Sundry Pictures

In our previous analysis of Lam Analysis Company (NASDAQ:LRCX), we assessed the corporate amid geopolitical tensions with the US authorities imposing export restrictions on semicon gear to China. Nonetheless, we estimated a minimal impression to the corporate of as much as solely 2.2% of revenues on each reminiscence and logic gear restrictions, thus affirming our constructive view on the corporate to capitalize on the semicon gear market progress. Since our earlier evaluation, Lam Analysis’s inventory value has surged by a whopping 176%. Thus, we analyzed the corporate once more following its newest earnings launch in Q2 FY2024 to find out whether or not the surge in its inventory value is justified. Firstly, we examined the corporate’s income progress efficiency and analyzed its P/S relative to rivals. Furthermore, we examined the corporate’s profitability and analyzed its P/E and P/FCF ratios compared to its friends.

Pretty Valued on P/S Regardless of Robust Income Progress Expectations

|

Lam Analysis Income ($ mln) (CY) |

2018 |

2019 |

2020 |

2021 |

2022 |

TTM |

5-Yr Common |

|

Income |

9,654 |

10,045 |

14,626 |

17,227 |

17,429 |

14,317 |

|

|

Income Progress |

-12.85% |

4.05% |

45.61% |

17.78% |

1.17% |

-17.85% |

11.15% |

Supply: Firm Knowledge, Khaveen Investments

The corporate’s inventory value has surged by 176% since our previous coverage in October 2022. However, the corporate’s income progress in 2022 (FY2023) was flattish (1.17%) and its progress based mostly on TTM for the ultimate quarter of 2023 was down considerably by 17.85%. The slowdown within the firm’s efficiency is attributed to weak point within the Reminiscence phase income, which accounted for 42% of income, as main reminiscence chipmakers akin to Micron (MU) and SK Hynix decreased capex in 2023 as highlighted in our previous analyses. From its earnings briefing, administration highlighted that the reminiscence gear market progress declined by 40% in 2023.

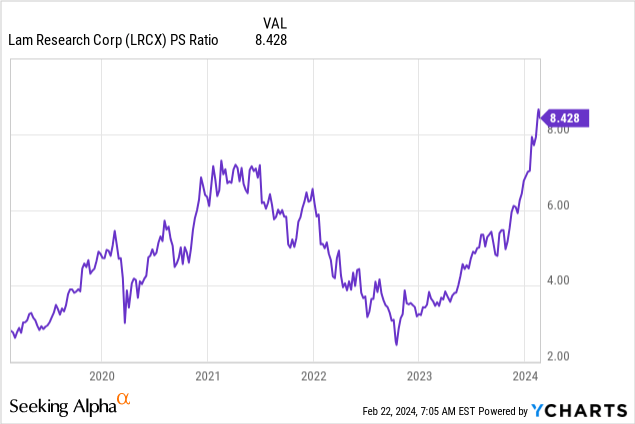

YCharts

Moreover, the corporate’s P/S ratio has elevated over the interval as seen within the chart above as its share value rose whereas income declined. Simply on this foundation alone, we will see the inventory value rising greater than its income progress. Subsequently, the income progress is unable to justify the surge in inventory value, and a extra applicable measure can be to check its P/S ratio in opposition to its historic common and the business common.

|

P/S Comparability |

2019 |

2020 |

2021 |

2022 |

2023 |

Present |

Common |

|

Lam Analysis |

4.80x |

6.47x |

3.48x |

5.01x |

7.32x |

8.43x |

5.42x |

|

Progress (%) |

34.8% |

-46.2% |

44.0% |

46.1% |

15.2% |

29.4% |

|

|

ASML (ASML) |

9.41x |

11.92x |

15.58x |

9.47x |

9.75x |

12.05x |

11.23x |

|

Progress (%) |

26.7% |

30.7% |

-39.2% |

3.0% |

23.6% |

9.7% |

|

|

KLA (KLAC) |

5.29x |

7.28x |

5.25x |

6.48x |

8.26x |

9.26x |

6.51x |

|

Progress (%) |

37.6% |

-27.9% |

23.4% |

27.5% |

12.1% |

20.7% |

|

|

Tokyo Electron (OTCPK:TOELF) |

2.87x |

5.23x |

4.94x |

10.19x |

6.41x |

8.23x |

5.93x |

|

Progress (%) |

82.2% |

-5.5% |

106.3% |

-37.1% |

28.4% |

25.3% |

|

|

Utilized Supplies (AMAT) |

3.51x |

3.18x |

5.45x |

3.00x |

4.22x |

6.05x |

3.87x |

|

Progress (%) |

-9.4% |

71.4% |

-45.0% |

40.7% |

43.4% |

31.9% |

|

|

Common |

5.18x |

6.82x |

6.94x |

6.83x |

7.19x |

8.80x |

6.59x |

|

Progress (%) |

31.7% |

1.8% |

-1.6% |

5.3% |

22.4% |

11.9% |

Supply: GuruFocus, Khaveen Investments

We compiled the corporate and its rivals’ previous 5-year P/S ratio within the desk above. Lam Analysis’s present P/S ratio of 6.42x is considerably increased than the corporate’s common (5.42x), suggesting an overvaluation. Regardless of the corporate’s slowdown in progress, its P/S ratio has risen by 142% since 2021. Moreover, evaluating Lam Analysis’s present P/S ratio to the business’s 5-year common P/S ratio of 6.59x signifies the corporate may very well be overvalued compared to its friends. Nevertheless, its present P/S ratio is decrease than the present common (8.8x) as ASML’s a lot increased P/S ratio (12.05x) lifted the typical.

Outlook

General, we imagine income progress solely doesn’t justify the corporate’s inventory value enhance. Based mostly on its newest earnings briefing, the corporate guided its March 2024 quarter income to decline additional by 4% YoY whereas analyst consensus estimates for the corporate’s full-year income progress is -15.39% earlier than restoration to 18.34% within the following yr. Nevertheless, administration highlighted in its newest earnings a constructive outlook for the semicon gear market that it expects H1 to stay gentle however get better in direction of the second half and into 2025. Furthermore, we analyzed the corporate’s product combine publicity has shifted to increased progress foundry & logic segments in comparison with reminiscence and we count on fab expansions by high clients together with TSMC (TSM), Intel (INTC) and Samsung (OTCPK:SSNLF) to profit the corporate’s progress restoration, thus we count on the corporate’s progress may get better stronger than anticipated and up to date our projections under.

|

Income Forecast ($ mln) (CY) |

2022 |

2023F |

2024F |

2025F |

|

Reminiscence |

7,320 |

5,403 |

6,021 |

6,649 |

|

Progress (%) |

-29.2% |

-26.2% |

11.4% |

10.4% |

|

Foundry |

6,623 |

6,564 |

7,812 |

9,219 |

|

Progress (%) |

47.9% |

-0.9% |

19.0% |

18.0% |

|

Logic/Built-in Machine Manufacturing |

3,486 |

3,651 |

4,572 |

5,679 |

|

Progress (%) |

44.5% |

4.7% |

25.2% |

24.2% |

|

Whole Income |

17,429 |

15,618 |

18,404 |

21,546 |

|

Progress (%) |

1.2% |

-10.4% |

17.8% |

17.1% |

Supply: Firm Knowledge, Khaveen Investments

Subsequently, we used the corporate’s historic progress of its end-market segments to mission its income progress. For 2023, we based mostly its revenues on its precise Q1 and Q2 phase outcomes and forecasted its Q3 and This autumn revenues based mostly on the corporate’s 9-year CAGR of every phase. Equally, we projected 2024 and past based mostly on the 9-year CAGR, tapering down by 1% per yr for every phase as a conservative assumption. Thus we anticipate its income progress to get better strongly and return to constructive progress in 2024.

|

Lam Analysis P/S Valuation |

2023F |

2024F |

2025F |

|

Forecasted Income ($ mln) |

15,618 |

18,404 |

21,546 |

|

Progress (%) |

-10.4% |

17.8% |

17.1% |

|

P/S Ratio |

8.05x |

7.26x |

6.59x |

|

Valuation ($ mln) |

125,688 |

133,599 |

142,008 |

|

Shares Excellent (mln) |

131.10 |

131.10 |

131.10 |

|

Value Goal |

958.70 |

1,019.04 |

1,083.18 |

|

Present Value |

901.93 |

901.93 |

901.93 |

|

Upside |

6.3% |

13.0% |

20.1% |

Supply: Khaveen Investments

Within the desk above, we derived a P/S valuation for the corporate based mostly on our forecasted income by way of 2025. Based mostly on the business’s 5-year common P/S, we calculated a value goal of $1,038 which is a 20% upside. Prorating this to 2023, we estimate an upside of merely 6.3%. Subsequently, whereas the corporate’s inventory runup could also be justified based mostly on P/S, our valuation signifies that it’s now pretty valued. It’s also value noting that ASML stands out as an outlier due to its increased P/S ratio than friends, thus excluding this, Lam Analysis is probably not pretty valued.

Pretty Valued Regardless of Earnings Progress Restoration

Furthermore, we examined the corporate’s earnings progress and whether or not it justifies the rise in its inventory value through the interval. Based mostly on the desk under, the corporate’s earnings have declined in 2022 in distinction with its flattish income progress and declined by 23.3% in This autumn 2023 TTM.

|

Lam Analysis Earnings ($ mln) (CY) |

2018 |

2019 |

2020 |

2021 |

2022 |

TTM |

Common |

|

Web Earnings |

2,191 |

2,252 |

3,909 |

4,605 |

4,511 |

3,458 |

|

|

Earnings Progress % |

-8.0% |

2.8% |

73.6% |

17.8% |

-2.0% |

-23.3% |

12.0% |

Supply: Firm Knowledge, Khaveen Investments

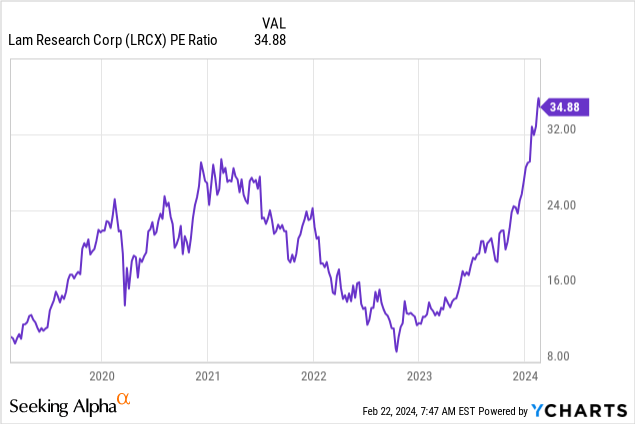

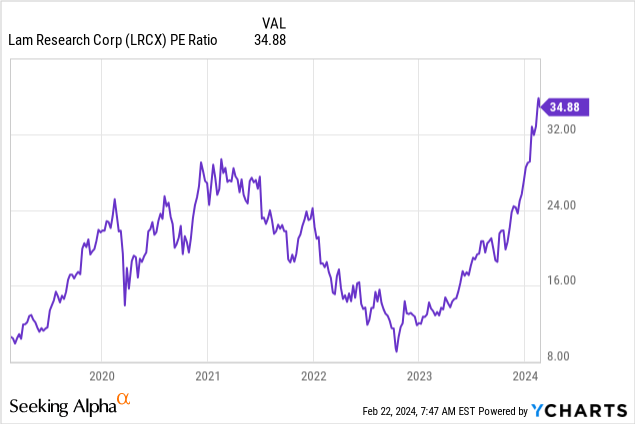

YCharts

As seen, the corporate’s P/E has elevated over the interval since our earlier protection to 34.8x at the moment. Simply on this foundation alone, we will observe that the inventory value rising greater than its internet earnings progress. Subsequently, the earnings progress is unable to justify the surge in inventory value, and a extra applicable measure can be to check its P/E ratio in opposition to its historic common and the business common.

|

P/E Comparability |

2019 |

2020 |

2021 |

2022 |

2023 |

Present |

Common |

|

Lam Analysis |

21.42x |

24.19x |

13.01x |

19.36x |

30.29x |

34.88x |

21.65x |

|

Progress (%) |

12.9% |

-46.2% |

48.8% |

56.5% |

15.2% |

18.0% |

|

|

ASML |

42.88x |

46.88x |

49.28x |

35.65x |

34.24x |

42.35x |

41.79x |

|

Progress (%) |

9.3% |

5.1% |

-27.7% |

-4.0% |

23.7% |

-4.3% |

|

|

KLA |

25.26x |

24.25x |

14.56x |

20.08x |

29.52x |

33.11x |

22.73x |

|

Progress (%) |

-4.0% |

-40.0% |

37.9% |

47.0% |

12.2% |

10.2% |

|

|

Tokyo Electron |

17.49x |

30.12x |

22.64x |

15.98x |

33.01x |

42.29x |

23.85x |

|

Progress (%) |

72.2% |

-24.8% |

-29.4% |

106.6% |

28.1% |

31.1% |

|

|

Utilized Supplies |

18.97x |

15.11x |

21.35x |

11.87x |

16.32x |

22.38x |

16.72x |

|

Progress (%) |

-20.3% |

41.3% |

-44.4% |

37.5% |

37.1% |

3.5% |

|

|

Common |

25.20x |

28.11x |

24.17x |

20.59x |

28.68x |

35.00x |

25.35x |

|

Progress (%) |

11.5% |

-14.0% |

-14.8% |

39.3% |

22.1% |

5.5% |

Supply: GuruFocus, Khaveen Investments

The desk above reveals the previous 5-year P/E ratios of Lam Analysis and its rivals. Lam Analysis at the moment has a P/E ratio of 34.88x, which is considerably increased than the corporate’s common (21.65x). This may increasingly point out that its inventory value can be not pretty valued in relation to its earnings, because it has elevated by 168% regardless of the corporate’s slowdown in earnings progress. Moreover, evaluating Lam Analysis’s present P/E ratio to the business’s previous 5-year common P/S ratio of 25.35x reveals that the corporate may very well be overvalued compared to its friends.

Outlook

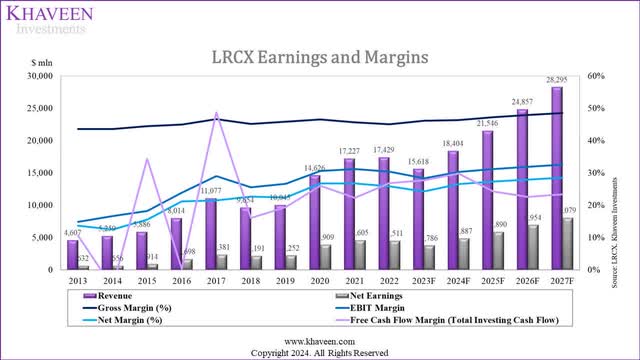

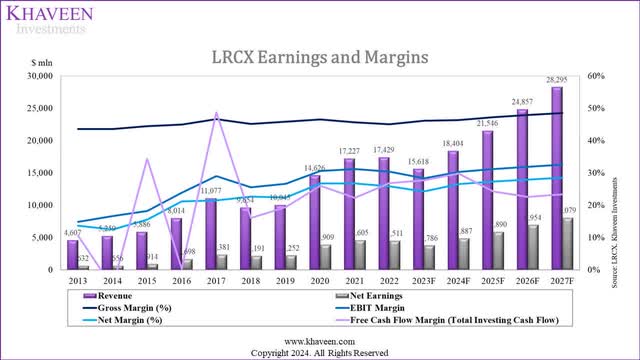

Firm Knowledge, Khaveen Investments

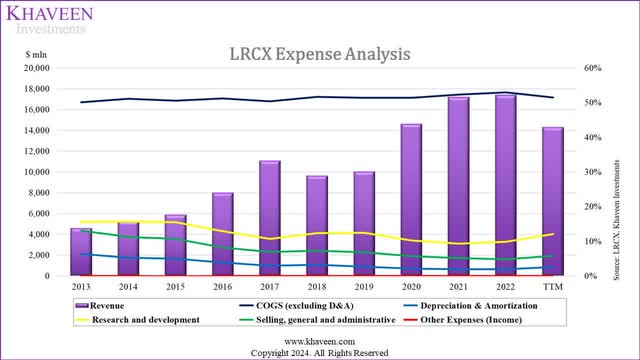

Lam Analysis’s profitability margins have been rising previously however have stabilized previously 2 years and moderated in 2023 TTM as seen by its EBIT and internet margins. Nevertheless, its gross margins have averaged 45.2% previously 10 years and have been very secure regardless of sure durations of income contraction.

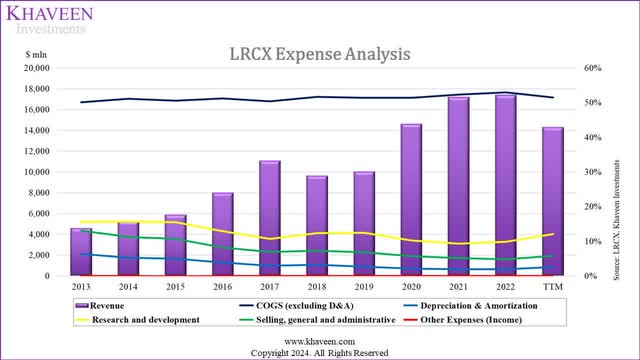

Firm Knowledge, Khaveen Investments

When it comes to expense evaluation, its SG&A % of income had been pretty secure in 2022 and TTM whereas its R&D spending % of income had elevated barely. Administration highlighted their intention to extend R&D spending to develop the corporate’s product portfolio and seize future alternatives. Moreover, there may be an rising development in R&D in TTM and administration previously highlighted that R&D spending could also be “a little bit independent of what revenue turns out to be” and likewise reiterated R&D spending to be up this yr in its newest briefing. Nevertheless, the corporate additionally highlighted it expects operational efficiencies to profit its gross margins with a guided enhance of 1% in 2024. Thus, we count on the corporate’s margins to stay secure and we modeled its internet margins of 28.55% by 2027.

|

Lam Analysis P/E Valuation |

2023F |

2024F |

2025F |

|

Forecasted Web Earnings ($ mln) |

3,786 |

4,887 |

5,890 |

|

Progress (%) |

-16.1% |

29.1% |

20.5% |

|

P/E Ratio |

31.82x |

25.12x |

21.24x |

|

Valuation ($ mln) |

120,489 |

122,774 |

125,103 |

|

Shares Excellent (mln) |

131.10 |

131.10 |

131.10 |

|

Value Goal |

919.04 |

936.47 |

954.24 |

|

Present Value |

901.93 |

901.93 |

901.93 |

|

Upside |

1.9% |

3.8% |

5.8% |

Supply: Khaveen Investments

Valuing the corporate based mostly on a PE comparable valuation based mostly on the 5-year common high gear friends (excluding ASML as its P/E common is nearly twice that of all high rivals), we derived a value goal of $954.24 at an upside of 5.8%. Prorating it to calculate our 2023 value goal with a 1.9%, we imagine this means the corporate’s runup in its inventory value based mostly on P/E is justified however at the moment presents restricted upside going ahead.

Restricted P/FCF Valuation Regardless of Sturdy FCF Margins

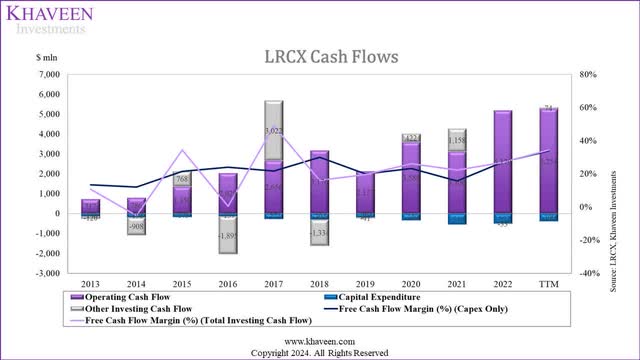

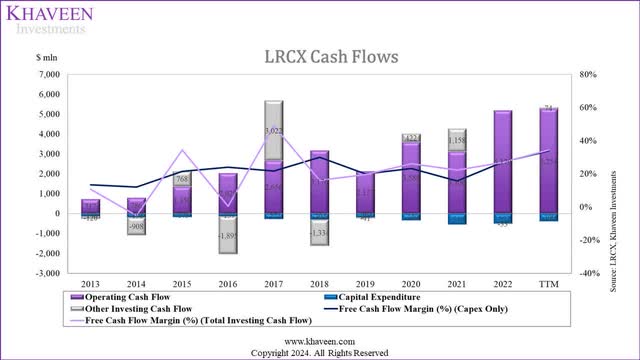

Lastly, we examined the corporate’s FCF progress and whether or not it justifies its inventory value enhance.

|

Money Move Assertion |

2018 |

2019 |

2020 |

2021 |

2022 |

TTM |

|

Free Money Move (Whole Investing Money Move) |

1,554 |

1,955 |

3,811 |

3,846 |

4,682 |

4,917 |

|

Progress (%) |

-71.3% |

25.8% |

94.9% |

0.9% |

21.7% |

5% |

Supply: Firm Knowledge, Khaveen Investments

Based mostly on the desk above, the corporate’s FCF based mostly on its complete investing money flows grew between 2021 and This autumn 2023 TTM in distinction with its internet earnings decline within the earlier level. Nevertheless, its FCF progress through the interval pales compared with the rise within the firm’s inventory value by 176%.

|

P/FCF |

2019 |

2020 |

2021 |

2022 |

2023 |

Present |

Common |

|

Lam Analysis |

25.07x |

29.19x |

23.47x |

18.67x |

21.56x |

24.83x |

23.59x |

|

Progress (%) |

16.4% |

-19.6% |

-20.5% |

15.5% |

15.2% |

-2.0% |

|

|

ASML |

46.51x |

45.94x |

29.28x |

27.97x |

82.73x |

101.62x |

46.49x |

|

Progress (%) |

-1.2% |

-36.3% |

-4.5% |

195.8% |

22.8% |

38.5% |

|

|

KLA |

18.90x |

25.80x |

16.09x |

20.44x |

25.25x |

28.31x |

21.30x |

|

Progress (%) |

4.1% |

36.5% |

-37.6% |

27.0% |

23.5% |

12.1% |

12.4% |

|

Tokyo Electron |

16.16x |

86.14x |

45.33x |

64.34x |

64.34x |

60.33x |

55.26x |

|

Progress (%) |

433.0% |

-47.4% |

41.9% |

0.0% |

-6.2% |

106.9% |

|

|

Utilized Supplies |

18.28x |

16.97x |

26.30x |

16.79x |

14.73x |

20.79x |

18.61x |

|

Progress (%) |

-7.2% |

55.0% |

-36.2% |

-12.3% |

41.1% |

-0.2% |

|

|

Common |

24.98x |

40.81x |

28.09x |

29.64x |

41.72x |

47.18x |

33.05x |

|

Progress (%) |

40.8% |

63.3% |

-31.2% |

5.5% |

40.8% |

13.1% |

19.6% |

Supply: GuruFocus, Khaveen Investments

Inspecting Lam Analysis’s P/FCF ratio, we see that from our earlier cowl in Oct 2022, its P/FCF has risen by 33% to the present ratio of 24.76x, which is nice because it signifies the corporate’s FCF has risen together with the robust rise in its inventory value.

Firm Knowledge, Khaveen Investments

|

Lam Analysis’s Free Money Move |

2019 |

2020 |

2021 |

2022 |

TTM |

Common |

|

Free Money Move Margin (Whole Investing Money Move) |

19.46% |

26.05% |

22.33% |

26.86% |

34.34% |

24.19% |

|

Free Money Move Margin (Capex Solely) |

19.87% |

23.17% |

15.60% |

27.05% |

33.83% |

24.90% |

Supply: Firm Knowledge, Khaveen Investments

From the desk above, the corporate’s FCF margins have been constructive and trended upward previously 5 years, with a median of 24.19% for FCF margin (Whole Investing Money Move) and 24.90% for FCF Margin (Capex Solely). Notably, the margins in 2021 moderated however bounced again within the subsequent years, with a major drop within the FCF margin (Capex Solely) by virtually 8%. This decline was attributed to the rise in internet modifications in working capital, ensuing from a surge in account receivables and stock to support elevated investments and mitigate provide chain disruptions. Furthermore, there was additionally a rise in capex because of the institution of a expertise middle in Korea in addition to the development of a manufacturing facility in Malaysia. Past that, the corporate’s FCF margin had elevated in 2022 as its internet margins elevated. In TTM, the corporate recorded a lift in working money flows in Q1 2023 as a consequence of an increase in internet change in working property of $738 mln. We modeled its FCF margins to stabilize with a forecast of 23.4% by 2027.

|

Lam Analysis P/FCF Valuation |

2023F |

2024F |

2025F |

|

Forecasted FCF ($ mln) |

4,329 |

5,493 |

5,229 |

|

Progress (%) |

-7.5% |

26.9% |

-4.8% |

|

P/FCF Ratio |

27.84x |

21.46x |

21.17x |

|

Valuation ($ mln) |

120,489 |

117,865 |

110,687 |

|

Shares Excellent (mln) |

131.10 |

131.10 |

131.10 |

|

Value Goal |

919.04 |

899.02 |

844.28 |

|

Present Value |

901.93 |

901.93 |

901.93 |

|

Upside |

1.9% |

-0.3% |

-6.4% |

Supply: Firm Knowledge, Khaveen Investments

Lastly, we derived a P/FCF comparable valuation within the desk above based mostly on the 5-year common ratio of its friends excluding ASML and Tokyo Electron as a consequence of their anomalous figures. Based mostly on our FCF forecasts in 2025, we derived an upside of -6.4% with a $901.93 value goal and prorated it in 2023 to derive a 1.9% upside. Subsequently, whereas we imagine this means the surge within the firm’s value is justified, the longer term upside from present ranges is restricted.

Dangers: Tokyo Electron Challenges Lam Analysis in NAND Etching

In 2023, competitor Tokyo Electron announced that it had developed 3D NAND flash reminiscence etching applied sciences, difficult Lam Analysis which has a monopoly on this space based on Nikkei Asia. Tokyo Electron claimed that its new gear expertise presents benefits with 2.5x much less time-consuming in comparison with present market options. We imagine this might have an effect on Lam Analysis’s competitiveness within the etch semicon gear market and have an effect on the corporate’s income progress as its Reminiscence phase nonetheless represented the biggest phase (over 40% of revenues).

Verdict

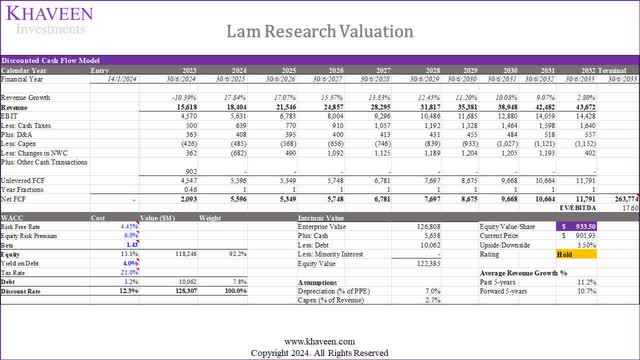

Moreover, based mostly on our up to date DCF, we valued the corporate with a restricted upside of three.5% based mostly on a reduction fee of 12.3% (firm’s WACC) and terminal valued based mostly on the 5-year common high semicon gear EV/EBITDA of 17.6x.

All in all, we imagine the corporate’s unbelievable inventory value runup of 176% since our earlier protection is justified based mostly on P/S, P/E and P/FCF comparability. Nevertheless, on a comparable valuation foundation for all 3 multiples, we discover the corporate’s upside is restricted at present value ranges. That is regardless of factoring in our constructive outlook for the corporate which we imagine is poised to profit from the anticipated semicon market restoration in 2024 particularly within the second half and its high clients’ fab expansions, in addition to accounting for its robust internet profitability and FCF margins which we count on to stay secure. Subsequently, we fee the corporate as a Maintain based mostly on our DCF value goal of $933.50 as a consequence of a restricted upside of three.5% following the surge in its inventory value.