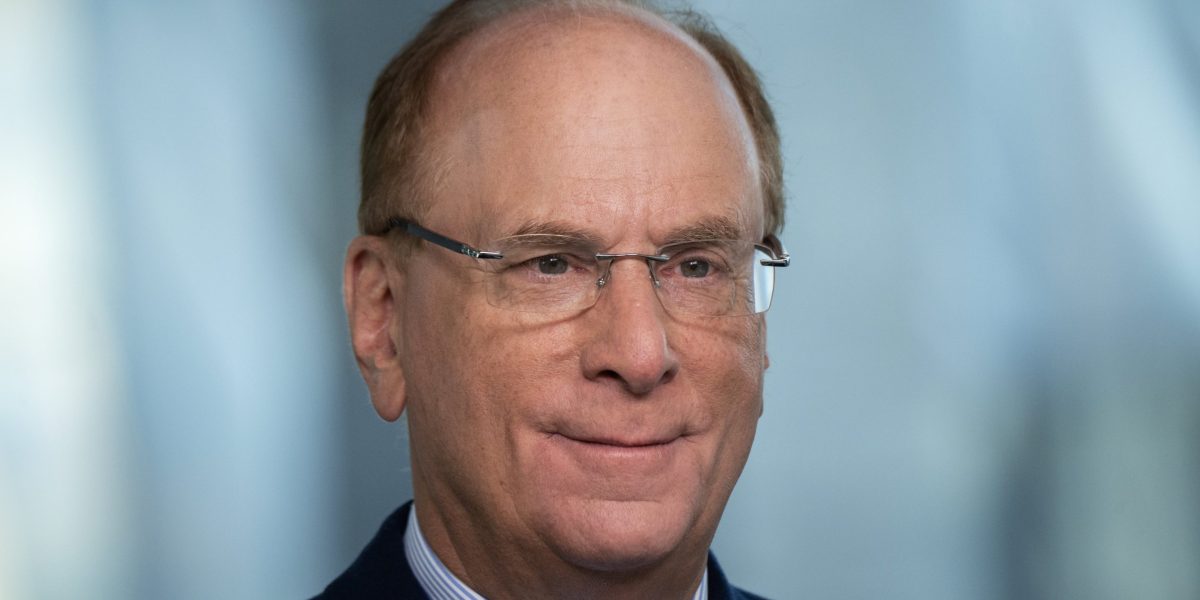

To Larry Fink, CEO of $90 trillion asset supervisor BlackRock, the financial system’s greatest fear isn’t excessive inflation or a potential recession: it’s a scarcity of hope. Extra particularly, it’s about how millennials and Gen Z simply don’t belief boomers after taking a look at what they’ve accomplished to the financial system. And , what, he says: They’re proper.

In his annual letter to BlackRock shareholders released Tuesday, Fink sounded alarmed as he seemed again on his dad and mom’ retirement scenario, his personal era’s expectations of retirement, and what lies forward for the younger staff who need to shoulder the load. And he stated he was shocked by one explicit reality about Gen Z.

Fink cited a latest discovering by a long-running University of Michigan survey that tracks twelfth graders’ public sentiment. In contrast with 20 years in the past, it discovered “the current cohort of young Americans is 50% more likely to question whether life has a purpose. Four-in-10 say it’s “hard to have hope for the world.’” It’s the worst outcome since 1976, the Wall Street Journal reported. Let that sink in, Fink writes: “I’ve been working in finance for almost 50 years. I’ve seen a lot of numbers. But no single data point has ever concerned me more than this one.”

Fink pointed to the retirement system as a key flashpoint. Because the nation’s demographics pattern older and extra Individuals dwell longer, Social Safety and different retirement profit plans are struggling to maintain up—and to this point, no one’s been prepared to make the huge adjustments required to guarantee that younger staff will be capable to accumulate their advantages as soon as they attain retirement age.

As Fink sees it, the blame for the retirement disaster—and, by affiliation, Gen Z’s basic malaise about their financial futures—sits squarely on the shoulders of his era. As Child Boomers have continued to kick the retirement-reform can down the street, they’ve misplaced the belief of youthful Individuals, who can already foresee that they’ll be left to cope with the implications.

“[Young people] believe my generation — the Baby Boomers — have focused on their own financial well-being to the detriment of who comes next,” Fink wrote. “And in the case of retirement, they’re right.”

The audacity of hope

Fink identified that the retirement disaster isn’t as distant as many individuals assume. The Social Safety Administration has stated it gained’t find the money for to pay individuals their full advantages as quickly as 2034. Whilst new medical therapies, together with medication like Ozempic and Wegovy, assist individuals dwell longer, the retirement age isn’t budging to make up for all these additional years of accumulating advantages.

“No one should have to work longer than they want to. But I do think it’s a bit crazy that our anchor idea for the right retirement age — 65 years old — originates from the time of the Ottoman Empire,” Fink wrote. “As a society, we focus a tremendous amount of energy on helping people live longer lives. But not even a fraction of that effort is spent helping people afford those extra years.”

Fink identified that the Netherlands began elevating the retirement age to correspond with rising life expectancy a decade in the past, and Japan has been enacting insurance policies to spice up its labor participation fee for the reason that early 2000s. He didn’t go as far as to explicitly advocate for rising the retirement age, however Fink’s message is obvious: one thing must budge.

Retirement is only one piece of the puzzle. In terms of the financial system at giant, Fink’s greatest worry is worry itself—particularly, younger Individuals’ rising insecurity about placing their cash in capital markets. Fink wrote that he sees standard confidence in investing as a key think about America’s historic success as a nation.

Whereas different international locations have struggled to persuade residents that placing their cash to work by investing it’s simply as secure as retaining it in money, Individuals have traditionally been way more trusting of capital markets. That’s been a key driver of financial development and American supremacy on the worldwide stage. Fink observes that that belief is waning, particularly amongst younger Individuals—and that dangers costing the nation its financial identification.

“Hope has been the nation’s greatest economic asset … If future generations don’t feel hopeful about this country and their future in it, then the U.S. doesn’t only lose the force that makes people want to invest. America will lose what makes it America,” Fink wrote. “Without hope…we risk becoming a country where people keep their money under the mattress and their dreams bottled up in their bedroom.”

Fortune recently reported that the U.S. is certainly one of simply 4 international locations the place younger individuals report being considerably much less pleased than older residents, per World Happiness Challenge knowledge. A post-pandemic surge in social anxiety, on high of a nationwide price of residing disaster, has soured many younger adults’ views on the financial system. This collides with the truth that their wallets are collectively fairly full: New York Fed data shows that Gen Z and Millennials have grown their collective wealth by 80% up to now 4 years, whereas nonetheless trailing effectively behind boomers.

Fink argues that the answer to the boldness disaster gripping the financial system for his era to surrender some management, and hearken to their youthful counterparts—the long run leaders who can be left to scrub up the damaged retirement system.

“How do we get our hope back? … Any answer has to start by bringing young people into the fold,” Fink wrote. “Young people have lost trust in older generations. The burden is on us to get it back. And maybe investing for their long-term goals, including retirement, isn’t such a bad place to begin.”