A guide to keeping it simple, staying focused, and not letting analysis turn into paralysis.

“The best investors don’t stare at their screens all day. They build a plan — and let it work.”

Over thinking in investing?

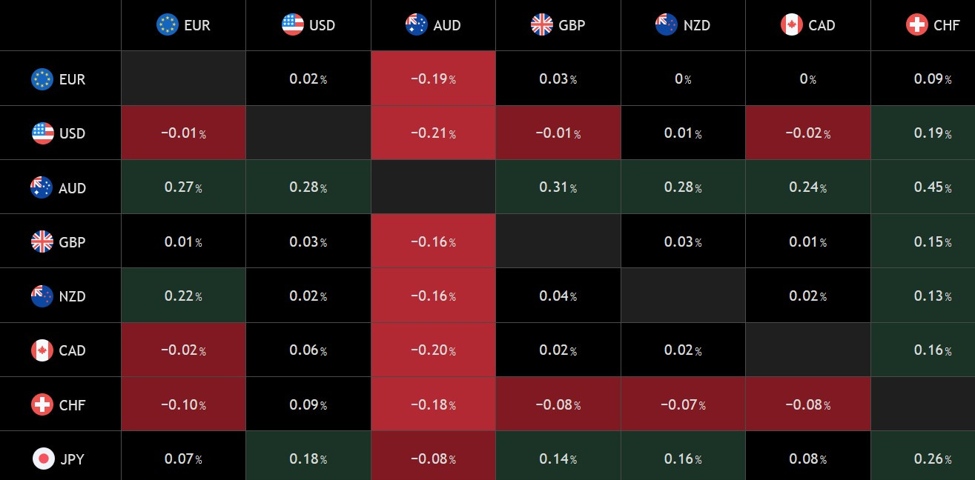

🔄 Why Overthinking Hurts Performance

Most people assume that doing more with their portfolio leads to better results.

But often, it does the opposite:

-

Too much tinkering increases costs and taxes

-

Overreacting to short-term moves creates unnecessary losses

-

Stress and indecision make it hard to stay invested

📉 Example: Investors who pulled out in March 2020 missed the fastest recovery in modern history. Those who stayed the course? They saw major gains.

🧠 Signs You Might Be Overthinking It

-

You check your portfolio multiple times a day

-

You constantly question your investment choices

-

You switch funds or stocks often based on news or social media

-

You feel guilty for not “doing more”

Here’s the truth: good investing is often boring. And that’s exactly what makes it work.

🛠️ A Simple System That Reduces Mental Load

Want peace of mind? Build a setup that removes emotion and guesswork.

| Step | Action |

|---|---|

| 1 | Pick 1–3 index funds or ETFs (like VTI, VOO, QQQ) |

| 2 | Set up automatic monthly contributions |

| 3 | Rebalance once or twice a year (not every week) |

| 4 | Review your portfolio quarterly — not daily |

| 5 | Have a written plan: how much you invest, why, and for how long |

📚 Analogy: Your portfolio is like a slow-cooking recipe. If you lift the lid every 5 minutes, you ruin the dish.

💬 Quote to Remember

“Don’t just do something — stand there.”

— Jack Bogle (Founder of Vanguard)

⚠️ What to Avoid

-

❌ Reacting emotionally to every news headline

-

❌ Obsessing over daily performance

-

❌ Changing strategies because someone else is doing something different

🧠 Remember: A good plan only works if you give it time. Constant changes break the very thing that makes investing powerful — compounding and consistency.

🧘♂️ Mindset Shift: From Manager to Steward

You’re not trying to “beat” the market every day. You’re building something meaningful over years.

Start seeing yourself as a steward of your wealth:

This shift removes the pressure to be perfect — and frees you to focus on what really matters.

👉 Read Next:

➡️ How to Build a Long-Term Mindset

➡️ How Automation Builds Wealth Without Effort

➡️ The Smart Way to Diversify (Coming soon)

📢 Brand Transition Note

ForexLive is now becoming InvestingLive.com — and this content series is part of our mission to help investors think clearly, act confidently, and grow wealth over the long haul. Join us as we continue building something better.