s largest defense giants. This includes rocket propulsion.

The takeover of Aerojet Rocketdyne added a business with massive secular growth potential. This business is so important that it captures roughly 20% of the total costs of every missile it is on.

This is something I have mentioned in prior articles as well, as it’s one of the things that makes L3Harris a mission-critical player in the defense supply chain. Especially in a time of elevated geopolitical risks, demand for missiles is elevated. This requires propulsion.

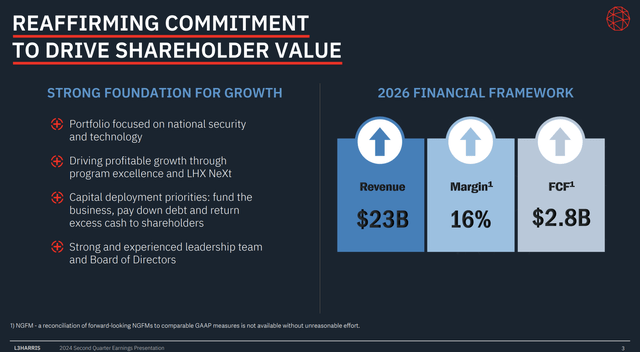

In general, the company is extremely upbeat about its future. During the Jefferies Global Industrial Conference on September 5, the CEO, Chris Kubasik, explained that he is looking to turn L3Harris into a $23 billion revenue business by 2026, potentially with at least 16% margins.

In 2023, the company generated $19.4 billion in revenue with 14.8% operating margins. Its 2026 plan would translate to a 3-year revenue CAGR of 5.8%.

The implied free cash flow 3-year CAGR is 12%.

One of the key drivers of long-term growth is L3Harris’ focus on the “future of warfare.” The 2019 merger between L3 and Harris was the perfect opportunity to build a future-proof framework by combining capabilities, divesting non-core assets, and using a stronger foundation for big-ticker M&A like the takeover of Aerojet Rocketdyne, a company Lockheed was trying to buy as well.

The company is now one of just two companies in the United States capable of supplying solid rocket motors, with secular growth from space launch propulsion, in-space propulsion, tactical missiles, air defense, and strategic deterrence.

Strategic deterrence includes the Missile Defense Agency’s Next Generation Interceptor (NGI). This award was announced in May.

This win is big, as it is expected to boost Aerojet’s revenue from $2.5 billion to $4.0 billion by the end of this decade.

It also helps that the integration of Aerojet is ahead of schedule, as the company has already surpassed the $50 million synergy target by using digitalization and investments in robotics.

Thanks to these improvements, the number of overdue deliveries has dropped by 40% within 12 months, which is extremely important in a supply chain with strong demand.

Speaking of supply chains, I have become a big fan of Mr. Kubasik, as he has done a tremendous job making the company a critical supply chain player without being dependent on a large number of bigger players.

This includes the company’s approach to Intelligence, Surveillance, and Reconnaissance (ISR). According to the company, its strategy allows it to use a wide range of aircraft, including the Gulfstream and Bombardier jets to meet specific demands from customers.

Improved flexibility comes at a time of strong demand growth, especially from international customers in Europe, the Far East, and the Middle East.

According to Global Market Insights, the ISR market could rise from $40.2 billion in 2022 to $74 billion in 2032.

L3Harris Technologies

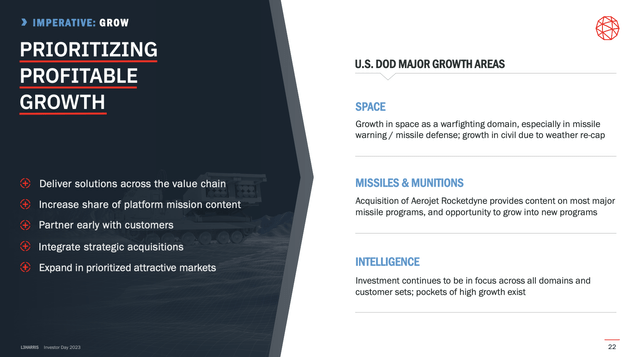

According to LHX’s 2023 Investor Presentation, intelligence is one of the three major growth areas of the DoD. The other two are space and missiles & munition, an area serviced by Aerojet – among others.

I also want to highlight the quote below from the conference, which describes perfectly how LHX is finding ways to benefit from major contracts. Please note that “prime” below refers to being the prime contractor.

Sometimes we prime. Sometimes we have an exclusive subcontract arrangement, and sometimes we’re a merchant supplier. So go back several years when the Navy was working on the frigate, there were 4 shipbuilders. We had content on all 4. I didn’t honestly care who won. I just wanted the Navy to pick one because no matter who they pick, we win. – LHX (emphasis added)

Moreover:

And even some of the subcontract arrangements are with these new entrants or these commercial-type companies, where we think they have a better chance of winning, and then we provide our capabilities and get 30%, 40% or 50% of the content. So I think another example we’re different than the traditional primes. – LHX (emphasis added)

Mr. Kubasik also said this in a special interview with CNBC.

In the interview, the CEO said that a company like Palantir (PLTR) has become a disruptor in the defense industry. However, that’s fine, as L3Harris is using the company to win deals as a subcontractor, allowing it to benefit from a wide range of orders, even if it’s not the prime contractor.

Moreover, the company is investing in startups, as it sees itself as a disruptor in the industry. According to Mr. Kubasik, L3Harris has 2-8% ownership in roughly 40 high-tech companies that focus on autonomy, cyber, AI, and space.

By working with these companies, the company can integrate these technologies into its own solutions. This is a perfect low-risk way of innovating in a market prone to disruption. L3Harris isn’t looking to buy these companies but uses their technologies. This also bodes well for future dividends and buybacks, but more on that later.

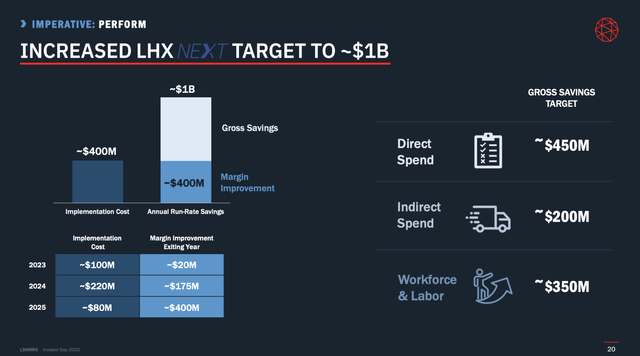

Additionally, the company is cutting costs. Using its LHX NeXt program, it targets a reduction of $1 billion in run-rate costs by 2026. So far, it’s ahead of schedule.

So, what does all of this mean for shareholders?

A Lot Of Shareholder Value

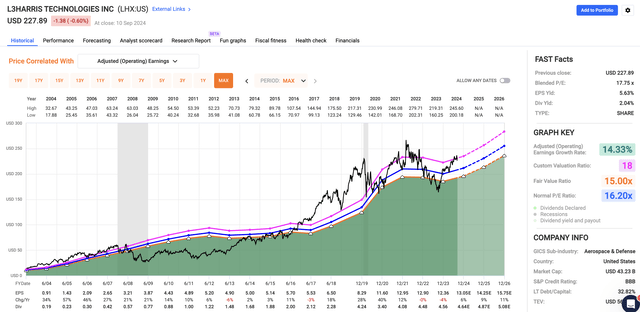

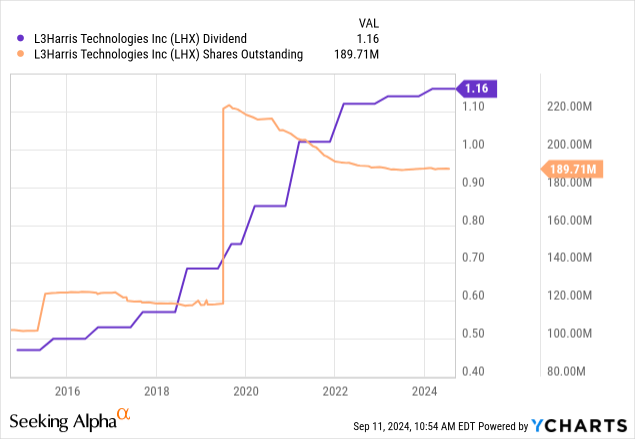

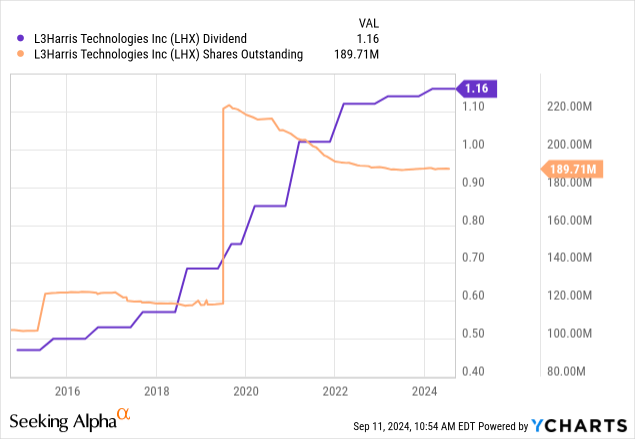

Using the data in the chart below, we see the company’s dividend growth has almost flatlined. It also has halted its buybacks.

Currently, the company yields 2.0%. The five-year dividend CAGR is 10.5%.

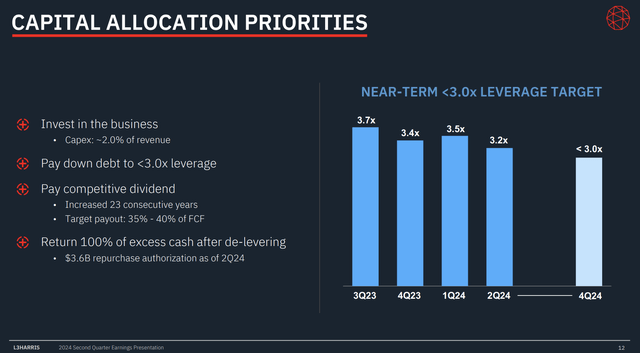

The reason why dividend growth has slowed in the past two years is the takeover of Aerojet Rocketdyne and other M&A projects. The company will return to growing the dividend more aggressively once it has lowered its leverage ratio to less than 3.0x EBITDA. This is expected to be achieved by 4Q24.

Even better, the company aims to return 100% of excess free cash flow to shareholders!

To give you an idea of how much value the company can unlock, analysts agree with the company, as they see a path to $2.8 billion in free cash flow by 2026. This translates to 6.6% of its current market cap and implies a cash dividend payout ratio of just 30%.

In other words, the company has a lot of room for aggressive dividend growth and buybacks, making it a terrific stock for a wide range of investors.

It also has a good valuation, as it trades at a blended P/E ratio of 17.8x. Using the FactSet data from the chart below, analysts expect accelerating EPS growth to 11% in 2026. Applying an 18.0x multiple, we get a total return outlook of 11-13% per year.

I truly believe LHX has one of the best business models among dividend growth stocks, which is why I keep adding to my investment, regardless of the massive size of the aerospace industry in my portfolio.

The value is just too good to ignore.

Takeaway

L3Harris stands out due to its diversified revenue streams, strong growth potential, and its role as a key supplier in critical defense areas like missile propulsion.

Even better, the company’s focus on innovation, cost reduction, and strategic partnerships further improves its resilience in a market that’s prone to disruption.

With promising free cash flow projections and a plan to return substantial value to shareholders, LHX remains a top long-term investment choice in the dividend growth space.

Pros & Cons

Pros:

- Diversification: Unlike other defense giants that rely heavily on specific programs, LHX offers a balanced portfolio with exposure to high-growth areas like missile propulsion, space launch, and ISR.

- Resilient Business Model: LHX benefits from its role as a supplier and prime contractor, allowing it to win contracts regardless of market shifts. This strategy provides a buffer against disruption from new entrants and allows it to stay on top of innovation trends.

- Strong Cash Flow and Shareholder Returns: With elevated projected free cash flow growth and a commitment to returning 100% of excess cash to shareholders through dividends and buybacks, LHX is well-positioned to reward long-term investors.

Cons:

- High Leverage: Recent acquisitions have increased debt levels, which has temporarily limited dividend growth and share buybacks until leverage targets are met.

- Exposure to Government Spending: LHX’s reliance on government contracts makes it vulnerable to budget constraints, although elevated global tensions bode well for targeted spending.

- Disruption Risk: The defense sector is evolving with new technologies like low-cost drones and AI, which could challenge traditional defense models and potentially disrupt LHX’s business – despite its efforts.