-

Technical analysts consider that inventory costs typically commerce in patterns, because the motivating driver behind the motion of shares is people, and people exhibit the identical feelings in terms of their cash: concern and greed.

-

These two predictable feelings assist create predictable buying and selling patterns that technical analysts attempt to capitalize on.

-

Listed here are seven of the highest bullish patterns that technical analysts use to purchase shares.

One of many greatest drivers of inventory costs is human feelings, significantly concern and greed.

Buyers usually exhibit predictable feelings when a inventory worth strikes up and down, and these feelings can result in buying and selling exercise that creates predictable charting patterns.

Technical analysts try to take the emotion out of investing by solely counting on the patterns discovered inside charts to commerce shares, probably giving them an edge over traders who’re inclined to to creating commerce selections pushed by concern and greed.

Whereas these patterns may be predictable, they aren’t bullet-proof. Head fakes, bull traps, and failed breakdowns happen typically and have a tendency to shake merchants out of their positions proper earlier than the massive transfer.

That’s why self-discipline is so vital in technical evaluation.

Having a plan earlier than getting into a place can assist merchants climate uneven worth actions, rising their possibilities of using an uptrend and avoiding a downtrend.

A plan earlier than getting into a commerce contains defining a “stop loss” degree the place if the inventory falls to a sure worth level, you robotically promote, take a small loss, and transfer on to the subsequent buying and selling alternative.

A plan would additionally embrace a worth goal the place the dealer would look to unload some if not the entire place to take earnings.

Listed here are seven of the highest bullish chart patterns that technical analysts use to purchase shares.

1. Double Backside

A double backside is a bullish reversal sample that describes the autumn, then rebound, then fall, after which second rebound of a inventory.

A profitable double backside sample seems like a W.

The sample usually marks the tip of a downtrend, and the start of an uptrend.

It’s typically accepted that the primary and second backside needs to be inside a pair p.c close to one another, if not on the identical degree.

A double backside usually takes two to 3 months to kind, and the farther aside the 2 bottoms, the extra probably the sample will likely be profitable.

2. Ascending Triangle

An ascending triangle is a bullish continuation sample and one in every of three triangle patterns utilized in technical evaluation.

The buying and selling setup is normally present in an uptrend, fashioned when a inventory makes increased lows, and meets resistance on the identical worth degree.

Rising assist and horizontal resistance in the end converge on the breakout degree.

This sample creates a well-defined setup for merchants. If the inventory breaks above horizontal resistance, merchants will purchase the inventory, and set a cease loss order normally slightly below the prior resistance degree.

But when the inventory breaks beneath the rising assist degree, a brief commerce sign could be generated.

An ascending triangle is a excessive chance setup if the breakout happens on excessive quantity, and is extra dependable than a symmetrical triangle sample.

3. Cup and Deal with

A cup and deal with is a bullish sample that resembles a cup, fashioned by a basing sample that usually seems like a “U,” adopted by a deal with that’s fashioned by a short-term down pattern.

As soon as a inventory breaks out above the deal with, a technical analyst would purchase the inventory.

A dealer may generate a measured transfer worth goal by measuring the depth of the cup in worth, and add that quantity to the lid of the cup.

This sample normally extends an uptrend that’s already in place.

A U-shaped cup is the next chance arrange than a V-shaped cup, however each can work.

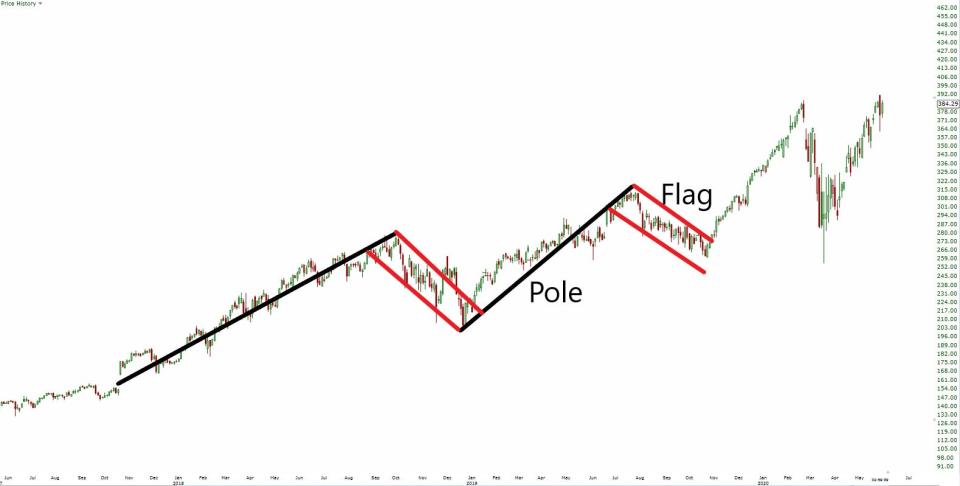

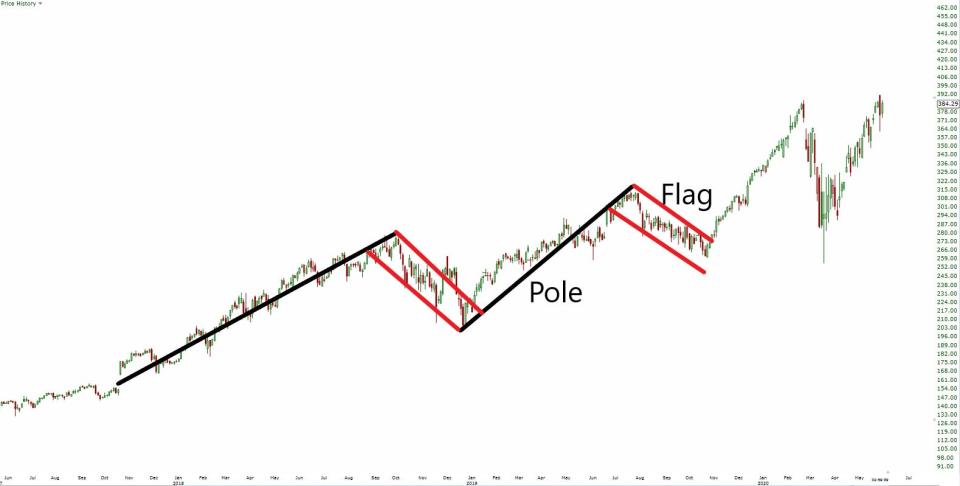

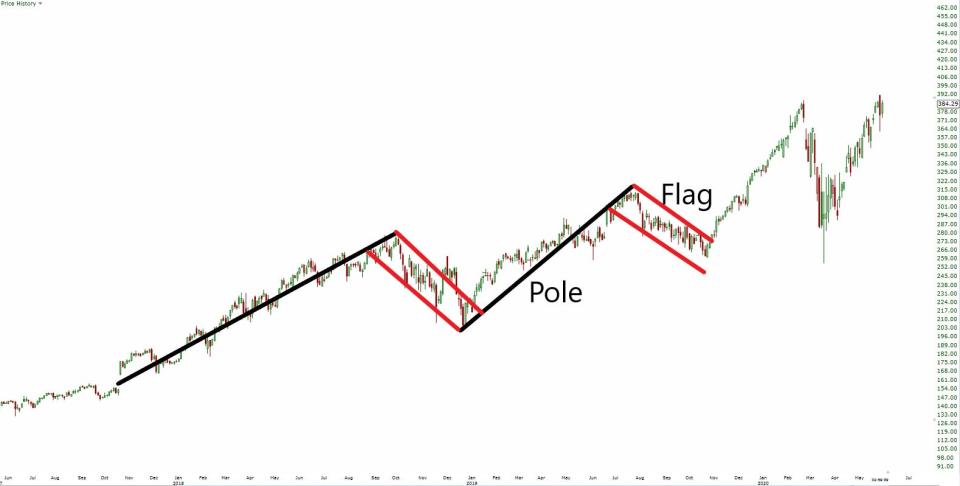

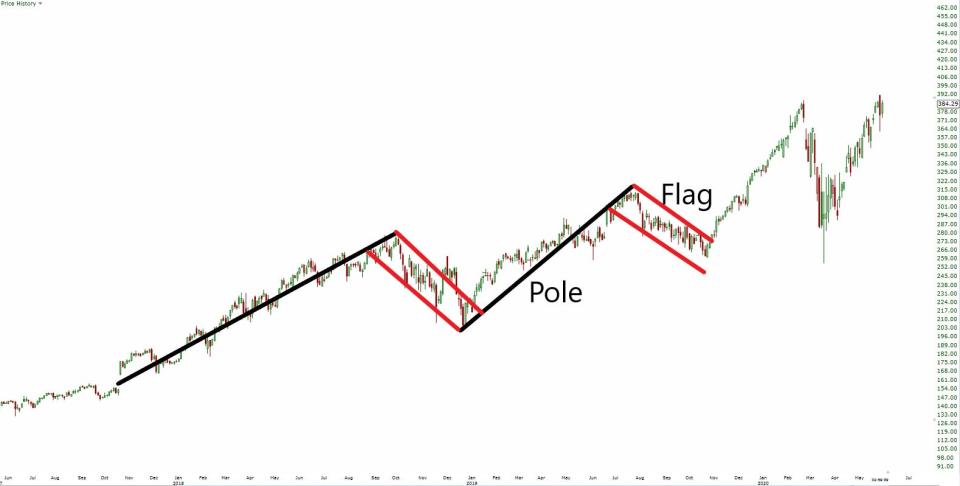

4. Bull Flag

A bullish flag sample happens when a inventory is in a powerful uptrend, and resembles a flag with two important parts: the pole and the flag.

This sample is a bullish continuation sample. Usually merchants would purchase the inventory after it breaks above the short-term downtrend, or flag.

A measured-move worth goal may be obtained by measuring the space of the pole, and including it to the highest proper nook of the flag.

Bullish flags are short-term patterns that ideally final one to 4 weeks, usually don’t last more than eight weeks, and normally observe an sharp uptrend.

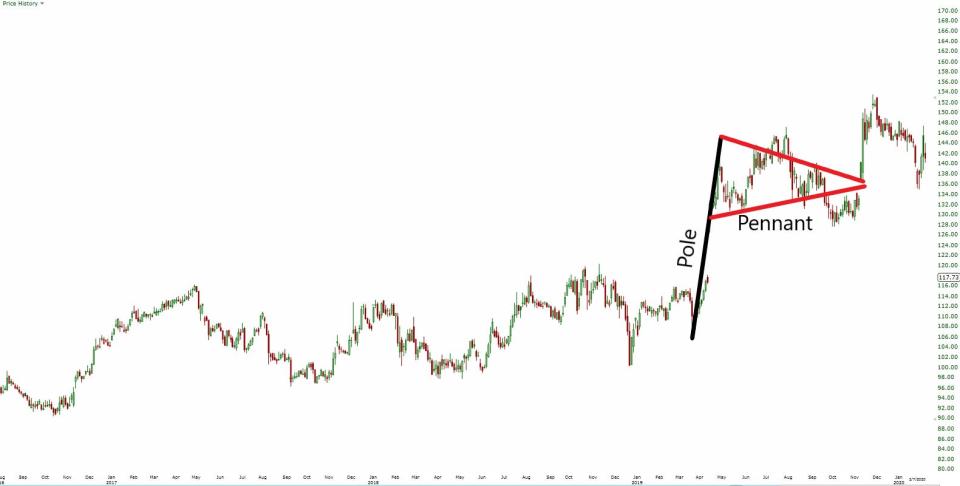

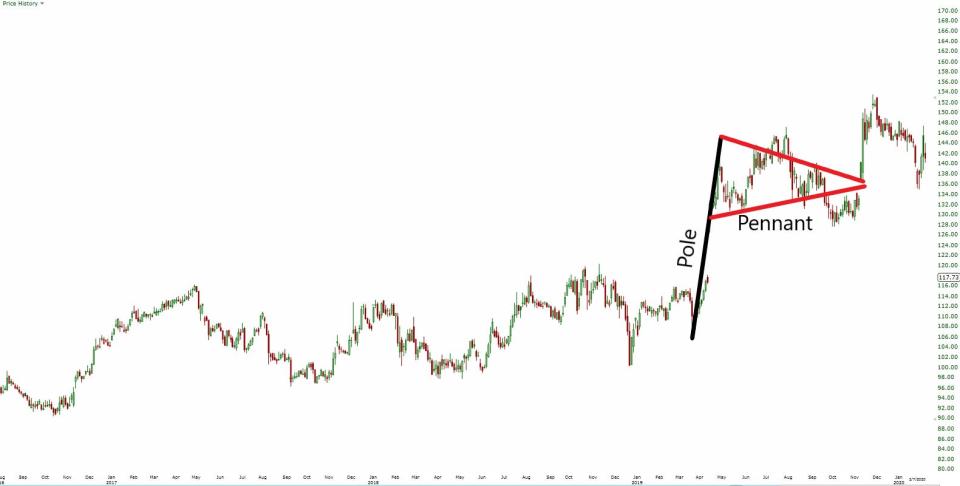

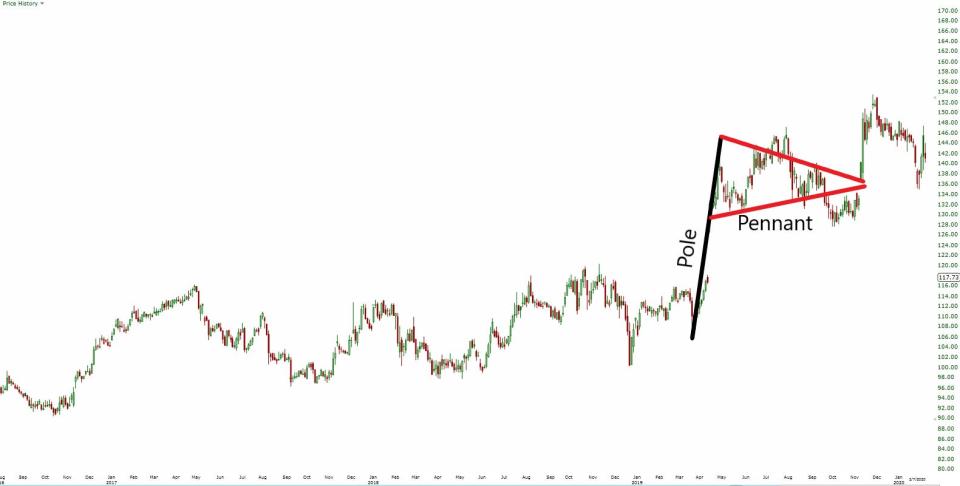

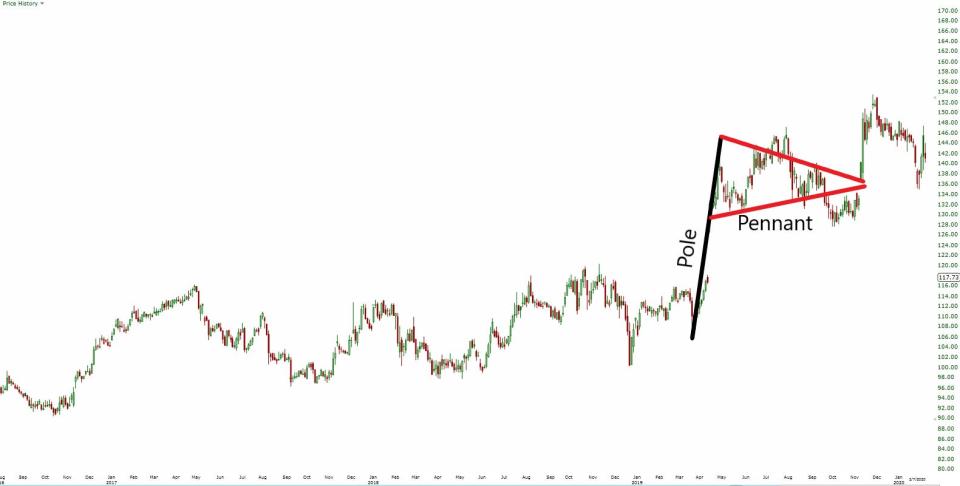

5. Bull Pennant

Just like a bull flag, a bullish pennant is a continuation sample that consists of a pole and a symmetrical triangle, normally following an uptrend in worth.

Relatively than a interval of sideways consolidation within the form of a rectangle, worth consolidates within the form of a symmetrical triangle, making a sequence of upper lows and decrease highs.

The uptrend within the safety will probably proceed on if the inventory breaks out above the pennant.

Within the chart instance above, an instance of a failed breakdown, or a bear entice is proven.

At first, the safety breaks beneath the pennant, signaling a breakdown and probably decrease costs forward.

However then, it rapidly recovers, breaks above the pennant, and the uptrend continues.

A measured transfer goal may be obtained by measuring the space of the pole and including it to the apex of the pennant triangle.

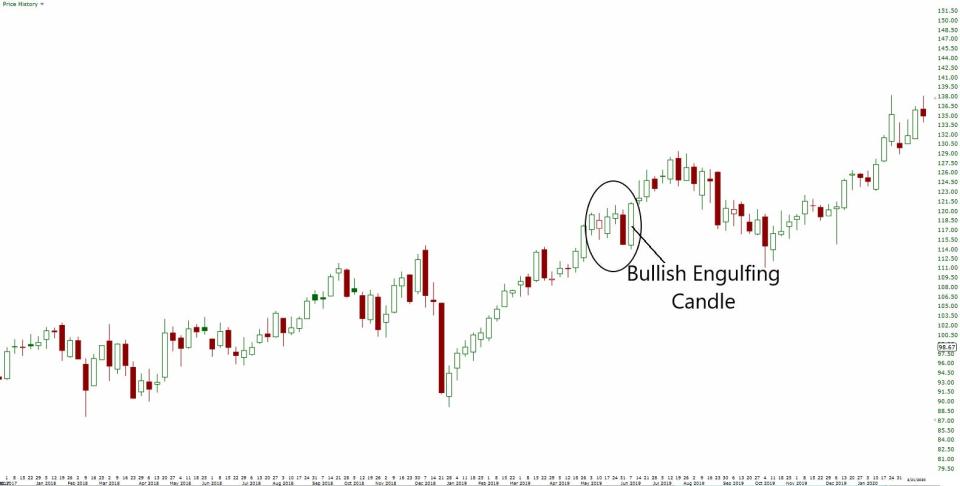

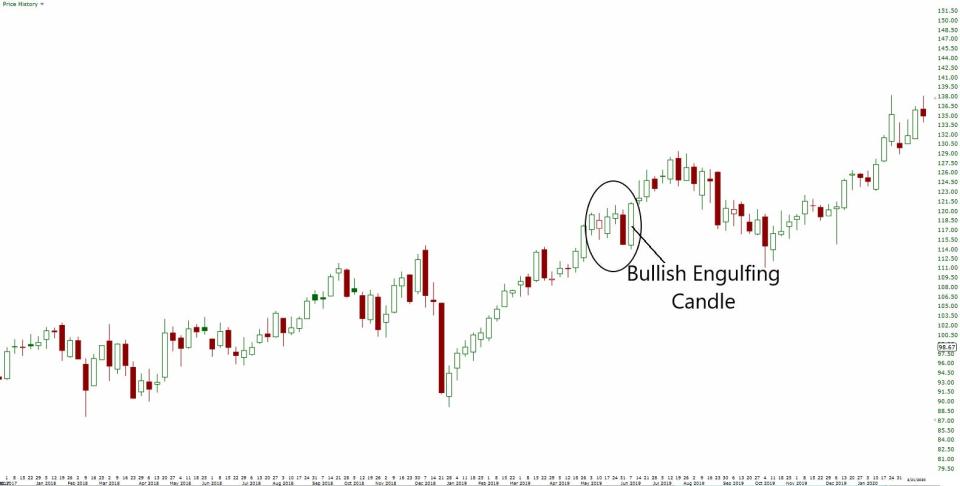

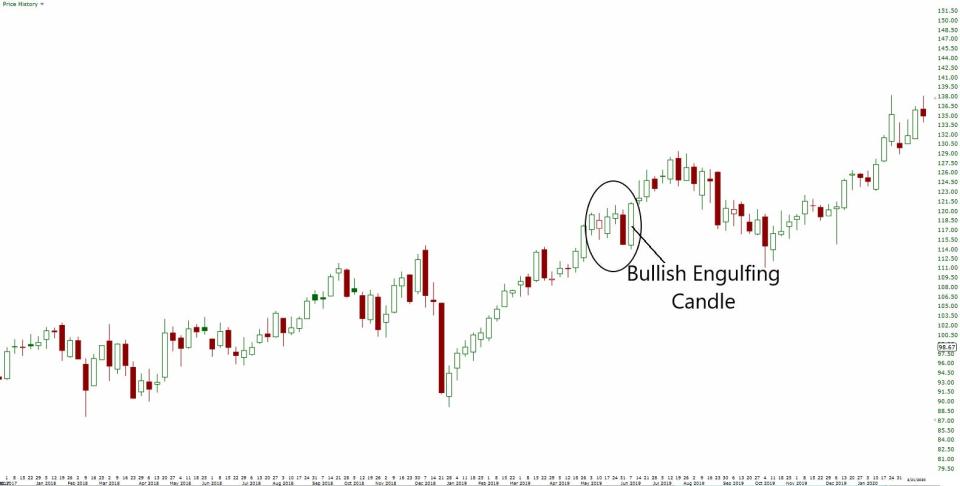

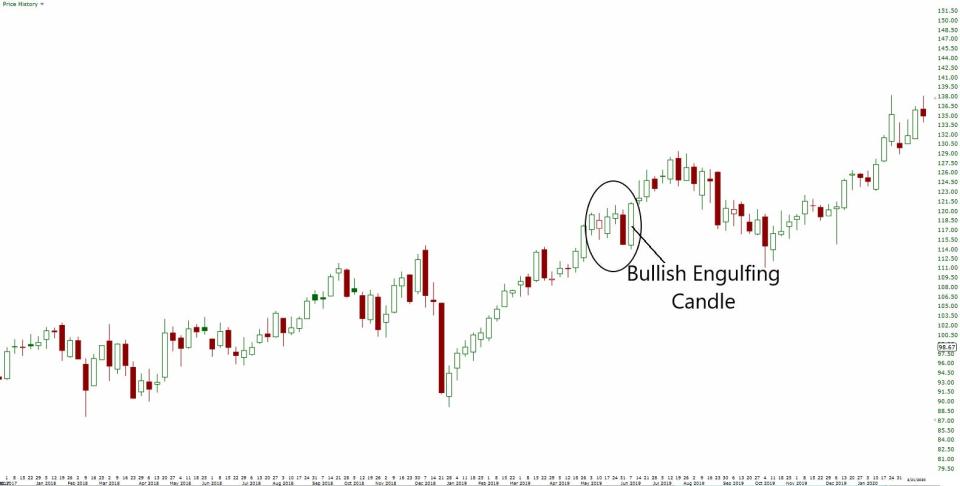

6. Bullish Engulfing Candle

A candlestick is a charting type that exhibits a safety’s opening worth, closing worth, intraday excessive, and intraday low.

The “body” is represented by the opening and shutting worth of a inventory, and the “tails” are represented by the intraday excessive and low.

A bullish engulfing candlestick happens when the physique of 1 buying and selling session fully engulfs the earlier session.

This occurs when the day’s open is decrease than the day before today, and its shut is increased than the day before today.

When the physique of a candle stick “engulfs” prior buying and selling periods, it indicators that bulls are beginning to take management from the bears, and a reversal in pattern is possible.

The extra buying and selling periods which can be engulfed by a single candlestick, the stronger the sign.

Within the chart above, the bullish engulfing candlestick engulfs the earlier 5 buying and selling periods, signifying the probability that shares are on monitor to maneuver increased.

7. Inverse Head & Shoulders

An inverse head-and-shoulders sample is a bottoming sample that always indicators a reversal in a inventory following a bearish pattern.

The inverse head and shoulders is said to the bearish head-and-shoulders sample, which is a topping sample.

The sample takes its form from a sequence of three bottoms, with the second backside being the deepest.

A neckline represents resistance and is fashioned by connecting the three restoration peaks related to the three bottoms.

When the inventory breaks above its neckline, that triggers a purchase sign for merchants, with a cease loss degree being set close to the neckline breakout degree.

A measured transfer worth goal may be obtained by measuring the space from the pinnacle to the neckline, and including that to the neckline breakout degree.

A proper shoulder that’s increased than the left shoulder is an effective signal that an inverse head-and-shoulders sample will lead to a transparent breakout and reversal in pattern.

Learn the unique article on Business Insider